Nationwide Insurance Auto Quote

Exploring Nationwide Insurance: A Comprehensive Guide to Auto Quotes

When it comes to safeguarding your vehicle and securing peace of mind on the road, Nationwide Insurance stands out as a prominent player in the insurance industry. In this comprehensive guide, we will delve into the world of Nationwide Insurance auto quotes, exploring the factors that influence rates, the coverage options available, and the steps you can take to secure a competitive quote. Join us as we navigate the intricate process of auto insurance, empowering you to make informed decisions for your vehicular protection.

Understanding Nationwide Insurance's Approach to Auto Quotes

Nationwide Insurance, a trusted name in the insurance sector, boasts a comprehensive approach to auto insurance. The company's commitment to providing personalized coverage options and competitive rates sets it apart from its competitors. By understanding the unique factors that influence auto insurance quotes, Nationwide Insurance strives to offer tailored solutions to meet the diverse needs of its customers.

At the core of Nationwide Insurance's auto quote process lies a meticulous assessment of various factors. These factors include the make and model of your vehicle, your driving history, and the geographical location where you primarily operate your vehicle. Additionally, Nationwide Insurance considers individual characteristics such as age, gender, and marital status, as these variables can significantly impact insurance rates.

One of the key strengths of Nationwide Insurance's auto quote system is its adaptability. The company understands that each driver's circumstances are unique, and thus, it offers a range of coverage options to cater to these diverse needs. Whether you require comprehensive coverage for a brand-new vehicle or prefer a more basic liability-only plan for an older car, Nationwide Insurance strives to provide customized solutions.

Furthermore, Nationwide Insurance is dedicated to making the auto quote process as transparent and straightforward as possible. The company provides online tools and resources that allow prospective customers to obtain quotes quickly and conveniently. These digital platforms not only streamline the quote-obtaining process but also empower individuals to make informed decisions about their auto insurance coverage.

Factors Influencing Nationwide Insurance Auto Quotes

When requesting an auto quote from Nationwide Insurance, several key factors come into play, each influencing the final quote you receive. Understanding these factors is essential for making sense of your quote and identifying opportunities to optimize your insurance coverage.

- Vehicle Information: The make, model, and year of your vehicle play a significant role in determining your auto insurance rates. Generally, newer and more expensive vehicles tend to carry higher insurance costs due to their higher replacement and repair values.

- Driving History: Your driving record is a critical factor in assessing your insurance risk. A clean driving history with no accidents or violations can lead to more favorable insurance rates. Conversely, a history of accidents or traffic violations may result in higher premiums.

- Location: The geographical area where you primarily drive your vehicle also impacts your insurance quote. Factors such as local crime rates, traffic congestion, and the incidence of natural disasters can all influence insurance rates in a particular region.

- Individual Characteristics: Nationwide Insurance considers individual factors such as age, gender, and marital status when determining auto insurance quotes. While these variables may not directly correlate with driving ability, they are statistically linked to different risk profiles and can thus impact insurance rates.

Exploring Nationwide Insurance's Coverage Options

Nationwide Insurance offers a comprehensive range of coverage options to cater to the diverse needs of its customers. Whether you're seeking basic liability coverage or comprehensive protection, Nationwide Insurance has a plan tailored to your requirements. Let's delve into the various coverage options available and explore the benefits they provide.

Liability Coverage

Liability coverage is a fundamental component of any auto insurance policy. It protects you from financial liability in the event that you are found at fault for an accident that causes injury or property damage to others. Nationwide Insurance offers liability coverage options that meet the minimum legal requirements in most states, providing essential protection against lawsuits and financial losses.

Within liability coverage, Nationwide Insurance offers flexibility in terms of coverage limits. You can choose higher limits to provide greater protection against potential claims, ensuring that you have adequate coverage in the event of a severe accident. Additionally, Nationwide Insurance provides optional liability coverage enhancements, such as umbrella policies, to further increase your protection against significant financial losses.

Collision and Comprehensive Coverage

Collision and comprehensive coverage are two essential components of a comprehensive auto insurance policy. Collision coverage protects your vehicle against damages resulting from collisions with other vehicles or objects, while comprehensive coverage provides protection against non-collision incidents such as theft, vandalism, and natural disasters.

With Nationwide Insurance, you can customize your collision and comprehensive coverage to suit your specific needs. The company offers flexible coverage limits, allowing you to choose the level of protection that aligns with the value of your vehicle. Additionally, Nationwide Insurance provides various discounts and incentives to encourage safe driving practices and reduce the risk of accidents, ultimately lowering your insurance premiums.

Additional Coverage Options

In addition to liability, collision, and comprehensive coverage, Nationwide Insurance offers a range of optional coverage enhancements to further protect your vehicle and provide added peace of mind.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event that you are involved in an accident with a driver who has little or no insurance. It ensures that you are not left financially burdened in such situations.

- Medical Payments Coverage: Also known as MedPay, this coverage provides payment for medical expenses incurred by you or your passengers as a result of an accident, regardless of fault.

- Rental Car Reimbursement: If your vehicle is damaged and requires repairs, this coverage provides reimbursement for the cost of renting a substitute vehicle during the repair period.

- Roadside Assistance: Nationwide Insurance offers roadside assistance coverage, which provides emergency services such as towing, battery jumps, and tire changes, ensuring that you have support whenever you need it on the road.

Obtaining a Nationwide Insurance Auto Quote

Now that you have a comprehensive understanding of Nationwide Insurance's auto quote process and coverage options, it's time to delve into the steps you can take to obtain a quote that aligns with your needs and budget.

Online Quote Process

Nationwide Insurance provides a user-friendly online platform that allows you to obtain auto insurance quotes conveniently from the comfort of your own home. By visiting the Nationwide Insurance website, you can access their online quote tool, which guides you through a series of simple steps to generate a personalized quote.

During the online quote process, you will be prompted to provide essential information about yourself, your vehicle, and your driving history. This information includes your name, date of birth, address, vehicle make and model, and details about any accidents or violations on your record. By accurately entering this data, you ensure that the quote you receive is tailored to your specific circumstances.

Once you have completed the online quote form, Nationwide Insurance's system will generate a preliminary quote based on the information you have provided. This quote serves as a starting point and may be subject to further adjustments based on additional factors that are not included in the online assessment.

Factors Affecting Final Quote

While the online quote provides a good estimate of your insurance costs, it is important to note that the final quote you receive may differ from the preliminary estimate. This is because Nationwide Insurance considers a range of factors that are not captured in the online assessment.

For instance, Nationwide Insurance may conduct a more detailed analysis of your driving history, including any accidents or violations that were not disclosed during the online quote process. Additionally, the company may assess your credit score, as insurance providers often use credit-based insurance scores to determine insurance rates. A higher credit score can lead to more favorable insurance rates, while a lower score may result in higher premiums.

Customizing Your Coverage

Once you have obtained a preliminary quote, it's important to review the coverage options and customize your policy to align with your specific needs. Nationwide Insurance provides a range of coverage options and add-ons that allow you to tailor your policy to your preferences and budget.

You can choose the level of liability coverage that suits your comfort level and legal requirements in your state. Additionally, you can opt for collision and comprehensive coverage with varying deductibles to strike a balance between affordability and comprehensive protection. Nationwide Insurance also offers a range of optional coverage enhancements, such as rental car reimbursement and roadside assistance, which you can add to your policy for added peace of mind.

Comparing Quotes and Making a Decision

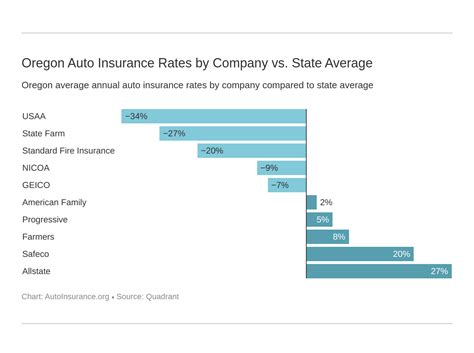

After obtaining quotes from Nationwide Insurance and potentially other insurance providers, it's crucial to compare the coverage options and prices to make an informed decision. Consider the level of coverage provided, the reputation and financial stability of the insurance company, and any additional perks or discounts offered.

Nationwide Insurance stands out for its commitment to customer satisfaction and its range of coverage options. The company's extensive network of agents and claims professionals ensures that you receive personalized support and guidance throughout the insurance process. Additionally, Nationwide Insurance offers various discounts and incentives, such as multi-policy discounts and safe driver rewards, which can help reduce your insurance costs.

Conclusion

In conclusion, Nationwide Insurance's auto quote process is designed to provide customers with personalized and competitive insurance solutions. By understanding the factors that influence auto insurance rates and exploring the range of coverage options available, you can make informed decisions about your vehicular protection. Whether you're seeking basic liability coverage or comprehensive protection, Nationwide Insurance has a plan tailored to your needs.

Remember, obtaining an auto insurance quote is just the first step. It's important to review and compare quotes from multiple providers to ensure you're getting the best coverage at the most competitive price. By taking the time to understand your options and customize your coverage, you can secure peace of mind on the road and protect your vehicle with confidence.

How long does it take to receive a Nationwide Insurance auto quote?

+Obtaining a Nationwide Insurance auto quote is a straightforward process that can typically be completed within a few minutes. The online quote tool provided by Nationwide Insurance is designed to be user-friendly and efficient, allowing you to input your information and receive a preliminary quote quickly. However, the final quote may take a bit longer as it involves a more detailed assessment of your driving history and other relevant factors.

Can I customize my Nationwide Insurance auto policy after obtaining a quote?

+Absolutely! Nationwide Insurance understands that every driver’s needs are unique, and they offer a range of coverage options to cater to those needs. Once you have obtained a quote, you can review and customize your coverage to align with your specific requirements. You can choose the level of liability coverage, collision and comprehensive coverage, and add optional enhancements to create a personalized policy that suits your budget and preferences.

Are there any discounts available with Nationwide Insurance auto policies?

+Yes, Nationwide Insurance offers a variety of discounts to help reduce your insurance costs. These discounts may include multi-policy discounts if you bundle your auto insurance with other policies, such as homeowners or renters insurance. Safe driver discounts are also available for drivers with a clean driving record. Additionally, Nationwide Insurance may offer discounts for completing defensive driving courses or for being a loyal customer.