Inexpensive Insurance Auto

In today's fast-paced world, having a reliable vehicle is often a necessity, but the associated costs can be a significant burden, with auto insurance being a crucial yet often overlooked expense. Finding inexpensive auto insurance that offers comprehensive coverage is a challenge many drivers face. This article aims to provide an in-depth guide to navigating the auto insurance market, offering strategies to secure the best coverage at the most affordable rates.

The quest for affordable auto insurance involves a delicate balance between cost and coverage, requiring an understanding of the market, your specific needs, and some clever negotiating tactics. With the right approach, you can find policies that offer protection without breaking the bank.

Whether you're a seasoned driver or a novice on the road, this comprehensive guide will arm you with the knowledge and tools to make informed decisions about your auto insurance, ensuring you get the coverage you need at a price you can afford.

Understanding Auto Insurance Basics

Coverage Types

Auto insurance is a complex landscape with various coverage types tailored to different needs and legal requirements. Understanding these types is crucial for choosing the right policy.

- Liability Coverage: This is the most basic form of auto insurance, covering damages caused to others in an accident for which you are at fault. It is typically mandated by law and includes bodily injury liability and property damage liability.

- Collision Coverage: This optional coverage pays for repairs to your vehicle after an accident, regardless of fault. It is particularly beneficial for newer or leased vehicles.

- Comprehensive Coverage: This coverage protects against non-collision incidents like theft, vandalism, weather damage, or collisions with animals. It is often recommended for vehicles that are fully paid off.

- Personal Injury Protection (PIP): PIP, or no-fault insurance, covers medical expenses for you and your passengers, regardless of who is at fault in an accident. It is required in some states.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Factors Affecting Premiums

The cost of auto insurance, known as the premium, is influenced by several factors. Being aware of these can help you navigate the market more effectively and potentially lower your costs.

- Driving Record: A clean driving history can lead to lower premiums, as it indicates a lower risk to the insurer. On the other hand, a history of accidents or traffic violations can significantly increase your rates.

- Vehicle Type: The make, model, and year of your vehicle play a role in determining premiums. Sports cars and luxury vehicles often have higher insurance costs due to their higher repair costs and increased risk of theft.

- Location: The area where you live and drive can impact your rates. Urban areas generally have higher premiums due to increased traffic and the higher likelihood of accidents or theft.

- Age and Gender: Younger drivers, especially males, are statistically more likely to be involved in accidents, leading to higher premiums. As you age, your rates may decrease, especially if you maintain a clean driving record.

- Credit Score: In many states, insurers use your credit score to determine your premium. A higher credit score often corresponds to lower insurance rates.

- Claims History: Filing frequent claims, even for minor incidents, can increase your premiums. Insurers may view you as a higher risk, leading to higher costs.

Strategies for Affordable Coverage

Shop Around and Compare

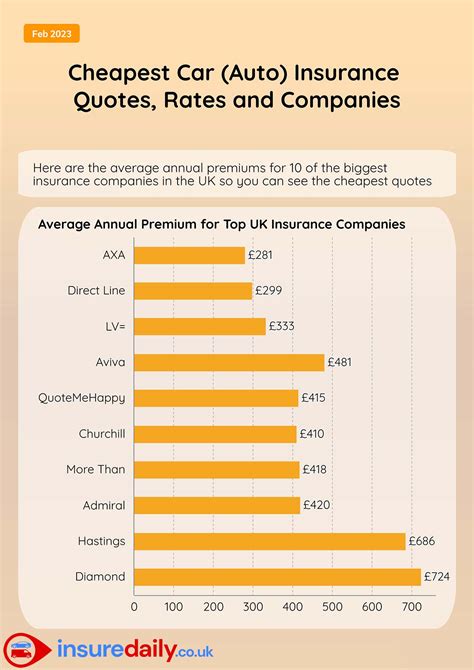

The auto insurance market is highly competitive, and rates can vary significantly between providers. Shopping around and comparing quotes is essential to finding the best deal. Online comparison tools can be particularly useful for this, allowing you to quickly see rates from multiple insurers.

Bundle Policies

Many insurers offer bundling discounts when you combine multiple policies, such as auto and home insurance. Bundling can lead to substantial savings, so it’s worth considering if you’re in the market for multiple types of insurance.

Increase Your Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can often lower your premium. However, it’s important to choose a deductible amount that you can comfortably afford in the event of a claim.

Explore Discounts

Insurance companies offer a variety of discounts to attract and retain customers. Common discounts include safe driver discounts for maintaining a clean driving record, good student discounts for young drivers with good grades, loyalty discounts for long-term customers, and multi-car discounts if you insure multiple vehicles with the same insurer.

Improve Your Credit Score

As mentioned earlier, your credit score can impact your insurance rates. Improving your credit score can lead to lower premiums. This involves practices like paying bills on time, reducing credit card balances, and limiting hard credit inquiries.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses data from a device installed in your car or an app on your phone to track your driving habits. Insurers use this data to offer personalized rates based on your actual driving behavior. This can be a good option for safe, low-mileage drivers.

Review Your Coverage Regularly

Your insurance needs may change over time, and so should your coverage. Regularly reviewing your policy and adjusting coverage as needed can help you avoid overpaying. For instance, if you’ve paid off your car, you may no longer need collision or comprehensive coverage.

Real-World Examples and Case Studies

John’s Story: Finding Affordable Coverage as a New Driver

John, a recent college graduate, needed auto insurance for his first car. With a limited budget and no prior driving experience, he faced the challenge of finding affordable coverage. By shopping around and comparing quotes, John discovered that rates varied significantly between insurers. He also learned that some insurers offered discounts for young drivers with good grades. By taking advantage of these discounts and choosing a higher deductible, John was able to secure a policy that fit his budget without compromising on essential coverage.

Sarah’s Experience: Saving with Telematics Insurance

Sarah, a cautious driver with a long-standing clean driving record, was looking to lower her insurance costs. After researching her options, she decided to try usage-based insurance. With this type of policy, her insurer provided her with a device that tracked her driving habits, including mileage, braking patterns, and times of day driven. Over the course of a year, Sarah maintained a safe driving profile, and as a result, her insurer rewarded her with lower premiums. This not only saved her money but also provided her with an incentive to continue driving safely.

Mike’s Strategy: Bundling for Savings

Mike, a homeowner and car owner, was in the market for new insurance policies for both his home and auto. Instead of purchasing separate policies, he decided to explore bundling options. He discovered that by combining his home and auto insurance with the same insurer, he could save a significant amount on his overall premiums. Additionally, the insurer offered a loyalty discount for customers who had been with the company for a certain number of years. By committing to a long-term relationship with the insurer, Mike was able to take advantage of these savings and secure affordable coverage for both his home and vehicle.

Future Trends and Implications

The Rise of Telematics and Personalized Insurance

The use of telematics and usage-based insurance is expected to grow in the coming years. This technology allows insurers to offer highly personalized rates based on individual driving behavior, which can lead to more accurate pricing and potentially lower costs for safe drivers. However, it also means that drivers with less safe habits may see their premiums increase.

The Impact of Autonomous Vehicles

As autonomous vehicles become more prevalent, the auto insurance industry will likely undergo significant changes. While the exact impact is uncertain, it’s expected that the number and severity of accidents will decrease, leading to lower insurance costs overall. However, the introduction of new technologies may also introduce new risks and complexities that insurers will need to address.

The Role of Data Analytics

The auto insurance industry is increasingly leveraging data analytics to improve risk assessment and pricing accuracy. This includes using advanced algorithms to analyze vast amounts of data, such as driving behavior, vehicle performance, and even social media activity, to better understand customer risk profiles. While this can lead to more efficient and accurate pricing, it also raises concerns about data privacy and the potential for discrimination based on non-driving-related factors.

Conclusion: Empowering Drivers with Knowledge

Finding inexpensive auto insurance is not just about comparing rates; it's about understanding the factors that influence premiums and knowing how to navigate the market to your advantage. By staying informed about coverage options, shopping around, and exploring discounts, you can secure the coverage you need without straining your budget.

The auto insurance landscape is constantly evolving, with new technologies and data analytics shaping the industry. By staying up-to-date with these trends and being proactive in managing your insurance, you can ensure you're getting the best value for your money.

Remember, the key to affordable auto insurance is a combination of knowledge, strategic planning, and a willingness to shop around. With these tools at your disposal, you can drive with confidence, knowing you have the right coverage at the right price.

How often should I review my auto insurance policy to ensure I’m getting the best rates and coverage?

+

It’s a good practice to review your policy annually, especially if your circumstances have changed (e.g., a new car, a move to a different area, or a change in marital status). Regular reviews allow you to stay up-to-date with your coverage and take advantage of any new discounts or changes in your risk profile.

Can my credit score really impact my auto insurance rates, and if so, how much can it affect my premiums?

+

Yes, in many states, insurers use credit-based insurance scores to determine your premium. These scores are different from your FICO credit score but are influenced by similar factors. The impact of your credit score on your insurance rates can vary, but generally, a higher credit score can lead to lower premiums, while a lower credit score can result in significantly higher rates.

What are some common discounts offered by auto insurance providers, and how can I qualify for them?

+

Common discounts include safe driver discounts (for maintaining a clean driving record), good student discounts (for young drivers with good grades), multi-car discounts (if you insure more than one vehicle), and loyalty discounts (for long-term customers). To qualify for these discounts, you typically need to meet certain criteria, such as having no at-fault accidents or traffic violations, maintaining good grades, or having been with the insurer for a certain number of years.