How Much Is Life Insurance Per Month

Understanding the cost of life insurance is crucial when planning for your financial future and ensuring the well-being of your loved ones. The price of life insurance policies can vary significantly, influenced by a multitude of factors. In this comprehensive article, we delve into the intricacies of life insurance costs, providing you with a detailed analysis and practical insights to help you navigate this important aspect of personal finance.

Factors Influencing Life Insurance Premiums

Life insurance premiums are calculated based on a combination of personal and environmental factors. Here’s a breakdown of the key elements that impact the monthly cost of life insurance:

1. Age and Health Status

One of the primary factors in determining life insurance costs is your age and overall health. Insurance companies assess your life expectancy and the associated risks. Generally, younger individuals pay lower premiums as they are statistically less likely to pass away during the policy term. Additionally, maintaining good health can lead to reduced premiums, as it indicates a lower risk profile.

For example, a healthy 30-year-old non-smoker may pay significantly less for life insurance compared to a 50-year-old with pre-existing health conditions.

2. Policy Type and Coverage Amount

The type of life insurance policy you choose and the coverage amount you select play a crucial role in determining your monthly premiums. There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years, and is generally more affordable. On the other hand, permanent life insurance, such as whole life or universal life insurance, provides coverage for your entire life and often includes a cash value component, making it more expensive.

The coverage amount you choose will directly impact your premiums. Higher coverage amounts provide more financial protection for your beneficiaries but also result in higher monthly costs.

3. Lifestyle and Occupation

Your lifestyle choices and occupation can also affect your life insurance premiums. Engaging in high-risk activities like extreme sports or having a hazardous occupation may lead to higher premiums. Insurance companies assess these factors to determine the likelihood of an early demise and adjust premiums accordingly.

4. Family History and Genetics

Your family’s medical history and genetic predispositions can influence your life insurance costs. If your family has a history of certain medical conditions or diseases, insurance companies may consider you to be at a higher risk, potentially leading to increased premiums.

5. Tobacco and Substance Use

The use of tobacco products and certain substances can significantly impact your life insurance premiums. Smokers, for instance, are often charged higher rates due to the increased health risks associated with smoking. Similarly, individuals with a history of substance abuse may face higher premiums or even be denied coverage.

6. Location and Regional Factors

Your geographic location can also affect your life insurance costs. Insurance companies consider regional factors such as crime rates, life expectancy, and healthcare accessibility when setting premiums. For instance, areas with higher crime rates or limited access to quality healthcare may have higher insurance costs.

7. Credit Score and Financial History

In some cases, insurance companies may consider your credit score and financial history when determining your premiums. A good credit score can sometimes result in lower premiums, as it indicates financial stability and a lower risk of default.

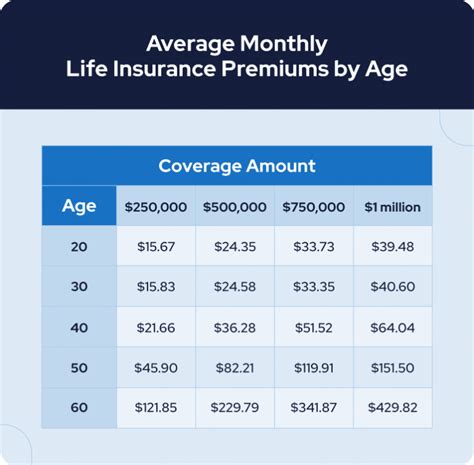

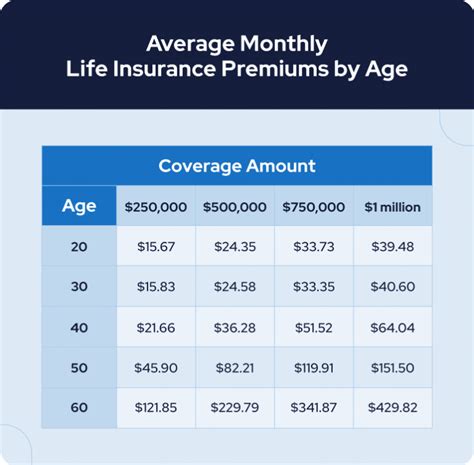

Average Monthly Costs of Life Insurance

The average monthly cost of life insurance can vary widely based on the factors mentioned above. Here’s a breakdown of average monthly premiums for different age groups and coverage amounts:

| Age | Coverage Amount ($) | Average Monthly Premium (Term Life) | Average Monthly Premium (Permanent Life) |

|---|---|---|---|

| 25 | 250,000 | 15-25 | 60-100 |

| 35 | 500,000 | 20-35 | 120-200 |

| 45 | 750,000 | 35-50 | 250-400 |

| 55 | 1,000,000 | 50-75 | 400-600 |

Please note that these averages are estimates and can vary based on individual circumstances and the insurance company. It's always recommended to obtain personalized quotes to get an accurate idea of your specific life insurance costs.

Tips for Finding Affordable Life Insurance

While life insurance premiums are influenced by various factors, there are strategies you can employ to find more affordable coverage:

1. Compare Multiple Quotes

Obtain quotes from multiple insurance providers to compare prices and coverage options. This allows you to identify the most competitive rates and choose a policy that suits your needs.

2. Choose the Right Coverage Amount

Determine the appropriate coverage amount based on your financial goals and the needs of your beneficiaries. Overestimating your coverage needs can lead to unnecessary expenses, while underestimating may leave your loved ones financially vulnerable.

3. Consider Term Life Insurance

Term life insurance is often more affordable than permanent life insurance. If you’re seeking coverage for a specific period, such as until your children become independent or you pay off your mortgage, term life insurance can provide cost-effective protection.

4. Maintain a Healthy Lifestyle

Adopting and maintaining a healthy lifestyle can lead to lower premiums. Regular exercise, a balanced diet, and avoiding tobacco and excessive alcohol consumption can improve your health status and reduce insurance costs.

5. Review and Adjust Your Policy Regularly

Life insurance needs can change over time. Review your policy periodically and adjust it as necessary to ensure it aligns with your current circumstances. This may involve increasing or decreasing coverage, changing beneficiaries, or exploring more cost-effective options.

Conclusion

Understanding the factors that influence life insurance costs and adopting strategic approaches can help you secure the coverage you need at a reasonable price. Remember, life insurance is a long-term investment in your financial security and the well-being of your family. By staying informed and taking proactive steps, you can make informed decisions and find the best life insurance policy for your unique circumstances.

FAQ

Can I get life insurance if I have a pre-existing medical condition?

+Yes, individuals with pre-existing medical conditions can still obtain life insurance. However, the premiums may be higher, and the coverage may be subject to certain conditions or exclusions. It’s important to disclose all relevant medical information to ensure accurate underwriting and to avoid potential issues with claims in the future.

How often should I review my life insurance policy?

+It’s recommended to review your life insurance policy at least once a year or whenever there are significant changes in your life, such as marriage, the birth of a child, or a major career shift. Regular reviews ensure that your coverage remains adequate and aligned with your evolving needs.

What happens if I miss a life insurance premium payment?

+Missing a premium payment can have serious consequences. Most policies have a grace period, typically 30 days, during which you can still make the payment without losing coverage. However, if you miss the grace period, your policy may lapse, and you’ll need to reapply, potentially facing higher premiums or being denied coverage altogether.