How Much Is Auto Insurance Per Month

Auto insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers. The cost of auto insurance, however, can vary significantly depending on numerous factors. Understanding the variables that influence insurance rates is crucial for consumers aiming to secure the best coverage at a competitive price. This comprehensive guide aims to unravel the complexities of auto insurance costs, offering insights into the average monthly premiums and the key factors that impact them.

The Average Cost of Auto Insurance

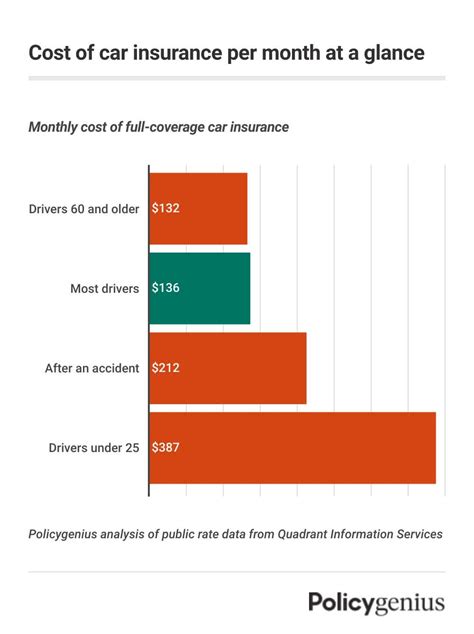

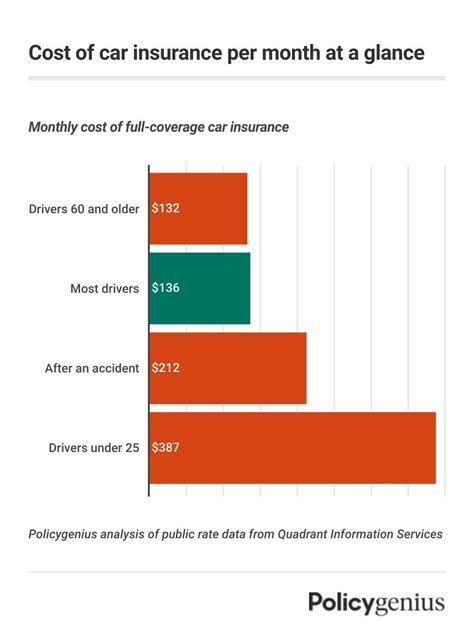

On average, American drivers can expect to pay between 500 and 1,500 per year for auto insurance, which translates to approximately 42 to 125 per month. However, it’s important to note that these figures are just estimates, and actual insurance costs can deviate significantly based on individual circumstances.

To illustrate, let's consider the state of California, where the average annual premium stands at $1,487 as of 2022. This places California as the 10th most expensive state for auto insurance in the U.S. Conversely, states like Maine, Ohio, and Idaho offer some of the most affordable rates, with average annual premiums ranging from $500 to $900.

Factors Influencing Auto Insurance Costs

Several key factors play a role in determining the cost of auto insurance. These include:

Location

The state and city where you reside significantly impact your insurance rates. This is due to variations in traffic patterns, accident rates, and even weather conditions across different areas. For instance, densely populated cities with high traffic volumes and frequent accidents tend to have higher insurance premiums.

Vehicle Type and Age

The make, model, and year of your vehicle can influence insurance costs. Insurers consider factors such as the vehicle’s safety ratings, repair costs, and theft rates. Generally, newer and safer vehicles with lower theft rates may result in lower insurance premiums.

Driving Record

Your driving history is a crucial factor in determining insurance rates. A clean driving record with no accidents or traffic violations can lead to more affordable insurance. Conversely, a history of accidents or traffic citations may result in higher premiums.

Age and Gender

Insurance rates often differ based on the insured’s age and gender. Young drivers, particularly those under 25, tend to face higher insurance costs due to their lack of driving experience. Similarly, male drivers, especially those under 25, often pay more for insurance compared to female drivers.

Credit Score

Surprisingly, your credit score can impact your insurance rates. Many insurers believe that individuals with lower credit scores are more likely to file insurance claims, leading to higher premiums for those with lower credit scores.

Coverage and Deductibles

The level of coverage you choose and your deductible amount can significantly affect your insurance costs. Comprehensive coverage, which includes protection for a wider range of incidents, typically costs more than basic liability coverage. Additionally, opting for a higher deductible (the amount you pay out of pocket before insurance coverage kicks in) can lower your monthly premiums.

Tips to Lower Your Auto Insurance Costs

If you’re looking to reduce your auto insurance expenses, here are some strategies to consider:

- Shop Around: Obtain quotes from multiple insurers to find the most competitive rates. Online quote tools can make this process easier.

- Bundle Policies: Insurers often offer discounts when you bundle multiple policies, such as auto and home insurance, under one provider.

- Improve Your Credit Score: Working on improving your credit score can lead to lower insurance premiums.

- Choose a Higher Deductible: While this means you'll pay more out of pocket in the event of a claim, it can significantly reduce your monthly premiums.

- Maintain a Clean Driving Record: Avoid traffic violations and accidents to keep your insurance costs down.

- Take Advantage of Discounts: Many insurers offer discounts for various reasons, such as good student discounts, safe driver discounts, or discounts for completing a defensive driving course.

The Impact of Accidents and Claims

Filing an insurance claim can have both immediate and long-term effects on your insurance costs. In the short term, your insurer may increase your premium, or surcharge, for the next policy period. This surcharge can range from 10% to 50% of your base premium, depending on the severity of the claim.

Over the long term, an accident or claim can stay on your driving record for several years, impacting your insurance rates. This is why it's crucial to drive safely and avoid accidents to keep your insurance costs as low as possible.

The Future of Auto Insurance

The auto insurance industry is evolving, and technological advancements are playing a significant role in shaping its future. One notable development is the introduction of usage-based insurance (UBI), which uses telematics to track driving behavior and offer customized insurance rates. This innovative approach could revolutionize the way insurance premiums are determined, providing more tailored coverage options for drivers.

Usage-Based Insurance (UBI) Explained

UBI is a type of auto insurance policy that uses telematics technology to monitor a driver’s behavior behind the wheel. This data is then used to calculate insurance premiums, offering a more personalized and accurate pricing model. UBI policies often include a device or app that collects information on driving habits, such as speed, acceleration, braking, and mileage.

For example, a driver who frequently speeds or brakes harshly may face higher insurance premiums under a UBI policy. Conversely, a cautious driver who adheres to speed limits and drives defensively could enjoy lower insurance costs.

The Benefits of UBI

UBI offers several advantages, including:

- Personalized Rates: UBI policies provide a more tailored insurance experience, as premiums are based on an individual's actual driving behavior rather than broad demographics.

- Incentives for Safe Driving: By rewarding safe driving habits with lower premiums, UBI policies encourage drivers to adopt safer practices on the road.

- Accurate Pricing: UBI eliminates the guesswork associated with traditional insurance pricing, ensuring that premiums are based on factual data rather than estimates.

The Drawbacks of UBI

However, UBI also presents some potential challenges, such as:

- Privacy Concerns: The extensive data collection involved in UBI policies may raise privacy concerns for some individuals.

- Increased Premiums for High-Risk Drivers: Drivers with risky driving habits may face higher insurance costs under UBI policies.

- Technical Issues: Telematics devices or apps used for UBI policies may encounter technical problems or compatibility issues with certain vehicles.

The Bottom Line

While UBI policies offer a promising new approach to auto insurance, they may not be suitable for everyone. Drivers who prioritize privacy or are comfortable with traditional insurance pricing models may prefer to stick with conventional policies. However, for those seeking a more personalized and data-driven insurance experience, UBI could be a game-changer.

Conclusion

Understanding the factors that influence auto insurance costs and staying informed about industry developments can help drivers make more informed decisions when choosing insurance coverage. By comparing quotes, taking advantage of discounts, and adopting safe driving habits, you can work towards securing the best insurance coverage at a competitive price.

As the auto insurance landscape continues to evolve, it's important to stay up-to-date with the latest trends and technologies, such as UBI, to ensure you're getting the most value from your insurance policy.

How can I get a more accurate estimate of my auto insurance costs?

+To obtain a more precise estimate of your auto insurance costs, it’s recommended to obtain quotes from multiple insurers. Online quote tools can be a convenient way to compare rates from different providers. Additionally, consider reaching out to insurance agents or brokers who can provide personalized advice based on your specific circumstances.

What is the difference between liability and comprehensive coverage?

+Liability coverage is the most basic type of auto insurance, providing protection if you cause an accident that results in bodily injury or property damage to others. Comprehensive coverage, on the other hand, offers protection for a wider range of incidents, including damage caused by theft, vandalism, natural disasters, or collisions with animals. Comprehensive coverage typically costs more than liability coverage.

Can I switch auto insurance providers to save money?

+Yes, switching auto insurance providers is a common way to potentially save money on your insurance costs. However, it’s important to carefully compare quotes and consider factors such as coverage options, customer service, and claims handling before making a decision. Additionally, some insurers may offer loyalty discounts, so be sure to weigh the benefits of switching against the potential savings.