California Insurance Lookup

California Insurance Lookup: Unraveling the Complexity of Insurance Policies

Navigating the world of insurance can be a daunting task, especially when it comes to understanding the intricacies of coverage and policy details. For residents of the Golden State, California Insurance Lookup offers a comprehensive solution to unravel the complexities and ensure peace of mind. In this extensive guide, we will delve into the world of insurance, providing an in-depth analysis of the process, benefits, and implications for policyholders.

California Insurance Lookup serves as a vital resource, empowering individuals and businesses to make informed decisions about their insurance coverage. With a diverse range of insurance options available, from auto insurance to health plans, understanding the specifics is crucial. This article aims to provide a detailed breakdown, offering clarity and insights into the often-confusing realm of insurance.

The Importance of Insurance Lookup in California

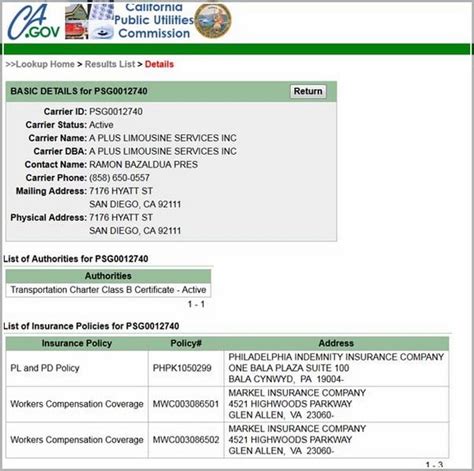

California, being one of the most populous states in the nation, boasts a diverse insurance landscape. With a myriad of insurance providers offering various policies, the need for a comprehensive lookup tool becomes evident. California Insurance Lookup acts as a centralized platform, bringing together essential information to aid individuals in their quest for adequate coverage.

The lookup process not only helps individuals compare policies but also ensures compliance with state regulations. California, known for its stringent insurance requirements, mandates specific coverage limits for various aspects of life, including auto insurance, homeowners' insurance, and health insurance. By utilizing the lookup tool, residents can ensure they meet these requirements and avoid any legal complications.

Understanding the Coverage Landscape: A Deep Dive

Insurance coverage in California encompasses a wide array of policies, each designed to cater to specific needs. Let's explore some of the key areas where insurance plays a crucial role:

Auto Insurance: Navigating the Roads Safely

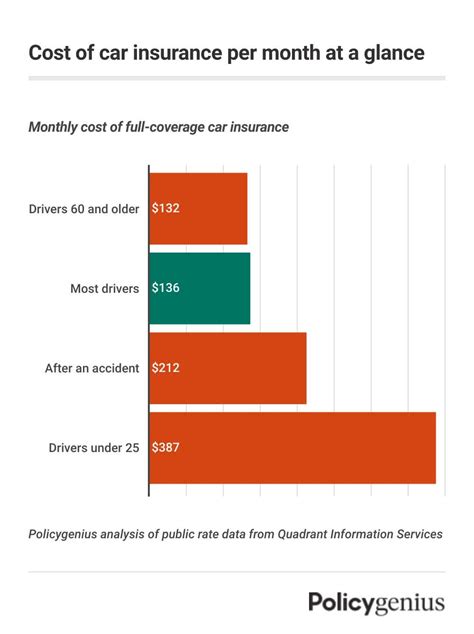

California requires all vehicle owners to carry auto insurance, which covers liabilities arising from accidents. The state's minimum liability limits are set at $15,000 per person for bodily injury, $30,000 per accident for bodily injury, and $5,000 for property damage. However, these limits might not be sufficient for certain situations, prompting the need for comprehensive coverage.

A deep dive into auto insurance reveals the importance of collision and comprehensive coverage. These additional policies provide protection against damages caused by accidents, theft, or natural disasters. By understanding the nuances of these coverages, drivers can make informed decisions to safeguard their vehicles and financial well-being.

Health Insurance: A Crucial Pillar of Well-being

In the realm of healthcare, California Insurance Lookup becomes a vital tool for individuals seeking comprehensive health coverage. With the implementation of the Affordable Care Act (ACA), California residents have access to a wide range of health insurance plans. The lookup tool enables individuals to compare different plans, considering factors like premium costs, deductibles, and covered services.

Furthermore, California Insurance Lookup provides insights into the state's Medicaid program, known as Medi-Cal. This program offers health coverage to eligible low-income individuals and families, ensuring access to essential medical services. Understanding the eligibility criteria and benefits of Medi-Cal becomes crucial for those seeking affordable healthcare options.

Homeowners' Insurance: Protecting Your Sanctuary

For homeowners in California, insurance plays a critical role in safeguarding their most valuable asset. The state's unique geographical features, including its susceptibility to earthquakes and wildfires, make homeowners' insurance an essential consideration. California Insurance Lookup aids homeowners in navigating the complex world of insurance, offering insights into coverage for natural disasters and property damage.

In addition to basic coverage, homeowners' insurance policies often include liability protection. This aspect of insurance safeguards homeowners against legal claims and lawsuits, providing peace of mind and financial security.

Life Insurance: Securing Your Legacy

Life insurance is an integral part of financial planning, ensuring the well-being of loved ones in the event of an untimely demise. California Insurance Lookup helps individuals explore the various types of life insurance policies available, including term life and whole life insurance. By understanding the differences and benefits of each, individuals can make informed decisions to protect their families' future.

The Process of California Insurance Lookup

California Insurance Lookup simplifies the process of finding the right insurance coverage. Here's a step-by-step breakdown of how it works:

- Define Your Needs: Start by identifying your specific insurance requirements. Whether it's auto insurance, health coverage, or homeowners' insurance, understanding your needs is the first step towards an effective lookup.

- Access the Lookup Tool: Navigate to the official California Insurance Lookup website, a trusted resource provided by the state government. This platform offers a user-friendly interface, making the lookup process accessible and efficient.

- Enter Your Details: Provide the necessary information, including your personal details, the type of insurance you seek, and any specific requirements. The tool will then generate a list of relevant insurance providers and policies.

- Compare and Analyze: Utilize the comprehensive comparison feature to evaluate different policies side by side. Consider factors such as coverage limits, deductibles, premiums, and additional benefits. This step ensures you make an informed choice.

- Review Provider Reputation: Before finalizing your decision, research the insurance providers. Check their financial stability, customer reviews, and any complaints filed against them. A reputable provider ensures reliable coverage and efficient claim settlement.

- Apply and Purchase: Once you've found the ideal policy, proceed with the application process. Follow the provider's instructions to complete the application and make the necessary payments. Ensure you understand the terms and conditions before finalizing the purchase.

Benefits and Implications of California Insurance Lookup

California Insurance Lookup offers a multitude of benefits, empowering individuals and businesses alike. Here's an overview of the key advantages and implications:

- Compliance and Legal Protection: By utilizing the lookup tool, individuals ensure they meet the state's insurance requirements, avoiding legal complications and potential fines.

- Cost Savings: The comparison feature allows users to identify the most cost-effective policies, potentially saving hundreds of dollars annually on insurance premiums.

- Peace of Mind: Understanding your insurance coverage provides peace of mind, knowing you're protected against unforeseen circumstances.

- Informed Decision-Making: California Insurance Lookup enables individuals to make educated choices, considering various factors and customizing their coverage to meet specific needs.

- Access to Information: The lookup tool provides a centralized platform, bringing together a wealth of insurance-related information, making it easily accessible for all.

Case Studies: Real-Life Examples of Insurance Lookup

To illustrate the impact and effectiveness of California Insurance Lookup, let's explore a couple of real-life case studies:

Auto Insurance: Finding the Perfect Coverage

John, a resident of Los Angeles, was in the market for auto insurance. He utilized California Insurance Lookup to compare various policies. The tool helped him understand the differences between liability-only coverage and comprehensive plans. After analyzing his needs and the potential risks, John opted for a comprehensive policy, ensuring protection against theft and natural disasters. This decision provided him with the peace of mind he sought, knowing he was adequately covered.

Health Insurance: Navigating the ACA Marketplace

Emily, a young professional in San Francisco, needed to find affordable health insurance. She turned to California Insurance Lookup to navigate the ACA marketplace. The tool guided her through the process, helping her understand the eligibility criteria and available plans. Emily was able to compare premiums, deductibles, and covered services, ultimately selecting a plan that met her budget and healthcare needs. The lookup tool simplified what could have been an overwhelming process, ensuring Emily had access to essential healthcare services.

The Future of Insurance in California: Trends and Innovations

As technology continues to advance, the insurance industry in California is experiencing transformative changes. Here's a glimpse into the future of insurance and the potential implications:

Digital Transformation

The insurance industry is embracing digital tools and platforms, enhancing the customer experience. California Insurance Lookup is a prime example of this transformation, offering a user-friendly online platform. In the future, we can expect further digitalization, with insurance providers utilizing artificial intelligence and machine learning to streamline processes and improve efficiency.

Personalized Coverage

Insurance companies are increasingly focusing on providing personalized coverage options. By analyzing individual needs and behaviors, insurance providers can offer tailored policies. This trend is likely to continue, ensuring that Californians receive coverage that aligns with their unique circumstances.

Environmental Considerations

With California's focus on sustainability and environmental initiatives, insurance policies are also evolving. We can anticipate the development of eco-friendly insurance options, covering aspects like renewable energy systems and sustainable practices. These policies will encourage and support individuals and businesses in their journey towards a greener future.

Enhanced Claim Processing

Technology is set to revolutionize claim processing, making it faster and more efficient. Insurance providers are investing in innovative solutions to streamline the process, reducing the time and effort required for claim settlement. This development will provide significant benefits to policyholders, ensuring they receive timely compensation in the event of a claim.

Conclusion: Empowering Californians with Insurance Knowledge

California Insurance Lookup stands as a testament to the state's commitment to empowering its residents with insurance knowledge and resources. By providing a comprehensive platform, individuals and businesses can make informed decisions, ensuring they have the right coverage for their specific needs. As the insurance landscape continues to evolve, California Insurance Lookup remains a vital tool, keeping pace with the changing times.

In a complex world of insurance policies, California Insurance Lookup shines as a beacon of clarity and guidance. With its user-friendly interface and wealth of information, it simplifies the insurance journey, offering peace of mind and financial security to all.

How often should I review my insurance policies?

+It is recommended to review your insurance policies annually to ensure they align with your current needs and any changes in your personal or professional circumstances. Regular reviews allow you to stay updated and make necessary adjustments.

What happens if I fail to comply with California’s insurance requirements?

+Failing to comply with California’s insurance requirements can result in legal penalties, including fines and even suspension of your driver’s license (in the case of auto insurance). It is crucial to maintain adequate insurance coverage to avoid such consequences.

Can I bundle my insurance policies to save money?

+Yes, many insurance providers offer discounts when you bundle multiple policies, such as auto and homeowners’ insurance. Bundling can lead to significant cost savings, so it’s worth exploring this option to maximize your insurance coverage while minimizing expenses.