Life Insurance Without Medical Exam

In today's fast-paced world, securing your future and that of your loved ones is more important than ever. Life insurance is a vital financial tool that provides peace of mind and ensures financial stability during uncertain times. However, traditional life insurance policies often require extensive medical examinations, which can be a barrier for many individuals. Fortunately, the insurance industry has evolved, and there are now options available for those seeking life insurance without the need for a medical exam.

The Rise of No-Exam Life Insurance Policies

The concept of no-exam life insurance policies has gained traction in recent years, offering a convenient and accessible alternative to traditional coverage. These policies recognize that not everyone has the time, desire, or ability to undergo extensive medical evaluations, and they provide a solution that caters to a broader range of individuals.

No-exam life insurance policies are designed to simplify the application process, allowing individuals to secure coverage quickly and easily. While traditional policies often involve multiple steps, including medical tests, physical examinations, and lengthy waiting periods, no-exam policies streamline the process, making it more efficient and less intrusive.

Understanding the Appeal of No-Exam Life Insurance

There are several key reasons why individuals opt for life insurance without a medical exam:

- Convenience: The application process for no-exam policies is typically faster and more straightforward. Applicants can often complete the entire process online or over the phone, eliminating the need for in-person visits and extensive paperwork.

- Privacy: For some individuals, the thought of undergoing a detailed medical examination can be invasive and uncomfortable. No-exam policies respect an applicant's privacy, as they do not require intimate medical details or physical examinations.

- Health Concerns: Those with pre-existing health conditions or a history of medical issues may face challenges when applying for traditional life insurance. No-exam policies offer an inclusive approach, providing coverage to individuals who may be declined by standard policies.

- Time Constraints: In today's busy world, finding time for extensive medical exams can be challenging. No-exam policies save applicants valuable time, allowing them to secure coverage promptly without disrupting their daily lives.

While no-exam life insurance policies offer numerous benefits, it's essential to understand their unique features and considerations.

How No-Exam Life Insurance Works

No-exam life insurance policies operate differently from traditional policies, and understanding their mechanics is crucial for making an informed decision.

Simplified Application Process

The application process for no-exam life insurance is designed to be straightforward and efficient. Here's a general overview:

- Online or Phone Application: Applicants can typically complete the entire process online or by phone. This eliminates the need for in-person meetings or extensive paperwork.

- Basic Information: The application requires basic personal details, such as name, date of birth, address, and contact information. It may also ask about smoking habits, occupation, and any known health conditions.

- Medical History: While no medical exam is required, applicants may need to provide information about their medical history. This can include details about any pre-existing conditions, hospitalizations, or treatments received.

- Health Declaration: Some policies may require a health declaration, where applicants affirm their current health status and any known health risks.

- Review and Approval: The insurance provider will review the application and assess the applicant's eligibility based on the provided information. If approved, the policy will be issued, and the coverage period will begin.

It's important to note that the specific application process may vary depending on the insurance provider and the type of policy chosen.

Coverage Options and Limitations

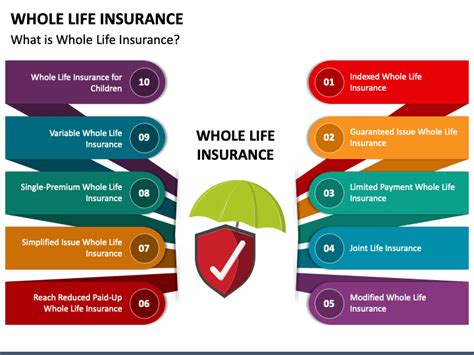

No-exam life insurance policies offer a range of coverage options to suit different needs and budgets. Here are some common types of policies available:

| Policy Type | Description |

|---|---|

| Term Life Insurance | Provides coverage for a specified term, typically ranging from 10 to 30 years. It offers a fixed death benefit and is often more affordable than permanent policies. |

| Guaranteed Issue Life Insurance | Designed for individuals with health concerns or those who may have difficulty securing traditional coverage. These policies do not require a medical exam or health questions and provide a guaranteed acceptance. |

| Simplified Issue Life Insurance | Offers a balance between traditional and no-exam policies. It typically requires answering a few health-related questions but does not involve a medical exam. Approval is based on the provided answers. |

| Accidental Death Insurance | Covers the insured individual in the event of an accidental death. This policy is often more affordable and provides a specific benefit amount for accidental fatalities. |

It's essential to carefully review the terms and conditions of each policy to understand the coverage limits, exclusions, and any potential restrictions.

Benefits and Considerations of No-Exam Life Insurance

While no-exam life insurance policies offer convenience and accessibility, it's crucial to consider both the advantages and potential drawbacks before making a decision.

Advantages

No-exam life insurance policies provide several notable benefits:

- Quick and Easy Application: The streamlined application process allows individuals to secure coverage rapidly, often within a few days.

- Privacy and Convenience: Applicants can maintain their privacy and avoid the discomfort of invasive medical exams. The process can be completed from the comfort of their own homes.

- Inclusive Coverage: These policies often cater to individuals with health concerns or pre-existing conditions who may struggle to find coverage through traditional channels.

- Affordable Options: No-exam policies can be more cost-effective than traditional policies, especially for individuals with a clean bill of health or those seeking term life insurance.

Considerations

Despite their advantages, no-exam life insurance policies also come with certain considerations:

- Limited Coverage: Some policies may have lower coverage limits or exclude certain conditions or causes of death. It's crucial to carefully review the policy's terms to understand the extent of coverage.

- Higher Premiums: In some cases, no-exam policies may come with slightly higher premiums compared to traditional policies. This is because the insurance provider assumes a higher level of risk without a medical examination.

- Health-Related Exclusions: Certain policies may exclude coverage for specific health conditions or causes of death. It's essential to disclose any known health issues to avoid surprises later on.

- Renewal and Conversion: Some policies may have renewal or conversion options, allowing applicants to extend or convert their coverage. However, these options may come with additional costs or limitations.

By weighing the benefits and considerations, individuals can make an informed decision about whether no-exam life insurance is the right choice for their specific needs and circumstances.

Evaluating Your Options

When considering no-exam life insurance, it's crucial to evaluate your unique circumstances and financial goals. Here are some key factors to consider:

Your Health and Lifestyle

Your current health and lifestyle play a significant role in determining the best life insurance option for you. If you lead a healthy lifestyle with no known health concerns, no-exam life insurance can be a convenient and affordable choice. However, if you have pre-existing conditions or a history of medical issues, traditional policies may provide more comprehensive coverage tailored to your specific needs.

Coverage Needs and Budget

Assess your coverage needs and financial situation to determine the appropriate policy type and amount of coverage. Consider factors such as your income, debts, dependents, and future financial goals. No-exam policies offer a range of coverage options, including term life insurance, which can be more budget-friendly for short-term needs. On the other hand, traditional policies may provide more comprehensive coverage for long-term financial protection.

Comparing Providers and Policies

Research and compare different insurance providers and their no-exam policies. Look for reputable companies with a strong financial standing and positive customer reviews. Compare the features, coverage limits, premiums, and any additional benefits or riders offered. Consider consulting with an insurance professional or financial advisor to ensure you choose a policy that aligns with your specific requirements.

Expert Insights and Recommendations

As an industry expert, I recommend carefully evaluating your options and considering the following tips when exploring no-exam life insurance:

- Seek Professional Advice: Consult with a qualified insurance agent or financial advisor who can guide you through the process and help you choose the most suitable policy for your needs. They can provide valuable insights and answer any questions you may have.

- Review Policy Terms: Carefully read and understand the policy terms and conditions before making a decision. Pay attention to coverage limits, exclusions, and any potential restrictions. Ensure you are comfortable with the terms and that they align with your expectations.

- Consider Future Needs: Evaluate your current and future financial goals. No-exam policies may be a temporary solution, but if your needs change, you may require more comprehensive coverage. Consider policies with conversion or renewal options to ensure you can adapt your coverage as your circumstances evolve.

- Compare Premiums: Compare the premiums offered by different providers for similar coverage amounts. While no-exam policies may have slightly higher premiums, it's essential to find a balance between affordability and the level of coverage you require.

Frequently Asked Questions

Are no-exam life insurance policies suitable for everyone?

+

No-exam life insurance policies are designed to cater to a wide range of individuals, including those with health concerns or busy lifestyles. However, it’s essential to assess your specific needs and circumstances. If you have complex health issues or require extensive coverage, traditional policies may be more suitable.

Can I get no-exam life insurance with pre-existing conditions?

+

Yes, no-exam life insurance policies are often more inclusive and may provide coverage to individuals with pre-existing conditions. However, the specific terms and conditions can vary, and some policies may have exclusions or limitations based on certain health issues. It’s important to disclose any known conditions to ensure accurate coverage.

Are no-exam policies more expensive than traditional life insurance?

+

No-exam policies may have slightly higher premiums compared to traditional policies due to the increased risk without a medical examination. However, the cost can vary depending on factors such as age, health status, and coverage amount. It’s essential to compare quotes from different providers to find the most affordable option.

Can I convert my no-exam policy to a traditional policy later on?

+

Some no-exam policies offer conversion options, allowing you to convert your coverage to a traditional policy in the future. This can be beneficial if your health status improves or your financial needs change. However, it’s important to review the specific terms and conditions of your policy to understand the conversion process and any potential limitations.

What happens if I pass away during the application process for no-exam life insurance?

+

In the unfortunate event of your passing during the application process, the outcome may vary depending on the specific policy and insurance provider. Some policies may provide coverage from the date of application, while others may have a waiting period. It’s crucial to review the policy terms to understand the coverage effective date and any potential exclusions.