Group Medical Insurance Plans

In the complex landscape of healthcare, group medical insurance plans emerge as a vital component, offering comprehensive coverage to employees and their families. These plans are not just about providing healthcare benefits; they are a strategic tool for employers to attract and retain talent, and for employees, they represent a crucial safety net in an increasingly uncertain healthcare environment. As we delve into the intricacies of group medical insurance, we'll uncover the key features, the benefits it offers, and its significant impact on both businesses and individuals.

Understanding Group Medical Insurance

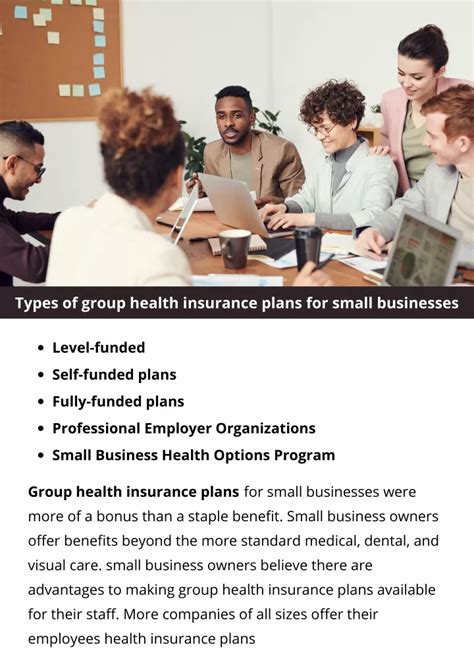

Group medical insurance plans are designed to provide healthcare coverage to a defined group of people, typically employees of a company or organization, and often their dependents as well. These plans are characterized by their ability to offer extensive coverage at a more affordable rate compared to individual insurance plans. The principle behind this is simple: by pooling together a large group of individuals, the insurance company can spread the risk and, consequently, offer more competitive premiums.

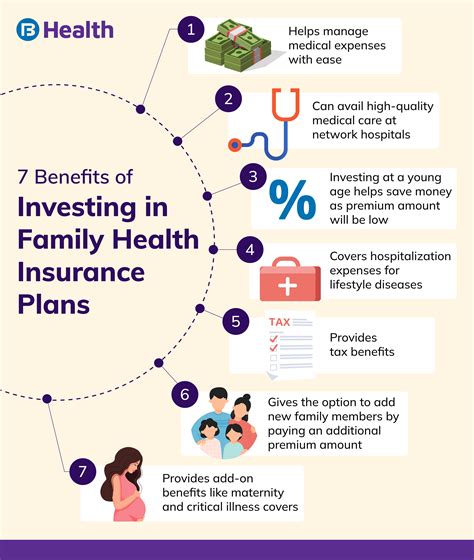

These plans can vary widely in their structure and benefits, tailored to meet the unique needs of each employer and their workforce. From comprehensive coverage that includes hospitalization, surgery, and outpatient care, to more specialized plans covering specific conditions or treatments, the options are diverse. Furthermore, many group insurance plans offer additional benefits such as dental, vision, and prescription drug coverage, enhancing the overall healthcare experience for employees.

Key Benefits and Features

Cost-Effectiveness

One of the primary advantages of group medical insurance is its cost-effectiveness. When employers offer group insurance, they can negotiate better rates with insurance providers due to the large number of individuals covered. This results in lower premiums for both the employer and employees, making quality healthcare more accessible.

Moreover, group plans often come with additional benefits that individual plans might not offer, such as wellness programs, disease management initiatives, and preventive care services. These added features can significantly enhance the overall health and well-being of employees, further reducing potential healthcare costs in the long run.

Comprehensive Coverage

Group medical insurance plans are renowned for their comprehensive coverage. They typically include a wide range of services and treatments, from routine check-ups and preventive care to more complex procedures and specialist consultations. Many plans also offer coverage for pre-existing conditions, ensuring that employees receive the care they need without financial strain.

In addition, group plans often provide coverage for mental health services, which are increasingly recognized as an essential component of overall health. This comprehensive approach to healthcare ensures that employees can access a full spectrum of medical services, promoting both physical and mental well-being.

Customizable Options

One of the most appealing aspects of group medical insurance is its flexibility. Employers can customize the plan to suit the specific needs of their workforce, taking into account factors such as age, health status, and family size. This customization ensures that the plan is not only cost-effective but also relevant and beneficial to the entire employee population.

For instance, an employer might opt for a plan with higher coverage limits for hospitalization and surgery, recognizing that these are common healthcare needs among their older employees. Alternatively, for a younger workforce, the focus might be on preventive care and wellness initiatives to promote long-term health.

| Plan Type | Key Features |

|---|---|

| Basic Coverage | Covers essential healthcare needs like hospitalization, surgery, and routine check-ups. |

| Comprehensive Coverage | Offers a wide range of benefits including outpatient care, prescription drug coverage, and mental health services. |

| Specialized Plans | Tailored to specific needs such as maternity care, chronic disease management, or dental/vision care. |

Impact on Employees and Businesses

Employee Well-being and Retention

Group medical insurance plans play a pivotal role in enhancing employee well-being and satisfaction. By providing access to quality healthcare, these plans ensure that employees can manage their health effectively, leading to improved productivity and overall job satisfaction. Moreover, offering competitive group insurance plans can be a significant factor in attracting and retaining top talent in today’s competitive job market.

Employees with access to comprehensive group insurance are more likely to take advantage of preventive care services, which can help identify and manage health issues early on. This not only improves their personal health outcomes but also reduces the risk of more serious health complications and associated costs.

Financial Stability and Risk Management

For businesses, group medical insurance is a strategic tool for managing financial risks associated with employee healthcare. By negotiating group rates, employers can control healthcare costs more effectively, which is especially beneficial for small and medium-sized businesses that might otherwise struggle to provide comprehensive healthcare benefits.

Additionally, group insurance plans often include features like stop-loss coverage, which protects employers from extremely high claims by one or a few individuals. This risk-sharing mechanism ensures that businesses can provide extensive healthcare benefits without the fear of financial strain.

Compliance and Legal Considerations

In many regions, offering group medical insurance is not just a strategic choice but a legal requirement. For instance, in the United States, the Affordable Care Act mandates that certain employers offer health insurance to their full-time employees. Failure to comply can result in significant penalties. Group insurance plans, therefore, help businesses meet these legal obligations while also providing valuable benefits to their workforce.

Furthermore, by offering group insurance, employers demonstrate a commitment to their employees' well-being, which can enhance company reputation and employee morale. This, in turn, can lead to improved customer perception and loyalty, contributing to the long-term success of the business.

Future Trends and Innovations

The landscape of group medical insurance is evolving rapidly, driven by advancements in technology, changing consumer preferences, and shifts in the healthcare industry. Here are some key trends and innovations that are shaping the future of group medical insurance plans:

Telemedicine and Virtual Care

The rise of telemedicine and virtual care services has been a game-changer in the healthcare industry. Group insurance plans are increasingly incorporating telemedicine benefits, allowing employees to access medical advice and consultations remotely. This not only enhances convenience and accessibility but also reduces the need for in-person visits, potentially lowering healthcare costs.

Virtual care services can include video consultations with healthcare professionals, remote monitoring of chronic conditions, and even virtual therapy sessions. By integrating these services into group plans, employees can receive timely medical care without the barriers of distance or travel, particularly beneficial for those in rural or remote areas.

Personalized Medicine and Precision Health

Advancements in genomics and personalized medicine are revolutionizing the way healthcare is delivered. Group medical insurance plans are starting to incorporate elements of personalized medicine, such as genetic testing and precision health initiatives. These approaches tailor healthcare interventions to an individual’s unique genetic makeup, lifestyle, and environment, potentially improving health outcomes and efficiency.

For instance, genetic testing can identify predispositions to certain diseases, allowing for early intervention and preventive measures. Precision health initiatives can also customize treatment plans based on an individual's genetic profile, optimizing the effectiveness of healthcare interventions.

Wellness and Preventive Care Initiatives

There is a growing emphasis on wellness and preventive care within group medical insurance plans. Employers are recognizing the long-term benefits of investing in employee health, not just in terms of reduced healthcare costs but also in improved productivity and morale. As a result, many group plans are incorporating wellness programs and incentives to encourage healthy behaviors.

These initiatives can include fitness challenges, nutrition counseling, stress management programs, and smoking cessation support. By promoting healthy lifestyles, these programs can help prevent chronic diseases and reduce the need for costly medical interventions down the line.

Data-Driven Decision Making

The healthcare industry is increasingly leveraging data analytics and artificial intelligence to improve decision-making and efficiency. Group medical insurance plans are no exception, with insurers and employers using data-driven insights to optimize plan designs and benefits. By analyzing large sets of healthcare data, insurers can identify trends, predict future healthcare needs, and design plans that are more responsive to the changing healthcare landscape.

For instance, data analytics can help identify which preventive services are most effective in reducing healthcare costs and improving health outcomes. This information can then be used to design more targeted and effective wellness programs and preventive care initiatives within group plans.

Consumer-Driven Health Plans

Consumer-driven health plans, such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), are gaining popularity in the group insurance market. These plans give employees more control over their healthcare spending, encouraging them to be more conscious consumers of healthcare services. By offering these plans as part of their benefits package, employers can help employees save on taxes and manage their healthcare expenses more effectively.

HSAs and HRAs often come with high-deductible health plans, which can be more cost-effective for employers. However, these plans require employees to be more engaged in their healthcare decisions, encouraging them to compare costs and shop around for the best value in healthcare services.

Flexible and Portable Benefits

There is a growing trend towards flexible and portable benefits in group medical insurance plans. Employers are recognizing that a one-size-fits-all approach to healthcare benefits may not meet the diverse needs of their workforce. As such, many are offering flexible benefits packages that allow employees to choose the benefits that best suit their individual needs.

For instance, some employers offer a menu of benefits, allowing employees to select from different levels of coverage for medical, dental, and vision care. Others provide a defined contribution amount that employees can use to purchase the benefits of their choice, whether it's additional coverage for a specific condition or a wellness program that aligns with their personal health goals.

Conclusion

Group medical insurance plans are a cornerstone of employee benefits, offering a comprehensive and cost-effective approach to healthcare coverage. From enhancing employee well-being and satisfaction to managing financial risks for businesses, these plans play a critical role in the modern workplace. As the healthcare landscape continues to evolve, group insurance plans will need to adapt and innovate to meet the changing needs of employers and employees alike.

By staying informed about the latest trends and advancements in group medical insurance, employers can ensure they are offering competitive benefits that meet the needs of their workforce. This not only helps attract and retain top talent but also contributes to a healthier, more productive workforce, ultimately driving business success.

What are the key factors to consider when choosing a group medical insurance plan for my business?

+When selecting a group medical insurance plan, consider factors such as the age and health status of your workforce, the level of coverage needed (basic, comprehensive, or specialized), the cost of premiums, and the additional benefits offered (e.g., wellness programs, telemedicine services). It’s also crucial to assess the financial stability and reputation of the insurance provider.

How can group medical insurance plans benefit small businesses with limited resources?

+Group insurance plans can be a cost-effective solution for small businesses, as they can negotiate better rates with insurance providers due to the larger group size. Additionally, many group plans offer flexible coverage options, allowing small businesses to tailor the plan to their specific needs and budget. This ensures that even small businesses can provide valuable healthcare benefits to their employees.

What are some strategies to encourage employee engagement and utilization of group medical insurance benefits?

+To encourage employee engagement, consider hosting educational sessions or workshops to explain the benefits of the group insurance plan. Provide clear and concise communication materials outlining the plan’s coverage and features. Additionally, offer incentives for employees who actively participate in wellness programs or utilize preventive care services. Regularly assessing employee feedback can also help tailor the plan to better meet their needs.