Sr22 Car Insurance Quotes

Securing an SR22 car insurance policy is often a necessary step for drivers with a less-than-perfect driving record. An SR22 is a certificate of insurance that some states require from drivers who have had their license suspended or revoked due to certain offenses. This document serves as proof of financial responsibility and is typically needed to reinstate driving privileges. Obtaining SR22 insurance can be a complex process, and the quotes for such policies can vary significantly depending on various factors. In this comprehensive guide, we will delve into the world of SR22 car insurance quotes, exploring the key considerations, the factors influencing rates, and the steps to secure the best coverage for your specific situation.

Understanding SR22 Car Insurance

An SR22, also known as a Certificate of Financial Responsibility, is a legal document filed by your insurance provider with the relevant state authorities. It certifies that you have purchased the minimum level of liability insurance required by law. SR22 insurance is often mandated for drivers with a history of serious violations, such as driving under the influence (DUI), reckless driving, or multiple traffic offenses. The purpose of SR22 insurance is to ensure that these high-risk drivers maintain adequate coverage, providing financial protection to others on the road.

When you need to obtain an SR22, it's essential to understand that the process involves more than just a standard car insurance policy. SR22 insurance typically comes with higher premiums and more stringent requirements. Insurance companies carefully assess the risks associated with these policies, as they are often considered a greater financial liability. As a result, the quotes you receive for SR22 insurance may differ significantly from regular car insurance quotes.

Factors Influencing SR22 Insurance Quotes

Several key factors play a role in determining the cost of SR22 car insurance quotes. These factors are often more intricate and specific compared to regular car insurance quotes. Understanding these factors can help you anticipate the costs and make informed decisions when shopping for SR22 insurance.

1. Type of Violation

The nature of the violation that led to your SR22 requirement is a significant factor in determining insurance rates. Offenses like DUI or hit-and-run carry more severe consequences and can result in higher insurance premiums. Insurance companies consider these violations as indicators of higher risk, leading to increased costs.

| Violation Type | Impact on SR22 Insurance Rates |

|---|---|

| DUI | One of the most impactful violations, often resulting in significant premium increases. |

| Reckless Driving | Can lead to higher rates, especially if it involves serious accidents or multiple offenses. |

| Speeding | Excessive speeding or repeated speeding tickets may impact SR22 rates. |

| Hit-and-Run | A serious offense that can result in increased insurance costs. |

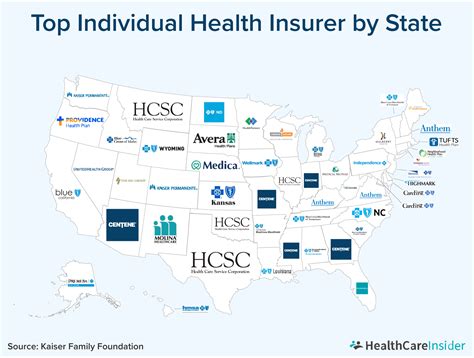

2. State Requirements

SR22 requirements and the associated insurance costs can vary significantly from one state to another. Each state has its own minimum liability insurance limits and SR22 filing regulations. For instance, some states may require an SR22 for a single DUI offense, while others might mandate it only after multiple violations.

3. Insurance Company Risk Assessment

Insurance companies use sophisticated risk assessment models to evaluate the potential financial risks associated with SR22 drivers. These models consider various factors, including your driving record, credit score, and claims history. Companies that specialize in high-risk insurance may offer more competitive rates, as they are better equipped to handle these specific risks.

4. Coverage Options

The level of coverage you choose for your SR22 insurance policy can impact the overall cost. While the SR22 itself certifies a minimum level of liability coverage, you may opt for additional coverage options, such as collision, comprehensive, or personal injury protection (PIP). Adding these coverages can increase your premium, but they provide enhanced protection in the event of an accident.

5. Duration of SR22 Requirement

The length of time you are required to maintain an SR22 can influence your insurance costs. In most states, the SR22 requirement lasts for a minimum of three years. However, if you have multiple violations or a more severe offense, the duration may be extended. The longer you need to maintain SR22 insurance, the more it can impact your overall insurance costs.

6. Discounts and Bundling

Despite the higher costs associated with SR22 insurance, there are still opportunities to save. Insurance companies often offer discounts for safe driving, multiple vehicles, or policy bundling. If you have other insurance policies, such as home or life insurance, with the same provider, you may be eligible for a discount on your SR22 car insurance.

Securing the Best SR22 Car Insurance Quotes

Navigating the SR22 insurance landscape can be challenging, but with the right approach, you can find the best quotes for your situation.

1. Shop Around

Don’t settle for the first SR22 insurance quote you receive. Shopping around with multiple insurance providers is crucial to finding the most competitive rates. Each company has its own risk assessment models and pricing structures, so getting quotes from a variety of insurers can help you identify the best options.

2. Compare Coverage Options

When comparing SR22 insurance quotes, ensure that you are comparing policies with similar coverage levels. Some companies may offer lower premiums by providing less coverage, so it’s essential to understand the specifics of each policy. Look for policies that meet or exceed the minimum liability requirements in your state.

3. Consider Specialized Insurers

There are insurance companies that specialize in providing coverage for high-risk drivers, including those requiring SR22 insurance. These insurers often have more experience in assessing and managing the risks associated with SR22 policies. While they may not always offer the lowest rates, they can provide valuable expertise and specialized coverage options.

4. Maintain a Clean Driving Record

While your past violations are a significant factor in SR22 insurance rates, maintaining a clean driving record going forward can help reduce costs over time. Avoid additional violations and focus on safe driving practices. A consistent record of responsible driving can demonstrate to insurers that you are a lower risk, potentially leading to reduced premiums in the future.

5. Explore Payment Options

Some insurance companies offer flexible payment plans for SR22 insurance. These plans can help spread out the cost of insurance, making it more manageable. Discuss payment options with your insurer to find a plan that fits your budget.

6. Understand the Cancellation Process

If you are able to restore your driving privileges without an SR22, it’s important to understand the cancellation process. Each state has its own regulations regarding SR22 cancellation. You’ll need to work with your insurance provider to ensure the SR22 is properly terminated to avoid any potential issues with your driving record.

FAQs about SR22 Car Insurance Quotes

Can I get SR22 insurance if I have a poor credit score?

+

Yes, it is possible to obtain SR22 insurance with a poor credit score. However, a low credit score is often considered a risk factor by insurance companies, which can lead to higher premiums. Improving your credit score over time can help reduce insurance costs.

How long do I need to maintain SR22 insurance?

+

The duration of the SR22 requirement varies by state and the nature of your violation. In most cases, it lasts for a minimum of three years. However, some states may extend the requirement for more severe or repeated offenses.

Are there any alternatives to SR22 insurance?

+

In some states, an SR22 may be replaced by an SR50 or an FR44 certificate, which serve similar purposes. These alternatives are often required for specific types of violations or in certain states. Consult with your insurance provider or local DMV to understand your options.

Can I switch insurance providers while having an SR22 requirement?

+

Yes, you can switch insurance providers while maintaining your SR22 requirement. However, it’s crucial to ensure a smooth transition to avoid any lapse in coverage. Work closely with your new insurance provider to ensure the SR22 filing is properly transferred.

How can I reduce the cost of SR22 insurance over time?

+

To reduce SR22 insurance costs over time, focus on maintaining a clean driving record and improving your credit score. Additionally, consider exploring discounts and bundling options with your insurance provider. Over time, as your risk profile improves, you may qualify for lower premiums.