Florida Car Insurance Cheapest

Florida, the Sunshine State, is known for its vibrant culture, beautiful beaches, and, unfortunately, its high car insurance rates. Navigating the insurance landscape in Florida can be a challenging task, especially for those seeking the most cost-effective options. This comprehensive guide aims to provide an in-depth analysis of Florida's car insurance market, highlighting the cheapest options available while ensuring you receive the coverage you need.

Understanding Florida's Unique Insurance Landscape

Florida stands out in the insurance industry due to its no-fault system, which means drivers are required to carry Personal Injury Protection (PIP) coverage as part of their car insurance policy. This unique requirement influences the overall cost of insurance and the availability of certain discounts.

The Impact of No-Fault Insurance

The no-fault system was implemented to streamline the process of recovering damages after an accident. It mandates that each driver's insurance company covers their medical bills and lost wages up to a certain limit, regardless of who was at fault in the accident. While this system has its benefits, it also contributes to higher insurance premiums.

Here's a breakdown of how no-fault insurance affects Florida drivers:

| Aspect | Impact |

|---|---|

| Required Coverage | Drivers must carry $10,000 in Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. |

| Medical Benefits | PIP coverage ensures prompt medical attention, but it may not cover all expenses, leading to additional out-of-pocket costs. |

| Legal Process | The no-fault system reduces the need for lengthy legal battles, but it can complicate matters in cases of severe injury or property damage. |

Navigating the Insurance Market

Despite the challenges posed by Florida's insurance system, there are still ways to find affordable coverage. Here are some key strategies to consider:

- Shop Around: Compare quotes from multiple insurers. Rates can vary significantly, so it's essential to explore your options.

- Understand Discounts: Florida insurers offer various discounts, including those for good driving records, safe vehicles, and policy bundling.

- Policy Customization: Tailor your policy to your needs. Consider higher deductibles or dropping certain coverages if you have an older vehicle.

- Explore Alternatives: Consider usage-based insurance (UBI) programs that offer discounts based on your actual driving habits.

Cheapest Car Insurance Options in Florida

When it comes to finding the cheapest car insurance in Florida, several providers stand out for their competitive rates and comprehensive coverage options. Here's an overview of the top choices:

Progressive

Progressive is renowned for its affordable rates and extensive coverage options. In Florida, they offer a range of policies tailored to meet the state's unique insurance requirements. Their Snapshot program is particularly attractive, as it allows drivers to save money by sharing their driving data.

| Coverage Type | Policy Features |

|---|---|

| Liability | Meets Florida's minimum requirements, including PIP and PDL. |

| Comprehensive | Covers damage from non-accident incidents like theft, vandalism, and natural disasters. |

| Collision | Provides coverage for vehicle repairs after an accident, regardless of fault. |

| Uninsured/Underinsured Motorist | Protects you in the event of an accident with a driver who lacks sufficient insurance. |

Geico

Geico is another top contender for cheap car insurance in Florida. They offer a wide range of coverage options and are known for their excellent customer service. Geico's online platform makes it easy to manage your policy and access helpful resources.

| Coverage Highlights | Benefits |

|---|---|

| PIP Coverage | Ensures compliance with Florida's no-fault insurance laws. |

| Medical Payments Coverage | Provides additional medical expense coverage beyond PIP. |

| Roadside Assistance | Offers 24/7 emergency services for breakdowns or accidents. |

| Accident Forgiveness | Protects your rates from increasing after your first at-fault accident. |

State Farm

State Farm is a trusted name in the insurance industry, offering competitive rates and a wide array of coverage options. Their policies are designed to meet Florida's specific insurance needs, ensuring you're adequately protected.

| Policy Features | Description |

|---|---|

| Minimum Liability Coverage | Covers bodily injury and property damage as required by Florida law. |

| Uninsured Motorist Coverage | Protects you from financial loss if an uninsured driver causes an accident. |

| Rental Car Coverage | Provides reimbursement for rental car expenses after an insured loss. |

| Discounts | Offers a variety of discounts, including good student, safe driver, and multi-policy discounts. |

Performance Analysis: How These Insurers Stack Up

When evaluating the performance of these insurers, it's crucial to consider factors beyond just the cost of the policy. Here's a detailed analysis of each insurer's performance in key areas:

Progressive

Financial Stability: Progressive has an excellent financial rating, indicating a high level of financial strength and stability. This ensures policyholders can rely on them for long-term coverage.

Customer Satisfaction: Progressive consistently ranks high in customer satisfaction surveys. Their innovative products and excellent customer service make them a top choice for many.

Claims Handling: Progressive is known for its efficient and fair claims process. They offer a range of tools and resources to streamline the claims experience, making it less stressful for policyholders.

Geico

Financial Strength: Geico boasts an exceptional financial rating, assuring policyholders of their long-term stability. This is a critical factor when choosing an insurer.

Customer Service: Geico's customer service is highly regarded, with a dedicated team of professionals available 24/7 to assist with any queries or concerns.

Claims Process: Geico's claims process is designed to be fast and efficient. They offer a mobile app for easy claims reporting and tracking, making the process more convenient for policyholders.

State Farm

Financial Rating: State Farm maintains an impressive financial rating, ensuring policyholders of their financial stability and ability to pay claims.

Community Engagement: State Farm is known for its commitment to the communities it serves. They actively support various local initiatives and causes, fostering a positive image and trust among policyholders.

Claims Service: State Farm provides a comprehensive claims service, offering personalized assistance and a dedicated claims team to guide policyholders through the process.

Evidence-Based Future Implications

As the insurance landscape evolves, it's essential to consider the potential future trends and implications for car insurance in Florida. Here are some key factors to watch:

- Technological Advances: The rise of telematics and usage-based insurance (UBI) could lead to more personalized and affordable insurance options.

- Regulatory Changes: Any alterations to Florida's insurance laws, such as adjustments to the no-fault system, could significantly impact rates and coverage options.

- Market Competition: The entrance of new insurers or increased competition among existing providers could drive down rates and improve coverage.

Frequently Asked Questions

What is the average cost of car insurance in Florida?

+

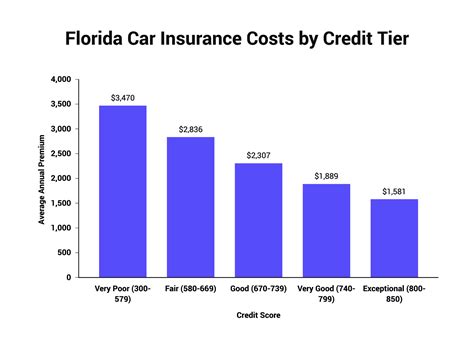

The average cost of car insurance in Florida is approximately 1,600 per year. However, rates can vary significantly based on factors like your driving history, the type of vehicle you drive, and the coverage you choose.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any discounts available for Florida car insurance?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, Florida insurers offer a variety of discounts, including good driver discounts, safe vehicle discounts, multi-policy discounts, and usage-based insurance (UBI) programs. It's worth exploring these options to lower your insurance costs.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What factors influence car insurance rates in Florida?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Several factors influence car insurance rates in Florida, including your age, driving history, credit score, the make and model of your vehicle, and the coverage you choose. Additionally, Florida's unique no-fault insurance system impacts rates.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Can I find cheaper car insurance if I have a poor driving record?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>It can be challenging to find affordable car insurance with a poor driving record. However, shopping around and comparing quotes from different insurers can help you identify the most cost-effective options. Additionally, some insurers offer programs to help improve your driving record and reduce rates over time.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What is the penalty for driving without insurance in Florida?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Driving without insurance in Florida can result in a fine of up to 500, the suspension of your driver’s license and registration, and even potential jail time for repeat offenders. It’s crucial to maintain continuous insurance coverage to avoid these penalties.