Standard Dental Insurance

Dental insurance is an essential aspect of healthcare coverage, ensuring that individuals have access to necessary oral care services without incurring excessive costs. In the United States, dental insurance plans come in various forms, catering to diverse needs and budgets. This article aims to provide a comprehensive overview of standard dental insurance, exploring its benefits, coverage options, and how it can be utilized to maintain optimal oral health.

Understanding Standard Dental Insurance

Standard dental insurance is a type of health insurance policy specifically designed to cover a range of dental services, from routine check-ups and cleanings to more complex procedures. It is often offered as an optional add-on to major medical insurance plans, allowing individuals to customize their healthcare coverage according to their unique needs.

The primary objective of dental insurance is to promote preventive care and provide financial protection against unexpected dental expenses. By encouraging regular dental visits and offering cost-effective solutions for various treatments, standard dental insurance plays a crucial role in maintaining overall well-being.

Key Features of Standard Dental Insurance Plans

Standard dental insurance plans typically offer a comprehensive range of benefits, including:

- Routine Dental Care: Coverage for regular check-ups, cleanings, and oral exams to detect and prevent dental issues.

- Restorative Treatments: Support for fillings, root canals, and other procedures to restore oral health.

- Orthodontic Services: Partial or full coverage for braces, aligners, and other orthodontic treatments.

- Emergency Dental Care: Immediate assistance for unexpected dental emergencies, such as toothaches or injuries.

- Preventive Services: Coverage for X-rays, fluoride treatments, and sealants to prevent dental problems.

- Major Dental Procedures: Financial assistance for more complex procedures like implants, bridges, and dentures.

- Dental Specialty Care: Access to specialized dental services, including periodontics, endodontics, and oral surgery.

These features ensure that individuals have a wide array of dental services covered, promoting comprehensive oral healthcare.

How Dental Insurance Works

Dental insurance operates on a similar premise to other types of health insurance, with a few unique characteristics tailored to dental care.

Premiums and Deductibles

Individuals pay a monthly premium to maintain their dental insurance coverage. This premium amount varies based on the specific plan chosen, the provider, and the level of coverage desired. Additionally, some plans may require a deductible, which is the amount an individual must pay out of pocket before the insurance coverage kicks in.

For instance, a standard dental insurance plan might have a monthly premium of $35 with an annual deductible of $50. This means the insured individual pays $35 each month and, after reaching the $50 deductible through their own dental expenses, the insurance coverage starts to apply.

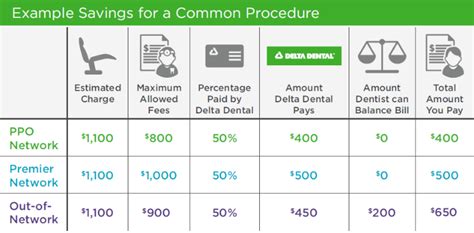

Copayments and Coinsurance

Copayments and coinsurance are two common methods used to share the cost of dental services between the insured individual and the insurance provider. A copayment is a fixed amount paid by the individual at the time of service, while coinsurance is a percentage of the total cost of the service that the individual is responsible for paying.

For example, a dental insurance plan may have a copayment of $25 for routine cleanings. This means that during each cleaning appointment, the insured individual pays $25 directly to the dentist, and the insurance provider covers the remaining cost.

Network of Dentists

Most dental insurance plans have a network of preferred providers, which are dentists and specialists who have agreed to accept the insurance plan’s terms and rates. Visiting an in-network dentist often results in lower out-of-pocket costs for the insured individual.

Suppose an individual has a standard dental insurance plan with an extensive network of dentists. In that case, they can choose from a wide range of dental practices, ensuring convenient access to quality care. On the other hand, if they choose to visit an out-of-network dentist, they may incur higher costs or need to pay the full amount upfront and seek reimbursement from their insurance provider.

Coverage Options and Benefits

Standard dental insurance plans offer a variety of coverage options to suit different needs and preferences. Here’s an overview of some common coverage levels:

Preventive Care Coverage

Preventive care is a fundamental aspect of dental insurance, as it focuses on early detection and treatment of dental issues to prevent more serious problems down the line. Most standard dental insurance plans cover preventive services at 100%, which means the insured individual pays nothing out of pocket for these services.

Preventive care typically includes:

- Dental cleanings and exams: Bi-annual check-ups and cleanings are essential for maintaining oral health.

- X-rays: Diagnostic X-rays are used to detect cavities, bone loss, and other dental issues.

- Fluoride treatments: Fluoride helps strengthen teeth and prevent tooth decay, especially in children.

- Sealants: Dental sealants are applied to the chewing surfaces of molars to prevent cavities.

Basic Restorative Coverage

Basic restorative coverage is designed to address common dental issues that require immediate attention. While the coverage level may vary, most standard dental insurance plans offer a certain percentage of coverage for these services.

Basic restorative services often include:

- Fillings: Dental fillings are used to restore decayed or damaged teeth.

- Root canals: Root canal therapy is necessary to save an infected tooth from extraction.

- Extractions: Tooth extraction may be required for severely damaged or impacted teeth.

- Periodontal treatments: Gum disease treatments are essential for maintaining gum health.

Major Restorative Coverage

Major restorative coverage is for more extensive dental procedures that are typically not considered routine. These procedures often require a higher level of expertise and are more costly. Standard dental insurance plans usually provide a lower percentage of coverage for major restorative services, with the insured individual responsible for the remaining cost.

Major restorative services can include:

- Dental implants: Implants are used to replace missing teeth and provide a permanent solution.

- Bridges: Dental bridges are fixed prosthetic devices that replace one or more missing teeth.

- Dentures: Full or partial dentures are removable prosthetic devices used to replace missing teeth.

- Crowns: Dental crowns are used to cover and protect damaged or weakened teeth.

Orthodontic Coverage

Orthodontic coverage is an optional benefit offered by some standard dental insurance plans. It provides financial assistance for orthodontic treatments, such as braces and clear aligners, which can be quite costly. The level of coverage varies, and some plans may require pre-authorization or a waiting period before orthodontic treatment is covered.

Maximizing Your Dental Insurance Benefits

To make the most of your standard dental insurance plan, consider the following tips:

Understand Your Plan

Familiarize yourself with the details of your dental insurance plan, including coverage levels, deductibles, and any limitations or exclusions. Knowing what is covered and what is not will help you make informed decisions about your dental care.

Choose an In-Network Dentist

Visiting an in-network dentist can significantly reduce your out-of-pocket costs. These providers have agreed to accept the insurance plan’s rates, ensuring you receive quality care at a discounted rate.

Schedule Regular Check-Ups

Regular dental check-ups are crucial for maintaining optimal oral health. Most standard dental insurance plans cover two check-ups and cleanings per year, so be sure to schedule these appointments to take advantage of your preventive care benefits.

Keep Good Records

Maintain a record of your dental visits, procedures, and any corresponding insurance claims. This will help you track your out-of-pocket expenses and ensure you receive the appropriate coverage and reimbursements.

Seek Pre-Authorization for Major Procedures

If you require a major dental procedure, such as implants or orthodontic treatment, it’s essential to seek pre-authorization from your insurance provider. This process ensures that the procedure is covered and helps you understand any out-of-pocket costs you may incur.

The Impact of Dental Insurance on Oral Health

Dental insurance plays a significant role in promoting good oral health by providing access to affordable dental care. Regular dental visits, facilitated by insurance coverage, allow for early detection and treatment of dental issues, preventing more complex and costly problems in the future.

Furthermore, dental insurance encourages individuals to take a proactive approach to their oral health. By covering preventive services and offering financial assistance for restorative treatments, dental insurance empowers individuals to make informed decisions about their dental care and prioritize their overall well-being.

Future Trends in Dental Insurance

The dental insurance industry is continuously evolving to meet the changing needs of patients and providers. Here are some trends that are shaping the future of dental insurance:

Digital Dentistry and Telehealth

The integration of digital technology and telehealth services is revolutionizing the dental industry. From digital impressions and 3D printing to virtual consultations, these advancements are improving patient experiences and making dental care more accessible. Dental insurance providers are adapting to these changes by offering coverage for digital dentistry services and telehealth appointments.

Preventive Focus

There is a growing emphasis on preventive dental care, with insurance providers recognizing the long-term benefits of early intervention. Many plans are now offering enhanced coverage for preventive services, such as increased frequency of cleanings, fluoride treatments, and oral cancer screenings. This shift towards prevention aims to reduce the need for more costly restorative procedures in the future.

Personalized Care

Dental insurance providers are increasingly adopting a personalized approach to coverage. This involves tailoring plans to individual needs and preferences, offering flexible benefit options, and providing educational resources to help patients make informed decisions about their oral health. By empowering patients to take control of their dental care, insurance providers aim to improve overall health outcomes.

Integration with Overall Health Plans

The recognition of the link between oral health and overall well-being is leading to a greater integration of dental insurance with major medical plans. This integration allows for a more holistic approach to healthcare, ensuring that dental care is considered as an essential component of overall health and wellness. As a result, dental insurance coverage is becoming more comprehensive and coordinated with other healthcare benefits.

Conclusion

Standard dental insurance is a valuable tool for maintaining optimal oral health and managing dental care expenses. By understanding the various coverage options, benefits, and utilization strategies, individuals can make the most of their dental insurance plans. As the dental insurance industry continues to evolve, patients can expect improved access to care, increased focus on prevention, and more personalized coverage options, all contributing to better oral health outcomes.

How often should I visit the dentist with dental insurance coverage?

+Most standard dental insurance plans cover two check-ups and cleanings per year. Regular dental visits are crucial for maintaining optimal oral health and preventing dental issues.

What happens if I visit an out-of-network dentist?

+Visiting an out-of-network dentist may result in higher out-of-pocket costs. These providers have not agreed to the insurance plan’s rates, so you may need to pay the full amount upfront and seek reimbursement from your insurance provider.

Are there any age restrictions for dental insurance coverage?

+Dental insurance coverage is typically available for individuals of all ages. Some plans may have specific benefits or limitations for pediatric or senior patients, but overall, dental insurance is designed to cater to a wide range of age groups.

Can I change my dental insurance plan during the year?

+Changing your dental insurance plan during the year is generally possible, but it may be subject to certain restrictions or requirements. It’s best to review your insurance provider’s guidelines or consult with a representative to understand the process and any potential limitations.