Amex Trip Insurance

Welcome to an in-depth exploration of American Express (Amex) Trip Insurance, a valuable service that offers comprehensive protection for travelers. With a wide range of coverage options, Amex's travel insurance plans provide peace of mind for those embarking on journeys, ensuring that unexpected events don't disrupt their travel plans.

In today's world, where travel plans can be disrupted by unforeseen circumstances, having travel insurance is not just a luxury but a necessity. Amex, a renowned financial services company, understands this need and has crafted its trip insurance policies to cater to the diverse requirements of travelers. From covering trip cancellations to providing medical assistance, Amex's trip insurance plans offer a robust safety net for travelers.

This comprehensive guide will delve into the various aspects of Amex Trip Insurance, shedding light on its benefits, features, and the value it brings to travelers. Whether you're a frequent flier or planning your first big trip, understanding Amex's travel insurance offerings can be a game-changer, helping you make informed decisions and ensuring a stress-free journey.

Understanding Amex Trip Insurance

Amex Trip Insurance is a suite of travel insurance plans designed to protect travelers against various travel-related uncertainties. These plans offer coverage for a wide range of situations, ensuring that travelers are financially protected in case of unforeseen events.

Coverage Options

Amex’s trip insurance policies offer a diverse set of coverage options to cater to different travel needs. Here’s a breakdown of some key coverage areas:

- Trip Cancellation and Interruption: This coverage reimburses travelers for non-refundable trip expenses if their trip is canceled or interrupted due to covered reasons. Covered reasons may include illness, injury, severe weather, or other unexpected events.

- Medical and Dental Coverage: Amex's plans typically provide coverage for emergency medical and dental expenses incurred during the trip. This includes hospitalization, doctor visits, prescription medications, and even emergency dental treatment.

- Baggage and Personal Effects: In case of lost, stolen, or damaged baggage, Amex's trip insurance plans offer reimbursement for the cost of replacing essential items. This coverage extends to personal effects and travel documents as well.

- Travel Delay: If a traveler's journey is delayed due to covered reasons, such as severe weather or mechanical issues, Amex's insurance plans provide reimbursement for additional expenses incurred during the delay, including meals, accommodation, and transportation.

- Emergency Evacuation and Repatriation: In the event of a medical emergency, Amex's insurance covers the cost of emergency medical evacuation and repatriation, ensuring travelers receive the necessary medical care and are safely transported home.

Benefits of Amex Trip Insurance

Amex Trip Insurance offers numerous benefits that make it an attractive choice for travelers. Some key advantages include:

- Comprehensive Coverage: Amex's insurance plans provide a wide range of coverage options, ensuring travelers are protected against various travel-related risks. From trip cancellations to medical emergencies, Amex has travelers covered.

- Quick and Efficient Claims Process: Amex is known for its efficient claims process, making it easy for travelers to file and receive reimbursements promptly. The company's dedicated claims team works to ensure a smooth and hassle-free experience.

- Flexible Plans: Amex offers a variety of trip insurance plans to cater to different budgets and travel needs. Travelers can choose the plan that best suits their requirements, ensuring they have the coverage they need without paying for unnecessary extras.

- Worldwide Assistance: With Amex's trip insurance, travelers have access to a global network of assistance providers. Whether it's medical assistance, legal advice, or emergency travel arrangements, Amex's partners are available 24/7 to provide support.

- Additional Benefits: Along with the standard coverage, Amex's trip insurance plans often include additional benefits like travel accident insurance, identity theft protection, and even rental car collision coverage. These added perks enhance the overall value of the insurance plans.

Key Features and Considerations

When considering Amex Trip Insurance, it’s important to understand the key features and considerations to make an informed decision. Here are some critical aspects to keep in mind:

Eligibility and Plan Selection

Amex Trip Insurance is available to Amex cardholders and their eligible travel companions. It’s essential to choose the right plan based on your travel needs and budget. Amex offers a range of plans with different coverage limits and premiums, so selecting the plan that aligns with your specific requirements is crucial.

Coverage Limits and Exclusions

While Amex’s trip insurance plans offer comprehensive coverage, it’s important to review the policy details carefully. Each plan has specific coverage limits and exclusions. Understanding these limits and exclusions ensures that you are aware of what is and isn’t covered, allowing you to make informed decisions about additional insurance or travel preparations.

Pre-Existing Conditions

Amex’s trip insurance plans typically cover pre-existing medical conditions, but only if certain conditions are met. It’s crucial to disclose any pre-existing conditions when purchasing the insurance and to understand the specific requirements for coverage. Failure to disclose pre-existing conditions can result in claims being denied.

Travel Destinations and Activities

Amex’s trip insurance plans may have specific restrictions or limitations based on the travel destination and activities undertaken during the trip. High-risk activities like skydiving or extreme sports may not be covered, or they may require additional coverage. It’s essential to review the policy details to ensure that your planned activities are covered.

Claim Process and Documentation

Understanding the claim process and the documentation required is crucial. Amex provides clear guidelines on how to file a claim and the necessary supporting documents. Familiarizing yourself with this process beforehand can help streamline the claims experience and ensure a smooth reimbursement process.

Real-Life Examples and Case Studies

To illustrate the value of Amex Trip Insurance, let’s explore some real-life scenarios where Amex’s insurance plans have made a difference:

Scenario 1: Medical Emergency Abroad

Imagine a traveler who suffers a sudden medical emergency while on vacation in a foreign country. With Amex’s trip insurance, the traveler receives immediate medical assistance, including coverage for hospitalization, doctor’s fees, and even emergency medical evacuation if necessary. The insurance plan ensures that the traveler receives the best possible care without worrying about the financial burden.

Scenario 2: Trip Cancellation Due to Natural Disaster

A traveler’s upcoming trip is disrupted due to a natural disaster at the destination. With Amex’s trip insurance, the traveler is reimbursed for non-refundable trip expenses, including airfare, hotel bookings, and other prepaid travel arrangements. The insurance plan provides financial relief and allows the traveler to reschedule their trip without incurring significant losses.

Scenario 3: Lost Baggage and Personal Items

During a trip, a traveler’s baggage is lost or stolen, containing essential items like clothing, electronics, and travel documents. Amex’s trip insurance plan provides reimbursement for the cost of replacing these items, ensuring the traveler can continue their journey without financial strain and with the necessary replacements.

Comparative Analysis and Industry Insights

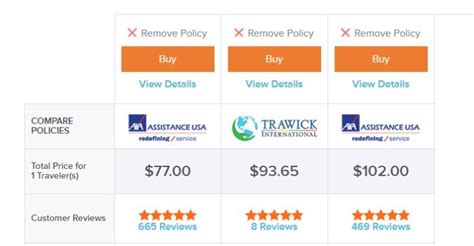

Amex Trip Insurance stands out in the travel insurance industry for its comprehensive coverage, efficient claims process, and additional benefits. Let’s explore how Amex’s insurance plans compare to other travel insurance providers and the unique advantages they offer:

Comprehensive Coverage

Amex’s trip insurance plans offer a wide range of coverage options, including trip cancellation, medical expenses, baggage loss, and more. This comprehensive approach ensures that travelers are protected against a broad spectrum of travel-related risks, providing a robust safety net.

Efficient Claims Process

Amex is known for its efficient and streamlined claims process. With a dedicated claims team and clear guidelines, travelers can expect a smooth and hassle-free experience when filing claims. This efficiency is a significant advantage, ensuring that travelers receive reimbursements promptly and can focus on their journey rather than claims paperwork.

Additional Benefits

Beyond the standard coverage, Amex’s trip insurance plans often include valuable additional benefits. These can include travel accident insurance, identity theft protection, and rental car collision coverage. These added perks enhance the overall value of Amex’s insurance plans, providing travelers with extra peace of mind.

Industry Recognition

Amex’s commitment to providing exceptional travel insurance services has been recognized by industry experts and travelers alike. Amex’s trip insurance plans have received positive reviews and accolades, solidifying its position as a trusted provider in the travel insurance industry.

Future Implications and Industry Trends

As the travel industry evolves, Amex Trip Insurance is poised to adapt and continue providing valuable protection to travelers. Here are some future implications and industry trends to consider:

Increased Focus on Digital Services

With the rise of digital technologies, Amex is likely to enhance its digital services for trip insurance. This may include streamlined online claims processes, digital documentation, and real-time updates for travelers. Amex’s focus on digital innovation will further improve the customer experience and make trip insurance more accessible.

Customized Insurance Plans

In the future, Amex may explore more customized insurance plans based on individual traveler needs. This could involve offering tailored coverage options, allowing travelers to select specific add-ons or adjust coverage limits to align with their unique travel requirements.

Expanded Coverage for Emerging Risks

As travel patterns and risks evolve, Amex is likely to expand its coverage to address emerging concerns. This may include enhanced coverage for pandemic-related risks, extreme weather events, or even cybersecurity threats. By staying ahead of these emerging risks, Amex can continue providing comprehensive protection to travelers.

Integration with Travel Services

Amex may further integrate its trip insurance services with other travel offerings. This could involve partnerships with travel agencies, airlines, or hotels to provide seamless insurance coverage as part of the travel booking process. Such integrations would make trip insurance more accessible and convenient for travelers.

Conclusion

Amex Trip Insurance offers a comprehensive and reliable solution for travelers seeking protection against various travel-related uncertainties. With its wide range of coverage options, efficient claims process, and additional benefits, Amex’s insurance plans provide a robust safety net for travelers. As the travel industry continues to evolve, Amex’s commitment to innovation and customer satisfaction ensures that its trip insurance offerings remain a trusted choice for travelers worldwide.

How do I purchase Amex Trip Insurance?

+Amex Trip Insurance is typically included as a benefit with certain Amex credit cards. When you book your trip using your eligible Amex card, the insurance coverage is automatically activated. You can also purchase additional trip insurance coverage separately, which can be tailored to your specific needs.

What happens if I need to file a claim under Amex Trip Insurance?

+In the event that you need to file a claim, Amex provides clear guidelines and a dedicated claims team to assist you. You’ll need to gather the necessary documentation, such as proof of loss or expenses, and submit your claim within the specified timeframe. Amex’s efficient claims process ensures a timely resolution.

Are there any exclusions or limitations to Amex Trip Insurance coverage?

+Like any insurance plan, Amex Trip Insurance has specific exclusions and limitations. It’s important to carefully review the policy details to understand what is and isn’t covered. Common exclusions may include certain high-risk activities, pre-existing medical conditions, or intentional acts. Understanding these exclusions helps you make informed decisions about additional insurance needs.