Classic Cars Insurance Quotes

Insuring a classic car is a unique process that requires specialized knowledge and an understanding of the vehicle's value and specific needs. Whether you're a proud owner of a vintage automobile or considering adding one to your collection, it's essential to explore the intricacies of classic car insurance. This article will delve into the world of classic car insurance, offering a comprehensive guide to help you navigate the process of obtaining the best coverage for your prized possession.

Understanding Classic Car Insurance

Classic car insurance is a specialized form of automotive coverage designed to meet the unique requirements of vintage and antique vehicles. Unlike standard car insurance, which is tailored for modern vehicles used for everyday commuting, classic car insurance caters to the specific needs of older, often collector-owned automobiles.

These policies recognize that classic cars are more than just modes of transportation; they are cherished pieces of automotive history, investments, and often, a labor of love for their owners. As such, classic car insurance policies are crafted to provide comprehensive protection while also accommodating the unique usage patterns and storage conditions of these vehicles.

Coverage Options for Classic Cars

Classic car insurance offers a range of coverage options to suit the diverse needs of collectors and enthusiasts. Here are some key components often included in these policies:

- Agreed Value Coverage: This type of coverage ensures that the vehicle is insured for an agreed-upon value, determined through an appraisal or agreed valuation process. It provides peace of mind for owners, as it guarantees that in the event of a total loss, the insurance company will pay the agreed amount, not just the depreciated value.

- Comprehensive Coverage: Similar to standard car insurance, comprehensive coverage protects against damage or loss due to non-collision incidents, such as theft, vandalism, fire, or natural disasters. This coverage is essential for classic car owners to safeguard their vehicles against unexpected events.

- Liability Coverage: This type of insurance protects the policyholder against bodily injury or property damage claims made by others in the event of an accident caused by the insured vehicle. It's a critical component of any insurance policy, ensuring the owner is financially protected in the event of a lawsuit.

- Specialized Parts Coverage: Classic cars often require unique or hard-to-find parts for repairs and maintenance. Specialized parts coverage ensures that these parts are covered, allowing owners to maintain the authenticity and integrity of their vehicles.

- Event Coverage: Many classic car owners participate in car shows, parades, or other events. Event coverage provides protection during these outings, ensuring that the vehicle is insured while it's being displayed or driven for recreational purposes.

It's important to note that the coverage options for classic cars can vary significantly between insurance providers. Therefore, it's crucial to thoroughly review the policy details and discuss your specific needs with an insurance agent who specializes in classic car insurance.

| Coverage Type | Description |

|---|---|

| Agreed Value | Insures the vehicle for an agreed-upon value, typically determined by appraisal. |

| Comprehensive | Protects against non-collision incidents like theft, fire, and natural disasters. |

| Liability | Covers bodily injury and property damage claims made against the policyholder. |

| Specialized Parts | Ensures coverage for unique or hard-to-find parts required for repairs. |

| Event Coverage | Provides protection during car shows, parades, or other recreational events. |

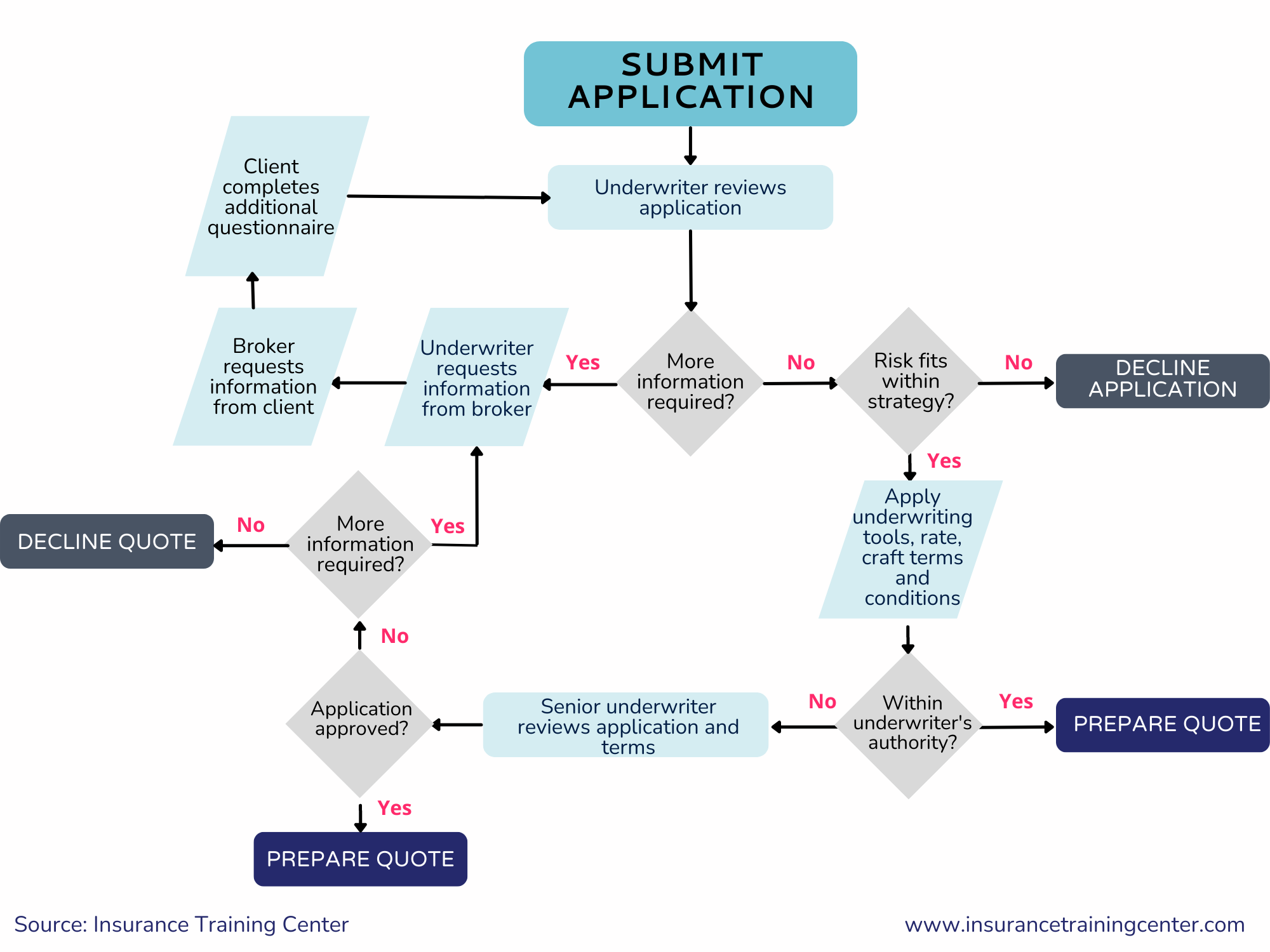

The Process of Obtaining Classic Car Insurance Quotes

Obtaining insurance quotes for your classic car involves a series of steps that are designed to assess the risk and value of your vehicle. Here’s a breakdown of the typical process:

Step 1: Assessing Your Classic Car

The first step in obtaining an accurate insurance quote is to provide a detailed assessment of your classic car. This includes information such as the make, model, year, and any modifications or enhancements you’ve made. It’s important to be as accurate as possible, as this data forms the foundation of your insurance policy.

In addition to the vehicle's specifications, you'll also need to provide details about its current condition, any recent repairs or restorations, and its storage location. This information helps the insurance company understand the risk factors associated with your vehicle and tailor the policy accordingly.

Step 2: Determining Coverage Needs

Once your classic car has been assessed, the next step is to determine the level of coverage you require. As mentioned earlier, classic car insurance offers a range of coverage options, and it’s crucial to select the ones that align with your needs and the value of your vehicle.

Consider factors such as the frequency of your car's usage, its storage conditions, and your budget when deciding on the coverage limits and deductibles. It's a good idea to consult with an insurance professional who specializes in classic car insurance to ensure you're getting the right level of protection.

Step 3: Comparing Quotes

After you’ve provided the necessary details about your classic car and determined your coverage needs, you can start comparing quotes from different insurance providers. This step is crucial as it allows you to find the best coverage at the most competitive price.

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional benefits or perks offered by the insurance company. It's also essential to read the fine print and understand any exclusions or limitations in the policy. Some insurance companies may offer discounts for multi-policy coverage or for vehicles that are stored in a secure location.

Step 4: Finalizing Your Policy

Once you’ve found an insurance provider that offers the coverage you need at a competitive price, it’s time to finalize your policy. This typically involves providing additional documentation, such as proof of ownership, and paying the initial premium.

Review the policy documents carefully to ensure that all the details, including the coverage limits, deductibles, and any endorsements or riders, are as agreed upon. If there are any discrepancies or questions, don't hesitate to contact your insurance agent to clarify and make any necessary adjustments.

Once your policy is in place, you can rest easy knowing that your classic car is protected. Remember to keep your insurance agent informed of any significant changes to your vehicle or its usage patterns, as this may impact your coverage and premiums.

How often should I review my classic car insurance policy?

+It’s recommended to review your classic car insurance policy annually or whenever there are significant changes to your vehicle, such as modifications or enhancements. This ensures that your coverage remains adequate and that you’re not overpaying for unnecessary coverage.

Can I get discounts on classic car insurance?

+Yes, many insurance companies offer discounts for classic car owners. These can include multi-policy discounts (if you bundle your classic car insurance with other types of insurance), secure storage discounts, and even discounts for participating in car clubs or associations.

What should I do if I’m involved in an accident with my classic car?

+If you’re involved in an accident with your classic car, it’s important to remain calm and follow the standard procedures. First, ensure the safety of yourself and any passengers. Then, contact the police to file a report and document the incident with photographs. Finally, notify your insurance company as soon as possible to begin the claims process.