Cost Of Car Insurance

Car insurance is a vital aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. However, the cost of car insurance can vary significantly depending on numerous factors, making it a complex and often confusing topic for consumers. In this comprehensive guide, we delve into the intricacies of car insurance costs, exploring the key elements that influence premiums and offering valuable insights to help you navigate this essential aspect of vehicle ownership.

Understanding the Factors Affecting Car Insurance Costs

The price of car insurance is determined by a multitude of factors, each playing a unique role in shaping the overall premium. These factors can be broadly categorized into personal, vehicle-related, and external influences. By understanding these elements, you can gain a clearer picture of why your insurance costs what it does and potentially identify areas where you can save.

Personal Factors

Your personal characteristics and driving history are among the most significant determinants of your car insurance premium. Age, for instance, is a critical factor; younger drivers, particularly those under 25, often face higher premiums due to their lack of experience on the road. Gender also plays a role, with some insurance providers considering it a relevant factor in assessing risk. Additionally, your driving record is scrutinized, with a history of accidents or traffic violations potentially leading to increased costs.

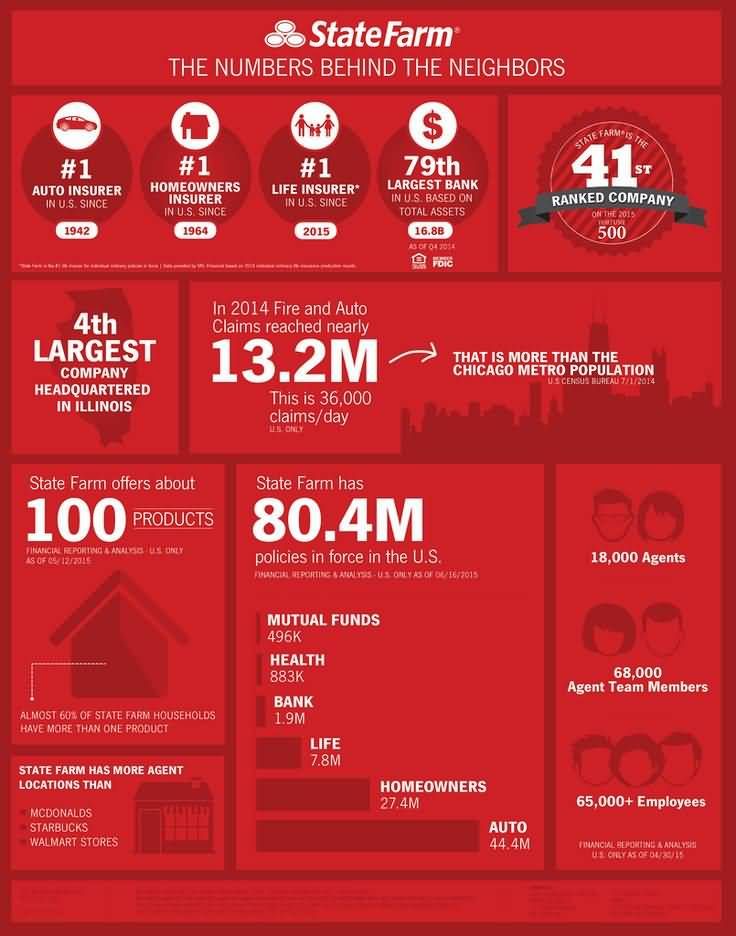

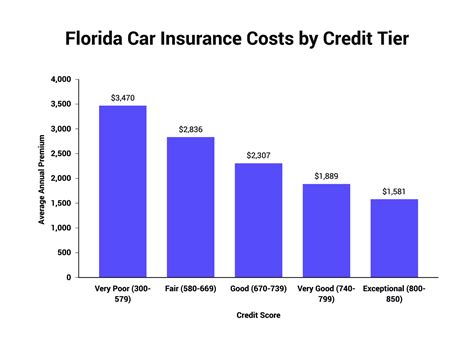

Moreover, your credit score can influence your insurance premium. Many insurers use credit-based insurance scores to assess risk, believing that individuals with lower credit scores may be more likely to file claims. Consequently, maintaining a good credit score can be beneficial when it comes to car insurance costs.

Another personal factor is your occupation. Some professions are perceived as higher risk, which can impact your insurance rates. For example, individuals in high-pressure jobs or those who frequently drive for work might face higher premiums.

Vehicle-Related Factors

The type of vehicle you drive and its specifications can significantly impact your insurance costs. Make and model are crucial considerations, as some vehicles are statistically more prone to accidents or theft, leading to higher insurance premiums. Similarly, the age and value of your vehicle can affect your premium, with older or more expensive cars often requiring higher coverage and thus commanding higher rates.

The safety features of your vehicle can also influence insurance costs. Cars equipped with advanced safety systems, such as lane departure warning or automatic emergency braking, are often considered less risky to insure, potentially resulting in lower premiums. Conversely, vehicles lacking such features might attract higher insurance costs.

The primary use of your vehicle is another factor. If you primarily use your car for commuting to work or for business purposes, your insurance rates might be higher compared to someone who uses their vehicle only occasionally or for pleasure driving.

External Factors

External influences beyond your control can also impact your car insurance costs. One significant factor is the location where you reside or park your vehicle. Areas with high crime rates or a history of frequent accidents tend to have higher insurance premiums. Similarly, the population density of your area can play a role, with more densely populated regions often associated with a higher risk of accidents.

The traffic conditions and road quality in your area are also considered. If your regular driving routes are known for heavy traffic or poorly maintained roads, your insurance costs might be higher due to the increased risk of accidents.

Lastly, external market factors, such as economic conditions or insurance industry trends, can affect premiums across the board. These factors are often beyond the control of individual consumers but can significantly influence the cost of car insurance.

Calculating Your Car Insurance Premium

The process of calculating car insurance premiums is intricate and involves a careful assessment of various factors. Insurance companies use sophisticated algorithms and data analysis to determine the likelihood of a driver filing a claim and the potential cost of that claim. This risk assessment is then translated into a premium, with higher-risk drivers typically paying more.

The specific formula used to calculate premiums varies among insurance providers and often involves a complex interplay of the factors mentioned earlier. For instance, a young driver with a history of accidents and a low credit score might face a significantly higher premium than an older driver with a clean record and a high credit score, even if they drive the same type of vehicle in the same location.

The Role of Data and Technology

Advancements in data analytics and technology have revolutionized the way car insurance premiums are determined. Insurers now have access to vast amounts of data, which they use to create detailed risk profiles for individual drivers. This data-driven approach allows for a more precise assessment of risk, which can lead to more accurate premiums.

One notable example of technology-driven insurance is the rise of telematics or usage-based insurance (UBI). With telematics, insurance providers install a device in your vehicle that tracks your driving behavior, such as speed, acceleration, and mileage. This data is then used to calculate your premium, offering a more personalized and potentially more affordable insurance option for safe drivers.

| Telematics | Description |

|---|---|

| Real-Time Tracking | Provides real-time data on driving behavior. |

| Pay-As-You-Drive (PAYD) | Premiums are calculated based on actual miles driven. |

| Usage-Based Insurance (UBI) | Insurers offer discounts to safe drivers based on driving data. |

The Impact of Discounts and Bundling

Insurance providers often offer a range of discounts to reduce the cost of car insurance. These discounts can significantly lower your premium, especially if you meet multiple eligibility criteria. Some common discounts include good driver discounts (for maintaining a clean driving record), multi-policy discounts (for bundling your car insurance with other policies like home or life insurance), and loyalty discounts (for staying with the same insurer over an extended period).

Additionally, bundling your car insurance with other policies can lead to substantial savings. By combining multiple insurance policies under one insurer, you can often negotiate better rates and benefit from reduced administrative costs.

Tips to Reduce Your Car Insurance Costs

While the cost of car insurance is influenced by various factors, there are strategies you can employ to potentially reduce your premiums. Here are some effective tips to consider:

Improving Your Driving Record

One of the most effective ways to lower your car insurance costs is by maintaining a clean driving record. Avoid traffic violations and prevent accidents as much as possible. Over time, a clean driving record can lead to significant savings on your insurance premium.

Enhancing Your Credit Score

Given the correlation between credit scores and insurance premiums, improving your credit score can be beneficial. Regularly review your credit report, dispute any errors, and work on paying off debts to boost your score. A higher credit score can lead to lower insurance rates.

Comparing Insurance Providers

Insurance providers offer a wide range of rates and policies. By comparing quotes from multiple insurers, you can identify the most affordable option for your specific needs. Online comparison tools can be particularly useful for this task, allowing you to quickly and easily assess various options.

Opting for Higher Deductibles

Increasing your deductible—the amount you pay out of pocket before your insurance coverage kicks in—can lead to lower premiums. This strategy works best for those with the financial means to cover a higher deductible in the event of an accident or claim. However, it’s essential to ensure that the increased deductible does not compromise your financial stability.

Utilizing Telematics and UBI

If you’re a safe driver, considering telematics or UBI can be a smart move. These technologies reward safe driving behavior with lower premiums. By installing a telematics device in your vehicle or opting into a UBI program, you can potentially save significantly on your car insurance costs.

Reviewing and Adjusting Your Coverage

Regularly review your insurance policy to ensure it aligns with your current needs. If your circumstances have changed, such as purchasing a new vehicle or moving to a different location, your insurance coverage might need adjustment. Additionally, consider whether you still require all the coverage you currently have. By trimming unnecessary coverage, you can reduce your premium.

Bundling Policies

Bundling your car insurance with other policies, such as home or life insurance, can lead to substantial savings. Many insurers offer discounts when you combine multiple policies, so it’s worth exploring this option to reduce your overall insurance costs.

Future Trends in Car Insurance Costs

The landscape of car insurance is constantly evolving, influenced by technological advancements, changing consumer behaviors, and regulatory shifts. Here are some key trends that are likely to shape the cost of car insurance in the coming years.

The Rise of Telematics and UBI

The use of telematics and UBI is expected to grow significantly in the coming years. As more drivers embrace these technologies, insurance providers will have access to an even larger pool of data, allowing for more precise risk assessment and potentially more affordable insurance options for safe drivers.

Impact of Autonomous Vehicles

The advent of autonomous vehicles is poised to revolutionize the insurance industry. As self-driving cars become more prevalent, insurance providers will need to adapt their models to account for the reduced risk of human error. This could lead to lower insurance costs for drivers of autonomous vehicles, although the exact impact is yet to be fully understood.

The Role of Artificial Intelligence

Artificial Intelligence (AI) is already playing a significant role in the insurance industry, and its influence is expected to grow. AI algorithms can analyze vast amounts of data quickly and accurately, allowing insurers to make more informed decisions about risk assessment and pricing. This enhanced data analysis could lead to more efficient and potentially more affordable insurance options.

Regulatory Changes and Industry Consolidation

Regulatory changes and industry consolidation can also impact the cost of car insurance. As the industry adapts to new regulations and technological advancements, insurance providers might need to adjust their pricing models. Additionally, consolidation within the industry could lead to a more competitive market, potentially driving down insurance costs for consumers.

Conclusion

The cost of car insurance is influenced by a myriad of factors, from personal characteristics and vehicle specifications to external market conditions. By understanding these factors and employing strategies to reduce your premiums, you can potentially save significantly on your car insurance costs. As the industry continues to evolve, keeping abreast of the latest trends and technologies can help you make informed decisions about your insurance coverage and ensure you’re getting the best value for your money.

What is the average cost of car insurance in the United States?

+

The average cost of car insurance in the United States varies significantly depending on numerous factors, including the state you reside in, your age, gender, driving record, and the type of vehicle you drive. However, as of recent data, the average cost of car insurance nationwide is approximately 1,674 per year, or 139 per month.

Are there any ways to get cheaper car insurance for young drivers?

+

Yes, there are several strategies young drivers can employ to reduce their car insurance costs. These include maintaining a clean driving record, opting for higher deductibles, taking defensive driving courses, and considering usage-based insurance (UBI) programs that reward safe driving behavior with lower premiums.

How do credit scores impact car insurance premiums?

+

Credit scores are often used by insurance companies as a factor in determining insurance premiums. Generally, a higher credit score is associated with lower insurance costs. This is because individuals with higher credit scores are statistically less likely to file claims. However, the exact impact of credit scores on insurance premiums can vary depending on the insurer and state regulations.

Can I reduce my car insurance costs by switching providers?

+

Absolutely! Insurance providers offer a wide range of rates and policies, and by comparing quotes from multiple insurers, you can often find more affordable options. It’s a good idea to review your insurance policy and shop around for the best deal at least once a year, especially if your circumstances have changed or if you’re not satisfied with your current provider.

What is the difference between comprehensive and liability-only car insurance?

+

Comprehensive car insurance provides coverage for a wide range of incidents, including accidents, theft, and natural disasters. On the other hand, liability-only car insurance covers only the damages you cause to others’ property or injuries you cause to others in an accident. It’s important to note that liability-only insurance does not cover damage to your own vehicle, so it’s generally recommended to have comprehensive coverage to ensure you’re fully protected.