Free Georgia Health Insurance

Accessing free health insurance in the state of Georgia is a significant concern for many residents, as health coverage plays a crucial role in ensuring access to essential medical services and maintaining overall well-being. This article aims to provide a comprehensive guide to understanding the options available for free or low-cost health insurance in Georgia, including the various programs, eligibility criteria, and the steps required to enroll.

Understanding Georgia’s Healthcare Landscape

Georgia, like many states in the US, offers a range of healthcare coverage options, each with its own set of benefits and eligibility requirements. Familiarizing yourself with these options is the first step towards securing the right health insurance plan for your needs.

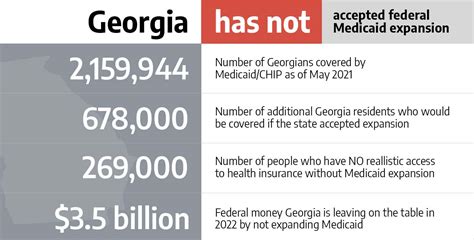

Medicaid in Georgia

Medicaid is a federal and state-funded program that provides health coverage to low-income individuals and families. In Georgia, the program is known as PeachCare for Kids and Georgia Families. This program is designed to cover a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and more.

| Program | Coverage | Income Eligibility |

|---|---|---|

| PeachCare for Kids | Children and teens up to age 19 | Up to 217% of the Federal Poverty Level |

| Georgia Families | Parents, pregnant women, children, and adults | Up to 138% of the Federal Poverty Level |

To determine your eligibility for Medicaid in Georgia, you can use the Georgia Department of Community Health's eligibility tool. This tool takes into account your income, family size, and other factors to assess your eligibility for Medicaid or other health coverage programs.

The Affordable Care Act (ACA) and Marketplace Plans

The Affordable Care Act, often referred to as Obamacare, offers a range of health insurance plans through the Health Insurance Marketplace. These plans are available to individuals and families who don’t have access to health insurance through their employers or government programs like Medicaid.

During the Open Enrollment Period, typically from November to December each year, Georgians can shop for and enroll in Marketplace plans. These plans are offered by private insurance companies and are regulated by the ACA to ensure they meet certain standards for coverage and consumer protections.

The Marketplace plans in Georgia are categorized into metal tiers - Bronze, Silver, Gold, and Platinum - each with different cost-sharing structures. Bronze plans have lower premiums but higher out-of-pocket costs, while Platinum plans have higher premiums but lower out-of-pocket costs.

Premium Tax Credits and Cost-Sharing Reductions

The Affordable Care Act provides two types of financial assistance to help make health insurance more affordable: Premium Tax Credits and Cost-Sharing Reductions.

Premium Tax Credits reduce the amount you pay each month for your health insurance premium. These credits are available to individuals and families with household incomes between 100% and 400% of the Federal Poverty Level. The amount of the credit depends on your income and family size, with lower-income individuals receiving larger credits.

Cost-Sharing Reductions lower the amount you pay out-of-pocket for deductibles, copayments, and coinsurance. These reductions are available to individuals and families with household incomes between 100% and 250% of the Federal Poverty Level. With Cost-Sharing Reductions, you can expect to pay less for covered services when you need medical care.

Special Enrollment Periods

In addition to the Open Enrollment Period, there are Special Enrollment Periods throughout the year when you can sign up for health insurance outside of the regular enrollment period. These periods are triggered by certain life events, such as losing your job-based health coverage, getting married, having a baby, or moving to a new state.

For example, if you lose your job and your employer-sponsored health insurance, you can enroll in a Marketplace plan during a Special Enrollment Period. This period typically lasts 60 days from the date of your qualifying life event. It's important to note that you must act quickly to take advantage of these special enrollment opportunities.

Qualifying for Free or Low-Cost Health Insurance

Qualifying for free or low-cost health insurance in Georgia largely depends on your income and family size. The following programs offer coverage at little to no cost:

- Medicaid (PeachCare for Kids and Georgia Families): As mentioned earlier, these programs offer free or low-cost health coverage to eligible individuals and families based on their income.

- Children's Health Insurance Program (CHIP): CHIP provides low-cost health coverage to children in families that earn too much to qualify for Medicaid. The program covers doctor visits, hospital stays, dental care, and more.

- Marketplace Plans with Premium Tax Credits: If your income is between 100% and 400% of the Federal Poverty Level, you may qualify for Premium Tax Credits that can significantly lower your monthly insurance premiums. This can make even the more comprehensive Platinum plans more affordable.

Enrolling in Free or Low-Cost Health Insurance

Enrolling in free or low-cost health insurance in Georgia involves a few key steps:

- Determine Your Eligibility: Use the Georgia Department of Community Health's eligibility tool to assess your eligibility for Medicaid, CHIP, or other health coverage programs. You can also check your eligibility for Marketplace plans and Premium Tax Credits.

- Choose Your Plan: If you're eligible for Marketplace plans, compare the available plans and choose the one that best fits your needs and budget. Consider factors like monthly premiums, out-of-pocket costs, and the types of services covered.

- Complete the Enrollment Process: Once you've chosen your plan, complete the enrollment process, which typically involves providing personal and financial information. You may also need to submit supporting documentation to verify your eligibility.

- Renew Your Coverage: Health insurance plans typically last for a year, so it's important to renew your coverage each year during the Open Enrollment Period or a Special Enrollment Period if you qualify.

Maximizing Your Coverage

To get the most out of your free or low-cost health insurance in Georgia, consider the following tips:

- Understand Your Coverage: Read your plan's Summary of Benefits and Coverage document carefully to understand what's covered, your out-of-pocket costs, and any limitations or exclusions. This knowledge can help you make informed decisions about your healthcare.

- Choose In-Network Providers: Using in-network providers can save you money, as these providers have negotiated rates with your insurance company. Check your plan's provider directory to find in-network doctors, hospitals, and other healthcare professionals.

- Take Advantage of Preventive Care: Many health insurance plans, including those offered through the Marketplace, cover a range of preventive services at no cost to you. These services can help you stay healthy and catch potential health issues early.

- Consider a Health Savings Account (HSA): If you're enrolled in a High Deductible Health Plan (HDHP), you may be eligible to open an HSA. HSAs allow you to save money tax-free to pay for qualified medical expenses. The money you contribute to an HSA is yours to keep and can roll over year to year.

Conclusion

Accessing free or low-cost health insurance in Georgia is a complex but achievable process. By understanding the available programs, determining your eligibility, and following the enrollment process, you can secure the health coverage you need. Remember to renew your coverage each year and make the most of your plan’s benefits to maintain your health and financial well-being.

What is the Federal Poverty Level (FPL) and how is it used to determine eligibility for health insurance programs?

+The Federal Poverty Level (FPL) is a measure of income established by the federal government to determine eligibility for certain programs and benefits. It’s updated annually and varies based on family size and the state in which you live. Health insurance programs like Medicaid and Marketplace plans use the FPL to determine income eligibility. For example, if your income is below a certain percentage of the FPL, you may qualify for free or low-cost health insurance.

Are there any other ways to reduce my out-of-pocket costs for healthcare besides Premium Tax Credits and Cost-Sharing Reductions?

+Yes, there are several strategies you can use to reduce your out-of-pocket costs for healthcare. These include choosing an in-network provider, taking advantage of preventive care services, and using generic medications instead of brand-name drugs. Additionally, some health insurance plans offer discounts or reduced costs for certain services or treatments. It’s important to understand your plan’s benefits and how to maximize them.

What happens if I miss the Open Enrollment Period and don’t qualify for a Special Enrollment Period? Can I still get health insurance coverage?

+If you miss the Open Enrollment Period and don’t qualify for a Special Enrollment Period, you may still be able to purchase a short-term health insurance plan or a plan through the Health Insurance Marketplace if you have a qualifying life event. However, it’s important to note that these options may not provide the same level of coverage or consumer protections as Marketplace plans purchased during the Open Enrollment Period.