Individual Dental Insurance Plan

Unlocking the Benefits of Individual Dental Insurance Plans: A Comprehensive Guide

In the realm of healthcare, dental care often takes a backseat, but its importance for overall well-being cannot be overstated. Individual dental insurance plans step in as a vital tool to ensure accessible and affordable dental care for those who may not have coverage through an employer or a family plan. This guide delves into the intricacies of these plans, shedding light on their advantages, features, and how they can be a game-changer for maintaining optimal oral health.

The Significance of Individual Dental Insurance

Dental insurance is not just about covering the costs of routine check-ups and cleanings. It is a preventive measure that encourages regular dental visits, helping to identify and address potential issues before they escalate into costly and complex problems. For individuals and families, dental insurance offers a financial safety net, ensuring that unexpected dental emergencies or treatments are manageable.

The benefits of individual dental insurance plans extend beyond the financial aspect. They promote a culture of proactive dental care, empowering individuals to take charge of their oral health. This, in turn, contributes to overall well-being, as oral health has been linked to various systemic health conditions.

Understanding the Coverage and Benefits

Individual dental insurance plans offer a range of coverage options, catering to different needs and budgets. At the core, these plans typically cover preventive care, which includes regular check-ups, dental cleanings, and X-rays. This preventive aspect is crucial as it forms the foundation for maintaining good oral health.

Beyond preventive care, individual plans often provide coverage for basic and major dental procedures. Basic procedures might include fillings, root canals, and extractions, while major procedures could encompass dental implants, crowns, and bridges. The extent of coverage for these procedures varies across plans, with some offering more comprehensive benefits.

Key Features of Individual Dental Insurance Plans

- Annual Maximums: This refers to the maximum amount the insurance plan will pay out in a year. Plans with higher annual maximums provide more extensive coverage for major dental procedures.

- Deductibles: Similar to health insurance, dental plans may have deductibles. The deductible is the amount you must pay out of pocket before the insurance coverage kicks in.

- Waiting Periods: Some plans may have waiting periods for certain procedures, especially for major treatments. It's important to understand these waiting periods when choosing a plan.

- Network of Dentists: Insurance providers typically have a network of preferred dentists. Choosing an in-network dentist can result in lower out-of-pocket costs.

The Process of Enrolling and Choosing the Right Plan

Enrolling in an individual dental insurance plan is a straightforward process, but it requires careful consideration. The first step is to assess your dental needs and budget. If you anticipate needing extensive dental work, a plan with higher annual maximums and more comprehensive coverage might be the best fit. On the other hand, if you primarily require preventive care, a plan with lower premiums and basic coverage could be sufficient.

When researching plans, pay attention to the provider's network of dentists. Ensure that your preferred dental professionals are in-network to avoid higher out-of-pocket costs. Additionally, consider the plan's waiting periods and deductibles to understand the immediate and long-term financial implications.

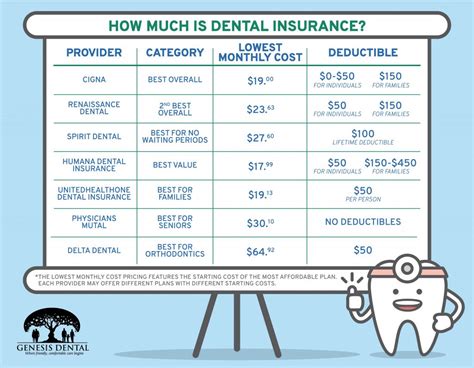

Comparative Analysis of Top Individual Dental Insurance Plans

| Plan | Annual Maximum | Deductible | Waiting Period | Network Size |

|---|---|---|---|---|

| Plan A | $2,000 | $50 | 3 months | 15,000+ dentists |

| Plan B | $1,500 | $100 | 6 months | 10,000+ dentists |

| Plan C | $3,000 | $200 | No waiting period | 20,000+ dentists |

The table above provides a glimpse into the features of three top individual dental insurance plans. Plan C, for instance, offers a higher annual maximum and a larger network of dentists, making it an attractive option for those seeking comprehensive coverage. However, the higher deductible and absence of a waiting period could make it a less appealing choice for those who anticipate immediate dental needs.

Maximizing Your Dental Insurance Benefits

Once you've enrolled in an individual dental insurance plan, it's crucial to understand how to make the most of your benefits. Here are some tips to ensure you're getting the full value of your coverage:

- Stay Informed: Familiarize yourself with your plan's coverage details, including what procedures are covered, any waiting periods, and the process for filing claims.

- Choose In-Network Dentists: As mentioned earlier, using in-network dentists can result in significant cost savings.

- Schedule Regular Check-Ups: Preventive care is the cornerstone of dental health. Ensure you schedule your check-ups and cleanings as recommended by your dentist.

- Understand Your Plan's Limitations: Know what procedures are not covered and plan accordingly. For instance, if cosmetic dentistry is not covered, you may need to budget separately for such procedures.

The Future of Individual Dental Insurance

The landscape of individual dental insurance is evolving, driven by advancements in dental technology and changing consumer needs. We're witnessing a shift towards more personalized plans, offering flexibility and customization to cater to individual dental requirements. Additionally, the integration of digital technologies, such as online portals for managing claims and appointments, is enhancing the overall user experience.

Looking ahead, the focus is on making dental insurance more accessible and understandable. Efforts are being made to simplify the enrollment process and provide clearer explanations of coverage and benefits. This transparency aims to empower consumers to make informed choices about their dental care and insurance.

Frequently Asked Questions (FAQ)

Can I use my dental insurance plan for cosmetic dentistry procedures?

+Cosmetic dentistry procedures are often not covered by basic dental insurance plans. However, some plans offer additional coverage for cosmetic procedures, usually at an increased premium. It’s important to carefully review your plan’s coverage details to understand what is and isn’t included.

What happens if I exceed my plan’s annual maximum?

+If you exceed your plan’s annual maximum, you will be responsible for paying any additional costs out of pocket. This is why it’s important to choose a plan with an annual maximum that aligns with your anticipated dental needs.

How often should I visit the dentist with my insurance plan?

+Most dental insurance plans recommend regular check-ups and cleanings every 6 months. These preventive visits are typically fully covered and are crucial for maintaining good oral health.

Can I switch my dental insurance plan if I’m not satisfied with my current one?

+Yes, you can typically switch your dental insurance plan during the open enrollment period, which often occurs annually. However, it’s important to note that switching plans may result in a new waiting period for certain procedures.

What are some common exclusions in dental insurance plans?

+Common exclusions in dental insurance plans may include orthodontic treatment (braces) for adults, cosmetic procedures, and certain restorative procedures like implants or bridges. It’s always best to review your plan’s exclusions list to be fully aware of what’s not covered.