Long Care Health Insurance

Long-term care health insurance is a crucial aspect of financial planning and healthcare coverage, especially for individuals seeking to protect themselves and their families from the potential financial burden of extended medical care needs. With an aging global population and rising healthcare costs, the demand for long-term care services is increasing. This comprehensive guide will delve into the world of long-term care health insurance, providing an in-depth analysis of its benefits, coverage options, and real-world applications.

Understanding Long-Term Care Health Insurance

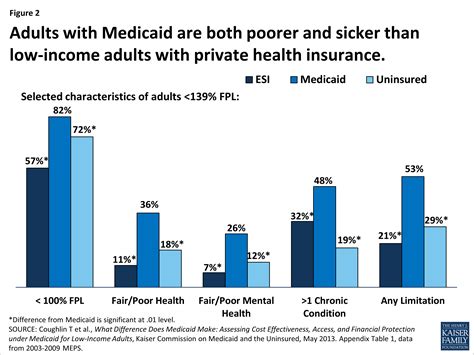

Long-term care health insurance, often referred to as LTC insurance, is a specialized type of coverage designed to address the unique challenges and expenses associated with extended care needs. Unlike traditional health insurance plans that primarily cover short-term medical treatments and hospitalizations, LTC insurance focuses on providing financial support for individuals requiring assistance with activities of daily living (ADLs) over an extended period.

The need for long-term care can arise from various circumstances, including age-related conditions, chronic illnesses, accidents, or disabilities. LTC insurance aims to bridge the gap between standard medical coverage and the substantial costs associated with long-term care facilities, home healthcare services, and other related expenses.

Key Benefits of Long-Term Care Health Insurance

LTC insurance offers a range of advantages that can significantly impact an individual’s financial well-being and peace of mind:

- Financial Protection: One of the primary benefits is the financial security it provides. LTC insurance helps cover the costs of long-term care, which can be exorbitant, allowing individuals to maintain their standard of living without depleting their savings or relying on government assistance.

- Customizable Coverage: Policies can be tailored to individual needs, offering flexibility in terms of coverage duration, benefit amounts, and the types of services included. This customization ensures that policyholders receive the specific care they require.

- Preserving Independence: By providing financial support for long-term care, LTC insurance enables individuals to maintain their independence and receive care in their preferred environment, whether at home or in a facility of their choice.

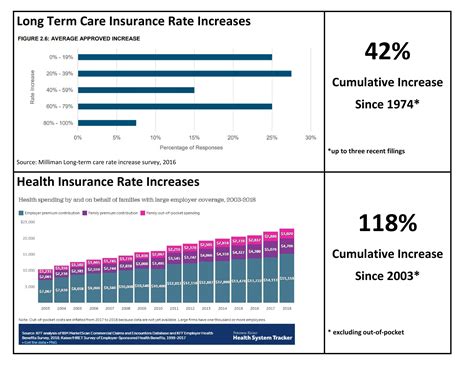

- Inflation Protection: Many policies include inflation protection, ensuring that the benefits keep pace with rising healthcare costs over time.

- Tax Advantages: In some cases, LTC insurance premiums may be tax-deductible, offering additional financial benefits.

Coverage Options and Policy Types

Long-term care health insurance policies come in various forms, each designed to cater to different needs and preferences. Understanding the available options is crucial when selecting the right coverage.

Traditional LTC Insurance

Traditional LTC insurance policies offer comprehensive coverage for a wide range of long-term care services. These policies typically provide benefits for skilled nursing care, assisted living facilities, home healthcare, adult day care, and other related services. The coverage duration and benefit amounts can be customized to the policyholder’s needs.

One notable feature of traditional LTC insurance is the ability to choose between indemnity and reimbursement plans. Indemnity plans pay a predetermined benefit amount, regardless of the actual cost of care, while reimbursement plans cover a percentage of the actual expenses incurred.

Hybrid LTC Insurance

Hybrid LTC insurance policies combine traditional long-term care coverage with other types of insurance, such as life insurance or annuity products. These policies offer a unique blend of benefits, providing both long-term care coverage and a death benefit or cash value accumulation.

Hybrid policies are appealing to individuals who want the flexibility of long-term care coverage along with additional financial benefits. In the event that long-term care is not needed, the policyholder can still receive a death benefit or access the cash value of the policy.

Short-Term Care Insurance

Short-term care insurance is designed to cover temporary care needs, typically lasting a few months. These policies are ideal for individuals recovering from surgeries, accidents, or short-term illnesses that require assistance with ADLs. Short-term care insurance provides a cost-effective solution for those who do not anticipate needing long-term care but want coverage for unexpected events.

Critical Illness Insurance

Critical illness insurance is another type of coverage that can be beneficial for long-term care planning. This type of policy provides a lump-sum benefit upon the diagnosis of a specified critical illness, such as cancer, stroke, or heart attack. The funds can be used to cover a wide range of expenses, including long-term care costs, medical bills, and other financial needs.

Real-World Applications and Case Studies

To illustrate the impact of long-term care health insurance, let’s explore a few real-world scenarios and how LTC insurance can make a difference:

Case Study 1: Aging in Place

Meet Sarah, a 65-year-old retiree who has invested in a comprehensive LTC insurance policy. As she ages, Sarah develops arthritis, making it increasingly difficult for her to perform daily tasks independently. With her LTC insurance, she is able to receive in-home care services, allowing her to maintain her independence and continue living in her own home.

Sarah's policy covers the cost of home healthcare aides, ensuring she receives assistance with activities like bathing, dressing, and meal preparation. This support not only improves her quality of life but also provides peace of mind for her family, knowing that she is receiving the care she needs without financial strain.

Case Study 2: Facility Care

John, a 72-year-old widower, has been diagnosed with Alzheimer’s disease. As his condition progresses, he requires 24-hour care and supervision. Fortunately, John has a LTC insurance policy that covers skilled nursing facility care.

With his insurance coverage, John is able to reside in a specialized memory care facility, where he receives personalized attention and medical care. The policy covers a significant portion of the facility's fees, alleviating the financial burden on John's family and ensuring he receives the high-quality care he deserves.

Case Study 3: Hybrid Policy Benefits

Emily, a 55-year-old professional, opted for a hybrid LTC insurance policy that combines long-term care coverage with a life insurance component. As she approaches retirement, Emily experiences a serious accident that leaves her with temporary disabilities. Her hybrid policy steps in to provide financial support during her recovery.

The policy covers the cost of short-term home healthcare services, ensuring Emily receives the assistance she needs to recover fully. Additionally, the policy's life insurance benefit remains intact, providing her with a death benefit upon her passing or a cash value accumulation that she can access as needed.

Performance Analysis and Future Implications

The demand for long-term care health insurance is on the rise, driven by an aging population and the increasing complexity of healthcare needs. As individuals live longer and the prevalence of chronic conditions grows, the importance of LTC insurance becomes more evident.

Recent studies indicate that the global long-term care insurance market is expected to experience significant growth over the next decade. This growth is attributed to several factors, including rising healthcare costs, changing family dynamics, and the desire for financial security in retirement.

| Market Segment | Growth Rate (2023-2028) |

|---|---|

| Traditional LTC Insurance | 6.2% |

| Hybrid LTC Insurance | 7.8% |

| Short-Term Care Insurance | 5.2% |

| Critical Illness Insurance | 4.9% |

The data highlights the increasing popularity of hybrid LTC insurance, reflecting the appeal of combined coverage options. As healthcare systems continue to evolve, the role of long-term care health insurance is likely to become even more crucial in ensuring individuals have access to the care they need without facing financial hardship.

How much does long-term care health insurance cost?

+The cost of LTC insurance can vary significantly based on factors such as age, health status, coverage duration, and benefit amounts. On average, premiums range from a few hundred to several thousand dollars per year. It’s advisable to obtain quotes from multiple insurers to find the most suitable coverage at a competitive price.

At what age should I consider purchasing LTC insurance?

+The ideal time to purchase LTC insurance is when you are in good health and have the financial means to do so. Most insurers offer LTC insurance up to a certain age, typically around 65-70 years. Starting earlier provides more flexibility and potentially lower premiums, as health conditions may limit your options as you age.

What happens if I don’t need long-term care services during the policy term?

+If you do not require long-term care services, you may be eligible for a refund of a portion of your premiums. This depends on the specific terms of your policy. Some policies offer a return of premium feature, while others may provide a reduced benefit upon maturity.

Can I customize my LTC insurance policy to fit my specific needs?

+Absolutely! LTC insurance policies are highly customizable. You can choose the coverage duration, daily benefit amounts, elimination period (waiting period before benefits begin), and the types of services covered. Working with an insurance professional can help you create a policy that aligns with your unique circumstances and preferences.