Mortgage Life Insurance Calculator

Understanding the Value of Mortgage Life Insurance: A Comprehensive Guide

In the world of financial planning, mortgage life insurance stands as a crucial tool to protect homeowners and their loved ones. This comprehensive guide aims to delve into the intricacies of mortgage life insurance, providing an in-depth analysis of its importance, benefits, and how to effectively utilize a mortgage life insurance calculator to make informed decisions.

As homeowners, we often face the daunting task of managing our financial responsibilities, especially when it comes to ensuring the security of our mortgage payments. Mortgage life insurance offers a safety net, providing financial support in the event of unforeseen circumstances. This guide will navigate you through the process of understanding your needs, calculating the right coverage, and making the most of this essential insurance.

The Significance of Mortgage Life Insurance

Mortgage life insurance, often referred to as decreasing term life insurance, is designed specifically to protect homeowners by covering their mortgage balance in the event of their untimely demise. This type of insurance provides peace of mind, ensuring that your loved ones are not burdened with the financial strain of a mortgage should the unthinkable occur.

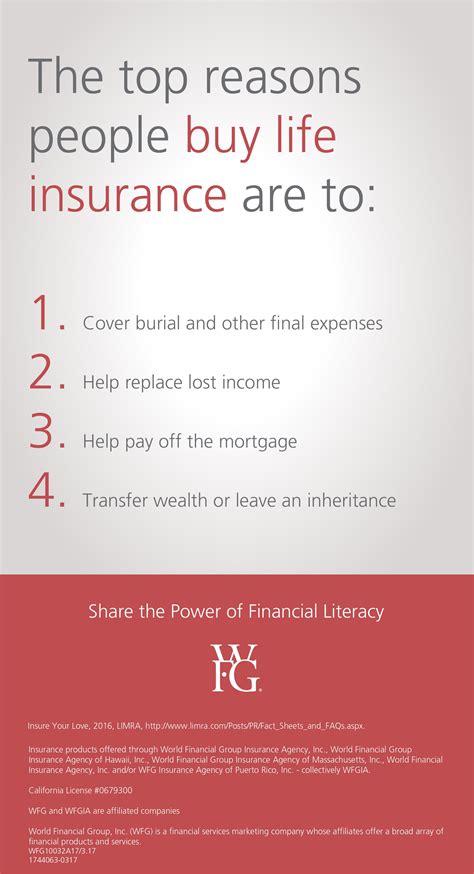

The primary goal of mortgage life insurance is to offer a safety net, allowing your beneficiaries to pay off the remaining mortgage balance without facing the risk of foreclosure or other financial hardships. It is an essential component of financial planning, ensuring that your family's future is secure and that your legacy is protected.

Key Benefits of Mortgage Life Insurance

- Financial Security: Mortgage life insurance provides a lump-sum payout to your beneficiaries, ensuring they have the means to cover the outstanding mortgage debt.

- Peace of Mind: Knowing that your loved ones are protected from the financial burden of your mortgage can bring immense peace of mind, allowing you to focus on your daily life with confidence.

- Affordability: Mortgage life insurance is often more cost-effective than traditional life insurance policies, especially for younger individuals or those with limited financial means.

- Customizable Coverage: These policies can be tailored to match your mortgage term, ensuring that the coverage decreases over time as your mortgage balance declines.

How Mortgage Life Insurance Calculators Work

Mortgage life insurance calculators are powerful tools that help you estimate the appropriate coverage amount for your needs. These calculators consider various factors to provide an accurate assessment of your mortgage protection requirements.

Key Factors in Mortgage Life Insurance Calculations

- Mortgage Balance: The outstanding balance on your mortgage is a critical factor. The calculator will use this information to determine the necessary coverage amount.

- Mortgage Term: The duration of your mortgage loan is another essential consideration. A longer mortgage term may require higher coverage, especially if you anticipate significant interest payments.

- Interest Rate: The interest rate on your mortgage loan influences the overall cost of your mortgage. A higher interest rate may necessitate a larger coverage amount to ensure your beneficiaries can pay off the debt.

- Additional Debt: Some calculators also consider other debts you may have, such as personal loans or credit card balances, to provide a comprehensive assessment of your financial protection needs.

Step-by-Step Guide to Using a Mortgage Life Insurance Calculator

- Gather Information: Before using the calculator, ensure you have the necessary details, including your current mortgage balance, mortgage term, and interest rate.

- Input Data: Enter the required information into the calculator. Some calculators may also ask for your age, income, and other personal details to provide a more accurate estimate.

- Review Results: The calculator will generate a recommended coverage amount based on your inputs. It's important to review these results carefully and consider whether the suggested coverage aligns with your financial goals and family's needs.

- Adjust as Needed: If the recommended coverage seems too high or low, you can adjust the inputs to find the right balance. Consider your family's future financial obligations and the potential impact of inflation on your mortgage balance.

- Compare Quotes: Once you have an estimate of your coverage needs, it's beneficial to compare quotes from different insurance providers. This step ensures you get the best value for your money and find a policy that fits your budget.

Real-Life Examples and Case Studies

To illustrate the effectiveness of mortgage life insurance and calculators, let's explore a few real-life scenarios:

Case Study 1: Young Family's Protection

John and Sarah, a young couple with a 3-year-old daughter, recently purchased their first home. They took out a 30-year fixed-rate mortgage with a balance of $300,000 and an interest rate of 4.5%. Using a mortgage life insurance calculator, they determined that a coverage amount of $320,000 would be sufficient to protect their family. This policy provides peace of mind, ensuring their daughter's future is secure should the unthinkable happen.

Case Study 2: Retirement Planning

Michael, a 55-year-old homeowner, is approaching retirement. He has a 15-year mortgage with a balance of $150,000 and an interest rate of 3.25%. Michael used a mortgage life insurance calculator to assess his coverage needs. The calculator suggested a coverage amount of $160,000, taking into account his remaining mortgage term and the potential impact of interest. This policy ensures that his retirement plans remain on track, even if an unexpected event occurs.

Case Study 3: Refinancing and Adjusted Coverage

Emily recently refinanced her mortgage, reducing her interest rate from 5.25% to 3.75% and extending her mortgage term from 25 to 30 years. With a new mortgage balance of $220,000, she used a calculator to reassess her coverage needs. The calculator recommended a coverage amount of $235,000, considering the extended term and potential future interest payments. This adjustment ensures that her mortgage protection remains adequate despite the refinancing changes.

Industry Insights and Expert Advice

Mortgage life insurance is a critical component of financial planning, and industry experts emphasize its importance:

Expert Tip: "Mortgage life insurance is an affordable and effective way to protect your loved ones from the financial burden of your mortgage. It's essential to regularly review and adjust your coverage to ensure it aligns with your changing needs and market conditions."

Additionally, when choosing a mortgage life insurance policy, it's beneficial to consider the following factors:

- Coverage Amount: Ensure the policy provides sufficient coverage to pay off your mortgage balance, taking into account future interest payments and any additional debts.

- Term Length: Select a policy term that matches or exceeds your mortgage term to ensure continuous protection.

- Renewability: Opt for a policy that allows for renewability, especially if you anticipate changes in your financial situation or mortgage terms.

- Premiums: Compare premium costs and consider your budget when selecting a policy. While affordability is important, it's crucial to strike a balance between cost and adequate coverage.

Future Implications and Considerations

As you navigate your financial journey, it's essential to stay proactive in managing your mortgage life insurance coverage. Here are some key considerations for the future:

Regular Reviews

Life circumstances and financial situations can change over time. It's crucial to review your mortgage life insurance coverage periodically, especially after significant life events such as marriage, divorce, the birth of a child, or changes in income. Regular reviews ensure that your coverage remains aligned with your needs and that your loved ones are adequately protected.

Inflation and Market Fluctuations

Inflation and market fluctuations can impact the value of your mortgage and the cost of living. When calculating your mortgage life insurance coverage, consider the potential impact of inflation on your mortgage balance and the future cost of living for your beneficiaries. Regularly adjusting your coverage to account for these factors ensures that your policy remains effective and relevant.

Retirement Planning and Estate Planning

As you approach retirement, mortgage life insurance can play a crucial role in your financial planning. It ensures that your retirement savings and assets are protected and that your loved ones are not burdened with unexpected debts. Additionally, consider integrating your mortgage life insurance policy into your estate planning to ensure a seamless transition of your assets and provide clarity for your beneficiaries.

Conclusion

Mortgage life insurance is a powerful tool that provides financial security and peace of mind to homeowners. By utilizing mortgage life insurance calculators, you can make informed decisions about your coverage needs, ensuring that your loved ones are protected from the financial strain of your mortgage. Regular reviews, consideration of inflation and market fluctuations, and integration into retirement and estate planning are essential steps to ensure a secure financial future for you and your family.

Frequently Asked Questions

How does mortgage life insurance differ from traditional life insurance?

+Mortgage life insurance is designed specifically to cover your mortgage balance, while traditional life insurance offers more comprehensive coverage, including financial support for your family’s living expenses and other debts. Mortgage life insurance is often more affordable and tailored to your mortgage term.

Can I change my mortgage life insurance coverage amount after purchasing a policy?

+Yes, many mortgage life insurance policies allow for adjustments to your coverage amount. However, the terms and conditions for making changes may vary, so it’s important to review your policy and consult with your insurance provider to understand the process and any potential fees or restrictions.

Is mortgage life insurance suitable for all homeowners?

+Mortgage life insurance is generally recommended for homeowners who have dependents or loved ones who rely on their income. It provides a safety net to ensure that your mortgage is paid off in the event of your demise, protecting your family from financial hardship. However, if you are single or have no financial dependents, other types of life insurance may be more suitable.

What happens if I sell my home or pay off my mortgage before the end of my policy term?

+If you sell your home or pay off your mortgage before the end of your mortgage life insurance policy term, you have a few options. You can cancel the policy and receive a partial refund of your premiums, or you can transfer the policy to your new mortgage. Some providers may also allow you to convert your mortgage life insurance into a traditional life insurance policy, offering more flexible coverage options.