Usaa Home Insurance Phone Number

Are you a homeowner seeking reliable insurance coverage? Look no further than USAA, a renowned insurance provider specializing in catering to military families and veterans. With a strong reputation for excellent customer service and comprehensive coverage options, USAA stands out as a trusted choice for homeowners. In this article, we'll delve into the world of USAA home insurance, providing you with the essential information you need to make informed decisions about your home insurance needs.

Understanding USAA Home Insurance

USAA offers a range of insurance products tailored to meet the unique needs of military personnel and their families. Their home insurance policies provide comprehensive coverage for various aspects of homeownership, including:

- Dwelling Coverage: Protects the structure of your home against damages caused by covered perils such as fire, wind, hail, and more.

- Personal Property Coverage: Covers the contents of your home, including furniture, electronics, and personal belongings, against theft, damage, or loss.

- Liability Protection: Provides financial coverage in case you're found legally responsible for injuries or property damage to others.

- Additional Living Expenses: Assists with temporary living expenses if your home becomes uninhabitable due to a covered loss.

- Optional Coverages: USAA offers a variety of optional coverages to customize your policy, such as water backup coverage, identity theft protection, and more.

Key Features and Benefits of USAA Home Insurance

USAA home insurance policies come with several standout features and benefits that set them apart:

- Military Discounts: USAA offers exclusive discounts to active-duty military personnel, veterans, and their families, making their insurance policies even more affordable.

- 24/7 Customer Support: With a dedicated team of experts, USAA provides round-the-clock assistance, ensuring you receive prompt support whenever you need it.

- Online Account Management: USAA's user-friendly online platform allows you to manage your policy, make payments, and access important documents anytime, anywhere.

- Claim Assistance: In the event of a claim, USAA's experienced claims adjusters work diligently to process your claim efficiently and ensure a smooth recovery process.

- Discounts and Bundling Options: By bundling your home and auto insurance policies with USAA, you can enjoy additional discounts and simplified coverage management.

Contacting USAA for Home Insurance

If you’re interested in learning more about USAA home insurance or have specific inquiries, reaching out to their dedicated customer support team is easy. Here’s how you can connect with them:

Phone Number

For direct assistance, you can call USAA’s home insurance phone number: (800) 531-8722. This toll-free number is available 24⁄7, ensuring you can reach a representative whenever you need it.

Additional Contact Methods

In addition to the phone number, USAA offers several alternative contact methods for your convenience:

- Online Chat: Visit the USAA website and navigate to the "Contact Us" section. Here, you'll find an option to initiate a live chat with a customer service representative.

- Email: Send an email to homeinsurance@usaa.com for non-urgent inquiries or to request specific information.

- Mobile App: Download the USAA mobile app, available on iOS and Android devices. The app provides a convenient way to manage your insurance policies and connect with customer support.

- Mail: If you prefer traditional mail, you can send your inquiries to the following address: USAA, 9800 Fredericksburg Road, San Antonio, TX 78288.

USAA Home Insurance Coverage Options

USAA offers two primary types of home insurance policies to cater to different needs and budgets:

Standard Homeowners Policy (HO-3)

The HO-3 policy is USAA’s most popular and comprehensive option, providing coverage for:

- Dwelling and personal property

- Liability protection

- Additional living expenses

- Optional coverages such as personal liability, medical payments, and identity theft protection

Broad Homeowners Policy (HO-5)

The HO-5 policy is designed for high-value homes and offers more extensive coverage, including:

- All the coverages of the HO-3 policy

- Additional coverage for personal property, including replacement cost coverage

- Enhanced liability protection

- Optional coverages for valuable items and home systems

Performance and Reputation

USAA has consistently maintained an excellent reputation for its home insurance offerings. Their commitment to customer satisfaction and military support has earned them high ratings and recognition in the industry. Here are some key highlights:

- J.D. Power Rankings: USAA has received top ratings in J.D. Power's Home Insurance Study for several years, ranking highly in customer satisfaction and claims handling.

- AM Best Rating: USAA's financial strength and stability are rated "A++" by AM Best, the highest possible rating, ensuring policyholders' peace of mind.

- Industry Awards: USAA has been recognized with numerous awards for its exceptional customer service, innovative technology, and commitment to military families.

Conclusion

USAA home insurance is a top choice for military families and veterans, offering comprehensive coverage, competitive rates, and excellent customer support. With their range of policy options, military discounts, and 24⁄7 assistance, USAA provides peace of mind for homeowners. To learn more or obtain a quote, don’t hesitate to reach out to their dedicated team using the contact methods provided.

What are the eligibility requirements for USAA home insurance?

+USAA home insurance is primarily available to active-duty military personnel, veterans, and their immediate family members. To be eligible, you must meet specific criteria, such as having a valid military ID or proof of military service. USAA also extends eligibility to certain civilian groups, such as cadets and midshipmen, and members of some professional organizations.

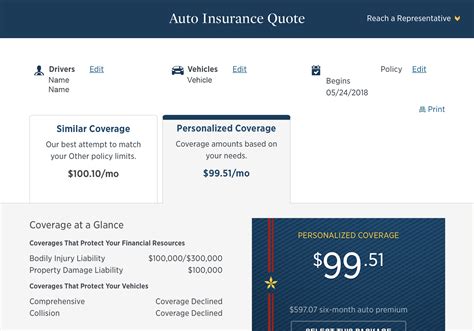

How can I get a quote for USAA home insurance?

+Obtaining a quote for USAA home insurance is straightforward. You can start the process by visiting their website and using their online quote tool. Alternatively, you can call the USAA home insurance phone number provided earlier in this article to speak with a representative who can guide you through the quoting process and answer any questions you may have.

Does USAA offer discounts for multiple policies?

+Yes, USAA encourages policy bundling by offering discounts when you combine your home and auto insurance policies with them. By doing so, you can save money and enjoy the convenience of managing multiple policies under one provider. Additionally, USAA may offer other discounts based on your military status, home safety features, and more.