Private Medical Insurance

Private medical insurance (PMI), also known as health insurance, plays a crucial role in providing individuals and families with access to personalized healthcare services beyond what is typically covered by public healthcare systems. In today's dynamic healthcare landscape, understanding the benefits, complexities, and nuances of private medical insurance is essential for making informed decisions about one's healthcare coverage.

This comprehensive guide aims to delve into the world of private medical insurance, exploring its various aspects, from the fundamental principles to the intricate details that impact policyholders. By shedding light on the advantages, challenges, and future prospects of PMI, we hope to empower readers with the knowledge they need to navigate this essential aspect of their well-being.

The Fundamentals of Private Medical Insurance

Private medical insurance operates on the principle of providing individuals and families with financial protection against the costs associated with healthcare services. This type of insurance typically covers a wide range of medical expenses, including but not limited to, hospitalization, surgical procedures, specialist consultations, diagnostic tests, and prescription medications.

The primary benefit of PMI is the access it grants to timely and specialized healthcare. Policyholders can often choose their preferred healthcare providers and gain expedited access to treatments, bypassing the potential delays and waitlists often associated with public healthcare systems. Additionally, private medical insurance can offer a higher level of comfort and privacy during medical procedures, as well as more flexible scheduling options.

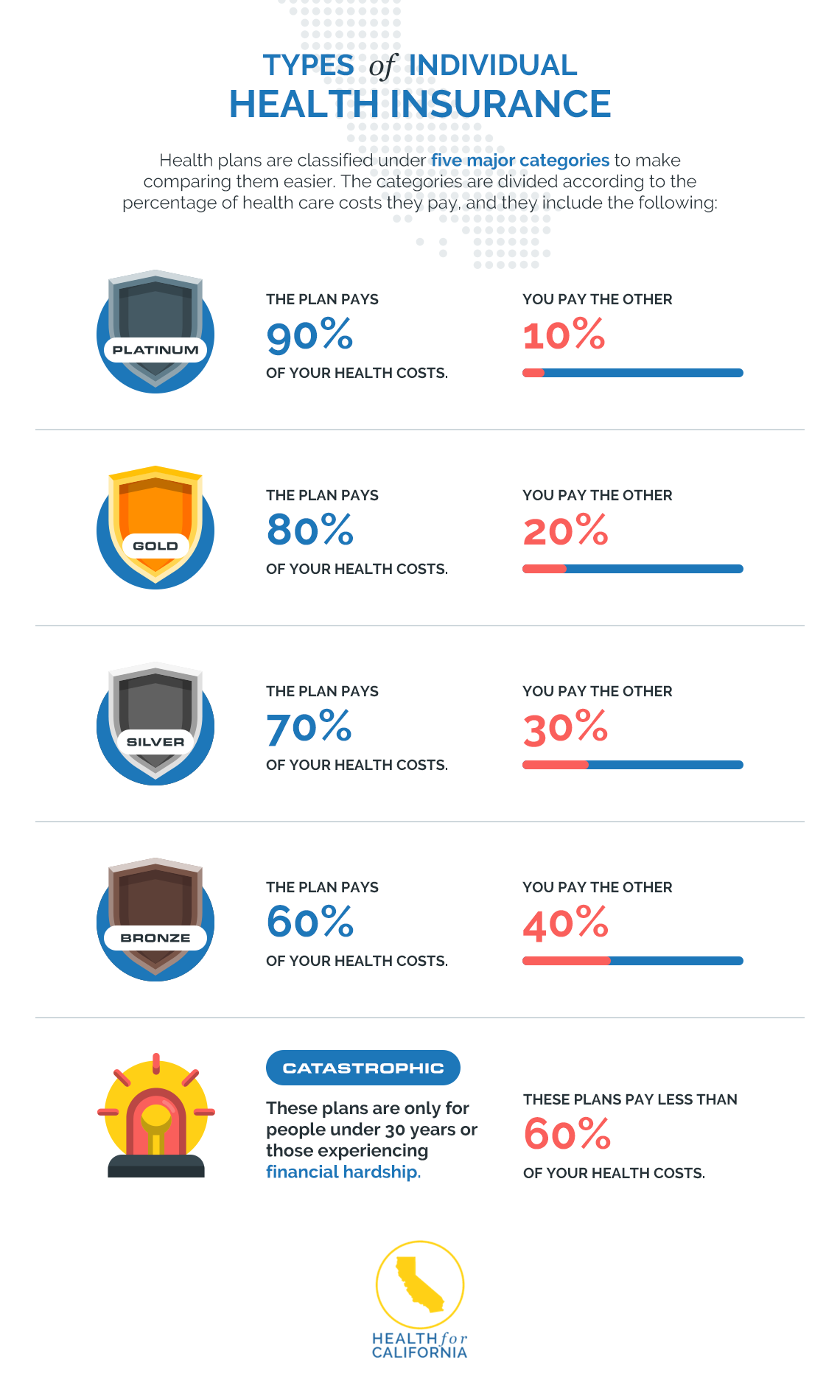

Private medical insurance policies are designed to cater to diverse needs and preferences. They come in various types, such as comprehensive plans covering a broad spectrum of medical services, or more specialized policies focused on specific conditions or treatments. These policies can be tailored to individual circumstances, including age, pre-existing conditions, and personal healthcare requirements.

The cost of private medical insurance varies depending on numerous factors, including the level of coverage, the age and health status of the insured individual, and the location. Generally, younger and healthier individuals may enjoy more affordable premiums, while those with pre-existing conditions or advanced age may face higher costs. It's important to note that while PMI can provide significant financial protection, it often comes with a price tag that must be carefully considered within one's overall financial plan.

Understanding Policy Terms and Coverage

When navigating the world of private medical insurance, it’s crucial to understand the intricacies of policy terms and coverage. Policies can vary significantly in their scope and limitations, and it’s essential to review these details carefully before making a decision.

One key aspect to consider is the waiting period. Most private medical insurance policies have a waiting period before certain benefits become effective. This period can range from a few months to a year and may apply to specific treatments or conditions. Understanding these waiting periods is crucial to avoid any unexpected delays in accessing healthcare services.

Policyholders should also be aware of any exclusions or limitations in their coverage. While private medical insurance aims to provide comprehensive protection, certain procedures, treatments, or conditions may not be covered. These exclusions can vary widely between policies, and it's essential to review them thoroughly to ensure that the coverage aligns with one's healthcare needs.

Another critical consideration is the process of claim settlement. Private medical insurance policies typically require policyholders to submit claims for reimbursement after receiving healthcare services. Understanding the claim settlement process, including the necessary documentation and timelines, is vital to ensure a smooth and efficient reimbursement experience.

Comparative Analysis of Policy Benefits

To make an informed decision about private medical insurance, it’s beneficial to conduct a comparative analysis of different policy benefits. Here’s a table outlining some key features of three hypothetical PMI policies:

| Policy | Waiting Period | Coverage Exclusions | Claim Settlement Process |

|---|---|---|---|

| Policy A | 3 months | Cosmetic procedures, pre-existing conditions for the first year | Online claim submission, 14-day processing time |

| Policy B | 6 months | Experimental treatments, mental health conditions | Paperwork-based claim, 21-day processing |

| Policy C | 1 year | Dental care, maternity-related expenses | Online claim with real-time tracking, 7-day processing |

By comparing these policies, individuals can assess which one best aligns with their healthcare needs and preferences. It's essential to consider factors such as waiting periods, coverage exclusions, and the claim settlement process to ensure a policy that provides the desired level of protection and accessibility.

The Role of Private Medical Insurance in Healthcare Access

Private medical insurance plays a significant role in enhancing healthcare access for individuals and communities. By providing an additional layer of financial protection, PMI can alleviate the burden of healthcare costs, making essential treatments and procedures more attainable.

For those with chronic conditions or complex healthcare needs, private medical insurance can be a lifeline. It ensures that individuals have the necessary resources to access specialized care, manage their conditions effectively, and maintain their quality of life. Additionally, PMI can provide access to innovative treatments and technologies that may not be widely available through public healthcare systems.

Moreover, private medical insurance contributes to reducing wait times and improving the overall efficiency of healthcare delivery. By offering an alternative to public healthcare, PMI can alleviate the strain on public systems, allowing them to focus on providing essential services to those who rely solely on public coverage. This dual-system approach can lead to improved healthcare outcomes and better patient experiences.

Impact on Healthcare Equity and Accessibility

The presence of private medical insurance can have a profound impact on healthcare equity and accessibility. While it primarily benefits those who can afford the premiums, it also has the potential to indirectly benefit the broader community.

Private medical insurance can help reduce the financial strain on public healthcare systems, freeing up resources that can be allocated to underserved communities or individuals with limited financial means. This can lead to improved access to essential healthcare services for those who might otherwise face significant barriers.

Additionally, the existence of private medical insurance can drive innovation and competition within the healthcare industry. As insurance companies strive to offer comprehensive and appealing policies, they may invest in new technologies, treatments, and healthcare delivery models. This can ultimately benefit all individuals, regardless of their insurance status, by driving overall improvements in healthcare quality and accessibility.

Future Prospects and Innovations in Private Medical Insurance

The landscape of private medical insurance is continuously evolving, driven by advancements in healthcare technologies, changing consumer preferences, and evolving regulatory frameworks.

One notable trend is the increasing focus on digital health and telemedicine. Private medical insurance providers are integrating digital tools and platforms into their policies, enabling policyholders to access healthcare services remotely. This not only enhances convenience but also expands access to specialized care, particularly in rural or underserved areas.

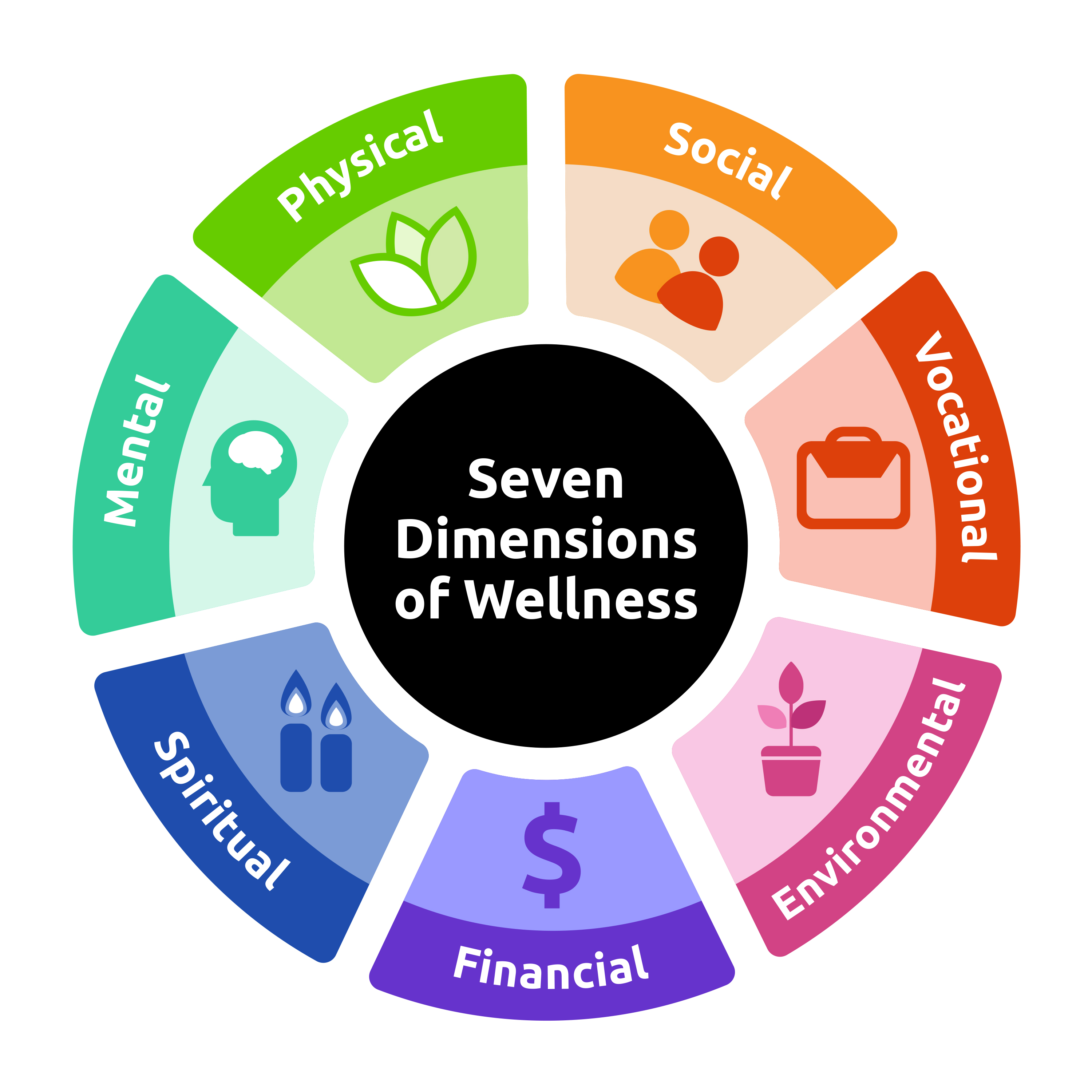

Furthermore, there is a growing emphasis on preventive care and wellness initiatives within private medical insurance. Insurance companies are recognizing the long-term benefits of investing in preventive measures, such as health screenings, vaccinations, and lifestyle coaching. By promoting healthier lifestyles and early detection of health issues, these initiatives can lead to better health outcomes and reduced healthcare costs in the long run.

Emerging Technologies and Their Impact

Emerging technologies are poised to revolutionize the private medical insurance industry, offering enhanced efficiency, personalized care, and improved patient experiences.

Artificial intelligence (AI) and machine learning are being leveraged to analyze vast amounts of healthcare data, enabling insurance providers to make more accurate predictions and assessments of health risks. This can lead to more precise underwriting processes and the development of innovative insurance products tailored to individual health profiles.

Blockchain technology is also making inroads into the healthcare industry, including private medical insurance. By providing a secure and transparent platform for managing healthcare data, blockchain can enhance the efficiency of claim settlements, reduce administrative burdens, and improve data privacy and security.

Additionally, the integration of wearable health devices and sensors is transforming the way healthcare is monitored and managed. Private medical insurance providers can leverage this data to offer more dynamic and personalized insurance plans, incentivizing policyholders to adopt healthier lifestyles and actively manage their health.

Conclusion: Empowering Healthcare Decisions with Knowledge

Private medical insurance is a complex yet essential aspect of modern healthcare. By understanding the fundamentals, policy terms, and coverage details, individuals can make informed decisions about their healthcare coverage. The benefits of PMI, including timely access to specialized care and financial protection, are undeniable.

As the healthcare landscape continues to evolve, private medical insurance will play a pivotal role in shaping the future of healthcare access and delivery. With emerging technologies and innovative approaches, the industry is poised to offer even more personalized and efficient healthcare solutions. By staying informed and engaged, individuals can navigate the complexities of private medical insurance with confidence, ensuring they have the coverage they need to protect their health and well-being.

How do I choose the right private medical insurance policy for my needs?

+Selecting the right private medical insurance policy involves careful consideration of your specific healthcare needs and financial circumstances. Start by evaluating your current health status, any pre-existing conditions, and your anticipated healthcare requirements in the future. Consider the level of coverage you desire, including the range of medical services and treatments you may need. Assess your financial situation to determine the premium you can comfortably afford. It’s also crucial to compare policies from different providers to find the best combination of coverage and cost. Seek advice from insurance brokers or financial advisors who can provide personalized recommendations based on your unique circumstances.

What are the potential drawbacks of private medical insurance?

+While private medical insurance offers numerous benefits, it’s important to be aware of potential drawbacks. One significant consideration is the cost, as premiums can be substantial, especially for individuals with pre-existing conditions or advanced age. Additionally, private medical insurance policies often come with limitations and exclusions, which can restrict coverage for certain treatments or conditions. It’s crucial to carefully review policy terms and understand any waiting periods or claim settlement processes to avoid unexpected surprises. Furthermore, private medical insurance may not always be accessible to everyone, as it requires the financial means to afford the premiums.

How does private medical insurance impact the overall healthcare system?

+Private medical insurance has a significant impact on the overall healthcare system. By providing an alternative to public healthcare, PMI can alleviate the strain on public systems, allowing them to focus on providing essential services to those who rely solely on public coverage. This dual-system approach can lead to improved healthcare outcomes and better patient experiences. Additionally, private medical insurance can drive innovation and competition within the healthcare industry, leading to improved healthcare quality and accessibility for all individuals.