Cheapest Health Insurance California

Health insurance is an essential aspect of life, ensuring that individuals have access to necessary medical care without incurring overwhelming financial burdens. In California, a state known for its diverse population and varying healthcare needs, finding the cheapest health insurance plan can be a challenging task. This comprehensive guide aims to provide an in-depth analysis of the options available to Californians seeking affordable health coverage.

Understanding Health Insurance Plans in California

California’s health insurance market offers a range of plans to cater to the diverse needs of its residents. These plans can be broadly categorized into government-funded programs and private insurance options. Each category has its own set of advantages and eligibility criteria.

Government-Funded Health Insurance Programs

The state of California, in collaboration with the federal government, provides several programs aimed at ensuring access to healthcare for specific demographics.

- Medi-Cal (California's Medicaid Program): This program offers free or low-cost health coverage to eligible Californians, including low-income adults, children, pregnant women, seniors, and people with disabilities. Medi-Cal covers a wide range of services, including doctor visits, hospital stays, prescription drugs, and mental health services.

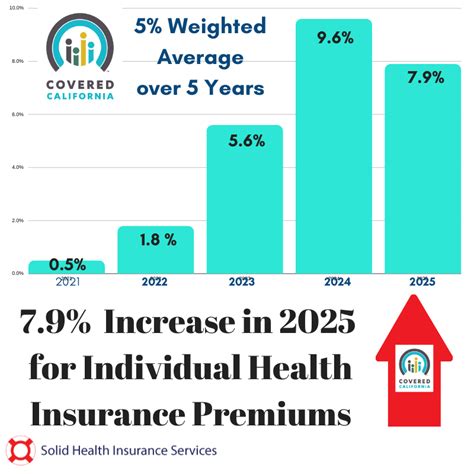

- Covered California: This is the state's official health insurance marketplace, offering a variety of plans from different insurers. While not specifically targeted at low-income individuals, Covered California does provide financial assistance to those who qualify, making it an affordable option for many.

- Veterans Health Benefits: The U.S. Department of Veterans Affairs (VA) offers health insurance coverage for eligible veterans. This program provides comprehensive medical services and can be a cost-effective option for those who have served in the military.

To be eligible for these government-funded programs, individuals must meet certain criteria, such as income level, age, or veteran status. It's important to note that these programs often have specific enrollment periods, so staying informed about deadlines is crucial.

Private Health Insurance Options

Private health insurance plans in California are offered by a variety of insurers, each with its own network of providers and unique set of benefits. While these plans can be more expensive than government-funded options, they often provide a wider range of coverage options and flexibility.

Some of the major private health insurance providers in California include:

- Blue Shield of California: Known for its comprehensive coverage and network of providers, Blue Shield offers a range of plans suitable for individuals and families. They also participate in Covered California, making their plans accessible to those seeking financial assistance.

- Kaiser Permanente: A well-established healthcare provider and insurer, Kaiser Permanente offers integrated healthcare plans. Their plans often include primary care physicians, specialists, and hospitals, all under one roof, providing a seamless healthcare experience.

- Anthem Blue Cross: With a focus on innovation and personalized care, Anthem Blue Cross offers a variety of plans, including PPOs and HMOs. They have a large network of providers across the state, ensuring accessibility for their members.

- UnitedHealthcare: This national insurer offers a wide range of health plans, including individual and family plans, as well as Medicare and Medicaid plans. Their plans often provide flexibility and customizable coverage options.

Comparing Costs and Benefits

When comparing health insurance plans in California, it’s crucial to consider both the cost and the benefits offered. While the cheapest plan may seem appealing, it’s important to ensure that it meets your specific healthcare needs.

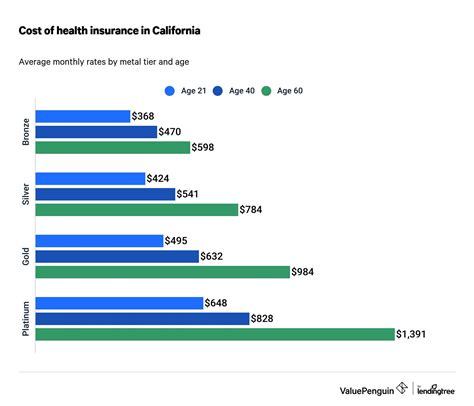

Premium Costs

The premium is the amount you pay each month to maintain your health insurance coverage. While it’s a significant factor in choosing a plan, it’s not the only consideration. Some plans may have lower premiums but higher deductibles or copays, which can result in higher out-of-pocket costs if you require extensive medical care.

| Insurance Provider | Average Monthly Premium |

|---|---|

| Blue Shield of California | $450 |

| Kaiser Permanente | $420 |

| Anthem Blue Cross | $480 |

| UnitedHealthcare | $430 |

These average monthly premiums are for individual plans and may vary based on factors such as age, location, and the specific plan chosen.

Deductibles and Copays

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Copays, on the other hand, are the fixed amounts you pay for certain services, such as doctor visits or prescription drugs. Plans with lower premiums often have higher deductibles and copays, so it’s important to consider your expected healthcare needs.

| Insurance Provider | Deductible | Copay (Doctor Visit) | Copay (Prescription Drugs) |

|---|---|---|---|

| Blue Shield of California | $2,000 | $30 | $10 - $50 |

| Kaiser Permanente | $1,500 | $25 | $15 - $40 |

| Anthem Blue Cross | $3,000 | $40 | $20 - $60 |

| UnitedHealthcare | $2,500 | $35 | $15 - $50 |

Network of Providers

Another crucial aspect to consider is the network of providers associated with each insurance plan. Some plans may have a limited network, which could mean higher out-of-network costs if you prefer a doctor or specialist outside the network. It’s important to check if your preferred healthcare providers are included in the plan’s network.

Tips for Finding the Cheapest Health Insurance in California

Finding the cheapest health insurance plan that also meets your healthcare needs requires careful consideration and comparison. Here are some tips to help you in your search:

- Check Eligibility for Government Programs: Before exploring private insurance options, ensure you're not eligible for any government-funded programs. Medi-Cal and Covered California can provide excellent coverage at little to no cost for those who qualify.

- Compare Plans on Covered California: Covered California's website offers a user-friendly platform to compare plans and prices. You can filter plans based on your budget, preferred providers, and other specific needs.

- Consider High-Deductible Health Plans (HDHPs): HDHPs often have lower premiums, making them an attractive option for those who are generally healthy and don't anticipate frequent medical expenses. These plans are also compatible with Health Savings Accounts (HSAs), which can provide additional tax benefits.

- Explore Short-Term Health Insurance: If you're between jobs or transitioning to a new insurance plan, short-term health insurance can be a cost-effective solution. These plans typically have lower premiums and cover essential healthcare services for a specified period.

- Negotiate with Insurers: Don't be afraid to reach out to insurers and negotiate. Many insurers offer discounts or promotions, especially if you're switching from another provider. It's worth inquiring about any available discounts or special rates.

FAQs

Can I enroll in Medi-Cal at any time?

+Yes, Medi-Cal is a year-round program, and you can apply at any time. However, it’s important to note that your eligibility will be determined based on your current income and household size. If you’re eligible, coverage can begin immediately.

What is the average cost of a health insurance plan in California for a family of four?

+The average cost can vary significantly depending on the plan and the insurance provider. For a family of four, you can expect to pay anywhere from 1,000 to 2,000 per month for a comprehensive plan. However, financial assistance through Covered California can significantly reduce these costs for eligible families.

Are there any free or low-cost mental health services available in California?

+Yes, California offers various free or low-cost mental health services. These include Medi-Cal, which covers mental health services, as well as community health centers and non-profit organizations that provide sliding-scale fee-based services based on income.

Can I keep my doctor if I switch health insurance plans?

+It depends on whether your preferred doctor is in-network with your new insurance plan. If they are not, you may have to pay out-of-network costs, which can be significantly higher. It’s always a good idea to check the provider network before switching plans.