Aca Health Insurance Exchange

Welcome to the comprehensive guide on the Aca Health Insurance Exchange, a vital component of the Affordable Care Act (ACA) that has revolutionized the way Americans access and obtain health insurance coverage. This exchange platform has played a significant role in expanding healthcare accessibility and providing individuals and families with a wide range of insurance options. In this article, we will delve into the intricacies of the Aca Health Insurance Exchange, exploring its history, functionality, benefits, and its impact on the healthcare landscape.

The Evolution of the Aca Health Insurance Exchange

The concept of a health insurance exchange emerged as a key component of the Affordable Care Act, which was signed into law in 2010. The goal was to establish a transparent and competitive marketplace where individuals and small businesses could easily compare and purchase health insurance plans. The Aca Health Insurance Exchange, often referred to as the Health Insurance Marketplace, has since become a vital resource for millions of Americans seeking affordable and comprehensive healthcare coverage.

The implementation of the Aca Health Insurance Exchange has undergone several phases, with continuous improvements and adaptations to meet the evolving needs of the population. Initially, the exchange focused on creating a user-friendly online platform that allowed individuals to compare plans based on their specific needs and preferences. Over time, the exchange has expanded its reach, offering a broader range of insurance options and providing additional support to assist users in making informed decisions.

Key Milestones and Achievements

-

2013-2014: Initial Rollout and Open Enrollment - The first open enrollment period for the Aca Health Insurance Exchange commenced on October 1, 2013, marking a significant milestone in the implementation of the Affordable Care Act. During this period, millions of Americans signed up for health insurance plans, many of whom were previously uninsured or had limited access to quality healthcare.

-

2015-2016: Enhanced Features and Support - Building on the success of the initial enrollment period, the Aca Health Insurance Exchange introduced several enhancements. This included improved search and comparison tools, expanded plan networks, and enhanced customer support services to assist users in navigating the complex world of health insurance.

-

2017-2018: Stabilization and Innovation - As the exchange gained traction, efforts were made to stabilize the marketplace and address any emerging challenges. During this phase, the Aca Health Insurance Exchange focused on attracting a diverse range of insurance providers, ensuring a competitive environment that benefited consumers. Additionally, innovative features such as personalized recommendations and simplified enrollment processes were introduced to enhance the user experience.

How the Aca Health Insurance Exchange Works

The Aca Health Insurance Exchange operates as a centralized online platform, serving as a one-stop shop for individuals and families to explore, compare, and purchase health insurance plans. The exchange offers a transparent and standardized environment, making it easier for users to understand their options and make informed choices.

The Enrollment Process

The enrollment process on the Aca Health Insurance Exchange is designed to be user-friendly and efficient. Here’s a step-by-step breakdown of how it works:

-

Eligibility Check - Users begin by determining their eligibility for coverage through the exchange. This involves providing basic information such as income, household size, and citizenship status. The exchange’s eligibility criteria are based on federal guidelines, ensuring a fair and consistent assessment process.

-

Plan Comparison - Once eligibility is confirmed, users can proceed to compare available health insurance plans. The exchange provides a comprehensive overview of each plan’s features, including coverage details, provider networks, and cost estimates. Users can filter and sort plans based on their specific needs, such as preferred doctors or prescription drug coverage.

-

Cost Estimation - The Aca Health Insurance Exchange employs a sophisticated algorithm to estimate the cost of each plan for the user. This estimation takes into account factors such as income, family size, and eligibility for subsidies. The exchange’s cost estimation tool provides a clear breakdown of premiums, deductibles, and out-of-pocket expenses, helping users understand the financial implications of each plan.

-

Enrollment and Payment - After selecting a plan, users can proceed with the enrollment process. This involves providing additional personal and medical information, as well as choosing a preferred payment method. The exchange offers secure online payment options, ensuring a seamless and convenient transaction.

-

Confirmation and Coverage - Once the enrollment and payment are complete, users receive a confirmation of their selected plan. The exchange then facilitates the transfer of the user’s information to the chosen insurance provider, who will issue an official insurance policy. The user can then begin utilizing their new health insurance coverage.

The Benefits of the Aca Health Insurance Exchange

The Aca Health Insurance Exchange offers a multitude of benefits to individuals and families seeking health insurance coverage. Here are some key advantages:

-

Increased Accessibility - The exchange has significantly expanded access to health insurance, particularly for individuals and families who were previously uninsured or faced limited options. By providing a centralized platform, the exchange has simplified the process of finding and obtaining coverage, making healthcare more accessible to a broader population.

-

Competition and Choice - The Aca Health Insurance Exchange fosters a competitive marketplace, bringing together a diverse range of insurance providers. This competition drives down costs and encourages providers to offer more comprehensive and affordable plans. Users benefit from a wide selection of options, allowing them to choose a plan that best suits their needs and budget.

-

Transparency and Standardization - The exchange platform ensures transparency by providing standardized information on each health insurance plan. Users can easily compare plans based on coverage, cost, and provider networks, making informed decisions without the confusion often associated with complex insurance terminology.

-

Financial Assistance - One of the most significant advantages of the Aca Health Insurance Exchange is the availability of financial assistance. The exchange calculates eligibility for subsidies and tax credits, helping eligible individuals and families offset the cost of their health insurance premiums. This financial support makes healthcare more affordable and accessible to those who need it most.

-

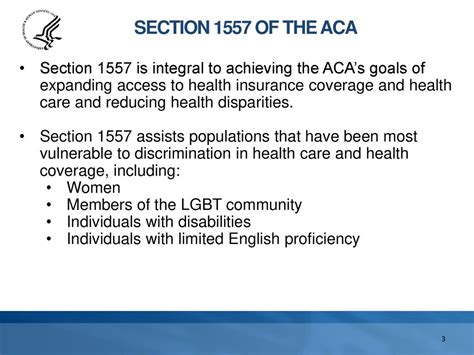

Consumer Protection - The Aca Health Insurance Exchange implements consumer protection measures to ensure that insurance providers offer fair and equitable coverage. These measures include prohibiting discrimination based on pre-existing conditions, setting minimum coverage standards, and implementing regulations to prevent excessive cost-sharing by consumers.

The Impact and Future of the Aca Health Insurance Exchange

The Aca Health Insurance Exchange has had a profound impact on the healthcare landscape in the United States. By increasing accessibility, promoting competition, and providing financial assistance, the exchange has contributed to a more equitable and efficient healthcare system. Here are some key implications and potential future developments:

Improved Healthcare Access

The Aca Health Insurance Exchange has played a pivotal role in reducing the number of uninsured Americans. By offering a streamlined enrollment process and providing access to affordable coverage, the exchange has enabled millions of individuals and families to obtain healthcare services they may not have otherwise been able to afford. This increased access to healthcare has led to improved health outcomes and reduced financial burdens for many.

Enhanced Competition and Innovation

The competitive nature of the Aca Health Insurance Exchange has driven insurance providers to innovate and improve their offerings. As providers strive to attract customers, they have introduced new plan designs, expanded provider networks, and enhanced customer support services. This competition benefits consumers by driving down costs, improving coverage options, and encouraging providers to deliver higher-quality care.

Continued Evolution and Adaptation

The Aca Health Insurance Exchange is an evolving platform, constantly adapting to meet the changing needs of the population. Future developments may include further enhancements to the user experience, such as personalized plan recommendations based on individual health needs and preferences. Additionally, efforts to streamline the enrollment process and integrate additional healthcare services into the exchange are likely to be explored.

Addressing Ongoing Challenges

While the Aca Health Insurance Exchange has made significant strides, there are still challenges to address. These include ensuring the sustainability of the exchange, especially in states with limited participation, and addressing concerns related to rising healthcare costs. Ongoing efforts to improve affordability, expand coverage options, and enhance consumer protection will be crucial in maintaining the success of the exchange.

The Role of Technology and Data

Technology and data analytics play a vital role in the future of the Aca Health Insurance Exchange. By leveraging advanced analytics, the exchange can improve plan recommendations, personalize coverage options, and enhance overall user experience. Additionally, data-driven insights can inform policy decisions, helping policymakers make informed choices to improve the efficiency and effectiveness of the exchange.

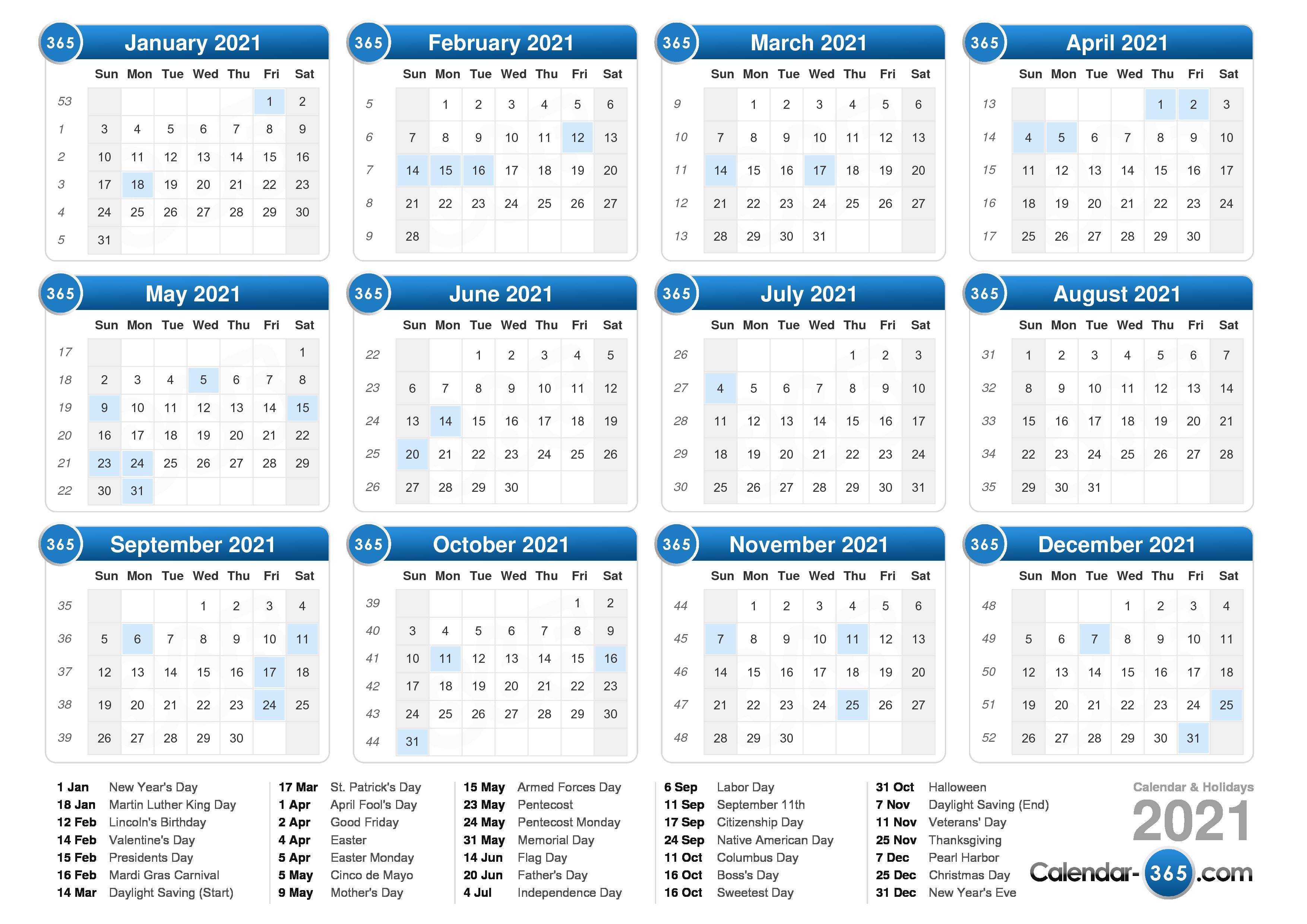

| Metric | Value |

|---|---|

| Total Enrollment (2021) | 12.2 Million |

| Average Premium Savings with Subsidies (2021) | $550 per month |

| Number of Participating Insurance Providers (2021) | 178 |

| States with the Highest Enrollment | Florida, Texas, California |

How do I know if I’m eligible for coverage through the Aca Health Insurance Exchange?

+Eligibility for coverage through the Aca Health Insurance Exchange is determined based on factors such as income, family size, and citizenship status. The exchange provides an eligibility checker tool, where you can input your information to determine if you qualify for coverage. If you meet the criteria, you can proceed to explore and compare available plans.

Can I still purchase health insurance outside of the open enrollment period?

+Yes, there are certain qualifying life events that allow you to purchase health insurance outside of the standard open enrollment period. These events include losing your job, getting married, having a baby, or moving to a new state. When one of these events occurs, you are eligible for a Special Enrollment Period, which allows you to enroll in a health insurance plan outside of the regular enrollment timeframe.

How can I ensure I’m getting the best deal on my health insurance plan through the exchange?

+To ensure you’re getting the best deal on your health insurance plan, it’s important to compare multiple plans based on your specific needs and preferences. Consider factors such as coverage limits, provider networks, and out-of-pocket costs. Additionally, take advantage of any available subsidies or tax credits to reduce your overall premium costs. By carefully reviewing and comparing plans, you can find the most suitable and affordable option for your healthcare needs.