Are You Required To Have Homeowners Insurance

Homeownership is a significant milestone, but it comes with its fair share of responsibilities. One of the crucial aspects often overlooked is homeowners insurance, a vital safeguard for your biggest investment. In this comprehensive guide, we delve into the intricacies of homeowners insurance, exploring its legalities, benefits, and the potential consequences of forgoing this essential coverage.

Understanding Homeowners Insurance: A Legal and Practical Necessity

Homeowners insurance serves as a protective shield, safeguarding your home and its contents from various perils. But is it a legal requirement? The answer is not a straightforward yes or no, as it varies depending on your circumstances and location.

While some states in the United States do not mandate homeowners insurance by law, there are compelling reasons why it should be considered a necessity. Lenders, for instance, often require borrowers to maintain homeowners insurance as a condition of their mortgage. This requirement is not arbitrary; it serves to protect the lender's investment in the property.

Beyond legal obligations, homeowners insurance offers a layer of financial protection that can prove invaluable in the face of unforeseen circumstances. From natural disasters like hurricanes and wildfires to more common occurrences such as burglaries or plumbing failures, homeowners insurance provides coverage for a wide range of events.

The Legal Landscape: A State-by-State Overview

To understand the legal requirements surrounding homeowners insurance, it's essential to examine the regulations in different states. While no state explicitly mandates homeowners insurance for owner-occupied residences, certain circumstances can make it a legal obligation.

For instance, Florida, a state prone to hurricanes, requires homeowners to carry insurance if their mortgage is backed by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). Similarly, California, known for its seismic activity, may require homeowners insurance as a condition of obtaining a mortgage.

In states like Texas and New York, while homeowners insurance is not legally mandated, it is often a practical necessity. These states experience a range of natural disasters, from hurricanes and tornadoes to blizzards and floods, making insurance coverage a prudent choice.

| State | Legal Requirement |

|---|---|

| Florida | Required for FHA/VA-backed mortgages |

| California | Common for mortgage loans |

| Texas | Not mandatory, but highly recommended |

| New York | Not legally required, but practical for disaster protection |

The Benefits of Homeowners Insurance: Peace of Mind and Financial Security

Beyond legal obligations, homeowners insurance offers a myriad of benefits that contribute to peace of mind and financial security.

Protection Against Natural Disasters

One of the most significant advantages of homeowners insurance is its coverage against natural disasters. From hurricanes and tornadoes to earthquakes and wildfires, these events can cause extensive damage to your home and belongings. With homeowners insurance, you gain financial protection, ensuring you have the means to rebuild and recover.

Coverage for Burglary and Theft

Homeowners insurance also provides coverage for burglary and theft. Should your home be broken into, you can file a claim to recover the value of stolen items and even receive compensation for any damage caused during the burglary.

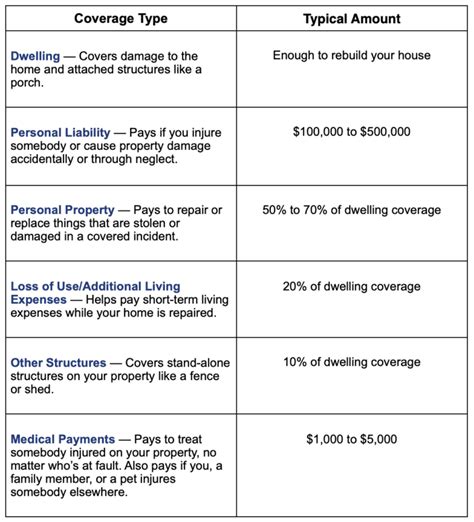

Liability Protection

An often-overlooked benefit of homeowners insurance is its liability coverage. If someone is injured on your property, your insurance can provide financial protection against potential lawsuits. This coverage extends to instances like a guest tripping on your staircase or a child getting injured while playing in your yard.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered loss, homeowners insurance can cover your additional living expenses. This includes hotel stays, meals, and other costs incurred while your home is being repaired or rebuilt.

Personal Property Coverage

Homeowners insurance typically includes coverage for your personal belongings, such as furniture, electronics, and clothing. In the event of a loss, you can receive compensation for the replacement or repair of these items, ensuring you're not left financially burdened.

Consequences of Forgoing Homeowners Insurance

While it may seem like an optional expense, forgoing homeowners insurance can have significant consequences. Without this coverage, you're leaving yourself vulnerable to financial ruin in the event of a disaster or other covered loss.

Financial Risk in the Face of Disasters

Natural disasters can strike without warning, and the financial burden of rebuilding or repairing your home can be overwhelming. Without insurance, you're responsible for covering these costs out of pocket, which can be financially devastating.

Lack of Coverage for Burglary and Theft

If your home is broken into and you don't have homeowners insurance, you'll be responsible for replacing stolen items and repairing any damage caused during the burglary. This can be a significant financial strain, especially if you have valuable possessions.

Legal and Financial Liability

Without homeowners insurance, you're exposed to potential legal and financial liability. If someone is injured on your property and you're found at fault, you could face costly lawsuits. Without insurance coverage, you'll be responsible for paying these expenses, which can quickly add up.

Limited Access to Mortgage Loans

Many lenders require homeowners insurance as a condition of their mortgage loans. Without this coverage, you may find it challenging to secure financing for your home, limiting your options and potentially impacting your ability to own a home.

Choosing the Right Homeowners Insurance Policy

When selecting a homeowners insurance policy, it's essential to consider your specific needs and circumstances. Here are some key factors to keep in mind:

- Coverage Limits: Ensure your policy provides adequate coverage for your home's value and your personal belongings.

- Deductibles: Choose a deductible that aligns with your financial comfort level. Higher deductibles can lower your premium, but ensure you can afford the out-of-pocket expense in the event of a claim.

- Additional Coverages: Consider adding optional coverages like flood insurance or earthquake insurance if you live in high-risk areas.

- Provider Reputation: Research insurance providers to ensure they have a strong financial standing and a good track record of paying claims.

FAQs: Homeowners Insurance Explained

What happens if I don’t have homeowners insurance and my home is damaged by a covered loss?

+

If you don’t have homeowners insurance and your home is damaged by a covered loss, you’ll be responsible for covering the costs of repairs and any associated expenses out of your own pocket. This can be financially devastating, especially if the damage is extensive.

Can I get homeowners insurance if I rent my home out to tenants?

+

Yes, you can obtain homeowners insurance even if you rent your home to tenants. However, it’s important to note that homeowners insurance primarily covers the structure and your personal belongings. For liability protection related to your tenants, you may need to consider landlord insurance or additional liability coverage.

Are there any circumstances where homeowners insurance is not necessary?

+

While homeowners insurance is not legally mandated in most states, there are a few scenarios where it may not be necessary. For instance, if you own a vacation home that you only use a few weeks a year, you may choose to forgo insurance. However, it’s essential to carefully consider the risks and potential costs before making this decision.