Whole Vs Term Life Insurance

Whole vs. Term Life Insurance: Understanding the Key Differences

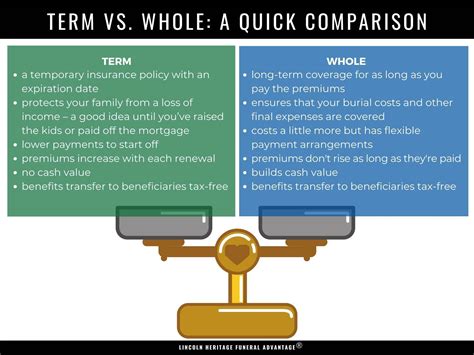

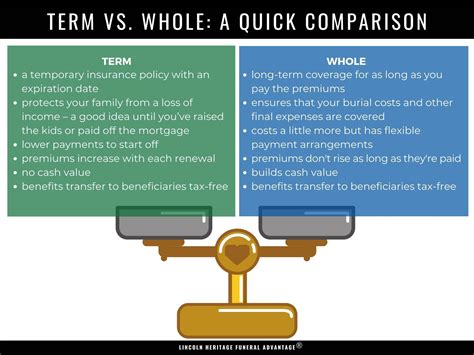

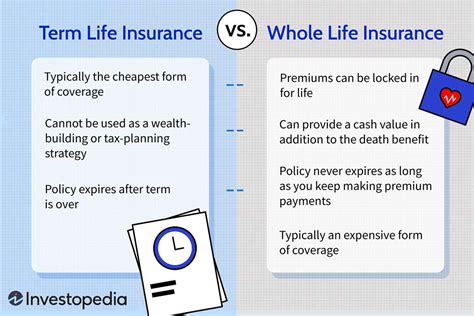

When it comes to safeguarding your loved ones' financial well-being, life insurance is a crucial consideration. Two of the most common types of life insurance policies are whole life and term life insurance. While both provide financial protection, they differ significantly in terms of coverage, cost, and long-term benefits. In this comprehensive guide, we will delve into the intricacies of whole and term life insurance, helping you make an informed decision based on your unique circumstances.

Life insurance serves as a safety net, ensuring that your family or beneficiaries receive a lump-sum payment upon your untimely passing. This financial support can cover various expenses, from funeral costs and daily living expenses to paying off debts and maintaining their standard of living. Choosing the right type of life insurance policy is essential to provide the level of protection you desire.

Whole Life Insurance: A Lifetime of Protection

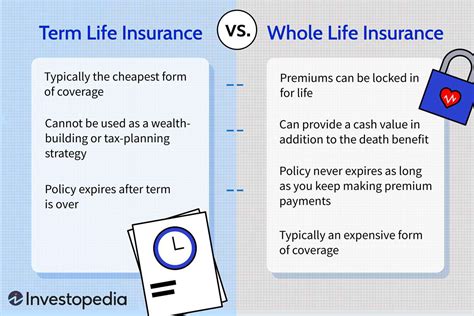

Whole life insurance, also known as permanent life insurance, offers lifelong coverage and accumulates cash value over time. It is designed to provide financial security and peace of mind, ensuring that your loved ones are taken care of regardless of when you pass away.

Key Features of Whole Life Insurance

- Lifetime Coverage: As the name suggests, whole life insurance provides coverage for your entire life, as long as premiums are paid. This means that as long as you pay your premiums, your beneficiaries will receive the death benefit upon your passing.

- Cash Value Accumulation: One of the unique aspects of whole life insurance is its cash value component. A portion of your premium payments goes towards building cash value within the policy. This cash value grows over time and can be accessed through loans or withdrawals during your lifetime. It serves as a savings component and can be used for various purposes, such as funding retirement or covering unexpected expenses.

- Guaranteed Premiums: Whole life insurance policies typically have fixed premium rates that remain constant throughout the policy term. This predictability allows for easier financial planning and ensures that your premium payments will not increase with age or changes in health.

- Tax Advantages: The cash value within a whole life insurance policy grows on a tax-deferred basis. This means that you won't pay taxes on the accumulated cash value until it's withdrawn or used. Additionally, if the policy is held for a certain period, the death benefit may be received tax-free by your beneficiaries.

Suitable for:

- Individuals seeking lifelong financial protection.

- Those who want to build a savings component alongside their insurance coverage.

- Families with long-term financial goals and a need for consistent, predictable premiums.

| Whole Life Insurance Features | Details |

|---|---|

| Coverage Period | Lifetime (as long as premiums are paid) |

| Premium Structure | Fixed premiums that remain constant throughout the policy term |

| Cash Value | Accumulates over time and can be accessed through loans or withdrawals |

| Tax Benefits | Tax-deferred growth of cash value; potential tax-free death benefit |

Term Life Insurance: Temporary Protection with Flexibility

Term life insurance, as the name suggests, offers coverage for a specific term or period, typically ranging from 10 to 30 years. It is designed to provide affordable protection during key life stages when financial obligations are high, such as raising a family or paying off a mortgage.

Key Features of Term Life Insurance

- Affordable Coverage: Term life insurance is known for its cost-effectiveness. Premiums are generally much lower compared to whole life insurance, making it an attractive option for those on a budget or with limited financial resources.

- Flexibility: Term life insurance policies can be customized to fit your specific needs. You can choose the term length (e.g., 10, 20, or 30 years) and the amount of coverage required. This flexibility allows you to adjust your coverage as your circumstances change.

- Renewable and Convertible: Many term life insurance policies offer the option to renew or convert your policy at the end of the term. Renewal may involve a new medical evaluation, while conversion allows you to switch to a permanent life insurance policy without providing additional evidence of insurability.

- No Cash Value: Unlike whole life insurance, term life insurance does not accumulate cash value. It solely provides death benefit coverage during the specified term.

Suitable for:

- Young families with financial obligations and limited budgets.

- Individuals seeking temporary coverage for specific life stages.

- Those who prefer a straightforward, no-frills insurance option.

| Term Life Insurance Features | Details |

|---|---|

| Coverage Period | Specific term (e.g., 10, 20, or 30 years) |

| Premium Structure | Affordable premiums that may increase at renewal or with age |

| Cash Value | No cash value component; solely provides death benefit coverage |

| Renewal and Conversion | Options to renew or convert the policy at the end of the term |

Comparing Whole and Term Life Insurance

When deciding between whole and term life insurance, it's essential to consider your financial goals, life stage, and the level of protection you desire. Here's a comparison of the key differences:

| Whole Life Insurance | Term Life Insurance | |

|---|---|---|

| Coverage Period | Lifetime | Specific term (e.g., 10-30 years) |

| Premium Structure | Fixed premiums | Affordable premiums that may increase |

| Cash Value | Accumulates cash value | No cash value |

| Tax Benefits | Tax-deferred cash value growth | No tax advantages |

| Flexibility | Limited flexibility | Highly flexible, customizable coverage |

| Cost | Higher premiums | Lower premiums |

Factors to Consider When Choosing

The decision between whole and term life insurance depends on various factors, including your financial situation, life stage, and personal preferences. Here are some key considerations:

- Financial Goals: Whole life insurance can be a good choice if you want to build long-term savings and have a stable financial plan. Term life insurance is ideal if you have short-term financial obligations and need affordable coverage.

- Life Stage: Young families often opt for term life insurance to cover critical expenses during their children's early years. As you age and your financial situation stabilizes, whole life insurance can provide lifelong protection.

- Health and Lifestyle: Term life insurance may be more accessible for individuals with health issues or risky lifestyles, as premiums are typically based on current health status. Whole life insurance may have stricter underwriting requirements.

- Budget: Term life insurance is generally more budget-friendly, making it an excellent option for those with limited financial resources. Whole life insurance, with its fixed premiums, offers predictability but at a higher cost.

- Long-Term Planning: Whole life insurance provides a stable financial foundation for your loved ones throughout your lifetime. Term life insurance requires periodic reassessment and may not offer the same long-term peace of mind.

In Conclusion

Understanding the differences between whole and term life insurance is crucial for making an informed decision about your financial future. Whole life insurance offers lifelong coverage, cash value accumulation, and tax benefits, making it an attractive option for long-term financial planning. Term life insurance, on the other hand, provides flexible, affordable coverage for specific life stages, making it ideal for those with temporary financial obligations.

When choosing between these options, consider your unique circumstances, financial goals, and the level of protection you desire. Consulting with a qualified financial advisor or insurance professional can help you navigate the complexities of life insurance and find the best policy to meet your needs.

Frequently Asked Questions

Can I switch from term life insurance to whole life insurance later in life?

+Yes, many term life insurance policies offer the option to convert your coverage to a whole life insurance policy without additional medical underwriting. However, it’s essential to review the terms and conditions of your specific policy to understand the conversion process and any potential limitations.

Are whole life insurance premiums guaranteed not to increase?

+Whole life insurance policies typically have guaranteed level premiums that remain constant throughout the policy term. However, it’s important to note that some whole life insurance policies may have adjustable premiums, so it’s crucial to review the policy details carefully.

Can I cancel my whole life insurance policy and receive a refund of my premiums?

+Whole life insurance policies are designed to provide lifelong coverage, and canceling the policy typically results in the loss of any accumulated cash value and potential surrender charges. It’s advisable to carefully consider your financial goals and consult with a professional before canceling a whole life insurance policy.

What happens if I outlive my term life insurance policy term?

+At the end of the term, you have the option to renew your term life insurance policy, typically with a new medical evaluation. Alternatively, you can convert your term life insurance to a permanent life insurance policy, such as whole life, without providing additional evidence of insurability.

Is term life insurance a good option for retirees?

+Term life insurance can be suitable for retirees who have specific financial obligations or want to provide additional financial support to their beneficiaries. However, it’s important to carefully assess your needs and consider the potential for increasing premiums as you age. Consulting with a financial advisor can help you make an informed decision.