Insurance Quotes For Small Business

For small business owners, obtaining insurance quotes can be a complex and crucial task. The right insurance coverage provides a safety net, protecting businesses from various risks and potential financial disasters. This article aims to guide small business owners through the process of securing insurance quotes, offering a comprehensive overview of the factors that influence quotes, the types of insurance available, and practical steps to ensure the best coverage at competitive rates.

Understanding the Factors That Influence Insurance Quotes

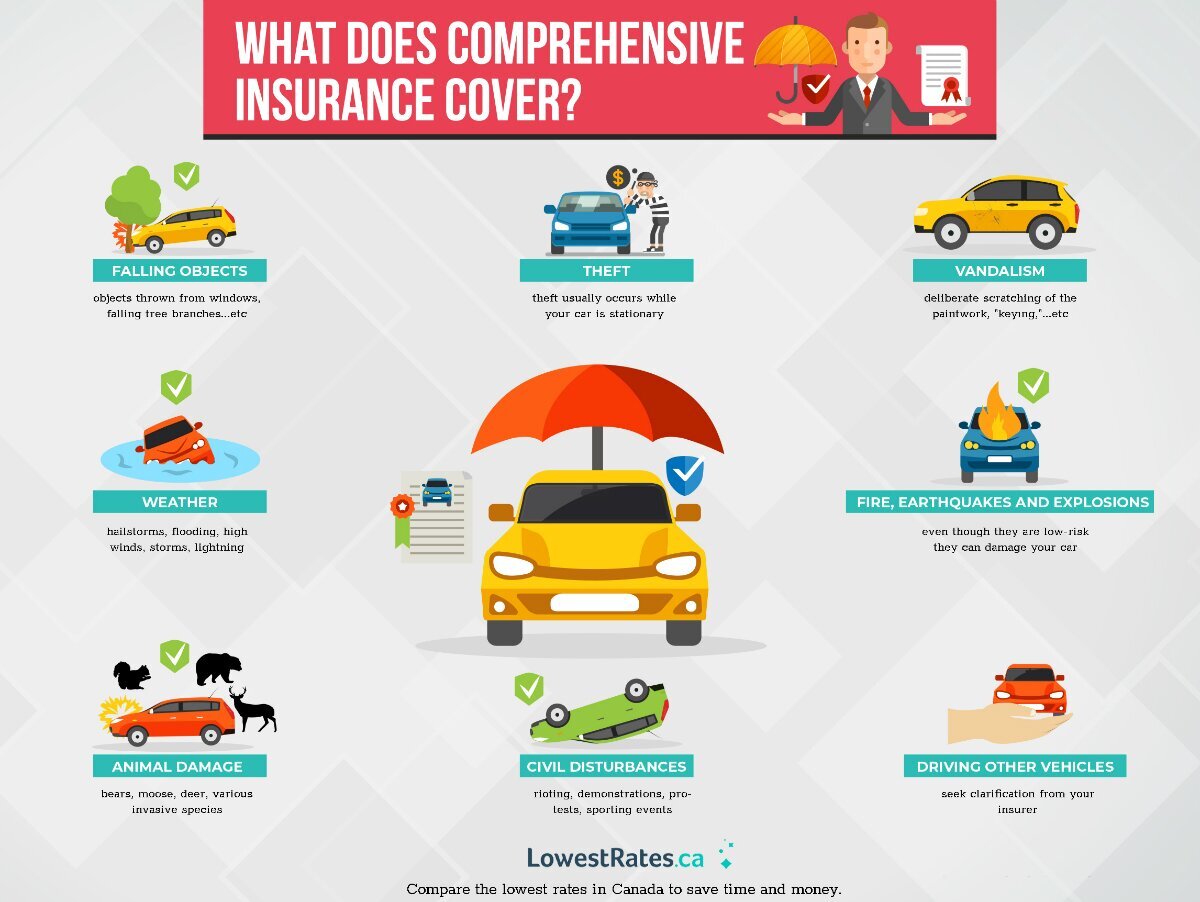

Several critical factors play a significant role in determining insurance quotes for small businesses. These include the industry and nature of the business, its location, the number of employees, and the specific risks associated with the operations. Each of these factors carries a unique weight in the insurance quote calculation, reflecting the level of risk the insurer perceives.

The industry a business operates in is a primary consideration. Some industries are inherently riskier than others due to the nature of their work. For instance, construction businesses face higher risks of accidents and injuries compared to, say, an online retail store. This higher risk translates to potentially higher insurance premiums.

The location of a business is another key factor. Insurance companies assess the local crime rates, weather conditions, and the general environment where the business operates. A business located in an area prone to natural disasters or with a high crime rate may face higher insurance costs.

The number of employees is also influential. Larger businesses with a higher employee count often require more extensive insurance coverage, especially for workers' compensation and liability. This is because larger businesses have a greater potential for workplace accidents and injuries, increasing the likelihood of insurance claims.

Additionally, the specific risks associated with a business's operations are carefully considered. For example, a business that handles hazardous materials or operates heavy machinery will likely face higher insurance costs due to the increased risk of accidents and environmental damage.

Types of Insurance for Small Businesses

Small businesses have a range of insurance options to choose from, each designed to protect against specific risks. Understanding these options is crucial for ensuring comprehensive coverage.

General Liability Insurance

General liability insurance is a fundamental coverage for most small businesses. It protects against a variety of common risks, including property damage, bodily injury, and personal and advertising injury. This insurance is particularly important for businesses that interact with the public, as it covers accidents that occur on their premises or due to their operations.

Professional Liability Insurance (Errors & Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is critical for businesses providing professional services. It protects against claims of negligence, errors, or omissions in the provision of professional services. This type of insurance is especially important for consultants, designers, architects, and other professionals who provide expert advice or services.

Product Liability Insurance

Product liability insurance is essential for businesses that manufacture, distribute, or sell physical products. It provides protection in case a product causes injury or damage to a consumer. This insurance covers the cost of defending against lawsuits and paying out any damages awarded to the injured party.

Workers’ Compensation Insurance

Workers’ compensation insurance is a legal requirement in most states for businesses with employees. It provides coverage for employees who are injured or become ill due to their work. This insurance covers medical expenses, a portion of lost wages, and rehabilitation costs. It also protects the business from being sued by injured employees.

Business Owners Policy (BOP)

A Business Owners Policy, or BOP, is a package policy designed specifically for small businesses. It typically includes property insurance, liability insurance, and business interruption insurance, all in one convenient package. A BOP can be a cost-effective solution for small businesses that need multiple types of coverage.

Steps to Obtain Competitive Insurance Quotes

Obtaining insurance quotes involves a systematic approach to ensure the best coverage at the most competitive rates. Here are some steps to guide small business owners through the process.

Assess Your Business’s Risks

The first step is to thoroughly assess the risks your business faces. Consider the nature of your operations, the products or services you provide, and the potential hazards that could lead to injuries, property damage, or other losses. Identifying these risks will help you determine the types and levels of insurance coverage you need.

Compare Multiple Insurance Providers

It’s essential to shop around and compare quotes from multiple insurance providers. Different insurers have different underwriting guidelines and risk assessments, which can result in varying premium rates for the same coverage. By comparing quotes, you can identify the insurer that offers the best value for your business’s specific needs.

Leverage Technology for Quicker Quotes

In today’s digital age, many insurance companies offer online quote tools that provide quick, preliminary quotes based on basic information about your business. While these quotes may not be final, they can give you a good starting point for comparison and help you understand the general cost of insurance for your business.

Consider Bundling Insurance Policies

Bundling multiple insurance policies with the same insurer can often lead to significant savings. Insurers often offer discounts when you purchase multiple policies from them, as it reduces their administrative costs and increases their business with you. This can be a cost-effective way to ensure your business has the coverage it needs.

Negotiate Your Premiums

Don’t be afraid to negotiate your insurance premiums. Insurance is a competitive business, and insurers are often willing to negotiate, especially if you’re a good customer with a strong risk profile. You can negotiate by highlighting your business’s strengths, such as a strong safety record, effective risk management strategies, or a low claims history.

Review and Update Your Insurance Regularly

Insurance needs can change as your business grows and evolves. Regularly review your insurance policies to ensure they still provide adequate coverage. As your business operations expand or contract, or as new risks emerge, you may need to adjust your insurance coverage. Staying proactive in this regard can help ensure your business is always adequately protected.

Future Trends in Small Business Insurance

The insurance landscape for small businesses is constantly evolving, driven by technological advancements, changing consumer behaviors, and emerging risks. Here are some key trends to watch that could impact insurance quotes and coverage for small businesses in the future.

The Rise of Digital Insurance

The digital transformation of the insurance industry is well underway, with many insurers now offering digital-first services and products. This includes online quote tools, digital policy management, and even digital claims processing. This trend is expected to continue, making it easier and more convenient for small businesses to obtain insurance quotes and manage their policies.

Increased Focus on Cyber Risks

With the rise of digital technologies and online business operations, cyber risks are becoming an increasingly important consideration for small businesses. Cyber insurance policies, which protect against data breaches, cyber attacks, and other online risks, are likely to become more prevalent and comprehensive in the future.

The Impact of Climate Change

Climate change is leading to more frequent and severe weather events, which can result in increased property damage and business interruptions. As a result, insurers are likely to pay more attention to climate-related risks when assessing insurance quotes for small businesses. This could lead to higher premiums for businesses located in high-risk areas.

Growing Importance of Risk Management

Insurance companies are increasingly focusing on risk management as a way to mitigate potential losses. This means that small businesses with strong risk management practices may be rewarded with more competitive insurance quotes. Implementing effective risk management strategies, such as regular safety audits and employee training, could therefore become a key factor in obtaining favorable insurance rates.

Conclusion

Obtaining insurance quotes for a small business is a critical yet complex process. By understanding the factors that influence quotes, the types of insurance available, and taking a strategic approach to obtaining coverage, small business owners can ensure their businesses are adequately protected. Staying informed about emerging trends in small business insurance is also key to staying ahead of potential risks and securing the best insurance solutions for the future.

What is the average cost of insurance for a small business?

+The average cost of insurance for a small business can vary significantly based on several factors, including the industry, location, and specific risks involved. General liability insurance, a common coverage for small businesses, typically ranges from 300 to 1,000 per year, but this can increase depending on the nature of the business. Professional liability insurance, product liability insurance, and workers’ compensation insurance can also vary widely based on the specific risks and coverage needed.

How often should I review my business’s insurance coverage?

+It’s recommended to review your business’s insurance coverage at least once a year, or whenever there are significant changes to your business operations, such as expansion, relocation, or the introduction of new products or services. Regular reviews ensure that your insurance coverage remains adequate and up-to-date with your business’s evolving needs.

What steps can I take to reduce my insurance premiums?

+There are several steps you can take to potentially reduce your insurance premiums. These include implementing strong risk management practices, such as regular safety audits and employee training, which can demonstrate to insurers that your business is taking proactive steps to mitigate potential losses. You can also consider bundling multiple insurance policies with the same insurer, as insurers often offer discounts for multi-policy customers. Additionally, maintaining a low claims history can signal to insurers that your business is a low-risk proposition, which may lead to more competitive premium rates.