How Much Homeowners Insurance

Homeowners insurance is an essential financial safeguard for property owners, offering protection against a wide range of risks and potential losses. However, determining the appropriate coverage amount can be a complex task, as it involves considering various factors specific to each homeowner's situation. This article aims to provide an in-depth analysis, offering expert insights and practical tips to help homeowners make informed decisions about their insurance coverage.

Understanding Homeowners Insurance Coverage

Homeowners insurance, often referred to as home insurance, is a contract between a property owner and an insurance company. It is designed to protect homeowners from financial losses resulting from damages to their home or personal belongings, as well as cover liabilities arising from accidents or injuries that occur on the insured property. The coverage provided by homeowners insurance can vary significantly depending on the policy and the insurer.

Typically, a homeowners insurance policy includes the following key components:

- Dwelling Coverage: This covers the physical structure of the home, including walls, roofs, and permanent fixtures. It ensures that in the event of a covered peril, such as a fire or storm, the home can be repaired or rebuilt.

- Personal Property Coverage: This protects the insured's personal belongings, like furniture, electronics, and clothing, against damage or theft. The coverage amount for personal property is usually a percentage of the dwelling coverage limit.

- Liability Coverage: This provides protection against legal claims and lawsuits arising from accidents or injuries that occur on the insured property. It covers medical expenses and legal fees, up to the policy limits.

- Additional Living Expenses: If a home is damaged and becomes uninhabitable, this coverage helps cover the additional costs of temporary housing and other living expenses during the repair or rebuilding process.

- Loss of Use: This covers the cost of additional living expenses when a home is uninhabitable due to a covered loss. It can include hotel stays, restaurant meals, and other expenses incurred while the home is being repaired.

Additionally, homeowners insurance policies may offer optional coverages for specific risks, such as:

- Flood Insurance: Standard homeowners insurance policies typically do not cover flood damage. Flood insurance is a separate policy that can be purchased to protect against flooding, which is a common and costly natural disaster.

- Earthquake Insurance: Similarly, most homeowners insurance policies do not cover damage caused by earthquakes. In areas prone to seismic activity, homeowners may choose to purchase this additional coverage.

- Personal Liability: This extends the liability coverage to include injuries or accidents that occur off the insured property, such as while a homeowner is away from home.

- Scheduled Personal Property: This provides additional coverage for high-value items, such as jewelry, art, or collectibles, which may exceed the standard personal property coverage limits.

Factors Influencing Homeowners Insurance Coverage

The amount of homeowners insurance coverage needed can vary significantly from one homeowner to another. Several factors come into play when determining the appropriate coverage limits, including:

The Value of Your Home

The replacement cost of your home is a crucial factor in determining the dwelling coverage limit. This is the amount it would cost to rebuild your home from the ground up, including materials and labor, if it were completely destroyed. It's important to note that the replacement cost may differ from the market value of your home, which includes factors like location and demand.

To accurately assess the replacement cost, consider consulting a professional appraiser or using a home replacement cost calculator. These tools can help you determine the appropriate dwelling coverage limit, ensuring you have enough insurance to rebuild your home if necessary.

The Value of Your Personal Belongings

Your personal property coverage should reflect the value of your belongings. This includes not only the items inside your home but also any structures on your property, such as a shed or garage. It's important to regularly review and update your personal property coverage to account for new purchases or changes in the value of your belongings.

Consider conducting a home inventory to create a comprehensive list of your possessions, including their purchase price, age, and current value. This inventory can be invaluable in the event of a loss, as it provides a detailed record for insurance claims.

Liability Risks

The liability coverage in your homeowners insurance policy protects you from financial losses arising from accidents or injuries that occur on your property. This coverage is crucial, as it can shield you from costly legal battles and medical expenses. The amount of liability coverage you need depends on your specific situation and the level of risk you are comfortable with.

Factors that can influence your liability coverage needs include:

- The number of people who regularly visit your property.

- The presence of any potentially hazardous conditions on your property, such as a swimming pool or trampoline.

- Your personal assets and the extent to which you want to protect them from potential lawsuits.

It's important to discuss your liability coverage needs with your insurance agent to ensure you have adequate protection.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered loss, additional living expenses coverage can help cover the costs of temporary housing, meals, and other living expenses until you can return to your home. The amount of coverage needed for additional living expenses should be based on your expected living costs during the time it takes to repair or rebuild your home.

Consider factors such as the size of your family, the cost of living in your area, and the average time it takes to rebuild homes in your region. By estimating these costs, you can determine the appropriate coverage limit for additional living expenses.

Deductibles and Policy Limits

When selecting a homeowners insurance policy, it's important to consider the deductible and policy limits. The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible can lower your premium, but it means you'll have to pay more out of pocket in the event of a claim. On the other hand, a lower deductible can provide more financial protection but may result in a higher premium.

Policy limits refer to the maximum amount your insurance company will pay for a covered loss. It's crucial to review these limits and ensure they align with your coverage needs. For example, if you have high-value belongings or live in an area prone to natural disasters, you may need to increase your policy limits to ensure adequate coverage.

Tips for Choosing the Right Coverage Amount

Determining the appropriate coverage amount for your homeowners insurance policy is a critical decision. Here are some expert tips to help you choose the right coverage limits:

- Conduct a Home Inventory: Create a detailed list of your personal belongings, including their value and purchase price. This inventory will help you assess the appropriate personal property coverage limit.

- Review Your Home's Replacement Cost: Consult a professional appraiser or use a home replacement cost calculator to determine the cost of rebuilding your home. This will guide your decision on the dwelling coverage limit.

- Consider Your Liability Risks: Evaluate the potential risks on your property and your personal assets. Discuss your liability coverage needs with your insurance agent to ensure you have adequate protection.

- Estimate Additional Living Expenses: Calculate the expected costs of temporary housing and living expenses if your home becomes uninhabitable. This will help you determine the appropriate coverage limit for additional living expenses.

- Evaluate Your Deductible: Consider your financial situation and choose a deductible that aligns with your comfort level. A higher deductible can lower your premium, but it's important to ensure you can afford the out-of-pocket costs in the event of a claim.

- Review Policy Limits: Carefully examine the policy limits to ensure they provide sufficient coverage for your needs. Consider increasing the limits for high-value items or if you live in an area with a higher risk of natural disasters.

- Seek Professional Advice: Consult with an insurance agent or broker who can provide expert guidance tailored to your specific situation. They can help you navigate the complexities of homeowners insurance and ensure you have the right coverage in place.

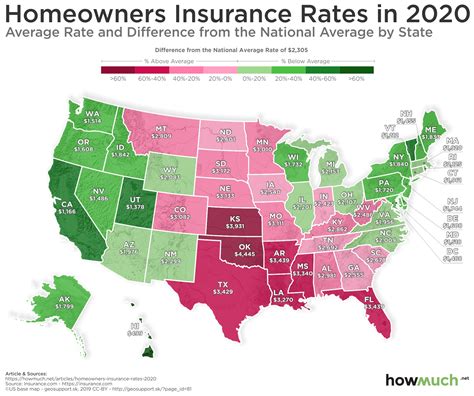

Homeowners Insurance Coverage by State

Homeowners insurance requirements and coverage limits can vary by state. While all states require some form of homeowners insurance, the specific regulations and guidelines can differ. Here's an overview of homeowners insurance coverage in select states:

California

In California, homeowners insurance is mandatory for most homeowners. The state's insurance regulations require policies to include coverage for earthquakes and wildfires, as these are significant risks in the region. Additionally, California homeowners are encouraged to review their policies regularly to ensure they have adequate coverage for their specific needs and the unique risks associated with their location.

Florida

Florida is known for its high risk of hurricanes and tropical storms. As a result, homeowners insurance policies in Florida typically include coverage for wind damage. However, it's important for homeowners to carefully review their policies to understand the specific terms and conditions, as some insurers may have restrictions or exclusions related to hurricane coverage.

Texas

Texas is prone to a variety of natural disasters, including hurricanes, tornadoes, and wildfires. Homeowners insurance policies in Texas often include coverage for these perils. Additionally, the state has specific regulations regarding windstorm coverage, requiring insurers to offer it as an option. Homeowners should carefully review their policies to ensure they have adequate protection against the unique risks associated with Texas' climate.

New York

New York homeowners face a range of potential risks, including hurricanes, blizzards, and floods. While standard homeowners insurance policies in New York may not cover flood damage, it's important for homeowners to be aware of this gap in coverage. Flood insurance is available through the National Flood Insurance Program (NFIP) and can be purchased separately to protect against this specific risk.

Illinois

Illinois is known for its severe weather, including tornadoes and thunderstorms. Homeowners insurance policies in the state typically cover damage caused by these weather events. However, it's crucial for homeowners to review their policies to understand the specific coverage limits and any exclusions or restrictions related to severe weather events.

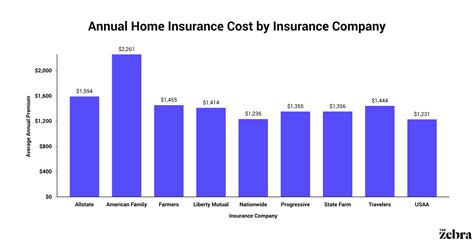

The Cost of Homeowners Insurance

The cost of homeowners insurance can vary significantly based on several factors, including the location of the home, the coverage limits chosen, and the insurer. On average, homeowners insurance policies in the United States range from $500 to $2,000 per year. However, the cost can be higher or lower depending on the specific circumstances.

Here's a breakdown of some factors that influence the cost of homeowners insurance:

- Location: The cost of homeowners insurance can vary greatly depending on where you live. Factors such as crime rates, the risk of natural disasters, and the cost of living in your area can all impact your insurance premiums.

- Coverage Limits: The amount of coverage you choose will directly affect your premium. Higher coverage limits generally result in higher premiums, while lower limits can lead to lower costs.

- Insurance Company: Different insurance companies offer varying rates and coverage options. It's important to compare quotes from multiple insurers to find the best combination of coverage and cost.

- Home's Age and Condition: Older homes may require more extensive coverage due to potential structural issues or outdated electrical or plumbing systems. The age and condition of your home can impact your insurance premiums.

- Claim History: Insurance companies consider your claim history when setting premiums. A history of frequent claims may result in higher premiums or even difficulty finding coverage.

- Discounts : Many insurance companies offer discounts for things like having multiple policies with the same insurer (e.g., auto and home insurance), installing security systems, or being a loyal customer for a certain number of years.

Frequently Asked Questions

How often should I review my homeowners insurance coverage?

+It is recommended to review your homeowners insurance coverage annually or whenever there are significant changes to your home or personal circumstances. Regular reviews ensure that your coverage remains adequate and aligned with your needs.

Can I customize my homeowners insurance policy to fit my specific needs?

+Yes, homeowners insurance policies can be customized to meet your specific needs. You can choose different coverage limits, add optional coverages for high-value items or specific risks, and adjust deductibles to find the right balance between cost and protection.

What should I do if I’m unsure about the coverage limits in my policy?

+If you have doubts about the coverage limits in your homeowners insurance policy, it’s best to consult with an insurance agent or broker. They can provide expert guidance based on your specific situation and help you understand the implications of different coverage limits.

Are there any common mistakes to avoid when choosing homeowners insurance coverage?

+Yes, some common mistakes to avoid include underinsuring your home, choosing a policy solely based on price without considering coverage, and neglecting to review your policy regularly. It’s important to strike a balance between cost and adequate protection.

Can I bundle my homeowners insurance with other policies to save money?

+Yes, many insurance companies offer discounts when you bundle multiple policies, such as homeowners insurance and auto insurance. Bundling can be a cost-effective way to protect your home and other assets while enjoying lower premiums.