Car Insurance Lower Rates

In the vast landscape of car ownership, one of the most significant expenses is often car insurance. It's a necessary cost to ensure peace of mind and compliance with the law, but it can sometimes feel like a burden, especially when faced with high premiums. Fortunately, there are strategies and insights that can help you navigate the world of car insurance and potentially unlock lower rates. In this comprehensive guide, we'll delve into the intricacies of car insurance, exploring the factors that influence rates, sharing expert tips, and providing actionable advice to help you secure the best possible coverage at a price that fits your budget.

Understanding the Factors That Impact Your Car Insurance Rates

Car insurance rates are not arbitrary; they are calculated based on a multitude of factors that insurance companies use to assess risk. By understanding these factors, you can make informed decisions to potentially lower your premiums.

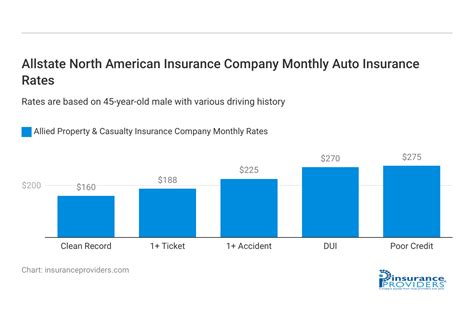

Your Driving Record

Your driving history is a critical component in determining your insurance rates. A clean driving record with no accidents or traffic violations often leads to lower premiums. Conversely, a history of accidents or moving violations can significantly increase your rates. Insurance companies view these as indicators of higher risk and potential future claims.

| Driving Record Status | Impact on Rates |

|---|---|

| Clean Record | Low Risk, Lower Rates |

| Minor Violations | Moderate Increase in Rates |

| Serious Violations or Accidents | Significant Rate Increase |

The Vehicle You Drive

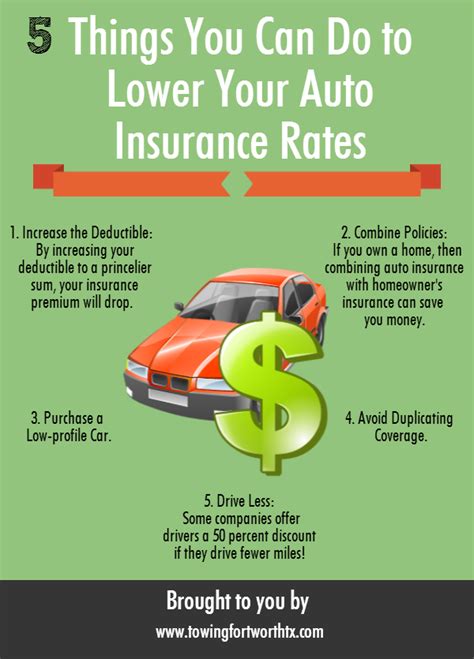

The make, model, and year of your vehicle play a role in insurance rates. Factors such as the car’s safety features, repair costs, and its popularity for theft can influence the premium. Sports cars and luxury vehicles, for instance, often have higher insurance costs due to their performance and potential for higher-risk driving.

Your Age and Gender

Insurance rates can be influenced by demographic factors. Younger drivers, particularly those under 25, are often considered higher risk and may face higher premiums. Similarly, gender can be a factor, with some insurance companies charging different rates for male and female drivers, although this practice is becoming less common due to legal restrictions in many regions.

Your Location

Where you live and drive your vehicle can significantly impact your insurance rates. Areas with higher populations and higher rates of accidents or thefts may result in increased premiums. Additionally, the specific address where your vehicle is garaged can also play a role, with urban areas often associated with higher rates compared to rural areas.

Your Insurance History

Insurance companies often reward loyalty and a history of responsible driving. If you’ve maintained continuous insurance coverage without any lapses, you may be eligible for lower rates or loyalty discounts. Conversely, gaps in coverage or frequent policy cancellations can lead to higher premiums.

Strategies to Secure Lower Car Insurance Rates

Now that we’ve explored the factors influencing car insurance rates, let’s delve into strategies to help you potentially reduce your premiums.

Shop Around and Compare

The insurance market is highly competitive, and rates can vary significantly between companies. Take the time to shop around and compare quotes from multiple insurers. Online comparison tools can be a great starting point, but be sure to also consider local insurers who may offer specialized rates or discounts.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies with them. For example, if you have homeowners or renters insurance, consider adding your car insurance to the same provider. Bundling policies can lead to substantial savings, as insurers often reward customers who centralize their insurance needs.

Utilize Discounts

Insurance companies offer a wide range of discounts that can significantly reduce your premiums. Some common discounts include:

- Safe Driver Discounts: Rewards for maintaining a clean driving record.

- Multi-Car Discounts: If you insure more than one vehicle with the same company.

- Loyalty Discounts: Recognizes long-term customers who have maintained continuous coverage.

- Good Student Discounts: For young drivers who maintain good grades in school.

- Defensive Driving Course Discounts: Incentivizes taking defensive driving courses.

Consider Higher Deductibles

Opting for a higher deductible can lead to lower premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially agreeing to bear more of the financial burden in the event of a claim, which can result in lower monthly premiums.

Review Your Coverage Regularly

Your insurance needs may change over time. Regularly review your coverage to ensure it aligns with your current circumstances. For example, if you’ve paid off your car loan, you may no longer need comprehensive or collision coverage, which can significantly reduce your premiums.

Maintain a Good Credit Score

In many regions, insurance companies use credit scores as a factor in determining rates. Maintaining a good credit score can lead to lower premiums, as it’s seen as an indicator of financial responsibility.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach where your premium is based on your actual driving behavior. This can be a great option for safe drivers, as it rewards responsible driving habits with lower rates.

The Future of Car Insurance: Emerging Trends and Technologies

The car insurance industry is evolving rapidly, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future of car insurance and how it may impact rates.

Connected Car Technology

The rise of connected car technology, where vehicles are equipped with internet connectivity and various sensors, is transforming the insurance landscape. This technology enables insurers to collect real-time data on driving behavior, vehicle usage, and even road conditions. This data can be used to offer more personalized and accurate insurance rates, rewarding safe driving habits.

Autonomous Vehicles

The advent of autonomous vehicles (AVs) is set to revolutionize the way we drive and the insurance industry. As AVs become more prevalent, insurance premiums are likely to decrease due to the expected reduction in accidents. However, the transition period as AVs integrate into our roads may bring unique challenges and opportunities for insurers.

Data-Driven Insurance Models

Insurance companies are increasingly leveraging advanced analytics and machine learning to develop more precise risk assessment models. These models can analyze vast amounts of data, including driving behavior, weather conditions, and even social media data, to predict risk more accurately. This data-driven approach has the potential to lead to fairer and more personalized insurance rates.

Insurtech Innovations

The emergence of Insurtech companies, which leverage technology to disrupt traditional insurance models, is driving innovation in the industry. These companies are often more agile and customer-centric, offering digital-first experiences and innovative products. They may offer more competitive rates and flexible coverage options, appealing to tech-savvy consumers.

Conclusion: Empowering Your Car Insurance Journey

Car insurance is an essential component of responsible car ownership, but it doesn’t have to be a financial burden. By understanding the factors that influence rates and implementing the strategies outlined in this guide, you can take control of your insurance costs and potentially secure lower premiums. Remember, car insurance is not a one-size-fits-all proposition; it’s a personalized journey that requires regular review and adaptation to your changing needs.

Stay informed, shop around, and don't be afraid to ask questions. The car insurance landscape is evolving, and by staying ahead of the curve, you can make the most of the opportunities available to save on your premiums while maintaining the coverage you need.

How often should I review my car insurance policy?

+

It’s recommended to review your car insurance policy annually, or whenever your life circumstances change significantly. This could include buying a new car, moving to a different location, getting married, or adding a young driver to your policy. Regular reviews ensure your coverage remains adequate and allow you to take advantage of any new discounts or coverage options.

What is the difference between comprehensive and collision coverage?

+

Comprehensive coverage protects against damage to your vehicle caused by events other than collisions, such as theft, vandalism, weather-related incidents, or collisions with animals. Collision coverage, on the other hand, specifically covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

Can I switch car insurance companies mid-policy term?

+

Yes, you can switch car insurance companies at any time, even mid-policy term. However, be aware that if you cancel your current policy before it expires, you may forfeit any unused premium and not receive a refund. It’s generally recommended to time your switch with your renewal date to avoid this issue.