Liability Insurance For Event

Planning and organizing an event, whether it's a small gathering or a large-scale affair, comes with its fair share of risks and potential liabilities. From accidents to property damage, the unforeseen can happen, and event organizers must be prepared to mitigate these risks. This is where liability insurance steps in as a crucial safeguard, offering protection and peace of mind to event planners and their clients. In this comprehensive guide, we will delve into the world of liability insurance for events, exploring its importance, coverage options, and the key considerations for a successful and stress-free event planning journey.

Understanding the Need for Liability Insurance

In the dynamic world of event planning, the unexpected can turn a carefully crafted celebration into a legal quagmire. From slip-and-fall accidents to damaged property or even guest injuries, the potential liabilities are vast and varied. Liability insurance serves as a critical safety net, ensuring that event organizers and their clients are protected from the financial burdens that can arise from such unforeseen circumstances.

Consider the scenario of a wedding reception where a guest trips over an uneven floorboard, resulting in a severe injury. Without liability insurance, the event planner could face substantial medical bills and legal costs, not to mention the potential damage to their reputation and business. With liability insurance in place, however, the planner is shielded from these financial risks, allowing them to focus on delivering exceptional events without the looming threat of unforeseen liabilities.

Comprehensive Coverage Options

Liability insurance for events offers a range of coverage options tailored to the unique needs of event planners. These policies typically include:

General Liability

General liability coverage is the cornerstone of event insurance, protecting against a wide array of potential liabilities. This includes bodily injury, property damage, and personal injury claims that may arise during the event. For instance, if a caterer spills a hot dish on a guest, general liability insurance would cover the resulting medical expenses and any legal costs associated with the incident.

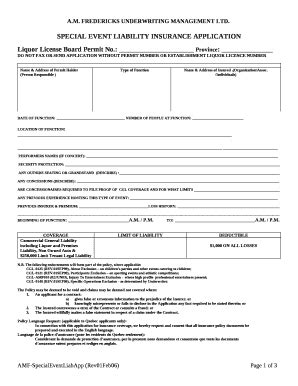

Liquor Liability

Events that involve the service of alcohol carry an added layer of risk. Liquor liability insurance is specifically designed to address this concern, providing coverage for accidents or injuries that occur as a result of alcohol consumption. This coverage is particularly crucial for events like weddings, corporate parties, or festivals where alcohol is served.

Special Event Coverage

Special event coverage is tailored to protect against the unique risks associated with specific types of events. This could include coverage for cancellations or postponements due to adverse weather, terrorism, or other unforeseen circumstances. For instance, a music festival organizer may opt for special event coverage to protect against the financial losses incurred if the event is canceled due to extreme weather conditions.

Equipment and Property Coverage

Event planners often rely on a variety of equipment and props to bring their visions to life. Equipment and property coverage ensures that any damage or loss to this vital event infrastructure is covered. This could include lighting rigs, sound systems, decor, and even rented furniture or linens.

Key Considerations for Event Planners

As an event planner, selecting the right liability insurance policy involves careful consideration of several key factors:

Venue Requirements

Many venues, particularly those hosting larger-scale events, require event planners to provide proof of liability insurance as a condition of booking. Understanding the venue’s insurance requirements is crucial to ensure compliance and a smooth event planning process.

Event Size and Scope

The size and complexity of your event will influence the level of insurance coverage required. Larger events with a higher guest count, multiple vendors, and intricate logistics may warrant more comprehensive coverage to address the heightened risks involved.

Vendor Requirements

Engaging the services of vendors, such as caterers, photographers, or entertainment providers, often comes with its own set of insurance considerations. Some vendors may require you to provide proof of insurance as a condition of their services, ensuring that they are protected in the event of any mishaps.

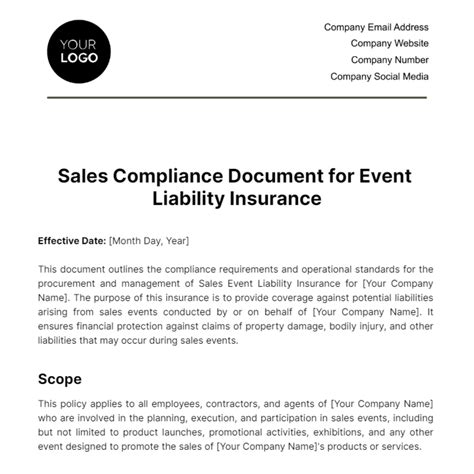

Customized Coverage

Every event is unique, and the risks associated with each one can vary significantly. Work closely with your insurance provider to tailor your policy to the specific needs of your event. This may involve adjusting coverage limits, adding endorsements, or exploring specialized coverage options to ensure you have the right protection in place.

The Role of Insurance Brokers

Navigating the complex world of liability insurance can be daunting, especially for event planners who are new to the industry. Insurance brokers specializing in event coverage can be invaluable resources, offering expert guidance and tailored solutions to meet your specific needs.

Insurance brokers have a deep understanding of the event industry and its associated risks. They can assess your event's unique requirements, recommend appropriate coverage options, and even negotiate with insurance providers to secure the best possible rates. Their expertise ensures that you receive the right level of protection without paying for unnecessary coverage.

The Benefits of Comprehensive Coverage

Investing in comprehensive liability insurance for your event offers a myriad of benefits, including:

- Financial Protection: Liability insurance provides a vital financial safety net, protecting you from the potentially devastating costs of accidents, injuries, or property damage.

- Peace of Mind: With the right insurance coverage in place, you can approach your event planning with confidence, knowing that you are shielded from unforeseen liabilities.

- Professional Reputation: By demonstrating a commitment to risk management through adequate insurance coverage, you enhance your professional reputation and build trust with clients and venues.

- Business Continuity: In the event of a claim, liability insurance ensures that your business can continue operating without interruption, protecting your livelihood and the future of your event planning endeavors.

Case Study: A Successful Event, Thanks to Liability Insurance

To illustrate the real-world impact of liability insurance, let’s consider the story of Event Planners Inc., a boutique event planning firm specializing in intimate destination weddings. When a bride-to-be approached the company with a vision for a romantic beachfront ceremony, the planners knew they had to be prepared for the unique risks associated with an outdoor event.

Working closely with their insurance broker, Event Planners Inc. secured a customized liability insurance policy that included coverage for adverse weather conditions, bodily injury, and property damage. As the big day approached, a sudden thunderstorm threatened to disrupt the carefully planned ceremony. However, thanks to their proactive insurance coverage, the planners were able to quickly relocate the event to an indoor venue, ensuring the couple's special day went ahead without a hitch.

The liability insurance policy not only protected the planners from financial losses but also demonstrated their professionalism and commitment to their clients. The bride and groom were thrilled with the seamless execution of their wedding, and Event Planners Inc. received glowing reviews and referrals as a result of their comprehensive risk management approach.

Conclusion

Liability insurance is an indispensable tool for event planners, offering protection, peace of mind, and a solid foundation for business growth. By understanding the unique risks associated with events and working closely with insurance experts, planners can create memorable experiences for their clients while safeguarding their financial well-being.

As you embark on your event planning journey, remember that liability insurance is not just a legal requirement but a strategic investment in the success and longevity of your business. With the right coverage in place, you can focus on crafting unforgettable events, confident in the knowledge that you are protected from the unforeseen.

How much does liability insurance for events typically cost?

+The cost of liability insurance for events can vary widely based on factors such as the size and scope of the event, the level of coverage required, and the insurer’s assessment of risk. Generally, smaller events with lower guest counts may have more affordable insurance premiums, while larger events may require more comprehensive coverage and thus higher costs. It’s advisable to obtain multiple quotes from insurance providers to find the best coverage at a competitive price.

Can I purchase liability insurance for a one-time event, or is it only for recurring events?

+Absolutely! Liability insurance for events is available for both one-time and recurring events. Whether you’re planning a single, large-scale event or a series of smaller gatherings, insurers offer tailored policies to meet your specific needs. This flexibility ensures that event planners of all sizes and frequencies can access the protection they require.

What happens if I don’t have liability insurance and an accident occurs during my event?

+In the absence of liability insurance, event planners may be held personally liable for any accidents, injuries, or property damage that occur during their event. This could result in substantial financial losses, legal fees, and damage to your professional reputation. By investing in liability insurance, you transfer these risks to the insurer, ensuring that you are protected from the potential financial and legal consequences of unforeseen circumstances.

Are there any discounts or incentives for event planners who purchase liability insurance?

+Yes, many insurance providers offer discounts and incentives to event planners who purchase liability insurance. These may include bundle discounts for multiple policies, loyalty rewards for long-term customers, or discounts for planners who maintain a strong safety record. Additionally, some insurers offer risk management resources and tools to help event planners identify and mitigate potential risks, further enhancing their safety and potentially reducing insurance costs.