Medical Insurance Fl

Understanding Medical Insurance: Navigating the Complexities of Florida's Healthcare System

In the intricate landscape of healthcare, medical insurance plays a pivotal role, especially in a state as diverse as Florida. With its unique demographics, healthcare challenges, and regulatory environment, navigating the world of medical insurance in Florida requires an expert's insight. This comprehensive guide aims to unravel the complexities, providing an in-depth analysis to empower individuals and businesses alike.

The Florida Healthcare Landscape: A Unique Perspective

Florida, known for its vibrant culture and diverse population, presents a distinct healthcare scenario. The state's aging population, coupled with a significant influx of seasonal residents and tourists, creates a dynamic demand for healthcare services. This demographic trend has profound implications for medical insurance, shaping the very foundation of healthcare accessibility and affordability.

Furthermore, Florida's geographic location and climate make it prone to natural disasters, such as hurricanes, which can significantly impact healthcare infrastructure and emergency response systems. This adds an additional layer of complexity to the healthcare ecosystem, necessitating robust insurance plans that can withstand unforeseen circumstances.

Key Statistics and Trends

- Florida's population stands at over 21 million, with a significant portion (18.7%) aged 65 and above, making it the third most populous state in the nation.

- The state's healthcare spending per capita is approximately $7,300, slightly higher than the national average of $6,700.

- The uninsured rate in Florida is estimated at 9.8%, slightly lower than the national average of 10.9%.

- A notable trend in Florida's healthcare sector is the rise of telemedicine, especially post-pandemic, providing remote healthcare services to residents in remote or disaster-stricken areas.

Medical Insurance in Florida: A Comprehensive Overview

Medical insurance in Florida is governed by a complex interplay of federal and state regulations, insurance providers, and healthcare networks. Understanding this ecosystem is crucial for individuals seeking coverage and businesses offering employee benefits.

Regulatory Environment

Florida's insurance regulations are primarily overseen by the Florida Office of Insurance Regulation (OIR). This body is responsible for approving insurance rates, ensuring compliance with state laws, and protecting consumers from unfair practices. Additionally, the Affordable Care Act (ACA) plays a significant role, mandating essential health benefits and prohibiting discrimination based on pre-existing conditions.

| Key Regulation | Description |

|---|---|

| Guaranteed Issue | Insurance companies must offer coverage to all applicants, regardless of health status, under the ACA. |

| Community Rating | Premium rates are based on the average health of the entire community, not individual health status. |

| Essential Health Benefits | ACA-mandated benefits include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more. |

Insurance Providers and Plans

Florida boasts a diverse range of insurance providers, each offering a myriad of plans to cater to different needs and budgets. From major national carriers to local providers, the market is highly competitive, driving innovation and affordability.

- Major National Carriers: Companies like UnitedHealthcare, Blue Cross Blue Shield, and Cigna offer a wide array of plans, including HMO, PPO, EPO, and POS options. These plans typically have a broader network of providers, making them ideal for those who travel frequently or require access to specialized care.

- Local Providers: Florida-based insurers, such as Florida Blue and AvMed, often have more localized networks, which can be advantageous for those primarily seeking in-state care. These providers often have deep roots in the community, offering tailored plans and support.

- Medicaid and Medicare: Florida's Medicaid program provides coverage to low-income residents, while Medicare caters to seniors and those with disabilities. These government-funded programs play a crucial role in ensuring healthcare accessibility for vulnerable populations.

Healthcare Networks and Providers

The effectiveness of medical insurance plans in Florida is highly dependent on the healthcare network and provider partnerships. A strong network ensures access to a wide range of healthcare services, from primary care to specialized treatments.

| Healthcare Network | Key Providers |

|---|---|

| Florida Blue's BlueOptions | Includes a vast network of primary care physicians, specialists, and hospitals across the state, ensuring comprehensive care. |

| UnitedHealthcare's Choice Plus Network | Offers a robust network with a focus on quality and value, providing access to a wide range of healthcare facilities and professionals. |

| Cigna's Open Access Plus Network | Provides flexibility with a large network of in-network providers, as well as out-of-network coverage at a reduced cost. |

Choosing the Right Medical Insurance: A Strategic Approach

With the plethora of options available, selecting the right medical insurance plan can be a daunting task. It requires a strategic approach, considering individual needs, budget constraints, and the unique aspects of Florida's healthcare landscape.

Assessing Individual Needs

Understanding personal healthcare needs is the first step towards choosing the right insurance plan. Factors such as age, health status, family size, and lifestyle play a significant role. For instance, a young, healthy individual may opt for a high-deductible plan with lower premiums, while an older individual with chronic conditions might prioritize a plan with comprehensive coverage and lower out-of-pocket costs.

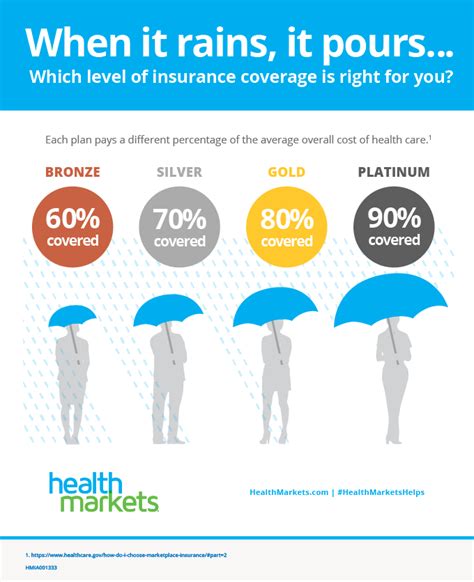

Evaluating Plan Options

Once individual needs are assessed, the next step is to evaluate the available plan options. This involves comparing premiums, deductibles, copayments, and out-of-pocket limits. It's crucial to consider the plan's network of providers and facilities, ensuring access to preferred healthcare professionals and hospitals. Additionally, understanding the plan's coverage for specific services, such as prescription drugs, mental health, and specialty care, is essential.

The Role of Brokers and Advisors

Navigating the complex world of medical insurance can be simplified with the help of experienced brokers and advisors. These professionals can provide personalized guidance, helping individuals and businesses find the most suitable plans. They can offer insights into plan details, network strengths, and potential cost-saving strategies, ensuring an informed decision.

Maximizing Benefits: Strategies for Optimal Coverage

Beyond selecting the right plan, there are strategies to maximize the benefits of medical insurance, ensuring cost-effectiveness and comprehensive coverage.

Understanding Your Plan

Thoroughly understanding the intricacies of your medical insurance plan is the foundation for optimal coverage. This includes knowing the plan's network, covered services, and any limitations or exclusions. Regularly reviewing the plan's benefits and costs, especially during open enrollment periods, can help identify potential changes or upgrades that align with your evolving healthcare needs.

Utilizing Preventive Care

Preventive care, often covered at no cost under most plans, is a powerful tool for maintaining good health and managing healthcare costs. Regular check-ups, screenings, and immunizations can help detect potential health issues early on, preventing more serious and costly conditions down the line. Additionally, many plans offer wellness programs and incentives to encourage healthy lifestyles, further reducing healthcare costs.

Managing Chronic Conditions

For individuals with chronic conditions, effective management is key to optimizing medical insurance benefits. This involves regular communication with healthcare providers, adherence to treatment plans, and utilization of support programs offered by insurance providers. Many plans offer disease management programs, providing resources and guidance to help individuals better manage their conditions, leading to improved health outcomes and reduced costs.

The Future of Medical Insurance in Florida: Trends and Innovations

The healthcare landscape in Florida, like the rest of the nation, is evolving rapidly, driven by technological advancements, changing demographics, and shifting regulatory landscapes. Understanding these trends and innovations is crucial for staying ahead of the curve and ensuring continued access to quality healthcare.

Telemedicine and Virtual Care

The COVID-19 pandemic accelerated the adoption of telemedicine, and this trend is expected to continue in Florida. Telemedicine offers remote healthcare services, including virtual consultations, remote monitoring, and digital health solutions. This not only improves access to healthcare for remote or underserved areas but also provides a convenient and cost-effective option for routine care and chronic condition management.

Value-Based Care Models

Value-based care models are gaining traction in Florida, focusing on the quality and outcomes of care rather than the quantity of services provided. These models incentivize healthcare providers to deliver high-quality, cost-effective care, often through Accountable Care Organizations (ACOs) or other collaborative arrangements. By aligning incentives between providers, insurers, and patients, these models have the potential to improve health outcomes and reduce costs.

Health Technology Innovations

Florida's healthcare sector is embracing digital health technologies, such as electronic health records (EHRs), health information exchanges (HIEs), and mobile health apps. These technologies enhance data sharing, improve patient engagement, and facilitate remote monitoring, leading to more efficient and effective care delivery. Additionally, health technology startups in Florida are developing innovative solutions, from artificial intelligence-powered diagnostics to blockchain-based healthcare data management systems.

Conclusion: Empowering Floridians with Knowledge

Medical insurance is a critical component of Florida's healthcare ecosystem, ensuring accessibility and affordability for millions of residents. By understanding the intricacies of this landscape, individuals and businesses can make informed decisions, choosing plans that align with their unique needs and budgets. As the healthcare industry continues to evolve, staying informed about the latest trends and innovations is essential for navigating the future of medical insurance in Florida.

What is the average cost of medical insurance in Florida?

+

The average cost of medical insurance in Florida varies depending on several factors, including the type of plan (HMO, PPO, etc.), the insurance provider, the age and health status of the insured individual, and the level of coverage desired. As of recent data, the average monthly premium for a single person in Florida is around 400 to 600, while family plans can range from 1,000 to 2,000 per month. It’s important to note that these are just averages, and actual costs can vary significantly based on individual circumstances.

How does Florida’s Medicaid program work?

+

Florida’s Medicaid program provides health coverage to low-income individuals and families who meet certain eligibility criteria. It covers a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and more. Eligibility is determined based on factors such as income, assets, family size, and certain other requirements. The program is jointly funded by the state and federal governments, with the federal government providing a matching rate for state spending.

What are some common challenges faced when navigating medical insurance in Florida?

+

Navigating medical insurance in Florida can present several challenges, including understanding complex plan details, choosing the right plan that fits individual needs and budget, managing out-of-pocket costs, and dealing with insurance provider networks and coverage limitations. Additionally, staying informed about changes in insurance regulations, plan offerings, and provider networks can be challenging, especially for those who are not familiar with the healthcare industry.