Insurance Business

Insurance is a vital component of our modern society, providing financial protection and peace of mind to individuals, businesses, and communities. The insurance industry plays a pivotal role in managing risks, ensuring stability, and fostering economic growth. In this comprehensive article, we will delve into the world of insurance business, exploring its intricacies, innovations, and impact on various sectors.

The Evolution of Insurance: A Historical Perspective

The concept of insurance has its roots in ancient civilizations, where early forms of risk-sharing arrangements were established. However, it was during the Renaissance era that insurance gained prominence as a formal business practice. The development of marine insurance in the 14th century laid the foundation for modern insurance, as merchants sought to protect their cargo and investments against the perils of sea voyages.

Over the centuries, insurance evolved to cover a wide range of risks, from property and life insurance to health, automobile, and liability coverage. The 20th century witnessed significant advancements in insurance regulation and technology, shaping the industry into a highly specialized and complex field.

Key Milestones in Insurance History

- 1752: The first life insurance policy in the United States was issued, marking the beginning of a new era of financial protection.

- 1868: The introduction of the first automobile insurance policy addressed the emerging risks associated with motor vehicles.

- 1935: The Social Security Act in the US established a national social insurance program, revolutionizing social welfare and risk management.

- 1990s: The insurance industry embraced technology, leading to the digitization of processes and the rise of online insurance platforms.

The Insurance Landscape: An Overview

Today, the insurance industry is a global powerhouse, offering a myriad of products and services to cater to diverse needs. From traditional insurers to innovative fintech startups, the landscape is dynamic and ever-evolving.

Types of Insurance

- Life Insurance: Providing financial security to beneficiaries upon the insured’s death, life insurance is a cornerstone of personal financial planning.

- Health Insurance: Covering medical expenses, this type of insurance is crucial for maintaining access to healthcare services.

- Property Insurance: Protecting assets such as homes, businesses, and valuables, property insurance safeguards against losses due to fire, theft, or natural disasters.

- Automobile Insurance: Mandatory in many countries, auto insurance provides coverage for vehicle-related accidents and liabilities.

- Liability Insurance: This insurance protects individuals and businesses from legal claims and lawsuits, offering vital protection for professionals and businesses.

The Insurance Market

The insurance market is characterized by a diverse range of players, including:

- Insurers: Traditional insurance companies, ranging from global giants to niche players, offer a wide array of policies.

- Reinsurers: Specialized insurers that provide coverage to other insurers, helping to manage large-scale risks.

- Brokers and Agents: Intermediaries who connect clients with insurers, offering expert advice and personalized solutions.

- Technology Startups : Innovative companies leveraging technology to disrupt the insurance industry, offering efficient and tailored solutions.

The Impact of Insurance: A Comprehensive Analysis

Insurance has a profound impact on various aspects of our lives and the economy as a whole. Let’s explore some key areas where insurance plays a critical role.

Economic Stability and Growth

Insurance is a driving force behind economic stability and growth. By transferring and managing risks, insurance companies enable businesses to operate with confidence, encouraging investment and innovation. Additionally, insurance facilitates international trade by mitigating the financial impact of losses and providing security for global transactions.

| Industry | Insurance Impact |

|---|---|

| Construction | Insurance covers project risks, ensuring completion despite unforeseen events. |

| Healthcare | Health insurance improves access to medical care and reduces financial burden. |

| Transportation | Automobile and cargo insurance provide protection against accidents and losses. |

Social Welfare and Protection

Insurance plays a crucial role in promoting social welfare and protecting vulnerable populations. Life and health insurance provide financial security and access to healthcare, ensuring individuals and families can weather unforeseen events and maintain their quality of life.

Furthermore, insurance plays a vital role in disaster relief and recovery. In the aftermath of natural disasters or catastrophic events, insurance companies step in to provide financial support, helping communities rebuild and recover.

Innovation and Technological Advances

The insurance industry has embraced innovation and technology to enhance efficiency, improve customer experience, and offer new products. Here are some notable advancements:

- Telematics: This technology uses data analytics and sensors to monitor driving behavior, offering personalized auto insurance rates.

- Blockchain: Blockchain technology is revolutionizing insurance by enhancing security, streamlining processes, and enabling smart contracts.

- Artificial Intelligence: AI-powered systems analyze vast amounts of data, improving risk assessment and claim processing.

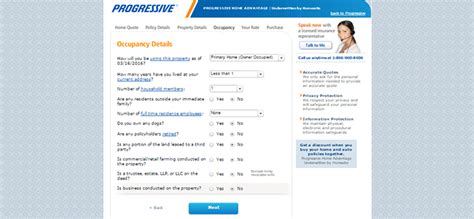

- Digital Platforms: Online insurance platforms provide convenient access to policies, allowing customers to compare and purchase coverage easily.

Challenges and Future Trends

While the insurance industry has achieved remarkable growth and innovation, it continues to face challenges and adapt to changing dynamics. Here are some key trends and considerations for the future:

Regulatory Environment

Insurance is heavily regulated to protect consumers and ensure fair practices. However, the regulatory landscape is complex and varies across jurisdictions. Insurers must navigate these regulations while maintaining competitive offerings.

Climate Change and Catastrophic Risks

Climate change poses significant challenges to the insurance industry, as extreme weather events and natural disasters increase in frequency and severity. Insurers must adapt their models and strategies to address these evolving risks.

Emerging Markets and Global Expansion

The insurance industry has significant growth potential in emerging markets, where insurance penetration is relatively low. Expanding into these markets presents opportunities for insurers, but also requires careful consideration of cultural, regulatory, and infrastructure factors.

Customer Expectations and Digital Transformation

Customers increasingly expect convenient, personalized, and digital insurance experiences. Insurers must embrace digital transformation to meet these expectations, leveraging technology to enhance customer engagement and streamline processes.

Conclusion: A Resilient and Innovative Industry

The insurance business is a dynamic and resilient sector, continually adapting to meet the evolving needs of individuals and businesses. From its historical roots to its modern-day innovations, insurance remains a cornerstone of financial protection and risk management.

As the industry navigates challenges and embraces opportunities, the future of insurance looks promising. With a focus on technology, customer-centric approaches, and sustainable practices, the insurance business is poised to continue its vital role in fostering economic growth, social welfare, and resilience in the face of uncertainty.

How does insurance impact small businesses?

+Insurance is crucial for small businesses as it provides financial protection against various risks. It helps cover losses due to property damage, liability claims, or business interruption, ensuring the business can continue operations and recover from setbacks.

What are the key considerations for choosing an insurance provider?

+When selecting an insurance provider, consider factors such as financial stability, reputation, policy coverage and limits, customer service, and the provider’s expertise in your specific industry or risk profile. It’s essential to find a provider that understands your unique needs.

How does the insurance industry contribute to economic growth?

+The insurance industry promotes economic growth by enabling businesses to manage risks effectively. This encourages investment, innovation, and international trade, creating a stable environment for economic development. Insurance also supports individuals’ financial security, allowing them to contribute to the economy.