Cheap Insurance Car Insurance

Finding cheap car insurance is a common goal for many drivers, and with the right strategies, it is indeed possible to secure affordable coverage without compromising on quality. The cost of car insurance can vary significantly depending on various factors, including your location, driving history, and the type of vehicle you own. This article will delve into the world of car insurance, offering valuable insights and practical tips to help you navigate the process and find the best deals available.

Understanding Car Insurance Policies and Costs

Car insurance is a vital financial protection for drivers, providing coverage for a range of potential incidents, from minor fender benders to more severe accidents. The cost of this coverage is influenced by numerous factors, each playing a unique role in determining the final premium.

Factors Affecting Car Insurance Premiums

- Driver’s Profile: Your age, gender, driving record, and credit score all impact your insurance rates. Young drivers and those with a history of accidents or traffic violations often face higher premiums.

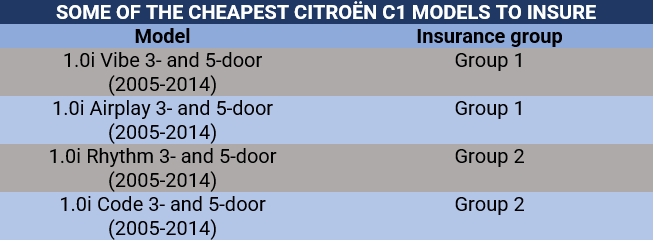

- Vehicle Type: The make, model, and year of your car matter. Sports cars and luxury vehicles generally cost more to insure due to their higher repair and replacement costs.

- Coverage Level: The level of coverage you choose directly affects your premium. Comprehensive and collision coverage, which protect against damage to your vehicle, can be more expensive than liability-only coverage.

- Location: Where you live and drive can significantly impact your insurance rates. Urban areas with higher traffic density and crime rates often result in higher premiums.

- Usage: How you use your vehicle matters. If you drive frequently or for long distances, your insurance may be more expensive than if you primarily use your car for short, local trips.

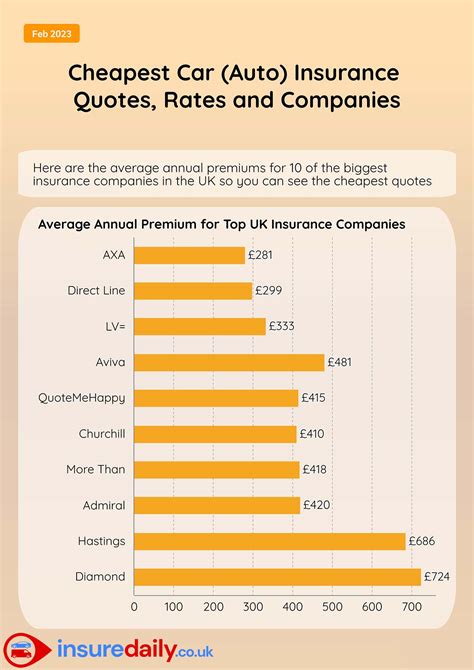

Average Cost of Car Insurance

The average cost of car insurance varies widely depending on these factors and can range from a few hundred to several thousand dollars annually. According to recent industry data, the national average for car insurance premiums is approximately $1,674 per year. However, this is just an average, and your personal premium may be significantly higher or lower.

Tips to Find Cheap Car Insurance

Finding cheap car insurance requires a combination of research, understanding your options, and making informed decisions. Here are some strategies to help you secure the best rates:

Compare Multiple Insurers

The insurance market is highly competitive, and rates can vary significantly between providers. By comparing quotes from multiple insurers, you can identify the most affordable option for your specific needs. Online comparison tools and websites can make this process easier and more efficient.

Choose the Right Coverage

While it’s tempting to opt for the lowest coverage to save money, it’s important to ensure you have adequate protection. Assess your specific risks and needs, and choose a coverage level that provides sufficient financial protection without being excessive.

Take Advantage of Discounts

Many insurers offer a range of discounts that can significantly reduce your premium. These may include discounts for safe driving records, multiple vehicles insured, bundling home and auto insurance, or even for specific occupations or affiliations. Be sure to inquire about all available discounts when getting quotes.

Consider Higher Deductibles

Increasing your deductible, the amount you pay out-of-pocket before your insurance kicks in, can lower your premium. This strategy works best if you have sufficient savings to cover a higher deductible in the event of an accident. It’s a trade-off between paying more upfront (higher deductible) and potentially saving more in the long run (lower premium).

Improve Your Driving Record

A clean driving record is one of the best ways to keep your insurance costs down. Avoid traffic violations and accidents, and consider taking a defensive driving course to demonstrate your commitment to safe driving. Many insurers offer discounts for accident-free periods or for completing approved driving courses.

Shop Around Regularly

Insurance rates can change over time, and it’s worth shopping around annually or whenever you renew your policy. Even if you’re happy with your current insurer, it’s a good idea to get quotes from other providers to ensure you’re still getting the best deal.

Consider Telematics Devices

Some insurers offer telematics devices or smartphone apps that track your driving behavior. These devices can monitor factors like speed, acceleration, and braking, and provide feedback to help you improve your driving habits. In return, you may be eligible for discounts based on your safe driving performance.

Explore Group Insurance Options

If you’re part of certain groups or organizations, you may be eligible for group insurance discounts. These can include discounts for members of professional associations, alumni groups, or even certain credit unions.

Review Your Policy Regularly

Your insurance needs may change over time. Regularly review your policy to ensure it still meets your requirements. If your circumstances have changed, such as buying a new car or moving to a different location, be sure to update your policy accordingly.

The Future of Affordable Car Insurance

The insurance industry is evolving, and new technologies are shaping the way car insurance is priced and provided. The rise of telematics and the use of big data analytics are allowing insurers to offer more personalized and affordable coverage. As these technologies advance, we can expect even more innovative solutions that make car insurance more accessible and affordable for all drivers.

The Role of Telematics in Affordable Insurance

Telematics devices are transforming the way insurance is priced by providing real-time data on driving behavior. This data can be used to reward safe drivers with lower premiums, creating a more equitable pricing system. Additionally, telematics can help insurers identify potential risks and provide tailored advice to drivers, further enhancing safety and affordability.

The Impact of Autonomous Vehicles

The future of driving is increasingly autonomous, and this trend is expected to have a significant impact on car insurance. As self-driving technologies become more prevalent, the number of accidents is likely to decrease, leading to lower insurance costs. Additionally, autonomous vehicles may reduce the need for certain types of coverage, further driving down insurance premiums.

The Promise of Blockchain Technology

Blockchain technology is poised to revolutionize the insurance industry by enhancing transparency, security, and efficiency. Smart contracts, for instance, can automate various insurance processes, from policy issuance to claims settlement. This not only reduces administrative costs but also speeds up processes, potentially leading to more affordable insurance options.

The Growing Role of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are already being used to improve the accuracy of risk assessment and claims processing. By analyzing vast amounts of data, these technologies can identify patterns and trends that were previously difficult to detect. This enhanced risk assessment capability allows insurers to offer more tailored and affordable coverage, benefiting consumers.

Conclusion

Finding cheap car insurance is not just about comparing prices; it’s about understanding the factors that influence premiums and making informed decisions. By leveraging the strategies outlined in this article, you can secure affordable coverage that meets your needs without compromising on quality. As the insurance industry continues to evolve, staying informed about the latest trends and technologies can help you navigate the market and find the best deals available.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. is approximately $1,674 per year, according to recent industry data. However, this average can vary significantly based on factors like location, driving history, and vehicle type.

How can I get the cheapest car insurance possible?

+To get the cheapest car insurance, consider a combination of strategies such as comparing quotes from multiple insurers, choosing the right coverage level, taking advantage of available discounts, increasing your deductible, improving your driving record, and regularly shopping around.

What are some common discounts offered by car insurance companies?

+Common discounts offered by car insurance companies include safe driving record discounts, multiple vehicle discounts, bundling discounts (for insuring multiple policies with the same company), good student discounts, and discounts for certain occupations or affiliations.

How do telematics devices impact car insurance rates?

+Telematics devices track your driving behavior, providing data on factors like speed, acceleration, and braking. Insurers use this data to assess your risk and offer personalized premiums. Safe drivers can often qualify for discounts, making car insurance more affordable.

What is the role of autonomous vehicles in the future of car insurance?

+Autonomous vehicles are expected to significantly reduce the number of accidents, leading to lower insurance costs. Additionally, as self-driving technologies become more prevalent, certain types of coverage may become less necessary, further driving down insurance premiums.