Champus Insurance

Champus Insurance, also known as CHAMPUS or Civilian Health and Medical Program of the Uniformed Services, is a comprehensive healthcare program that has played a pivotal role in supporting the well-being of military families and retirees in the United States. With a rich history spanning decades, Champus Insurance has evolved to meet the changing healthcare needs of the military community, offering a range of benefits and services that deserve a closer look.

A Brief History of Champus Insurance

Champus Insurance has its roots in the early 1960s when the Department of Defense (DoD) recognized the need for a dedicated healthcare program for military personnel and their families. The program, initially known as the Civilian Health and Medical Program of the Uniformed Services, was established to provide medical care to active duty service members, retirees, and their dependents. Over the years, Champus Insurance has undergone significant transformations, adapting to the evolving healthcare landscape and the specific needs of the military community.

One of the key milestones in the history of Champus Insurance was its transition to TRICARE in the late 1990s. TRICARE, a more modern and comprehensive healthcare program, replaced Champus Insurance and expanded its scope to cover not only active duty personnel but also National Guard and Reserve members, retirees, and their families. This transition brought about improved benefits, enhanced access to healthcare services, and a more streamlined administrative process.

Benefits and Coverage

Champus Insurance, and subsequently TRICARE, offers a wide array of benefits designed to meet the diverse healthcare needs of military families. These benefits encompass a range of services, including:

- Medical Care: Comprehensive medical coverage for active duty service members, retirees, and their dependents, including primary care, specialty care, and emergency services.

- Dental and Vision: Dental and vision care plans are available, ensuring that military families have access to essential oral and vision health services.

- Prescription Drugs: Champus Insurance provides coverage for prescription medications, ensuring that military personnel and their families have access to necessary pharmaceuticals.

- Mental Health Services: Recognizing the unique challenges faced by military personnel, the program includes mental health services such as counseling, therapy, and access to specialized care for post-traumatic stress disorder (PTSD) and other mental health conditions.

- Preventive Care: Emphasizing the importance of preventive healthcare, Champus Insurance covers a range of preventive services, including immunizations, screenings, and wellness programs.

Additionally, Champus Insurance offers specialized coverage for certain medical conditions and circumstances, such as maternity care, chronic illness management, and long-term care. The program aims to provide a safety net for military families, ensuring that they have access to the necessary healthcare services regardless of their deployment status or location.

Plan Options and Eligibility

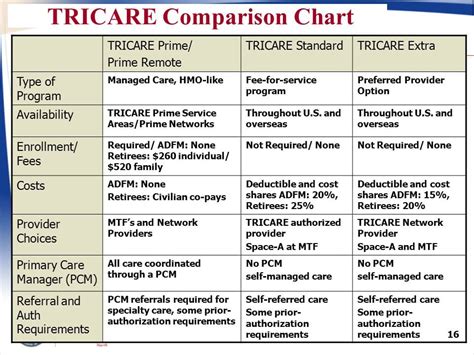

Champus Insurance, now TRICARE, offers a variety of plan options to cater to the diverse needs of military families. These plans include:

- TRICARE Prime: A managed care plan that provides comprehensive healthcare coverage with a primary care manager. This plan typically requires enrollment and offers low out-of-pocket costs.

- TRICARE Select: A fee-for-service plan that allows beneficiaries to choose their healthcare providers. This plan offers flexibility but may have higher out-of-pocket costs compared to TRICARE Prime.

- TRICARE For Life (TFL): Designed for Medicare-eligible retirees, TFL coordinates with Medicare to provide comprehensive healthcare coverage. It acts as a secondary payer to Medicare, filling in gaps in coverage.

- TRICARE Reserve Select: This plan is specifically tailored for National Guard and Reserve members who are not activated or on active duty for more than 30 days. It provides comprehensive healthcare coverage for a monthly premium.

Eligibility for Champus Insurance/TRICARE typically includes active duty service members, retirees, and their dependents. However, the specific eligibility criteria may vary depending on the plan and the individual's circumstances. It is important for military personnel and their families to stay informed about the latest eligibility requirements and plan options to ensure they are enrolled in the most suitable program.

Network of Providers and Access to Care

One of the strengths of Champus Insurance/TRICARE is its extensive network of healthcare providers. The program has established partnerships with a wide range of medical facilities, hospitals, and healthcare professionals, both within and outside military installations. This network ensures that military families have access to quality healthcare services regardless of their location.

To facilitate access to care, Champus Insurance/TRICARE offers various options, including:

- Military Treatment Facilities (MTFs): These are military-operated medical facilities that provide healthcare services to eligible beneficiaries. MTFs are typically located on military bases and offer a range of medical specialties.

- Preferred Provider Organizations (PPOs): TRICARE has established relationships with PPOs, which are networks of healthcare providers that offer discounted rates. Beneficiaries have the flexibility to choose their providers within these networks.

- Point of Service (POS) Plans: These plans combine features of both managed care and fee-for-service plans. Beneficiaries can choose between in-network and out-of-network providers, with varying levels of cost-sharing.

The program's focus on accessibility extends beyond physical proximity. Champus Insurance/TRICARE recognizes the unique challenges faced by military families during deployments and transitions. As such, the program offers telemedicine services, allowing beneficiaries to receive remote medical consultations and even prescriptions, ensuring continuous access to care regardless of their location.

Administrative Process and Enrollment

The administrative process for Champus Insurance/TRICARE is designed to be user-friendly and efficient. Enrollment and management of benefits can be done online through the TRICARE website, where beneficiaries can access their accounts, view their coverage details, and make necessary updates. The website also provides a wealth of resources, including plan summaries, provider directories, and helpful guides for navigating the healthcare system.

To enroll in Champus Insurance/TRICARE, individuals typically need to provide their military identification and dependency verification documents. The enrollment process may vary depending on the plan and the beneficiary's status. Active duty service members and their families may have automatic enrollment, while retirees and their dependents may need to apply separately. It is important to note that timely enrollment is crucial to avoid gaps in coverage and to ensure seamless access to healthcare services.

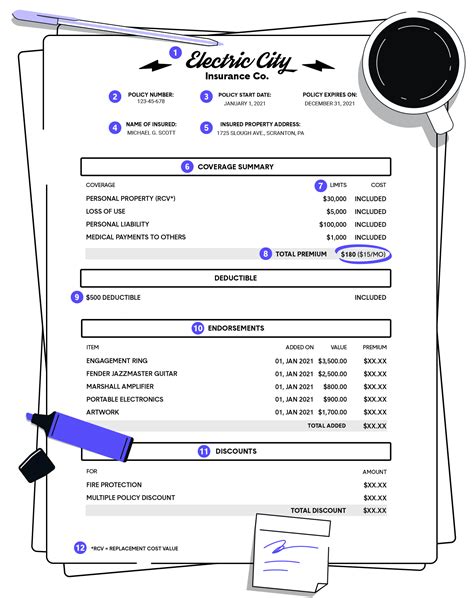

Cost-Sharing and Financial Responsibilities

Champus Insurance/TRICARE employs a cost-sharing model, where beneficiaries contribute to their healthcare expenses through premiums, deductibles, copayments, and coinsurance. The specific financial responsibilities vary depending on the plan and the beneficiary’s eligibility category.

For example, active duty service members and their families typically have lower out-of-pocket costs compared to retirees and their dependents. Retirees and their families may have higher deductibles and copayments, but TRICARE For Life (TFL) helps mitigate these costs by acting as a secondary payer to Medicare.

It is essential for beneficiaries to understand their financial responsibilities and the cost-sharing structure of their chosen plan. TRICARE provides detailed information on its website, including cost estimators and plan-specific financial guidelines, to assist beneficiaries in making informed decisions about their healthcare coverage.

Future Implications and Continuous Improvement

As the healthcare landscape continues to evolve, Champus Insurance/TRICARE remains committed to adapting and improving its services to meet the changing needs of military families. The program’s focus on accessibility, comprehensive coverage, and beneficiary-centric design positions it well for the future.

Looking ahead, Champus Insurance/TRICARE aims to further enhance its telemedicine capabilities, expanding access to remote healthcare services and ensuring that military families can receive timely medical care regardless of their location or deployment status. Additionally, the program is exploring ways to integrate digital health technologies, such as wearable devices and health apps, to promote preventive care and empower beneficiaries to take a more active role in managing their health.

Furthermore, Champus Insurance/TRICARE is dedicated to addressing the unique mental health challenges faced by military personnel and their families. The program is investing in specialized mental health services, including telehealth options, to provide timely and convenient access to counseling, therapy, and support for conditions such as PTSD, depression, and anxiety. By prioritizing mental health, the program aims to create a supportive environment that fosters resilience and overall well-being within the military community.

Conclusion

Champus Insurance, now known as TRICARE, has evolved into a robust and comprehensive healthcare program that plays a vital role in supporting the health and well-being of military families. With its wide range of benefits, extensive network of providers, and commitment to accessibility, the program has become a trusted partner for military personnel and their loved ones. As the program continues to adapt and innovate, it remains a beacon of support, ensuring that military families have the healthcare resources they need to thrive, both during deployments and in their everyday lives.

What is the difference between Champus Insurance and TRICARE?

+Champus Insurance and TRICARE are essentially the same program, with TRICARE being the modern iteration. Champus Insurance, the original program, underwent a transformation in the late 1990s, evolving into TRICARE to better meet the healthcare needs of the military community. TRICARE offers expanded benefits, improved access to healthcare services, and a more streamlined administrative process.

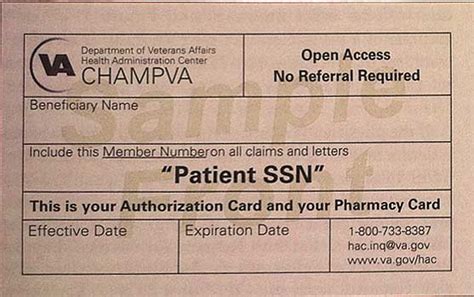

Who is eligible for Champus Insurance/TRICARE coverage?

+Champus Insurance/TRICARE typically covers active duty service members, retirees, and their dependents. However, eligibility may vary depending on the plan and the individual’s circumstances. It’s important to check the specific eligibility requirements for each plan and stay updated on any changes.

How do I enroll in Champus Insurance/TRICARE?

+Enrollment in Champus Insurance/TRICARE can be done online through the TRICARE website. The process typically involves providing military identification and dependency verification documents. The specific enrollment steps may vary depending on the plan and the beneficiary’s status. It’s recommended to consult the TRICARE website for detailed instructions and resources.

What are the financial responsibilities for Champus Insurance/TRICARE beneficiaries?

+Champus Insurance/TRICARE employs a cost-sharing model, where beneficiaries contribute to their healthcare expenses through premiums, deductibles, copayments, and coinsurance. The financial responsibilities vary depending on the plan and the beneficiary’s eligibility category. Active duty service members and their families typically have lower out-of-pocket costs compared to retirees and their dependents. TRICARE For Life (TFL) helps mitigate costs for Medicare-eligible retirees by acting as a secondary payer to Medicare.

How can I access healthcare services through Champus Insurance/TRICARE?

+Champus Insurance/TRICARE offers various options for accessing healthcare services, including Military Treatment Facilities (MTFs) located on military bases, Preferred Provider Organizations (PPOs) with discounted rates, and Point of Service (POS) plans that combine features of managed care and fee-for-service plans. The program also emphasizes telemedicine services to ensure access to care regardless of location.