Dog Insurance Cost

Welcome to this comprehensive guide on dog insurance costs, an essential topic for every pet owner to understand. Dog insurance is a critical aspect of responsible pet ownership, providing financial protection and peace of mind for unexpected veterinary expenses. In this article, we will delve into the factors that influence dog insurance premiums, explore the various types of policies available, and offer valuable insights to help you make informed decisions about insuring your beloved canine companion.

Understanding the Cost of Dog Insurance

The cost of dog insurance can vary significantly based on a multitude of factors. It is important to recognize that the price of a policy is not a reflection of the quality of care your dog will receive, but rather a complex calculation based on several key considerations. These factors include the breed of your dog, their age, pre-existing conditions, location, and the type of coverage you choose.

Breed and Age Considerations

Breed and age are two of the most significant factors influencing dog insurance costs. Certain breeds are predisposed to specific health conditions, and these genetic factors can greatly impact insurance premiums. For example, breeds like Bulldogs, German Shepherds, and Poodles are more susceptible to hereditary conditions, which may result in higher insurance costs. Younger dogs, typically considered more resilient, often attract lower premiums compared to older dogs, who are more likely to develop age-related health issues.

| Breed | Average Premium (Monthly) |

|---|---|

| Bulldog | $50 - $80 |

| German Shepherd | $40 - $60 |

| Poodle | $35 - $55 |

Additionally, the age of your dog at the time of policy inception can affect your premium. Many insurers offer discounted rates for younger dogs, recognizing the reduced likelihood of immediate health concerns. However, it is important to note that some companies may charge higher premiums for older dogs, particularly those over 7 years old, due to the increased risk of age-related illnesses.

Pre-Existing Conditions

The presence of pre-existing conditions can significantly impact the cost and availability of dog insurance. These are health issues that your dog has before you apply for insurance. Insurers carefully review your dog’s medical history to assess the risk associated with insuring them. If your dog has a known health condition, it may result in higher premiums, reduced coverage options, or even denial of coverage.

For example, if your dog has been diagnosed with hip dysplasia, a common condition in certain breeds, you may find it challenging to secure comprehensive insurance coverage. Insurers may exclude this condition from the policy or charge a higher premium to cover the risk.

| Condition | Average Premium Increase |

|---|---|

| Hip Dysplasia | 20% - 30% |

| Allergies | 15% - 25% |

| Diabetes | 30% - 40% |

It is crucial to disclose all pre-existing conditions accurately when applying for insurance. Failure to do so can result in claim denials or policy cancellations, leaving you with unexpected veterinary bills.

Location and Lifestyle Factors

The location where you live and your dog’s lifestyle can also affect insurance costs. Insurance providers consider the cost of veterinary care in your area, as well as any specific regional risks or environmental factors that could impact your dog’s health. For instance, if you live in an area with a high incidence of Lyme disease, your insurance premium may reflect this risk.

Additionally, your dog's lifestyle, such as frequent travel or participation in high-risk activities like agility competitions, can influence insurance costs. Insurers may offer specialized policies or add-ons to cover these activities, but they will likely come at a higher premium.

| Location | Average Premium (Monthly) |

|---|---|

| Urban Areas | $45 - $65 |

| Rural Areas | $35 - $50 |

Types of Dog Insurance Policies

There are several types of dog insurance policies available, each offering different levels of coverage and benefits. Understanding the differences between these policies is crucial to ensure you choose the right one for your dog’s specific needs.

Accident-Only Policies

Accident-only policies, as the name suggests, cover only accidents and injuries. These policies are generally the most affordable option, providing coverage for unexpected events like car accidents, bites, or broken bones. However, they do not cover illnesses or routine care.

Accident-only policies are ideal for dog owners on a budget or for those with healthy, young dogs who are less likely to develop serious health issues. These policies can provide a safety net for unexpected accidents, ensuring you are not faced with a large, unexpected expense.

Accident and Illness Policies

Accident and illness policies, also known as comprehensive policies, offer a broader range of coverage. They cover not only accidents but also illnesses and injuries. These policies can include coverage for chronic conditions, hereditary diseases, and even certain pre-existing conditions.

Comprehensive policies are a popular choice for many dog owners, providing peace of mind and financial protection for a wide range of potential health issues. However, they tend to be more expensive than accident-only policies due to the broader coverage they offer.

| Policy Type | Average Premium (Monthly) |

|---|---|

| Accident-Only | $20 - $35 |

| Accident and Illness | $40 - $60 |

Wellness Plans

Wellness plans are a relatively new addition to the dog insurance market. These plans are designed to cover routine care and preventive treatments, such as vaccinations, flea and tick control, and annual check-ups. They can also cover certain conditions that are not typically covered by traditional insurance policies, like obesity or behavioral issues.

Wellness plans are an excellent option for dog owners who want to ensure their pet receives regular veterinary care without the financial burden. They are particularly beneficial for older dogs or those with pre-existing conditions that may not be covered by traditional insurance policies.

Specialized Policies

Some insurance providers offer specialized policies tailored to specific breeds or conditions. These policies are designed to provide comprehensive coverage for the unique health needs of certain breeds or to address specific concerns, such as cancer or orthopedic issues.

Specialized policies can be a lifesaver for dog owners facing significant health challenges with their pets. They offer peace of mind and financial protection, ensuring that your dog receives the best possible care without breaking the bank.

Tips for Finding the Right Dog Insurance

With so many factors influencing dog insurance costs and policy options, it can be overwhelming to choose the right coverage for your furry friend. Here are some tips to help you navigate the process and find the best dog insurance policy for your needs.

Research Multiple Providers

Start by researching several dog insurance providers. Compare their policies, coverage options, and premiums. Look for providers that offer customizable plans, allowing you to choose the coverage that best suits your dog’s needs.

Understand Exclusions and Limitations

Read the fine print carefully to understand what is and is not covered by each policy. Look for exclusions and limitations, such as pre-existing condition exclusions or waiting periods for certain procedures. Understanding these details can help you make an informed decision and avoid unpleasant surprises later.

Consider Your Dog’s Health History

Take into account your dog’s current and past health history when choosing a policy. If your dog has pre-existing conditions, look for providers that offer coverage for these conditions or at least have flexible policies that can accommodate them.

Assess Your Financial Situation

Consider your financial situation and how much you can afford to spend on insurance premiums. While it is tempting to opt for the most comprehensive policy, it may not be feasible for your budget. Strike a balance between the coverage you need and what you can afford.

Read Reviews and Seek Recommendations

Research customer reviews and seek recommendations from other dog owners to get an idea of the insurer’s reputation and customer service. A good insurer should provide excellent support and make the claims process as smooth as possible.

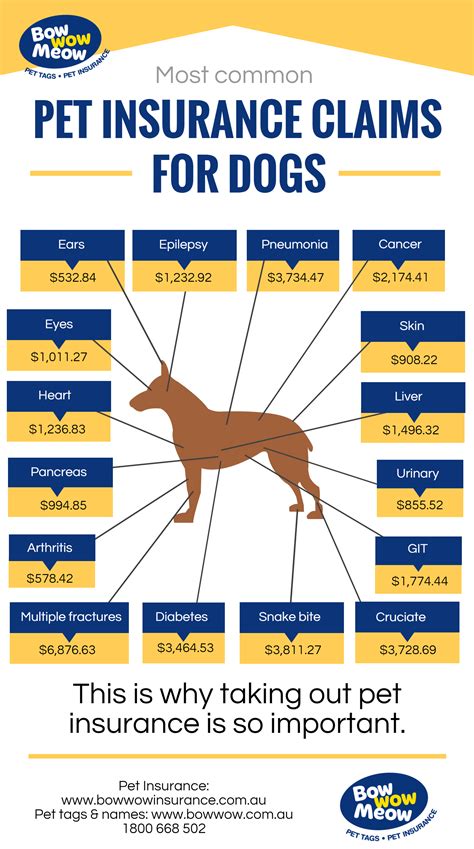

The Benefits of Dog Insurance

Dog insurance offers a multitude of benefits that extend beyond financial protection. Here are some key advantages to consider when deciding whether dog insurance is right for you and your canine companion.

Peace of Mind

Perhaps the most significant benefit of dog insurance is the peace of mind it provides. Knowing that you have coverage for unexpected veterinary expenses can significantly reduce stress and anxiety, allowing you to focus on your dog’s health and well-being.

Access to Quality Care

Dog insurance can give you access to the best veterinary care available. With insurance, you are not limited by financial constraints and can choose the most suitable treatment options for your dog, ensuring they receive the highest standard of care.

Early Detection and Prevention

Many dog insurance policies cover preventive care, such as annual check-ups and vaccinations. This early detection and prevention can help identify potential health issues before they become serious, potentially saving you money and providing a better outcome for your dog’s health.

Coverage for Chronic Conditions

Chronic conditions, such as arthritis or diabetes, can be expensive to manage. Dog insurance can provide coverage for these conditions, helping you manage the cost of ongoing treatments and medications.

Reduced Financial Burden

Veterinary care can be costly, and unexpected expenses can quickly add up. Dog insurance can significantly reduce the financial burden of these costs, allowing you to provide the best possible care for your dog without straining your finances.

Conclusion: Securing Your Dog’s Future

Dog insurance is an essential aspect of responsible pet ownership, providing financial protection and peace of mind for unexpected veterinary expenses. By understanding the factors that influence insurance costs and exploring the various policy options available, you can make an informed decision about insuring your dog.

Remember, the cost of dog insurance is a small price to pay for the love and companionship your dog brings into your life. With the right insurance policy, you can ensure your furry friend receives the best possible care, no matter what life throws their way.

Can I get insurance for my senior dog?

+Yes, you can find insurance providers that offer coverage for senior dogs. However, it’s important to note that premiums may be higher due to the increased risk of age-related health issues. It’s always best to explore your options and compare policies to find the best fit for your senior canine companion.

Are there any discounts available for dog insurance?

+Yes, many insurance providers offer discounts for various reasons. Common discounts include multi-pet discounts, automatic payment discounts, and loyalty discounts for long-term customers. Additionally, some insurers may offer promotional discounts for new customers or during certain times of the year. It’s worth inquiring about these discounts when researching insurance options.

What is the process for making a claim with dog insurance?

+The claims process can vary slightly between insurance providers, but generally, you will need to submit a claim form along with supporting documentation, such as veterinary invoices and medical records. Some insurers offer online claim submission, while others may require you to mail or fax the necessary documents. It’s important to familiarize yourself with your insurer’s specific claims process to ensure a smooth and timely reimbursement.