Bcbs Health Insurance Plans

Blue Cross Blue Shield (BCBS) is a renowned name in the healthcare industry, offering a comprehensive range of health insurance plans to individuals and families across the United States. With a rich history dating back to the early 20th century, BCBS has evolved to become a trusted provider, catering to the diverse healthcare needs of millions of Americans.

The organization's vast network of plans, combined with its commitment to quality care and innovation, makes it a go-to choice for many seeking reliable health coverage. In this article, we will delve into the world of BCBS health insurance plans, exploring their features, benefits, and unique offerings, to help readers make informed decisions about their healthcare.

Understanding BCBS Health Insurance Plans

BCBS health insurance plans are designed to offer a wide array of coverage options, catering to the varying needs of individuals, families, and businesses. These plans are underwritten by independent Blue Cross and Blue Shield companies, each with its own unique set of products and services.

One of the key strengths of BCBS plans is their adaptability. Whether you're a young professional, a growing family, or an elderly individual, there's likely a BCBS plan that suits your healthcare requirements. From basic coverage for routine check-ups to more comprehensive plans for specialized medical needs, BCBS provides a spectrum of choices.

Key Features of BCBS Health Insurance Plans

BCBS health insurance plans are renowned for their extensive network of healthcare providers. With a vast array of doctors, specialists, and facilities across the country, BCBS ensures that its members have convenient access to quality care.

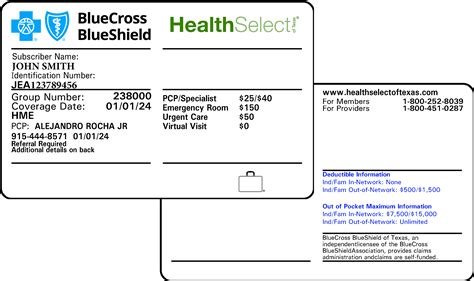

- Flexible Coverage Options: BCBS offers a range of plan types, including Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), and Exclusive Provider Organizations (EPOs). These options provide varying levels of flexibility and coverage, allowing individuals to choose the plan that aligns with their healthcare preferences and budget.

- Comprehensive Benefits: BCBS plans typically cover a wide range of medical services, including doctor visits, hospital stays, prescription drugs, mental health services, and preventive care. Some plans also offer additional benefits like dental and vision coverage, making them even more attractive.

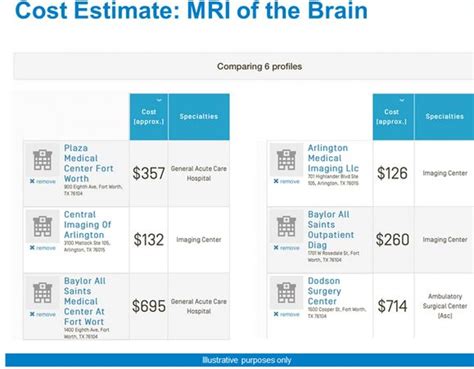

- Cost-Effective Solutions: BCBS is known for its competitive pricing, ensuring that quality healthcare is accessible to a broad range of consumers. The organization offers various cost-saving features, such as low deductibles, copayments, and out-of-pocket maximums, helping individuals manage their healthcare expenses effectively.

BCBS’s Commitment to Innovation

BCBS is at the forefront of healthcare innovation, continuously developing new technologies and initiatives to enhance the member experience. The organization has invested in digital health solutions, offering convenient online tools for members to manage their healthcare needs, from scheduling appointments to accessing medical records.

BCBS has also partnered with leading healthcare providers and organizations to promote preventive care and wellness. Through these partnerships, BCBS members can access exclusive resources and programs aimed at maintaining good health and preventing illnesses. This proactive approach to healthcare aligns with BCBS's vision of creating a healthier community.

BCBS Plan Options: A Detailed Look

BCBS offers a diverse range of plan options, each tailored to meet specific healthcare needs. Here’s a closer look at some of the most popular BCBS plan types:

Preferred Provider Organization (PPO) Plans

PPO plans are a popular choice among BCBS members, offering flexibility and a wide network of healthcare providers. With a PPO plan, you have the freedom to choose any in-network provider without a referral. Additionally, you can visit out-of-network providers, although you may incur higher costs.

- Key Benefits:

- Freedom to choose any in-network provider.

- No referral needed for specialist visits.

- Coverage for both in-network and out-of-network care.

- Suitable For: Individuals and families seeking flexibility and the ability to choose their healthcare providers without restrictions.

Health Maintenance Organization (HMO) Plans

HMO plans are designed to provide cost-effective coverage with a focus on preventive care. These plans typically require you to choose a primary care physician (PCP) who coordinates your healthcare services. Referrals are often necessary for specialist visits.

- Key Benefits:

- Affordable premiums and out-of-pocket costs.

- Emphasis on preventive care and wellness.

- Coordinated care through a designated PCP.

- Suitable For: Budget-conscious individuals who prioritize preventive care and are comfortable with a more structured healthcare approach.

Exclusive Provider Organization (EPO) Plans

EPO plans offer a balance between the flexibility of PPO plans and the cost-effectiveness of HMO plans. With an EPO plan, you have access to a broad network of providers, but you must choose from this network for coverage. Referrals are usually not required for specialist visits.

- Key Benefits:

- Wider network of providers compared to HMO plans.

- No referral needed for specialist visits.

- Cost-effective coverage with limited out-of-network benefits.

- Suitable For: Individuals seeking a balance between flexibility and cost-effectiveness, without the need for a designated PCP.

Comparison Table: BCBS Plan Types

| Plan Type | Flexibility | Cost | Provider Choice |

|---|---|---|---|

| PPO | High | Moderate | Wide network, no referrals needed |

| HMO | Limited | Low | Narrow network, PCP required |

| EPO | Moderate | Moderate | Broader network, no referrals needed |

BCBS’s Commitment to Quality Care

BCBS is dedicated to ensuring its members receive the highest quality healthcare. The organization has implemented various initiatives and partnerships to enhance the member experience and promote excellent medical outcomes.

Quality Assurance Programs

BCBS has developed robust quality assurance programs to evaluate and improve the performance of its network providers. These programs ensure that members receive timely, effective, and safe healthcare services. BCBS regularly monitors provider performance, identifies areas for improvement, and implements strategies to enhance the overall quality of care.

Specialty Care Networks

Recognizing the importance of specialized medical care, BCBS has established specialty care networks. These networks bring together a select group of highly skilled providers who specialize in specific medical conditions or treatments. By partnering with these experts, BCBS ensures that members with complex or chronic conditions have access to the best possible care.

Patient Advocacy Programs

BCBS understands the challenges individuals face when navigating the healthcare system. To address these challenges, the organization offers patient advocacy programs. These programs provide members with personalized support and guidance, helping them understand their coverage, navigate the healthcare system, and make informed decisions about their care.

The Future of BCBS Health Insurance

As the healthcare landscape continues to evolve, BCBS remains committed to staying at the forefront of innovation and change. The organization is actively exploring new technologies and partnerships to enhance the member experience and improve healthcare outcomes.

Digital Health Solutions

BCBS is investing in digital health solutions to provide members with convenient and accessible healthcare services. This includes developing mobile apps and online platforms that allow members to schedule appointments, access medical records, and communicate with healthcare providers remotely. By embracing digital health, BCBS aims to improve access to care and enhance member engagement.

Value-Based Care Initiatives

BCBS is shifting its focus towards value-based care, which emphasizes quality over quantity. By incentivizing healthcare providers to deliver high-quality, cost-effective care, BCBS aims to improve patient outcomes and reduce healthcare costs. This approach aligns with the organization’s commitment to promoting a healthier community and ensuring sustainable healthcare solutions.

Expanding Network Partnerships

BCBS is continually expanding its network of healthcare providers to offer members even more choices. By partnering with top hospitals, medical centers, and specialists, BCBS ensures that members have access to the latest advancements in medical care. This commitment to expanding network partnerships demonstrates BCBS’s dedication to providing members with the best possible healthcare options.

FAQs

What is the difference between BCBS and other health insurance providers?

+BCBS stands out for its extensive network of providers, offering members a wide range of choices. Additionally, BCBS’s commitment to innovation and quality care sets it apart, ensuring members receive the best possible healthcare experience.

How can I choose the right BCBS health insurance plan for me?

+Consider your healthcare needs and budget. If you prioritize flexibility and the ability to choose your providers, a PPO plan might be suitable. If cost-effectiveness is your main concern, an HMO plan could be the right choice. EPO plans offer a balance between flexibility and cost. It’s essential to carefully review the benefits and costs of each plan.

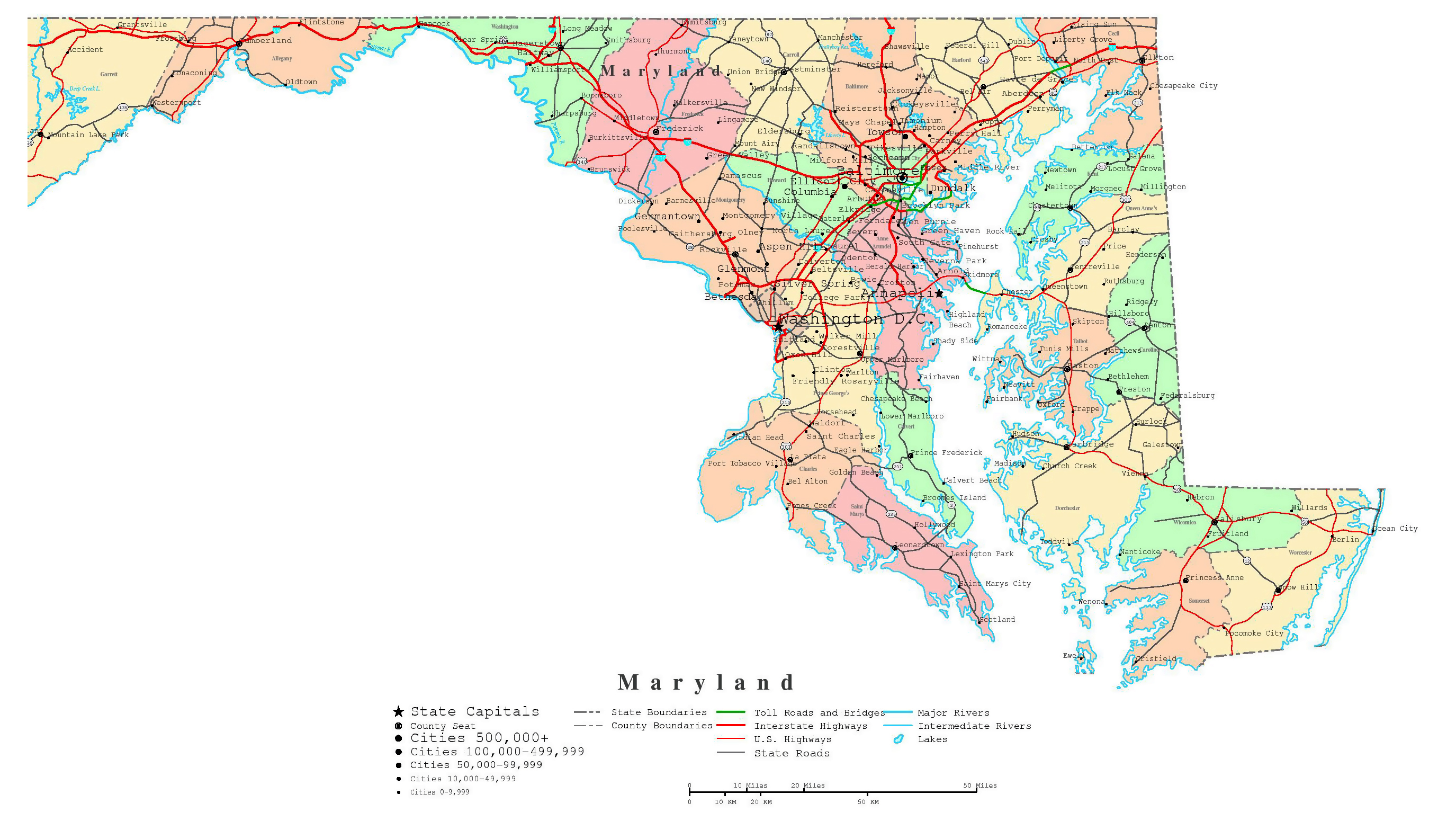

Are BCBS plans available nationwide?

+Yes, BCBS plans are available across the United States. However, the specific plans and coverage options may vary by state and region. It’s recommended to check the availability and coverage details for your specific area.

How can I enroll in a BCBS health insurance plan?

+You can enroll in a BCBS plan during the annual open enrollment period, which typically runs from November to January. However, you may also qualify for a special enrollment period if you experience certain life events, such as losing your job or getting married. Contact BCBS or a licensed insurance agent for assistance with enrollment.

What happens if I need medical care outside my BCBS network?

+Depending on your plan type, you may have limited or no coverage for out-of-network care. PPO plans typically offer some coverage for out-of-network services, while HMO and EPO plans may not cover such care. It’s essential to review your plan’s details to understand your out-of-network benefits.