Texas Car Insurance Companies

When it comes to choosing car insurance in Texas, you have a plethora of options. With a diverse range of insurance providers, understanding the nuances of each company and their offerings is essential to make an informed decision. This article delves into the world of Texas car insurance companies, offering an in-depth analysis to guide you through the process of selecting the best coverage for your needs.

A Comprehensive Overview of Texas Car Insurance Companies

Texas, known for its vast landscapes and vibrant cities, also boasts a highly competitive insurance market. Understanding the landscape of car insurance providers in this state is crucial for drivers seeking the best coverage and value. This section provides an insightful exploration of the key players in the Texas car insurance industry, shedding light on their unique features and offerings.

State Farm: A Trusted Companion for Texas Drivers

State Farm, a household name in insurance, stands out in the Texas market with its comprehensive range of car insurance policies. Known for its personalized approach, State Farm offers customized coverage plans tailored to the unique needs of each driver. From liability-only policies to comprehensive coverage, they provide a spectrum of options to suit different budgets and requirements.

One of the standout features of State Farm’s Texas car insurance is their innovative use of technology. Their mobile app, for instance, offers convenient policy management and access to digital tools like the Drive Safe & Save™ program, which provides discounts based on safe driving habits. Additionally, State Farm’s Steer Clear® program encourages safe driving practices for young drivers, offering potential discounts and educational resources.

State Farm’s claim handling process is also highly efficient, with a dedicated team of local agents who are well-versed in Texas laws and regulations. Their commitment to customer satisfaction is evident in their A+ rating from the Better Business Bureau (BBB), solidifying their position as a trusted partner for Texas drivers.

Geico: Competitive Rates and Digital Convenience

Geico, the well-known gecko-endorsed insurer, has made significant strides in the Texas car insurance market. Their focus on digital innovation and competitive pricing has resonated with Texas drivers, making them a popular choice for those seeking convenient and affordable coverage.

Geico’s online platform offers a seamless experience, allowing drivers to easily compare quotes and purchase policies. Their Digital Toolkit provides a range of digital tools and resources, making policy management a breeze. From filing claims online to accessing roadside assistance, Geico’s digital offerings enhance the overall customer experience.

In terms of coverage, Geico offers a comprehensive suite of car insurance options, including liability, collision, comprehensive, and personal injury protection (PIP). They also provide additional coverage options like rental car reimbursement and emergency roadside service. With their Military and Federal Employee Discount, Geico is particularly appealing to those serving in the armed forces or working for the federal government.

Progressive: Customizable Coverage and Rewards

Progressive, a leader in the insurance industry, has a strong presence in Texas, offering a wide range of car insurance policies. Their focus on customization and rewards-based programs sets them apart, making them an attractive option for Texas drivers seeking flexible coverage.

Progressive’s Name Your Price® tool allows drivers to set their desired price range for car insurance, providing a unique approach to policy selection. They also offer a Snapshot® program, which uses a small device plugged into your car’s diagnostic port to track your driving habits. Based on safe driving, customers can earn discounts on their car insurance premiums.

In addition to their innovative programs, Progressive provides a comprehensive suite of car insurance coverages, including liability, collision, comprehensive, and medical payments coverage. They also offer unique add-ons like pet injury coverage and gap insurance, ensuring that drivers can tailor their policies to their specific needs.

USAA: A Top Choice for Military Families

USAA, a leading provider of insurance and financial services, is highly regarded in the Texas car insurance market, particularly among military families. With a mission to serve those who serve, USAA offers a range of insurance products tailored to the unique needs of military personnel and their families.

USAA’s car insurance policies provide comprehensive coverage, including liability, collision, and comprehensive protection. They also offer additional coverage options like rental car reimbursement, roadside assistance, and gap insurance. USAA’s commitment to customer service is evident in their A++ rating from AM Best, reflecting their financial strength and stability.

What sets USAA apart is their Discounts for Life® program, which provides lifetime value discounts to policyholders who maintain a consistent insurance history with the company. This program, coupled with their military-focused benefits, makes USAA an appealing choice for service members and their families.

Texas Farm Bureau: Tailored Coverage for Rural Areas

Texas Farm Bureau Insurance, a subsidiary of the Texas Farm Bureau, is a leading provider of car insurance in rural areas of the state. With a focus on understanding the unique needs of rural communities, they offer tailored coverage options and a strong network of local agents.

Their car insurance policies provide comprehensive coverage, including liability, collision, and comprehensive protection. They also offer additional coverages like roadside assistance, rental car reimbursement, and personal injury protection (PIP). Texas Farm Bureau Insurance’s Safe Driver Discount rewards drivers with a clean driving record, providing potential savings on premiums.

What sets Texas Farm Bureau Insurance apart is their commitment to community involvement and education. They offer a range of resources and programs to promote safe driving habits, particularly among young drivers. Their local agents, who are well-integrated into rural communities, provide personalized service and support, making them a trusted choice for many Texans.

Comparative Analysis: Key Features and Benefits

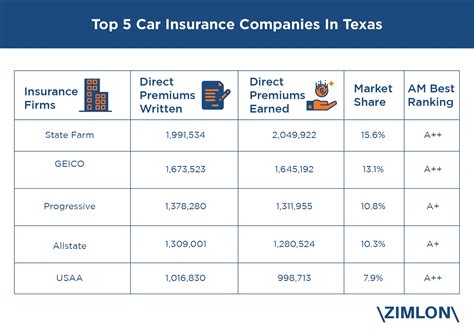

This table provides a comparative analysis of the key features and benefits offered by the aforementioned Texas car insurance companies.

| Company | Coverage Options | Discounts | Digital Tools | Customer Service |

|---|---|---|---|---|

| State Farm | Customized plans, liability, collision, comprehensive | Safe driving discounts, Steer Clear program | Mobile app, Drive Safe & Save program | A+ BBB rating, local agents |

| Geico | Liability, collision, comprehensive, PIP | Military & Federal Employee Discount | Digital Toolkit, online claim filing | High customer satisfaction, efficient claims process |

| Progressive | Liability, collision, comprehensive, add-ons | Snapshot program, Name Your Price tool | Online quotes, policy management | A+ BBB rating, 24/7 customer support |

| USAA | Comprehensive coverage, rental car reimbursement | Discounts for Life program, military benefits | Mobile app, online claims | A++ AM Best rating, military-focused service |

| Texas Farm Bureau | Liability, collision, comprehensive, PIP | Safe Driver Discount, community involvement | Local agent support, educational resources | Strong rural community presence, personalized service |

The above analysis highlights the unique features and benefits offered by each insurance company, providing a comprehensive view of the Texas car insurance landscape. By understanding these key differences, drivers can make informed decisions based on their specific needs and preferences.

Future Outlook and Industry Insights

The Texas car insurance market is dynamic and ever-evolving, with constant innovations and shifts in consumer preferences. As technology continues to advance, insurance companies are leveraging digital tools and data analytics to enhance their services and provide more personalized coverage options.

One emerging trend in the industry is the increasing focus on usage-based insurance (UBI). UBI programs, like Progressive’s Snapshot and State Farm’s Drive Safe & Save, use telematics to track driving behavior and offer discounts based on safe driving habits. This trend is expected to gain momentum, providing incentives for safer driving and potentially reducing insurance costs for responsible drivers.

Additionally, the rise of electric vehicles (EVs) and autonomous driving technologies is set to impact the car insurance landscape in Texas. Insurance companies are already adapting their policies to accommodate these new technologies, offering specialized coverage for EV owners and exploring the potential risks and benefits of autonomous vehicles.

From a regulatory perspective, the Texas Department of Insurance continues to play a crucial role in overseeing the car insurance market. Their efforts to promote competition, consumer protection, and affordability are likely to shape the industry’s future. As the market evolves, it is essential for insurance companies to stay agile and responsive to these regulatory changes.

In conclusion, the Texas car insurance market offers a diverse range of options, each with its own unique features and benefits. Whether it’s State Farm’s personalized approach, Geico’s digital convenience, Progressive’s customization, USAA’s military-focused benefits, or Texas Farm Bureau’s rural community focus, there is a provider suited to every driver’s needs. As the industry continues to innovate, staying informed about the latest trends and offerings is key to making the right insurance choice.

Frequently Asked Questions

What is the average cost of car insurance in Texas?

+

The average cost of car insurance in Texas varies depending on several factors, including the driver’s age, driving record, vehicle type, and coverage limits. According to recent data, the average annual premium for minimum liability coverage in Texas is around 650, while full coverage policies can range from 1,000 to 2,000 or more. However, it's important to note that rates can vary significantly based on individual circumstances.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any unique requirements for car insurance in Texas?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, Texas has specific requirements for car insurance. All drivers must carry at least the minimum liability coverage, which includes 30,000 bodily injury liability per person, 60,000 bodily injury liability per accident, and 25,000 property damage liability. Additionally, Texas law requires proof of financial responsibility, which can be met through car insurance, a surety bond, or a self-insurance certificate.

What factors influence car insurance rates in Texas?

+

Several factors influence car insurance rates in Texas, including the driver’s age, gender, marital status, driving record, and credit score. The type of vehicle, its make and model, and the area where the driver resides also play a significant role. Additionally, insurance companies may consider factors like the driver’s occupation, education level, and even their hobbies or pastimes.

Are there any discounts available for car insurance in Texas?

+

Yes, Texas car insurance companies offer a variety of discounts to help drivers save on their premiums. These discounts can include safe driver discounts, multi-policy discounts, multi-car discounts, good student discounts, and loyalty discounts. Some companies also offer usage-based insurance programs that reward safe driving habits with potential discounts.

How can I choose the best car insurance company in Texas?

+

Choosing the best car insurance company in Texas depends on your individual needs and preferences. It’s important to compare multiple providers, considering factors like coverage options, pricing, customer service, and available discounts. Reading reviews and seeking recommendations from trusted sources can also help in making an informed decision.