Most Inexpensive Car Insurance

In today's fast-paced world, car insurance is an essential financial protection measure for vehicle owners. Finding the most inexpensive car insurance can be a challenging task, especially with the multitude of options and factors to consider. This comprehensive guide aims to shed light on the key aspects of obtaining affordable car insurance, offering insights and strategies to help you secure the best coverage at the lowest possible cost.

Understanding Car Insurance Costs

Car insurance premiums are influenced by a myriad of factors, including your location, driving history, age, gender, the make and model of your vehicle, and the coverage limits you select. Additionally, insurance companies use sophisticated algorithms to assess risk and determine premiums, taking into account external factors like accident rates in your area and the average cost of vehicle repairs.

For instance, let's consider a hypothetical scenario where a young driver resides in an urban area known for high accident rates. Due to their age and the location's accident history, their insurance premiums are likely to be significantly higher compared to an experienced driver residing in a rural area with a lower accident rate. This example highlights the intricate nature of insurance pricing and the need for a tailored approach to find the most cost-effective coverage.

Factors Influencing Insurance Rates

- Age and Gender: Statistically, younger drivers, especially males, tend to pay higher premiums due to their perceived higher risk on the road. However, this stereotype is slowly changing as more data-driven models are used to assess risk.

- Location: The area where you live and drive plays a crucial role. Areas with high accident rates or frequent natural disasters may have higher insurance costs.

- Vehicle Type: The make, model, and age of your vehicle can impact insurance rates. Sports cars and luxury vehicles, for instance, often have higher premiums due to their expensive repair costs.

- Driving Record: A clean driving record with no accidents or traffic violations is a major factor in securing lower insurance rates. Insurance companies reward safe drivers with discounted premiums.

| Factor | Impact on Premium |

|---|---|

| Age and Gender | Younger drivers and males often face higher premiums. |

| Location | Areas with high accident rates or natural disasters may have higher costs. |

| Vehicle Type | Sports cars and luxury vehicles typically have higher premiums. |

| Driving Record | A clean record can lead to significant discounts. |

Strategies for Finding Inexpensive Car Insurance

Securing the most inexpensive car insurance requires a strategic approach and a good understanding of the insurance market. Here are some key strategies to help you navigate the process effectively.

Shop Around and Compare Quotes

Insurance companies offer a wide range of rates, and shopping around can lead to significant savings. Compare quotes from at least three to five reputable insurers to get a good understanding of the market rates. Online quote comparison tools can be particularly useful for this purpose.

For instance, let's say you're looking for insurance for a mid-range sedan. By obtaining quotes from multiple insurers, you might find that one company offers significantly lower rates for your specific vehicle and driving history. This simple comparison step could save you hundreds of dollars annually.

Understand Your Coverage Needs

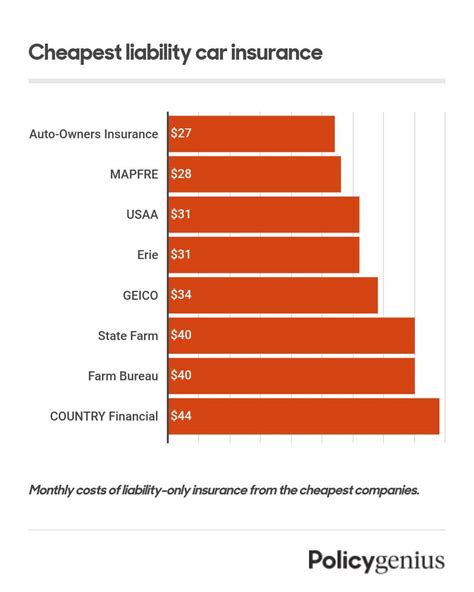

It’s crucial to understand the different types of car insurance coverage and their respective costs. Common coverage types include liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. Each type serves a specific purpose and has its own cost implications.

Liability coverage, for example, is often the minimum required by law, but it may not be sufficient if you're at fault in an accident. Collision and comprehensive coverage offer more extensive protection but come at a higher cost. Understanding your needs and balancing them with your budget is key to finding the right coverage at the right price.

Bundle Policies and Explore Discounts

Bundling your car insurance with other policies, such as home or renters’ insurance, can often lead to substantial savings. Many insurers offer multi-policy discounts, recognizing the convenience and loyalty of customers who choose to consolidate their insurance needs.

Additionally, insurance companies often provide discounts for a variety of reasons. These may include safe driving records, loyalty rewards, military service, good student status, and more. Always inquire about available discounts when obtaining quotes, as they can significantly reduce your overall insurance costs.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a relatively new concept that allows insurers to tailor premiums based on your actual driving habits. This type of insurance uses telematics devices or smartphone apps to track factors like miles driven, driving speed, and braking habits.

For example, if you primarily drive during low-traffic hours and maintain a safe driving record, you may be eligible for lower premiums with usage-based insurance. This innovative approach rewards safe and responsible driving, offering a more personalized insurance experience.

Navigating the Fine Print

When comparing insurance policies, it’s important to look beyond the headline premium. Different policies may have varying deductibles, coverage limits, and exclusions. A lower premium may be appealing, but it could come with higher deductibles or limited coverage, which could end up costing you more in the long run.

Understanding Deductibles

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. For instance, if you have a 500 deductible and are involved in an accident with 2,000 in damages, you’ll pay the first 500, and your insurance will cover the remaining 1,500. Higher deductibles often lead to lower premiums, so it’s a trade-off between immediate savings and potential future costs.

Coverage Limits and Exclusions

Coverage limits define the maximum amount your insurance company will pay for a covered claim. For example, your policy may have a liability limit of 100,000 per person and 300,000 per accident. If you’re involved in an accident with multiple injured parties and the total damages exceed these limits, you’ll be responsible for paying the excess out of pocket.

Exclusions, on the other hand, are specific situations or events that are not covered by your policy. For instance, most standard car insurance policies exclude damage caused by floods or earthquakes. Understanding these exclusions is crucial to ensure you have the coverage you need in case of unforeseen events.

Future Implications and Innovations

The car insurance industry is evolving rapidly, driven by advancements in technology and changing consumer preferences. Here are some key trends and innovations that are shaping the future of car insurance.

Telematics and Connected Cars

Telematics and connected car technologies are increasingly being used to monitor and analyze driving behavior. These technologies not only offer real-time data for usage-based insurance but also provide valuable insights for insurers to improve risk assessment and fraud detection.

For example, telematics data can reveal patterns of aggressive driving, such as frequent hard braking or rapid acceleration, which can be used to identify higher-risk drivers and adjust their premiums accordingly. This level of detail was previously unavailable, making risk assessment more accurate and fair.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are revolutionizing the insurance industry. These technologies are being used to automate various processes, from policy underwriting and claims processing to fraud detection and risk assessment. AI-powered chatbots, for instance, are becoming common in customer service, offering quick responses to policyholders’ queries.

Furthermore, machine learning algorithms can analyze vast amounts of data, including driving behavior, weather patterns, and traffic conditions, to predict and prevent potential accidents. This predictive capability can lead to more proactive insurance offerings, potentially reducing the frequency and severity of claims.

Blockchain Technology

Blockchain, the technology that underpins cryptocurrencies like Bitcoin, is also finding applications in the insurance industry. Blockchain’s distributed ledger system can enhance data security, streamline claim processes, and improve transparency in insurance transactions.

For instance, smart contracts on a blockchain platform can automatically trigger payments for valid claims, eliminating the need for manual processing and reducing the time taken to settle claims. This increased efficiency can benefit both insurers and policyholders, leading to faster payouts and reduced administrative costs.

Future Trends and Challenges

As the insurance industry continues to embrace technology, several key trends and challenges will shape its future. These include the continued development of usage-based insurance models, the integration of AI and machine learning for more accurate risk assessment, and the potential disruption of the industry by new players, such as tech giants or startups focused on niche markets.

Additionally, the rise of electric and autonomous vehicles presents both opportunities and challenges for insurers. While these vehicles may reduce certain risks, such as accidents caused by human error, they also introduce new risks, such as cyber attacks on vehicle systems. Insurers will need to adapt their policies and risk models to accommodate these changing dynamics.

What is the average cost of car insurance in the US?

+The average cost of car insurance in the US varies significantly depending on numerous factors, including the state you live in, your age, gender, driving record, and the make and model of your vehicle. According to recent data, the national average for car insurance premiums is approximately $1,674 per year. However, it’s important to note that this is just an average, and your personal rate could be significantly higher or lower.

Are there any ways to reduce my car insurance premium without compromising coverage?

+Absolutely! There are several strategies you can employ to reduce your car insurance premium while still maintaining adequate coverage. These include shopping around for quotes from multiple insurers, bundling your car insurance with other policies (such as home or renters’ insurance), and exploring discounts for safe driving records, loyalty rewards, or other qualifying factors. Additionally, understanding your coverage needs and opting for higher deductibles can also lead to lower premiums.

What is usage-based insurance, and how can it benefit me?

+Usage-based insurance, also known as pay-as-you-drive insurance, is a relatively new concept that allows insurers to tailor premiums based on your actual driving habits. This type of insurance uses telematics devices or smartphone apps to track factors like miles driven, driving speed, and braking habits. If you’re a safe and responsible driver, you may be eligible for lower premiums with usage-based insurance, as it rewards good driving behavior. However, it’s important to carefully review the terms and conditions of such policies to ensure they meet your coverage needs.