Largest Auto Insurance Companies

In the dynamic landscape of the insurance industry, auto insurance giants play a pivotal role, offering protection and financial security to millions of vehicle owners. This article delves into the world of the largest auto insurance companies, exploring their influence, services, and impact on the industry.

Exploring the Titans of Auto Insurance

The realm of auto insurance is dominated by a few key players, each with a unique story and a massive customer base. These companies have not only withstood the test of time but have also adapted to the ever-changing demands of the market, making them industry leaders.

State Farm: A Longstanding Leader

State Farm stands tall as one of the oldest and largest auto insurance providers in the United States. With a history dating back to 1922, the company has grown exponentially, catering to over 40 million policies and offering a comprehensive suite of insurance products.

Their success lies in a customer-centric approach, providing personalized insurance plans and a wide range of coverage options. State Farm’s extensive network of agents ensures a localized and personalized experience, making it a preferred choice for many.

Key Statistics:

| Year Established | Total Policies | Revenue (2022) |

|---|---|---|

| 1922 | 40+ million | $73.9 billion |

Geico: A Modern Icon

Geico, or the Government Employees Insurance Company, has carved a significant niche in the auto insurance market. Known for its innovative marketing strategies and digital-first approach, Geico has rapidly expanded its customer base, especially among younger generations.

Their online platform offers a seamless and efficient insurance purchasing experience, catering to the needs of tech-savvy individuals. Geico’s focus on affordability and customer satisfaction has made it a popular choice, challenging traditional insurance models.

Notable Facts:

- Geico was founded in 1936 and has since grown to serve over 30 million customers.

- Their famous slogan, “15 minutes could save you 15% or more on car insurance,” has become an iconic catchphrase.

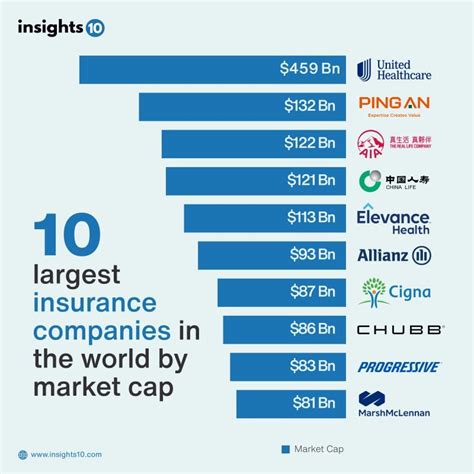

Progressive: Revolutionizing the Industry

Progressive Insurance has revolutionized the auto insurance sector with its innovative products and services. They were among the first to introduce the concept of “name your price,” allowing customers to customize their policies based on their budget.

Progressive’s Snapshot program, which uses telematics to monitor driving behavior and offer discounts, has been a game-changer. This data-driven approach has not only attracted new customers but has also incentivized safer driving practices.

Market Impact:

- Progressive’s innovative strategies have disrupted the traditional insurance model, forcing competitors to adapt and offer more flexible options.

- Their market share has steadily increased, making them a formidable player in the industry.

Allstate: Comprehensive Coverage

Allstate Insurance is renowned for its comprehensive coverage options and a strong focus on customer education. They offer a wide range of insurance products, including auto, home, life, and business insurance, providing a one-stop shop for customers’ insurance needs.

Allstate’s “Good Hands” promise ensures customers receive personalized support and guidance, building trust and loyalty. Their commitment to community involvement and disaster relief further strengthens their brand reputation.

Community Initiatives:

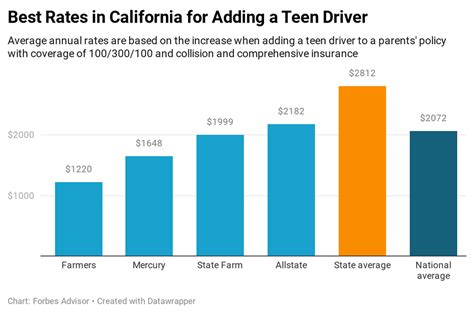

- Allstate’s “Teens Safe Driving” program aims to reduce teen driving accidents through education and awareness.

- They also actively support various causes, such as the American Red Cross and the United Way.

USAA: A Military-Focused Provider

USAA (United Services Automobile Association) specializes in providing insurance and financial services to military members, veterans, and their families. With a unique focus on this demographic, USAA has built a strong reputation for its customer-centric approach and exceptional service.

Their insurance policies are tailored to the specific needs of military personnel, offering flexible payment plans and comprehensive coverage. USAA’s commitment to this community has earned them high loyalty and satisfaction ratings.

Target Audience:

- USAA’s membership is open to current and former military members and their immediate family.

- They offer a range of discounts and benefits, making insurance more accessible for this community.

Liberty Mutual: Global Reach

Liberty Mutual is a global leader in insurance, with a presence in over 30 countries. Their comprehensive suite of insurance products caters to a diverse range of customers, offering personalized solutions and local expertise.

With a focus on innovation and customer experience, Liberty Mutual has consistently ranked among the top insurance providers. Their global network ensures a consistent level of service and support, regardless of a customer’s location.

International Presence:

- Liberty Mutual has operations in North America, Europe, Asia, and Latin America.

- They employ over 50,000 professionals worldwide, providing local expertise and support.

The Impact and Future of Auto Insurance

The largest auto insurance companies have a significant influence on the industry’s direction and innovation. Their size and resources allow them to invest in technology, research, and development, driving forward the industry’s progress.

As the industry evolves, these companies are expected to continue adapting to changing consumer needs and technological advancements. The focus on personalized insurance, digital platforms, and data-driven insights will likely shape the future of auto insurance.

With increasing competition and evolving customer expectations, the largest auto insurance companies must stay agile and responsive to maintain their market dominance. The future promises exciting developments, and these industry leaders are well-positioned to lead the way.

What sets these companies apart from smaller providers?

+These large auto insurance companies have established a strong reputation, built trust with customers, and offer a comprehensive range of insurance products. Their scale allows for better negotiation with repair shops and other partners, often resulting in cost savings that can be passed on to customers. Additionally, their extensive resources enable them to invest in technology and customer service, providing a more seamless and efficient experience.

How do these companies adapt to changing market trends?

+The largest auto insurance companies are highly adaptable and responsive to market shifts. They continuously analyze data and consumer behavior to stay ahead of the curve. This involves investing in research and development, exploring new technologies, and adapting their products and services to meet evolving customer needs and preferences.

Are there any emerging trends in the auto insurance industry?

+Yes, the auto insurance industry is witnessing several emerging trends. One notable trend is the increasing focus on data analytics and telematics. Insurance providers are using data-driven insights to offer more personalized and accurate insurance policies. Additionally, the rise of electric and autonomous vehicles is prompting insurers to adapt their coverage and pricing strategies.