What Is Travelers Insurance

Travelers Insurance is a leading provider of insurance products and services, offering a comprehensive range of coverage options to individuals, families, and businesses. With a rich history spanning over a century, Travelers has established itself as a trusted name in the insurance industry, providing financial protection and peace of mind to its customers worldwide.

A Legacy of Trust: The History of Travelers Insurance

The roots of Travelers Insurance can be traced back to the late 19th century when it was founded as the Travelers Insurance Company of Hartford, Connecticut, in 1864. During this era, the company focused on providing life insurance policies to individuals, offering a vital financial safety net to families in the event of a loved one’s passing.

Over the years, Travelers expanded its operations and diversified its offerings. In the early 20th century, the company ventured into property and casualty insurance, recognizing the growing need for coverage against accidents, natural disasters, and other unforeseen events. This strategic move positioned Travelers as a versatile insurer, capable of meeting the evolving insurance needs of its clients.

Travelers' commitment to innovation and customer satisfaction has been a hallmark of its success. Throughout its history, the company has adapted to changing market dynamics and technological advancements, ensuring its products remain relevant and accessible to a wide range of consumers. This adaptability has allowed Travelers to maintain its position as a leading insurer in a highly competitive industry.

Comprehensive Insurance Solutions for Every Need

Today, Travelers Insurance offers a vast array of insurance products tailored to meet the diverse needs of its customers. Whether you’re an individual seeking personal protection, a business owner requiring commercial coverage, or a family looking for comprehensive plans, Travelers has tailored solutions to fit your requirements.

Personal Insurance

Travelers understands that life is full of uncertainties, and personal insurance plays a crucial role in safeguarding your financial well-being. The company offers a comprehensive suite of personal insurance products, including:

- Life Insurance: Travelers provides a range of life insurance policies, from term life to permanent life insurance, ensuring your loved ones are financially protected in the event of your passing.

- Home Insurance: With Travelers’ home insurance policies, you can protect your home and its contents against damage, theft, and other risks. Whether you own a house, condominium, or rental property, Travelers has tailored coverage options to fit your needs.

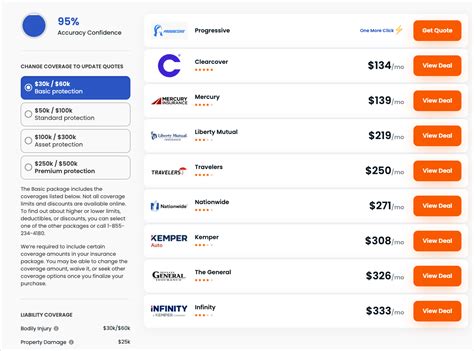

- Auto Insurance: Travelers’ auto insurance policies offer comprehensive coverage for your vehicles, including liability, collision, and comprehensive protection. Additionally, the company provides unique features like gap coverage and accident forgiveness to enhance your peace of mind on the road.

- Umbrella Insurance: For those seeking additional liability protection beyond their standard policies, Travelers offers umbrella insurance. This coverage provides an extra layer of financial security in the event of a major claim or lawsuit.

Business Insurance

Travelers recognizes that businesses face unique risks and challenges. To address these concerns, the company offers a diverse range of business insurance solutions, including:

- Commercial Property Insurance: Protect your business premises and assets with Travelers’ commercial property insurance. This coverage safeguards your business against fire, theft, and other perils, ensuring your operations can continue smoothly.

- General Liability Insurance: Mitigate the risks associated with operating a business with Travelers’ general liability insurance. This policy provides coverage for bodily injury, property damage, and personal and advertising injury claims, helping to protect your business from costly lawsuits.

- Business Owners Policy (BOP): Travelers’ BOP combines essential coverages, such as property, liability, and business interruption insurance, into one comprehensive policy. This streamlined approach offers small business owners cost-effective protection and simplifies the insurance process.

- Workers’ Compensation Insurance: Ensure the well-being of your employees and protect your business with Travelers’ workers’ compensation insurance. This coverage provides benefits to employees injured on the job, helping to manage medical expenses and lost wages, while also protecting your business from potential lawsuits.

Specialty Insurance

Travelers also caters to specialized insurance needs with its diverse range of specialty products, such as:

- Farm and Ranch Insurance: Protect your agricultural operations with Travelers’ tailored farm and ranch insurance policies. These policies cover a range of risks, including crop damage, livestock injuries, and equipment breakdowns, ensuring your farm or ranch remains a thriving business.

- Marine Insurance: Whether you own a yacht, a fishing vessel, or a commercial fleet, Travelers’ marine insurance provides the necessary coverage for your watercraft. From hull and machinery insurance to protection and indemnity coverage, Travelers has your marine ventures protected.

- Professional Liability Insurance: For professionals in fields like healthcare, engineering, and consulting, Travelers offers specialized professional liability insurance. This coverage safeguards against claims of negligence or malpractice, providing vital protection for your reputation and financial stability.

Innovative Features and Customer-Centric Approach

Travelers Insurance sets itself apart with its commitment to innovation and customer satisfaction. The company continuously strives to enhance its products and services, introducing cutting-edge features and tools to simplify the insurance process and provide added value to its customers.

One notable example is Travelers' digital initiatives, which have revolutionized the way customers interact with their insurance policies. Through the Travelers mobile app, policyholders can access their insurance information, file claims, and receive real-time updates on the status of their claims. This digital convenience has transformed the insurance experience, making it more accessible and efficient for customers.

Additionally, Travelers offers a range of value-added services to its policyholders, such as 24/7 customer support, online resources, and educational materials. These resources empower customers to make informed decisions about their insurance coverage and provide assistance whenever needed. Travelers' customer-centric approach has earned the company a reputation for excellence and has contributed to its success in the highly competitive insurance market.

Conclusion: A Trusted Partner for Your Insurance Needs

Travelers Insurance has earned its reputation as a trusted provider of insurance solutions through its rich history, comprehensive product offerings, and unwavering commitment to customer satisfaction. Whether you’re an individual, a business owner, or a family, Travelers has the expertise and resources to tailor insurance coverage to your unique needs.

With its innovative features, digital capabilities, and customer-centric approach, Travelers continues to lead the way in the insurance industry. As you navigate the complex world of insurance, Travelers stands as a reliable partner, offering financial protection and peace of mind for your personal and business ventures. Trust Travelers to be your companion on the journey toward a secure and prosperous future.

What sets Travelers Insurance apart from other insurance providers?

+Travelers Insurance distinguishes itself through its rich history, extensive product offerings, and commitment to innovation. The company’s century-long presence in the industry has allowed it to develop a deep understanding of customer needs, resulting in comprehensive insurance solutions. Travelers’ focus on digital transformation and customer-centric approaches further sets it apart, ensuring a seamless and efficient insurance experience for its policyholders.

How can I choose the right insurance coverage from Travelers Insurance?

+Choosing the right insurance coverage depends on your unique needs and circumstances. Travelers Insurance offers a wide range of products, from personal to business insurance. Assess your risks, consider your assets, and evaluate your financial situation to determine the appropriate level of coverage. You can also consult with Travelers’ experienced agents who can guide you through the process and tailor a policy that aligns with your requirements.

What are the benefits of using Travelers’ digital platforms and mobile app?

+Travelers’ digital platforms and mobile app offer numerous benefits to policyholders. These tools provide convenient access to your insurance information, allowing you to manage your policies, view coverage details, and make payments anytime, anywhere. In the event of a claim, the app simplifies the process, enabling you to file claims, track their progress, and receive real-time updates. Additionally, these digital resources provide valuable resources and educational materials to enhance your understanding of insurance and help you make informed decisions.