Worker Insurance

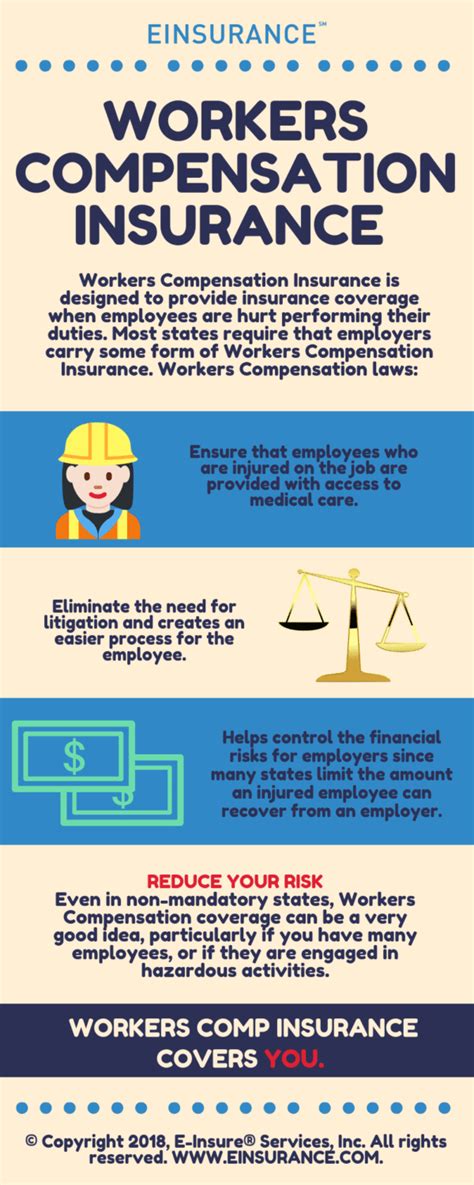

Worker insurance, also known as workers' compensation or workmen's compensation, is a critical aspect of the employment landscape. It is a form of insurance that provides wage replacement and medical benefits to employees who are injured or become ill as a result of their job. This comprehensive guide will delve into the intricacies of worker insurance, exploring its history, coverage, benefits, and the impact it has on both employees and employers.

A Historical Perspective on Worker Insurance

The concept of worker insurance has evolved significantly over the years, shaping labor laws and employee rights worldwide. Its origins can be traced back to ancient times when societies recognized the need to support those who were injured while performing labor-intensive tasks. However, it was during the Industrial Revolution that the true necessity for comprehensive worker protection became evident.

In the late 19th century, as industries grew and the number of workplace accidents soared, governments and employers began to address the issue. The first worker insurance laws emerged in Europe, with Germany taking the lead in 1884 under the leadership of Otto von Bismarck. This marked a pivotal moment in labor history, as it set a precedent for providing financial security to workers who faced the risks of industrial labor.

The United States followed suit, with individual states passing their own worker compensation laws. Over time, these laws became more standardized, ensuring that workers across the country received fair and consistent treatment. Today, worker insurance is a cornerstone of employment, providing a safety net for millions of workers and their families.

Understanding Worker Insurance Coverage

Worker insurance offers a wide range of coverage, designed to address the diverse needs of injured or ill employees. Here’s an overview of the key aspects:

Medical Benefits

This is perhaps the most critical component, as it covers the cost of medical treatment for work-related injuries or illnesses. Medical benefits can include:

- Doctor visits and hospital stays.

- Prescription medications.

- Diagnostic tests and procedures.

- Rehabilitation and physical therapy.

- Prosthetics and assistive devices.

Wage Replacement

Worker insurance ensures that employees receive a portion of their wages while they are unable to work due to their injury or illness. The specific amount and duration of wage replacement vary depending on the jurisdiction and the severity of the case. Typically, workers are entitled to a percentage of their average weekly wages, which is calculated based on their earnings history.

Vocational Rehabilitation

In cases where an employee’s injury or illness prevents them from returning to their previous job, worker insurance may provide vocational rehabilitation services. These services aim to help the worker develop new skills and find suitable employment that accommodates their physical limitations. Vocational rehabilitation can include job training, career counseling, and job placement assistance.

Survivor Benefits

In the unfortunate event of a worker’s death due to a work-related incident, worker insurance provides survivor benefits to the worker’s dependents. These benefits can include a death benefit payment and ongoing financial support, ensuring the worker’s family is not left destitute.

| Coverage Type | Description |

|---|---|

| Medical Benefits | Covers the cost of treatment for work-related injuries or illnesses. |

| Wage Replacement | Provides a portion of an employee's wages during their recovery. |

| Vocational Rehabilitation | Assists workers in transitioning to new careers if their injury prevents them from returning to their previous job. |

| Survivor Benefits | Offers financial support to the dependents of workers who pass away due to work-related incidents. |

The Benefits of Worker Insurance

Worker insurance brings a multitude of advantages to both employees and employers, fostering a more secure and productive work environment.

Employee Benefits

For employees, worker insurance provides a sense of security and peace of mind. Knowing that they are covered in the event of a workplace accident or illness can alleviate financial worries and allow them to focus on their recovery. Additionally, worker insurance ensures that employees receive timely and appropriate medical care, promoting their overall well-being.

Furthermore, worker insurance protects employees from potential financial ruin. Without this insurance, an injured worker might face mounting medical bills and a loss of income, leading to severe financial strain. Worker insurance acts as a safety net, preventing employees from falling into debt or becoming dependent on social welfare programs.

Employer Benefits

From an employer’s perspective, worker insurance is a crucial risk management tool. By providing insurance coverage, employers demonstrate their commitment to the health and safety of their workforce. This can boost employee morale, enhance productivity, and reduce absenteeism.

Worker insurance also protects employers from potential lawsuits. In the past, injured workers often had to resort to costly and time-consuming litigation to receive compensation. With worker insurance, employees are provided with a more efficient and standardized process, reducing the likelihood of legal disputes and the associated expenses.

Moreover, worker insurance can help employers attract and retain top talent. In a competitive job market, offering comprehensive insurance benefits can make a company more appealing to prospective employees. It signals to workers that the company values their well-being and is willing to invest in their security.

Challenges and Future Implications

While worker insurance has come a long way, it continues to face challenges and evolving needs. One of the primary concerns is keeping up with the changing nature of work. With the rise of gig economy jobs and remote work, traditional worker insurance models may need to adapt to ensure coverage for a broader range of workers.

Another challenge is the rising cost of healthcare. As medical expenses increase, worker insurance programs must find ways to remain sustainable without placing an undue burden on employers or employees. This may involve exploring innovative solutions, such as telemedicine or preventive health programs, to reduce overall healthcare costs.

Looking ahead, worker insurance is likely to play an even more significant role in shaping the future of work. As automation and technology continue to transform industries, the risk of workplace injuries and illnesses may shift, requiring worker insurance programs to adapt and provide coverage for new types of hazards.

Additionally, there is a growing focus on mental health in the workplace. Worker insurance programs may need to expand their scope to include coverage for mental health conditions, recognizing the impact of stress, burnout, and other psychological issues on employee well-being and productivity.

What happens if an employee’s injury is not work-related?

+

Worker insurance typically covers injuries or illnesses that arise from and in the course of employment. If an injury is not work-related, it may not be covered by worker insurance. However, employees can still seek compensation through personal health insurance or other means.

Can an employer deny worker insurance benefits to an injured employee?

+

In most jurisdictions, employers are legally required to provide worker insurance coverage to their employees. Denying benefits to an injured worker could result in legal consequences for the employer. However, there may be certain circumstances where an employer can dispute a claim, such as if the injury was self-inflicted or the result of gross negligence.

How long does it take to receive worker insurance benefits after an injury?

+

The timeframe for receiving worker insurance benefits can vary depending on the jurisdiction and the complexity of the case. In general, employees should receive prompt medical treatment for their injuries, and wage replacement benefits should start within a few weeks. However, more complex cases may require additional investigations, potentially prolonging the process.