Insurance Agencys

In the realm of financial services, insurance agencies play a pivotal role, acting as intermediaries between insurance companies and policyholders. These agencies are vital in offering tailored insurance solutions to individuals and businesses, thereby protecting their assets, health, and overall well-being. With a diverse range of insurance products available, from life and health insurance to property and casualty coverage, insurance agencies provide the expertise and guidance necessary to navigate the complex world of insurance.

The Evolution of Insurance Agencies: A Historical Perspective

The history of insurance agencies is deeply rooted in the evolution of the insurance industry itself. From its humble beginnings in ancient civilizations, where rudimentary forms of insurance were practiced to mitigate risks, the industry has grown exponentially. The establishment of insurance agencies marked a significant shift, introducing a professional and specialized approach to risk management.

In the 17th century, the world witnessed the emergence of the first insurance agencies in Europe. These agencies, often operating as small, family-run businesses, offered marine insurance, primarily safeguarding maritime trade and voyages. As trade expanded and the need for comprehensive risk protection grew, insurance agencies began to diversify their offerings, branching out into life, health, and property insurance.

The 19th century brought about a revolution in the insurance industry, marked by the rise of large, corporate insurance agencies. With the advent of industrialization and the growth of cities, the demand for insurance coverage soared. These agencies, backed by robust financial resources and a wider reach, were able to offer a broader range of insurance products and services, catering to the diverse needs of an expanding market.

The 20th century saw the insurance industry further mature, with insurance agencies becoming increasingly specialized. The introduction of new technologies and the advent of digital platforms transformed the way insurance was sold and serviced. Agencies began to leverage data analytics and customer relationship management tools to enhance their services, providing more personalized and efficient insurance solutions.

The Role of Insurance Agencies in Modern Times

In today’s complex and dynamic world, insurance agencies continue to be the cornerstone of the insurance industry. They provide an invaluable service by helping individuals and businesses navigate the myriad of insurance options available, ensuring they secure the coverage that best suits their unique needs.

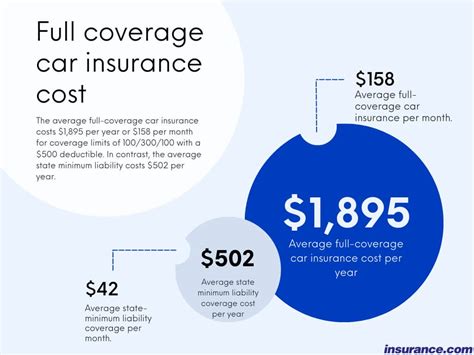

One of the key roles of insurance agencies is to educate and inform. With a vast array of insurance products and services on offer, from basic liability coverage to specialized policies for unique risks, it can be overwhelming for the average consumer. Insurance agents, with their expert knowledge, simplify this process, explaining the intricacies of insurance in a clear and concise manner. They help policyholders understand the coverage they are purchasing, ensuring they are adequately protected without overspending.

Insurance agencies also provide a crucial layer of support and advocacy. In the event of a claim, they assist policyholders in navigating the often complex and bureaucratic claims process. They advocate for their clients, ensuring fair and prompt settlements. Additionally, they offer ongoing support and guidance, helping policyholders manage their insurance portfolios, making necessary adjustments as their circumstances change.

Furthermore, insurance agencies play a vital role in risk management. They help individuals and businesses identify potential risks and vulnerabilities, offering strategies to mitigate these risks. Through comprehensive risk assessments and tailored insurance solutions, agencies help their clients minimize potential losses and ensure business continuity.

The Impact of Technology on Insurance Agencies

The insurance industry, like many others, has been significantly impacted by technological advancements. The rise of digital platforms and online insurance marketplaces has revolutionized the way insurance is sold and serviced. While this has presented new challenges for insurance agencies, it has also opened up a world of opportunities.

Digitalization has allowed insurance agencies to enhance their services, offering greater convenience and efficiency to their clients. Online platforms enable policyholders to compare insurance options, receive instant quotes, and purchase policies with just a few clicks. Additionally, these platforms provide a wealth of information and resources, empowering policyholders to make informed decisions about their insurance needs.

However, with the increased digital presence of insurance companies, insurance agencies have had to adapt and innovate to remain competitive. Many agencies have embraced digital transformation, leveraging technology to streamline their operations, enhance customer engagement, and improve overall efficiency. This includes the use of digital tools for sales and marketing, customer relationship management, and data analytics.

Despite the advancements in digital technology, the human touch remains a crucial aspect of insurance agency services. While online platforms offer convenience and speed, insurance agents provide personalized advice and support, building relationships based on trust and understanding. This combination of technology and human expertise ensures that policyholders receive the best of both worlds – efficient, convenient services, coupled with personalized guidance and advocacy.

The Future of Insurance Agencies: Trends and Predictions

Looking ahead, the future of insurance agencies is poised for continued growth and evolution. Several key trends are shaping the industry, influencing the way insurance is sold and serviced.

Data-Driven Decisions

The insurance industry is increasingly becoming data-driven, leveraging advanced analytics and artificial intelligence to make more informed decisions. Insurance agencies are using data to gain deeper insights into customer needs and behavior, allowing them to offer more tailored insurance solutions. By analyzing vast amounts of data, agencies can identify patterns and trends, enabling them to develop innovative products and services that meet the evolving needs of their clients.

Personalized Insurance Solutions

The future of insurance lies in personalization. Insurance agencies are moving away from one-size-fits-all insurance products, instead, focusing on creating customized solutions that cater to the unique needs of each policyholder. By leveraging data analytics and customer insights, agencies can design insurance packages that offer the right coverage at the right price, ensuring that policyholders are not overinsured or underinsured.

Digital Transformation and Automation

The continued adoption of digital technologies and automation is set to revolutionize the way insurance agencies operate. From digital onboarding and policy management to automated claims processing and risk assessment, technology will play a pivotal role in enhancing efficiency and reducing costs. By embracing digital transformation, insurance agencies can improve their operational effectiveness, allowing them to focus more on delivering value-added services and building stronger relationships with their clients.

Expanded Role in Risk Management

Insurance agencies are increasingly becoming trusted advisors in risk management. They are going beyond traditional insurance services, offering a holistic approach to risk mitigation. This includes providing risk assessment and management services, helping businesses identify and manage potential risks. By leveraging their expertise and access to advanced analytics, insurance agencies can help businesses implement effective risk management strategies, ensuring business continuity and resilience.

Focus on Customer Experience

In a highly competitive market, customer experience is set to become a key differentiator for insurance agencies. Agencies are investing in enhancing their customer service, offering convenient and efficient services, and providing personalized support. By leveraging technology and data, agencies can deliver a seamless customer experience, from initial contact to ongoing policy management and claims processing. A positive customer experience will be vital in retaining clients and driving business growth.

Conclusion

Insurance agencies are integral to the insurance industry, providing vital services that protect individuals and businesses from financial loss. With a rich history and a bright future ahead, these agencies continue to evolve, adapting to the changing needs of their clients and the industry. By leveraging technology, focusing on data-driven decisions, and delivering personalized solutions, insurance agencies are well-positioned to continue thriving in the dynamic world of insurance.

What are the key services offered by insurance agencies?

+Insurance agencies offer a wide range of services, including helping clients understand their insurance needs, providing tailored insurance solutions, assisting with policy selection and purchase, advocating for fair and prompt claim settlements, and offering ongoing support and guidance in managing insurance portfolios.

How do insurance agencies add value to their clients?

+Insurance agencies add value by providing expert guidance, ensuring clients are adequately protected without overspending, offering personalized support and advocacy, and helping clients manage their insurance portfolios effectively. They also play a vital role in risk management, offering strategies to mitigate potential risks and vulnerabilities.

What is the future outlook for insurance agencies?

+The future of insurance agencies is bright, with several key trends shaping the industry. These include a focus on data-driven decisions, personalized insurance solutions, digital transformation and automation, an expanded role in risk management, and an emphasis on delivering an exceptional customer experience.