The Root Insurance

The insurance industry has been undergoing a digital transformation, with a growing number of companies leveraging technology to offer innovative and personalized insurance solutions. Among these disruptors, The Root Insurance Company has emerged as a prominent player, challenging traditional insurance models and reshaping the landscape with its unique approach.

In this in-depth analysis, we delve into the world of The Root Insurance, exploring its origins, business model, and the revolutionary impact it has had on the insurance sector. From its innovative use of data-driven underwriting to its focus on customer experience, we uncover the secrets behind Root's success and its potential future implications.

A Revolutionary Vision: The Birth of The Root Insurance

The story of The Root Insurance Company began in 2015, founded by a team of experienced entrepreneurs and insurance industry veterans. With a mission to disrupt the status quo and bring about much-needed change, Root set out to revolutionize the car insurance market. The company’s vision was clear: to create a fair and efficient insurance system that rewards safe drivers.

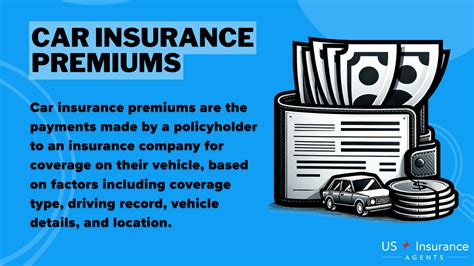

Traditional insurance models often rely on a one-size-fits-all approach, where premiums are calculated based on a variety of factors, including age, gender, and location. Root, however, took a different path. It aimed to eliminate bias and provide a more accurate assessment of individual risk by utilizing advanced data analytics and machine learning.

The Root Difference: Data-Driven Underwriting

At the core of Root’s business model is its innovative use of data-driven underwriting. Instead of relying solely on historical data and demographic factors, Root collects and analyzes vast amounts of real-time driving data to assess a driver’s risk profile.

Root's mobile app plays a pivotal role in this process. It tracks a driver's behavior, including their acceleration, braking, and turning patterns, to create a comprehensive picture of their driving habits. This data, combined with other factors such as the driver's history and the vehicle's safety features, is then used to calculate a personalized insurance rate.

| Traditional Underwriting Factors | Root's Data-Driven Approach |

|---|---|

| Age | Real-time driving behavior |

| Gender | Historical driving record |

| Location | Vehicle safety features |

| Credit Score | Personalized risk assessment |

By eliminating the use of demographic factors and focusing on actual driving behavior, Root aims to create a fair and unbiased insurance system. This approach not only rewards safe drivers with lower premiums but also encourages better driving habits across the board.

The Technology Behind Root’s Success

The success of The Root Insurance Company is closely tied to its innovative use of technology. The company has invested heavily in developing cutting-edge solutions that streamline the insurance process and enhance the overall customer experience.

Digital Onboarding and Policy Management

Root has embraced a fully digital approach to insurance, allowing customers to sign up, manage their policies, and make claims entirely online or through its mobile app. This digital transformation has not only improved efficiency but also reduced administrative costs, enabling Root to offer competitive pricing.

The company's intuitive app allows customers to easily navigate their insurance journey. From calculating personalized rates to providing real-time updates on claims, the app puts the power of insurance management into the hands of customers.

Advanced Telematics and Data Analytics

As mentioned earlier, Root’s use of telematics and data analytics is a key differentiator. The company’s proprietary algorithms analyze driving data to create a unique risk profile for each driver. This data-driven approach allows Root to offer highly accurate and personalized insurance rates, ensuring fairness and transparency.

Additionally, Root's data analytics capabilities extend beyond underwriting. The company continuously monitors driving patterns and road conditions to identify potential risks and offer personalized safety tips to its customers. This proactive approach to safety not only benefits individual drivers but also contributes to overall road safety.

Root’s Impact on the Insurance Industry

The rise of The Root Insurance Company has had a profound impact on the insurance industry, challenging traditional norms and forcing competitors to reevaluate their strategies. Root’s success has demonstrated the power of technology and data-driven approaches in transforming a centuries-old industry.

Disrupting the Status Quo

Root’s innovative business model has disrupted the traditional insurance landscape by offering a more personalized and fair approach to underwriting. By eliminating demographic factors and focusing on driving behavior, Root has shown that insurance rates can be calculated with greater accuracy and fairness.

This disruption has not only benefited consumers but has also forced traditional insurance companies to reconsider their practices. Many established insurers are now investing in technology and data analytics to stay competitive and meet the evolving expectations of customers.

Empowering Safe Drivers

Root’s mission to reward safe drivers has had a positive impact on road safety. By offering lower premiums to those with good driving habits, Root incentivizes safer driving behavior. This, in turn, contributes to a reduction in accidents and road congestion, ultimately benefiting society as a whole.

Furthermore, Root's focus on customer empowerment has encouraged a culture of transparency and trust. Customers are actively engaged in the insurance process, understanding their risk profile and the factors that influence their premiums. This level of transparency has fostered a stronger relationship between insurers and policyholders.

The Future of Insurance: Root’s Vision

As The Root Insurance Company continues to innovate and expand its reach, its vision for the future of insurance is one of continued disruption and positive change.

Expanding Product Offerings

While Root initially focused on car insurance, the company is now exploring opportunities to expand its product offerings. This includes potentially branching out into other lines of insurance, such as home, life, and health insurance, leveraging its data-driven expertise to offer personalized coverage across a broader spectrum.

International Expansion

Root’s success in the US market has laid the foundation for potential international expansion. The company’s unique business model and focus on technology can be easily adapted to different markets, allowing Root to bring its innovative insurance solutions to a global audience.

Collaborations and Partnerships

Root recognizes the value of collaboration and is open to partnerships that can further enhance its services. By working with technology companies, automotive manufacturers, and other industry stakeholders, Root can leverage emerging technologies and trends to stay at the forefront of insurance innovation.

Conclusion

The Root Insurance Company has emerged as a pioneer in the insurance industry, disrupting traditional models and reshaping the way insurance is perceived and delivered. Its data-driven approach, focus on customer experience, and commitment to fairness have not only benefited consumers but have also driven positive change across the industry.

As Root continues to innovate and expand, its impact on the insurance landscape is set to grow. With its unique vision and technological prowess, The Root Insurance Company is well-positioned to lead the way in transforming the insurance industry for the better.

How does Root determine insurance rates for its customers?

+Root uses a combination of real-time driving behavior data, historical driving records, and vehicle safety features to calculate personalized insurance rates. This data-driven approach allows Root to offer fair and accurate premiums based on individual risk profiles.

What are the benefits of Root’s digital onboarding process?

+Root’s digital onboarding process simplifies the insurance journey for customers. It allows for a seamless sign-up experience, efficient policy management, and real-time claim updates. This digital transformation reduces administrative costs and enables Root to offer competitive pricing.

How does Root’s focus on safe driving benefit society?

+By incentivizing safe driving through lower premiums, Root encourages better driving habits. This, in turn, leads to a reduction in accidents and road congestion, contributing to overall road safety and societal well-being.