Auto Insurance Finder

Welcome to the comprehensive guide on finding the best auto insurance coverage tailored to your needs! Navigating the world of car insurance can be a daunting task, with numerous options and complex policies. In this expert-written article, we aim to simplify the process and provide you with the knowledge and tools to make informed decisions. By the end of this guide, you'll be equipped to find the perfect auto insurance policy that offers the right balance of protection and value.

Understanding Auto Insurance: A Necessity for Every Driver

Auto insurance is a crucial aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. It’s a legal requirement in most countries and states, ensuring drivers are responsible for the potential damages they may cause. With a wide range of coverage options available, understanding the basics is essential to make the right choice.

Key Components of Auto Insurance

Let’s break down the fundamental components of an auto insurance policy:

- Liability Coverage: This covers the costs associated with bodily injury or property damage caused by you to others. It’s a mandatory component in most regions and ensures you can compensate others for their losses.

- Collision Coverage: This optional coverage pays for repairs to your vehicle after an accident, regardless of fault. It’s especially beneficial for newer or more expensive vehicles.

- Comprehensive Coverage: Another optional type, comprehensive coverage protects against non-collision incidents like theft, vandalism, natural disasters, or damage caused by animals.

- Personal Injury Protection (PIP): Available in some states, PIP covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage.

Each of these components can be customized to create a unique policy that suits your specific needs and budget. It's important to strike a balance between adequate coverage and affordability.

The Importance of Shopping Around

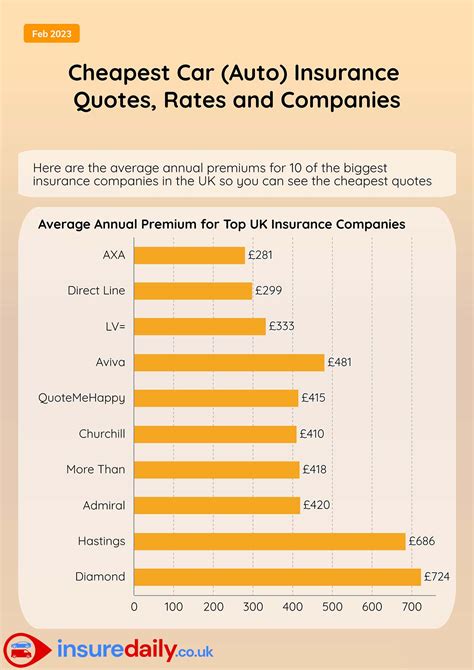

With countless insurance providers offering various policies, it’s crucial to compare and shop around to find the best deal. Prices and coverage can vary significantly between companies, and finding the right fit can save you a substantial amount of money while ensuring you’re adequately protected.

Finding the Right Auto Insurance: A Step-by-Step Guide

To assist you in your search for the perfect auto insurance policy, we’ve compiled a detailed step-by-step guide. Follow these steps to navigate the process efficiently and effectively.

Step 1: Assess Your Needs and Budget

Before diving into the world of auto insurance, take the time to understand your specific needs and financial capabilities. Consider the following:

- What type of vehicle do you drive, and what is its current value? Different vehicles have varying insurance costs and requirements.

- How often do you drive, and for what purpose? Commuting to work, leisure driving, or long-distance travel can impact your insurance needs.

- Do you have any specific requirements or preferences, such as green insurance or policies that offer additional perks like roadside assistance?

- What is your budget for insurance premiums? It’s essential to find a policy that fits your financial situation without compromising on necessary coverage.

Step 2: Research and Compare Providers

Now that you have a clearer idea of your needs, it’s time to explore the market and research different insurance providers. Here’s how:

- Start by creating a list of reputable insurance companies in your area. You can find recommendations online, through friends and family, or by checking with local insurance brokers.

- Visit the websites of these companies to gather information about their policies, coverage options, and additional services they offer.

- Compare the prices and coverage limits of similar policies across different providers. Look for any discounts or promotions that could reduce your premiums.

- Read reviews and ratings from current and past customers to get an idea of the company’s reputation and customer service quality.

- Consider the company’s financial stability and claims-handling process. You want to ensure they can provide timely and fair compensation in the event of a claim.

Step 3: Obtain Quotes and Assess Coverage

Once you’ve narrowed down your options to a few reputable providers, it’s time to request quotes and assess the coverage they offer.

- Contact each insurance company or use their online quote tools to provide details about your vehicle, driving history, and desired coverage.

- Compare the quotes you receive, paying attention to the specific coverage limits and any exclusions or limitations within the policy.

- Ensure you understand the terms and conditions of each policy. If anything is unclear, don’t hesitate to ask for clarification.

- Consider any optional add-ons or endorsements that could enhance your coverage, such as rental car reimbursement or gap insurance.

Step 4: Evaluate Additional Factors

Apart from coverage and price, there are other important factors to consider when choosing an auto insurance provider. These include:

- Claims Process: Research how the company handles claims. Look for providers with a streamlined process and a reputation for fair and prompt settlements.

- Customer Service: Excellent customer service can make a big difference when you need assistance. Check online reviews and ratings to gauge the company’s responsiveness and helpfulness.

- Technology and Digital Tools : Many insurance companies offer digital platforms and apps for policy management, claims filing, and other services. These can make your insurance experience more convenient and efficient.

- Discounts and Rewards: Look for providers that offer discounts for safe driving, loyalty, or other factors. Some companies also reward customers with additional perks or benefits.

Step 5: Make an Informed Decision

With all the information at hand, it’s time to make a decision. Choose the provider that offers the best combination of coverage, price, and additional benefits that align with your needs.

Remember, it’s essential to review your auto insurance policy annually or whenever your circumstances change. This ensures you maintain adequate coverage and take advantage of any new discounts or offers.

Advanced Tips for Optimizing Your Auto Insurance

Now that you have a solid understanding of the auto insurance landscape and the steps to find the right policy, let’s explore some advanced tips to further optimize your insurance experience.

Understanding Coverage Limits

When comparing policies, it’s crucial to understand the coverage limits. These limits define the maximum amount an insurance company will pay for a covered loss. Here’s what you need to know:

- Liability Coverage Limits: These limits are typically represented as three numbers, such as 100/300/100. The first number represents the maximum payout for bodily injury per person, the second for bodily injury per accident, and the third for property damage.

- Collision and Comprehensive Coverage Limits: These limits are usually expressed as a percentage of the vehicle’s value. For example, a policy with an 80% limit will pay up to 80% of your vehicle’s value in the event of a total loss.

It's important to choose limits that provide adequate protection without being excessive. Consider your assets and financial situation when determining the right limits for your policy.

Bundling Policies for Discounts

Many insurance companies offer discounts when you bundle multiple policies with them. This is known as a multi-policy discount and can lead to significant savings.

If you own a home, consider purchasing your homeowners or renters insurance from the same provider as your auto insurance. The same goes for other types of insurance, such as life or umbrella policies. By bundling your policies, you can often negotiate better rates and save money.

Utilizing Telematics and Usage-Based Insurance

Telematics and usage-based insurance are innovative approaches to auto insurance that reward safe driving behaviors. These programs use technology to track your driving habits and offer discounts based on your performance.

- Telematics: This involves installing a small device in your vehicle that records data such as speed, acceleration, and mileage. The data is then used to calculate your insurance premium, often resulting in lower rates for safe drivers.

- Usage-Based Insurance: This approach relies on GPS and mobile apps to track your driving behavior. It takes into account factors like the time of day you drive, the distance traveled, and your braking and acceleration habits. Safe drivers can benefit from lower premiums.

Maintaining a Clean Driving Record

Your driving record plays a significant role in determining your insurance rates. A clean driving record, free of accidents and violations, can lead to substantial savings on your premiums. Here’s how:

- Avoid getting into accidents, as at-fault accidents can increase your rates significantly.

- Obey traffic laws and avoid speeding tickets and other violations. Even a single ticket can result in higher insurance costs.

- Consider taking a defensive driving course, which can not only improve your driving skills but may also qualify you for insurance discounts.

Exploring Alternative Insurance Options

In addition to traditional insurance companies, there are alternative options to consider, especially if you have a unique situation or specific requirements.

- Peer-to-Peer Insurance: This is a community-based insurance model where members contribute to a shared pool of funds to cover each other’s claims. It can offer more affordable rates and a sense of community.

- Captive Agents: Captive agents work exclusively for a single insurance company, providing personalized service and expertise on that company’s products. They can help you navigate the company’s offerings and find the best policy for your needs.

- Independent Agents: Independent agents represent multiple insurance companies, allowing them to shop around and find the best policy for you. They can provide a wide range of options and expert advice.

Conclusion: Empowering Your Auto Insurance Journey

Finding the right auto insurance policy is a crucial step in protecting your financial well-being and ensuring peace of mind while on the road. By following the comprehensive guide outlined above, you’ll be well-equipped to navigate the complex world of auto insurance and make informed decisions. Remember, your choice of insurance provider and policy can significantly impact your driving experience and your wallet.

Stay informed, shop around, and don’t be afraid to ask questions. With the right knowledge and approach, you can find an auto insurance policy that offers the perfect balance of coverage and value, allowing you to drive with confidence and security.

How often should I review my auto insurance policy?

+It’s a good practice to review your auto insurance policy annually or whenever your circumstances change significantly. This ensures your coverage remains adequate and you’re taking advantage of any new discounts or offers available.

What are some common discounts I can look for when shopping for auto insurance?

+Common discounts include safe driver discounts, multi-policy discounts (when you bundle multiple insurance policies with the same provider), good student discounts, loyalty discounts, and discounts for completing defensive driving courses.

How can I improve my chances of getting lower auto insurance rates?

+To get lower rates, maintain a clean driving record, avoid accidents and violations, consider bundling your insurance policies, and explore usage-based insurance options. Additionally, shop around and compare quotes from multiple providers to find the best deal.