Cheap Vehicle Insurance Near Me

Finding affordable vehicle insurance is a top priority for many drivers, and with the right knowledge and strategies, it's possible to secure coverage that fits your budget without compromising on essential protections. In this comprehensive guide, we'll delve into the world of vehicle insurance, exploring various factors that influence rates, offering tips to identify cheap options near you, and providing insights to ensure you make informed decisions.

Understanding the Factors That Affect Vehicle Insurance Rates

Vehicle insurance rates are influenced by a multitude of factors, each playing a unique role in determining the overall cost of coverage. These factors can be broadly categorized into two main groups: personal circumstances and vehicle-related aspects.

Personal Circumstances

Your personal details and driving history significantly impact insurance rates. Insurers consider factors such as your age, gender, marital status, and credit score. For instance, young drivers and those with poor credit scores often face higher premiums due to perceived higher risk. Additionally, your driving record is scrutinized, with a history of accidents or traffic violations leading to increased costs.

Vehicle-Related Aspects

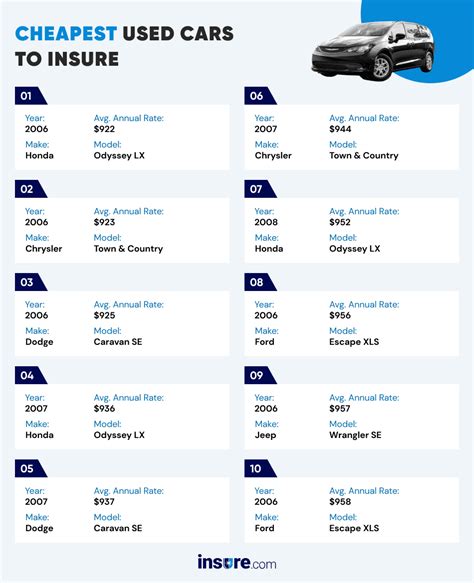

The type of vehicle you own and its usage also influence insurance rates. Insurers consider factors like the make, model, and year of your vehicle, as well as its safety features and repair costs. Vehicles with high-performance engines or those prone to theft and accidents typically result in higher premiums. Furthermore, the primary purpose of your vehicle (e.g., commuting, business use) and the annual mileage you cover can affect your insurance costs.

Strategies to Find Cheap Vehicle Insurance Near You

Now that we understand the key factors, let’s explore practical strategies to identify affordable vehicle insurance options in your area.

Shop Around and Compare Quotes

One of the most effective ways to find cheap insurance is by comparing quotes from multiple providers. Utilize online tools and insurance marketplaces to request quotes from various insurers. This process allows you to quickly assess different options and identify the most cost-effective coverage for your needs. Remember, insurance rates can vary significantly between providers, so it’s crucial to explore multiple options.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies together. Consider combining your vehicle insurance with other types of coverage, such as homeowners or renters insurance. By doing so, you can often secure a discounted rate on your vehicle insurance, making it more affordable.

Increase Your Deductible

Opting for a higher deductible can lead to reduced insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to a higher deductible, you essentially share a portion of the risk with your insurer, which can result in lower monthly premiums. However, it’s essential to choose a deductible amount that you can comfortably afford in the event of an accident or claim.

Take Advantage of Discounts

Insurance companies often offer various discounts to attract and retain customers. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and even discounts for completing defensive driving courses. Be sure to inquire about available discounts and meet the necessary criteria to qualify. By taking advantage of these discounts, you can significantly reduce your insurance costs.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that allows insurers to track your driving habits and reward safe driving behavior with lower premiums. This type of insurance typically involves installing a telematics device in your vehicle, which monitors factors like driving distance, acceleration, and braking. By demonstrating safe driving practices, you can potentially qualify for substantial discounts on your insurance.

Tips for Choosing the Right Vehicle Insurance Provider

Once you’ve identified affordable insurance options, it’s essential to evaluate the providers to ensure you’re selecting the best coverage for your needs.

Research the Insurer’s Reputation

Before committing to an insurance provider, conduct thorough research to assess their reputation and financial stability. Check online reviews, customer feedback, and ratings from reputable organizations like the Better Business Bureau (BBB) or J.D. Power. A solid reputation and financial strength indicate that the insurer is likely to provide reliable coverage and timely claim settlements.

Understand the Coverage Options

Different insurers offer varying coverage options and policy limits. Ensure you understand the specifics of the coverage being offered, including the types of coverage available (e.g., liability, collision, comprehensive), the policy limits, and any exclusions or limitations. Compare these details across providers to find the option that best aligns with your needs and provides adequate protection.

Evaluate Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your overall insurance experience. Research the insurer’s track record in handling claims, including their timeliness and customer satisfaction. Consider factors like the ease of communication, the availability of 24⁄7 support, and the insurer’s reputation for fair and prompt claim settlements. Positive customer service and efficient claims handling can provide peace of mind during stressful situations.

Analyzing Performance and Future Implications

As you evaluate different insurance options, it’s crucial to assess their performance and future implications. Here are some key considerations:

Financial Stability and Longevity

Choose an insurance provider with a strong financial foundation and a proven track record of longevity in the industry. Financial stability ensures that the insurer will be able to honor their commitments and provide reliable coverage over the long term. Look for insurers with a solid financial rating from reputable agencies like A.M. Best or Standard & Poor’s.

Policy Flexibility and Customization

Opt for an insurer that offers flexible and customizable policies. This allows you to tailor your coverage to your specific needs and budget. Look for providers who offer a range of coverage options, additional endorsements, and the ability to adjust policy limits to fit your requirements. Flexibility ensures that your insurance evolves with your changing circumstances and provides the protection you need at every stage.

Technological Advancements and Digital Services

In today’s digital age, insurers are increasingly leveraging technology to enhance the customer experience. Look for providers who offer convenient online platforms for policy management, claims filing, and communication. Additionally, consider insurers who utilize advanced technologies like artificial intelligence or machine learning to streamline processes and provide personalized recommendations. These technological advancements can simplify your insurance journey and improve overall efficiency.

| Factor | Impact on Insurance Rates |

|---|---|

| Age | Younger drivers often face higher premiums due to perceived higher risk. |

| Gender | Gender can influence rates, with some insurers considering it a risk factor. |

| Marital Status | Married individuals may enjoy lower premiums. |

| Credit Score | A good credit score can lead to reduced insurance costs. |

| Driving Record | A clean driving record with no accidents or violations results in lower premiums. |

| Vehicle Type | High-performance or expensive vehicles often attract higher premiums. |

| Safety Features | Vehicles with advanced safety features may qualify for discounts. |

| Vehicle Usage | Commuting or business use can affect insurance rates. |

| Annual Mileage | Higher mileage typically results in increased premiums. |

How often should I review my vehicle insurance policy and quotes?

+It’s advisable to review your insurance policy and quotes annually or whenever your circumstances change significantly. This allows you to stay up-to-date with the latest rates and ensure you’re still receiving the best value for your insurance needs.

Are there any downsides to opting for a higher deductible to reduce insurance premiums?

+While increasing your deductible can lower premiums, it’s important to consider your financial capabilities. A higher deductible means you’ll need to pay more out of pocket in the event of an accident or claim. Ensure you can comfortably afford the deductible amount before making this choice.

What should I do if I’m not satisfied with my current insurance provider’s performance or rates?

+If you’re unhappy with your current insurance provider, it’s worth exploring alternative options. Shop around, compare quotes, and assess the reputation and coverage options of other insurers. Switching providers can sometimes lead to significant savings and improved overall satisfaction.