Auto Insurance Nationwide Quote

Securing affordable and comprehensive auto insurance is a priority for every vehicle owner. In a highly competitive market, understanding the factors that influence insurance quotes is essential for making informed decisions. This in-depth analysis will delve into the intricacies of auto insurance quotes, exploring the key elements that impact rates and offering insights into how to navigate the process effectively. By examining real-world examples and industry data, we aim to empower readers with the knowledge to obtain the best coverage at the most competitive prices.

Understanding the Basics of Auto Insurance Quotes

Auto insurance quotes are personalized estimates provided by insurance companies to potential clients, outlining the cost of coverage based on individual circumstances. These quotes are influenced by a myriad of factors, each contributing to the overall insurance rate. To navigate this complex landscape, it’s crucial to grasp the fundamental elements that shape auto insurance quotes.

Risk Assessment: The Foundation of Insurance Quotes

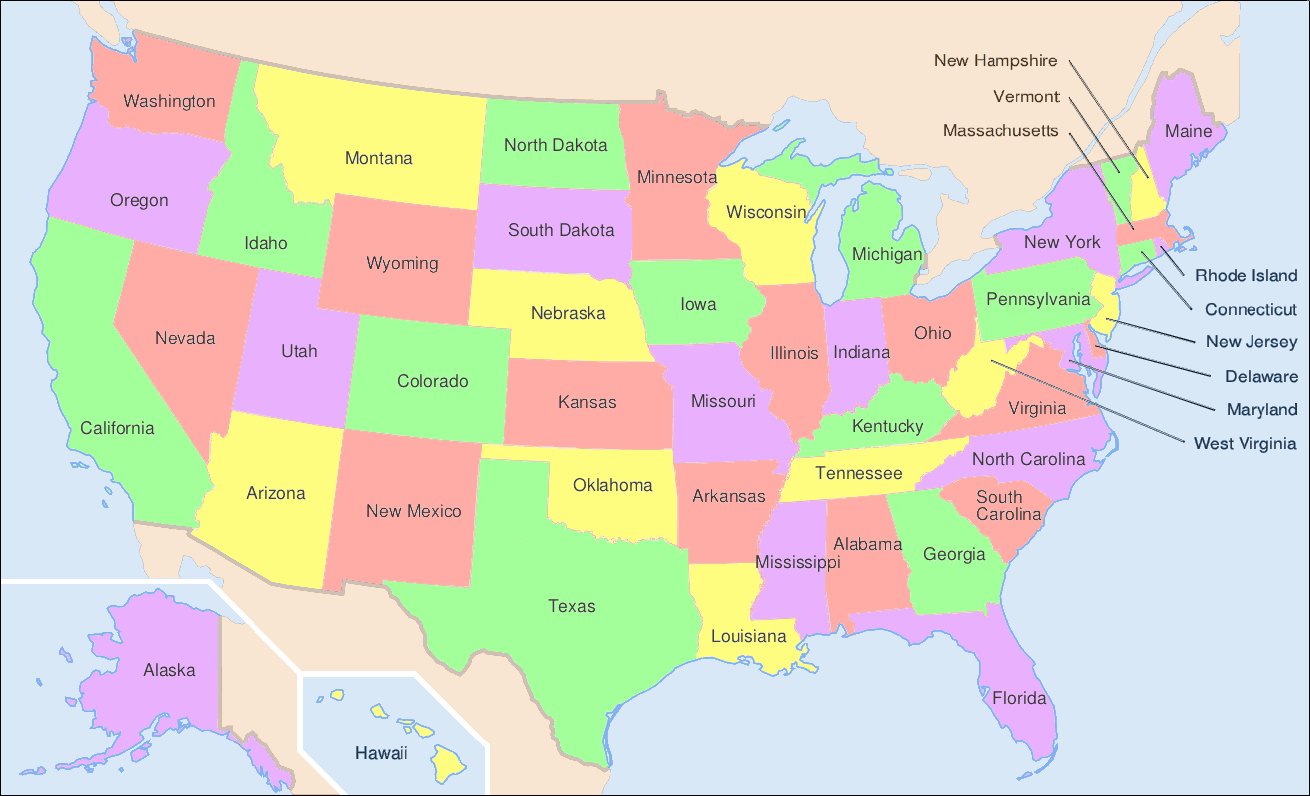

At its core, auto insurance is designed to mitigate risks associated with driving. Insurance companies meticulously assess various risk factors to determine the likelihood of claims. These factors encompass personal characteristics, driving history, vehicle specifics, and geographic location. By evaluating these elements, insurers can assign a risk profile to each driver, which forms the basis for insurance quotes.

| Risk Factor | Description |

|---|---|

| Age | Younger drivers are often considered higher risk due to their lack of experience, leading to higher premiums. |

| Gender | Historically, male drivers tend to face higher premiums due to statistical trends indicating higher accident rates. |

| Driving History | A clean driving record with no accidents or violations can lead to lower premiums. |

| Vehicle Type | High-performance cars or luxury vehicles may attract higher premiums due to their costliness and higher risk of theft. |

| Location | Areas with higher crime rates or dense traffic may result in increased premiums. |

Coverage Options: Tailoring Insurance to Your Needs

Auto insurance quotes are not one-size-fits-all. Insurance companies offer a range of coverage options, allowing drivers to customize their policies based on their specific needs and budget. The type and extent of coverage chosen significantly influence the overall insurance quote.

- Liability Coverage: This is the most basic form of auto insurance, covering damages you cause to others' property or injuries you cause to others in an accident. It's typically mandatory by law and forms the foundation of most auto insurance policies.

- Collision Coverage: This optional coverage pays for repairs to your vehicle after an accident, regardless of who is at fault. It's especially beneficial for newer or more valuable vehicles.

- Comprehensive Coverage: This coverage protects against non-collision incidents like theft, vandalism, natural disasters, or damage caused by animals. It's a crucial component for comprehensive protection.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when an at-fault driver lacks sufficient insurance to cover the damages they've caused. It's a vital safeguard against financial losses.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers, regardless of fault.

The more extensive the coverage, the higher the insurance quote is likely to be. However, striking the right balance between coverage and cost is crucial to ensure adequate protection without overpaying.

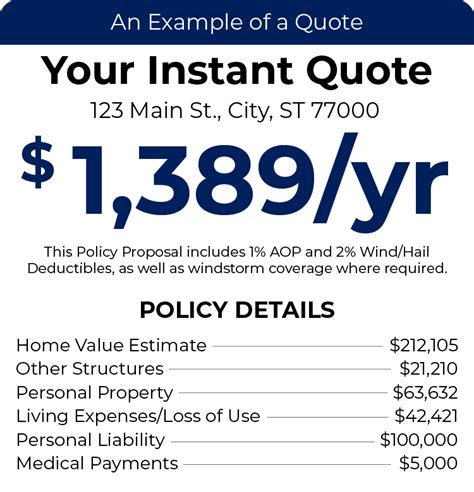

The Impact of Deductibles on Insurance Quotes

Deductibles are the amount you agree to pay out-of-pocket before your insurance coverage kicks in. They play a significant role in determining your insurance quote, as higher deductibles often result in lower premiums. This is because by accepting a higher deductible, you’re assuming more financial responsibility in the event of a claim, which reduces the insurer’s risk and thus your premium.

| Deductible Amount | Premium Impact |

|---|---|

| $250 | Standard premium with moderate deductible. |

| $500 | Slightly reduced premium compared to a $250 deductible. |

| $1000 | Significantly lower premium, but a higher financial burden in the event of a claim. |

It's important to carefully consider the balance between your deductible and premium. While a higher deductible can lower your monthly payments, it also means you'll have to pay more out-of-pocket if you need to make a claim. Finding the right balance is key to ensuring both financial security and affordability.

The Role of Discounts in Reducing Insurance Quotes

Insurance companies often offer a variety of discounts to incentivize certain behaviors or reward loyalty. These discounts can significantly reduce your insurance quote and should be explored thoroughly when shopping for auto insurance.

- Multi-Policy Discounts: Bundling your auto insurance with other policies, such as home or renters insurance, can result in substantial savings.

- Safe Driver Discounts ": Maintaining a clean driving record for a certain period often qualifies you for discounts, as it indicates a lower risk of accidents.

- Loyalty Discounts: Staying with the same insurance company for an extended period may lead to loyalty discounts, rewarding your long-term commitment.

- Vehicle Safety Discounts: Having a vehicle equipped with advanced safety features or anti-theft devices can qualify you for discounts, as these features reduce the risk of accidents and theft.

- Low Mileage Discounts: If you drive fewer miles annually, you may be eligible for a low mileage discount, as this often correlates with lower risk.

When obtaining insurance quotes, it's beneficial to ask about available discounts and ensure you're taking advantage of all applicable options to reduce your premium.

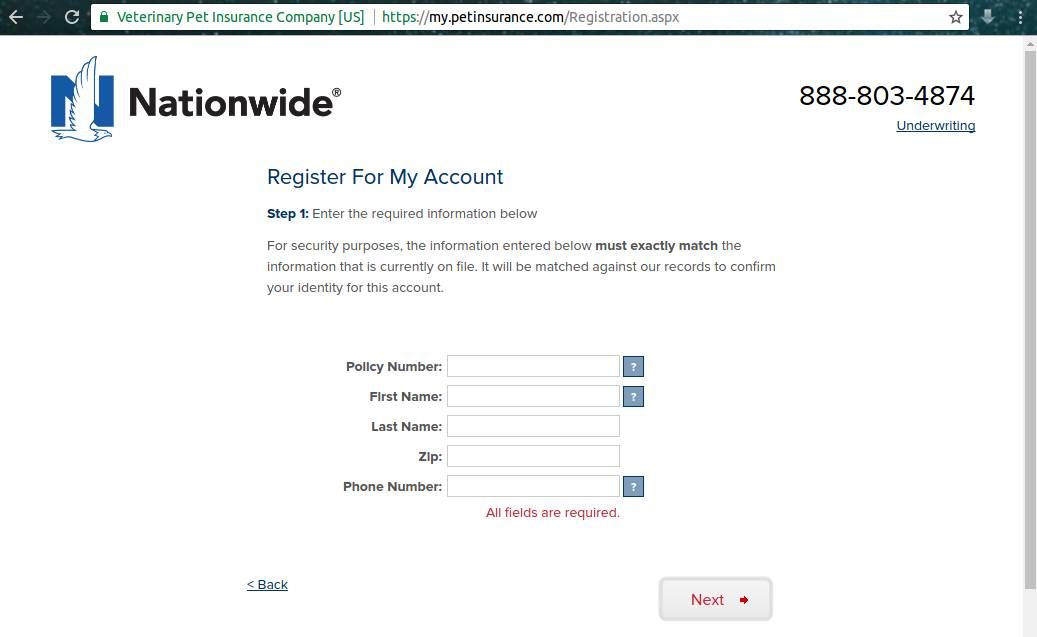

Navigating the Quote Process: Tips and Strategies

Obtaining auto insurance quotes can be a complex process, but with the right approach, it can be streamlined and efficient. Here are some tips and strategies to help you navigate the quote process and secure the best coverage at the most competitive rates.

Compare Multiple Quotes

One of the most effective ways to find the best auto insurance quote is to compare multiple offers from different insurers. This allows you to see the range of prices and coverage options available, ensuring you get the best value for your money. Online comparison tools can be particularly useful for this, providing a quick and easy way to view and compare quotes from various providers.

Understand Your Coverage Needs

Before requesting quotes, take the time to understand your specific coverage needs. Consider factors such as the value of your vehicle, your daily commute, and any personal circumstances that might influence your risk profile. By tailoring your coverage to your needs, you can avoid overpaying for unnecessary coverage or, conversely, underinsuring yourself and facing financial hardship in the event of a claim.

Explore Discount Opportunities

Insurance companies offer a variety of discounts to attract and retain customers. When requesting quotes, be sure to inquire about all available discounts. Common discounts include multi-policy discounts (for bundling your auto insurance with other policies), safe driver discounts (for maintaining a clean driving record), loyalty discounts (for staying with the same insurer over time), and vehicle safety discounts (for having a vehicle equipped with advanced safety features). By taking advantage of these discounts, you can significantly reduce your insurance quote.

Consider Payment Frequency

The frequency of your insurance payments can impact your overall cost. While paying monthly may seem convenient, it often comes with a higher premium. Consider paying your premium annually or semi-annually to take advantage of potential discounts and reduce the overall cost of your insurance.

Research Insurer Reputation and Financial Stability

In addition to finding the best quote, it’s crucial to select an insurer with a solid reputation and financial stability. This ensures that the company will be able to pay out claims when needed. Check independent rating agencies like AM Best, Standard & Poor’s, or Moody’s to assess an insurer’s financial strength. Additionally, read reviews and seek recommendations from trusted sources to ensure you’re choosing a reputable insurer.

Ask About Bundling Discounts

If you have multiple insurance needs, such as home, renters, or life insurance, consider bundling these policies with your auto insurance. Many insurers offer significant discounts for bundling multiple policies, which can lead to substantial savings. By consolidating your insurance needs with one provider, you not only simplify your insurance management but also often benefit from lower overall costs.

Negotiate Your Quote

Don’t be afraid to negotiate your insurance quote. Insurance providers often have some flexibility in setting prices, and a polite, professional negotiation can sometimes result in a better deal. Highlight your loyalty, good driving record, or any other factors that might qualify you for a lower rate. While it may not always be successful, it’s worth attempting to secure the best possible quote.

Stay Informed About Rate Changes

Insurance rates can fluctuate over time due to various factors, including changes in your personal circumstances, insurer rate adjustments, or policy renewals. Stay informed about these changes and be prepared to review and adjust your coverage as needed. Regularly comparing quotes and assessing your insurance needs can help you stay on top of any necessary adjustments and ensure you’re always getting the best value.

Conclusion

Obtaining an auto insurance quote is a critical step in securing the right coverage for your vehicle. By understanding the factors that influence quotes and adopting a strategic approach to the quote process, you can navigate the complex world of auto insurance with confidence. Remember, the best quote is not always the cheapest, but rather the one that provides adequate coverage at a competitive price. With the right knowledge and a proactive approach, you can find the perfect balance between protection and affordability.

Frequently Asked Questions

How often should I review my auto insurance policy and quotes?

+

It’s recommended to review your auto insurance policy and quotes annually or whenever there’s a significant change in your personal circumstances, such as a move to a new location, a new vehicle purchase, or a life event like marriage or having children. Regular reviews ensure you’re always getting the best value and coverage for your needs.

What factors can lead to an increase in my auto insurance quote over time?

+

Several factors can lead to an increase in your auto insurance quote, including: changes in your driving record (such as accidents or violations), an increase in the value of your vehicle, moving to a higher-risk area, or simply the passage of time as insurance companies periodically adjust their rates.

How can I lower my auto insurance quote if I have a poor driving record?

+

If you have a poor driving record, there are still ways to lower your auto insurance quote. Consider increasing your deductible, as this can significantly reduce your premium. Additionally, explore all available discounts, such as safe driver discounts for maintaining a clean record over a certain period. Finally, consider enrolling in a defensive driving course, as this can sometimes lead to discounted rates.

What is the difference between liability coverage and collision coverage in auto insurance quotes?

+

Liability coverage is the most basic form of auto insurance, covering damages you cause to others’ property or injuries you cause to others in an accident. It’s typically mandatory by law. Collision coverage, on the other hand, is optional and pays for repairs to your own vehicle after an accident, regardless of who is at fault. It’s especially beneficial for newer or more valuable vehicles.