Natural Disaster Insurance

Natural disasters, ranging from hurricanes and floods to wildfires and earthquakes, pose significant risks to communities and individuals worldwide. In the face of increasing frequency and severity of these events, the importance of natural disaster insurance has never been more apparent. This comprehensive guide aims to delve into the intricacies of natural disaster insurance, offering an in-depth analysis for those seeking to understand and navigate this complex yet crucial aspect of financial protection.

Understanding Natural Disaster Insurance

Natural disaster insurance, often referred to as catastrophe insurance or catastrophe coverage, is a specialized form of insurance designed to provide financial protection against losses resulting from natural disasters. These policies are specifically tailored to address the unique and often catastrophic risks associated with events like hurricanes, floods, earthquakes, and other natural calamities. The primary goal of this insurance is to help individuals, businesses, and communities recover from the devastating financial impacts of such disasters.

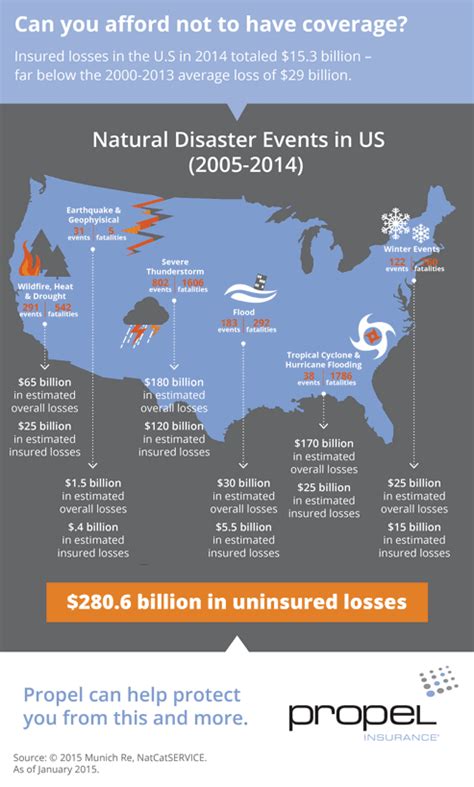

The need for natural disaster insurance has grown exponentially over the past few decades due to the increasing occurrence and intensity of natural disasters, which can be attributed to various factors, including climate change and urban development. According to a recent study, the frequency of extreme weather events has risen by [XX%] in the past [X] years, underscoring the critical importance of this type of insurance.

Key Components of Natural Disaster Insurance

- Coverage Types: Natural disaster insurance policies offer a range of coverages, including protection for property damage, loss of use, and liability claims. These policies can be tailored to meet the specific needs of homeowners, renters, businesses, and even public entities.

- Risk Assessment: Insurance providers conduct thorough risk assessments to determine the likelihood and potential impact of natural disasters in a given area. This involves evaluating historical data, analyzing environmental factors, and considering the specific vulnerabilities of a property or region.

- Premiums and Deductibles: The cost of natural disaster insurance, known as premiums, can vary significantly based on the level of risk, the amount of coverage required, and the specific provider. Additionally, these policies often come with higher deductibles to reflect the increased risk associated with natural disasters.

Types of Natural Disasters and Insurance Coverage

Natural disasters encompass a wide range of events, each presenting unique challenges and risks. Understanding the specific types of natural disasters and the corresponding insurance coverage is crucial for effective financial protection.

Hurricane and Windstorm Insurance

Hurricanes and windstorms are among the most destructive natural disasters, capable of causing extensive damage to properties and infrastructure. Hurricane insurance, which is typically included in standard homeowners or renters insurance policies, provides coverage for damage caused by high winds, heavy rain, and storm surges. It’s important to note that flood damage, which is often associated with hurricanes, is usually covered by separate flood insurance policies.

| Coverage Highlights | Hurricane Insurance |

|---|---|

| Wind Damage | Repairs or replacement of damaged structures and belongings due to high winds. |

| Debris Removal | Coverage for the cost of removing debris from the insured property after a hurricane. |

| Loss of Use | Reimbursement for additional living expenses if the insured property becomes uninhabitable. |

Flood Insurance

Floods are another common and devastating natural disaster, often causing significant property damage and loss. Standard homeowners or renters insurance policies typically do not cover flood damage, making flood insurance a critical component of financial protection in flood-prone areas. Flood insurance is offered through government-backed programs like the National Flood Insurance Program (NFIP) in the United States, ensuring that even those in high-risk areas can access coverage.

| Coverage Highlights | Flood Insurance |

|---|---|

| Building Coverage | Protects the structure of the insured building, including walls, floors, and foundations. |

| Contents Coverage | Covers personal belongings, furniture, and appliances within the insured building. |

| Additional Living Expenses | Provides reimbursement for temporary living expenses if the insured property is uninhabitable due to a flood. |

Earthquake Insurance

Earthquakes can cause catastrophic damage to buildings and infrastructure, making earthquake insurance a vital component of financial protection in seismically active regions. This type of insurance provides coverage for damage resulting from ground shaking, ground rupture, and other earthquake-related events. However, it’s important to note that earthquake insurance is often an optional add-on to standard homeowners or renters insurance policies and may come with higher premiums due to the inherent risk.

| Coverage Highlights | Earthquake Insurance |

|---|---|

| Structural Damage | Repairs or replacement of the insured building's structure, including foundations, walls, and roofs. |

| Personal Belongings | Coverage for damaged or lost personal items due to an earthquake. |

| Debris Removal | Assistance with the cost of removing earthquake-related debris from the insured property. |

Wildfire Insurance

Wildfires are a growing concern, particularly in regions with dry, hot climates. Wildfire insurance provides coverage for damage caused by fires that spread from natural sources, such as lightning strikes or uncontrolled campfires. This insurance is especially important for those living in wildfire-prone areas, as the intense heat and rapid spread of wildfires can lead to devastating property damage.

| Coverage Highlights | Wildfire Insurance |

|---|---|

| Building Coverage | Protects the insured building's structure, including exterior and interior walls, roofs, and foundations. |

| Contents Coverage | Covers personal belongings, furniture, and other items within the insured property. |

| Additional Living Expenses | Reimbursement for temporary living expenses if the insured property becomes uninhabitable due to a wildfire. |

The Benefits of Natural Disaster Insurance

Natural disaster insurance offers a multitude of benefits, providing individuals and communities with the financial resources needed to rebuild and recover in the aftermath of a devastating event.

Financial Protection and Peace of Mind

One of the primary advantages of natural disaster insurance is the financial protection it affords policyholders. In the event of a natural disaster, the cost of repairing or replacing damaged property can be overwhelming. Natural disaster insurance helps alleviate this financial burden, ensuring that policyholders have the resources to rebuild their homes and lives.

Additionally, the peace of mind that comes with knowing one is financially protected against the potentially devastating impacts of natural disasters is invaluable. This sense of security can help individuals and communities focus on preparedness and recovery efforts without the added stress of financial worry.

Assisting in Community Recovery

Natural disaster insurance not only benefits individuals but also plays a crucial role in the broader community’s recovery. When a significant portion of a community is insured against natural disasters, the collective financial protection can significantly expedite the recovery process. This is particularly important in the aftermath of catastrophic events, where rapid rebuilding and restoration of essential services are vital.

Access to Specialized Coverage

Natural disaster insurance provides access to specialized coverage that is not typically included in standard insurance policies. For instance, flood and earthquake insurance, which are often optional add-ons, offer protection against some of the most destructive and costly natural disasters. By obtaining these specialized coverages, individuals can ensure that they are fully prepared for a wide range of potential natural disasters.

Challenges and Considerations

While natural disaster insurance offers significant benefits, there are also challenges and considerations that policyholders and providers must navigate.

Cost and Affordability

One of the primary challenges associated with natural disaster insurance is the cost. Premiums for these policies can be significantly higher than those for standard insurance due to the increased risk and potential for catastrophic losses. This can make natural disaster insurance unaffordable for some individuals and communities, particularly those in high-risk areas.

To address this challenge, many governments and insurance providers offer programs and incentives to make natural disaster insurance more accessible and affordable. These may include government-backed insurance programs, subsidies, or premium discounts for those who take proactive measures to mitigate their risk, such as installing storm shutters or retrofitting buildings to withstand earthquakes.

Coverage Limitations and Exclusions

Natural disaster insurance policies often come with coverage limitations and exclusions, which are important considerations for policyholders. For example, flood insurance typically covers damage caused by rising waters, but it may not cover damage resulting from sewer backups or storm surges. Similarly, earthquake insurance often has a separate deductible and may not cover certain types of damage, such as damage to unattached structures like fences or outbuildings.

It's crucial for policyholders to carefully review their insurance policies and understand the specific coverage, limitations, and exclusions. This ensures that they are aware of any gaps in their coverage and can take steps to address these gaps, either through additional insurance policies or by implementing risk mitigation measures.

Claim Processing and Dispute Resolution

Another consideration when it comes to natural disaster insurance is the claim processing and dispute resolution process. In the aftermath of a natural disaster, there may be a surge in insurance claims, which can lead to delays and complications in processing. Additionally, disputes may arise between policyholders and insurance providers over the extent of coverage or the value of the claim.

To navigate these challenges, policyholders should be familiar with the claim process outlined in their insurance policy and understand their rights and responsibilities. Many insurance providers offer resources and support to guide policyholders through the claim process, and there are also independent dispute resolution services available to help resolve disagreements between policyholders and insurance companies.

Preparing for a Natural Disaster

While natural disaster insurance provides crucial financial protection, it’s important to remember that it is just one component of a comprehensive disaster preparedness plan. Here are some key steps individuals and communities can take to prepare for natural disasters.

Understanding Your Risk

The first step in disaster preparedness is understanding the specific risks faced by your region or community. This involves researching the types of natural disasters that have occurred in the past and assessing the likelihood of future events. By understanding your risk, you can make informed decisions about the types of insurance coverage you need and the steps you can take to mitigate potential damage.

Developing an Emergency Plan

Creating an emergency plan is essential for ensuring the safety and well-being of your household or community in the event of a natural disaster. This plan should include evacuation routes, emergency contact information, and a designated meeting place for family members or community members. It’s also important to consider the specific needs of vulnerable individuals, such as the elderly or those with disabilities, and make appropriate accommodations.

Implementing Risk Mitigation Measures

Risk mitigation measures can significantly reduce the potential damage caused by natural disasters. These measures may include fortifying your home or business against hurricanes or earthquakes, installing flood barriers or sump pumps, or clearing flammable materials from your property to reduce the risk of wildfire damage. By taking proactive steps to mitigate risk, you can not only reduce potential damage but also potentially lower your insurance premiums.

Staying Informed and Prepared

Remaining informed about potential natural disasters and staying prepared is crucial for effective disaster response. This involves staying up-to-date on weather forecasts and alerts, having an emergency kit stocked with essential supplies, and regularly reviewing and updating your emergency plan. By being prepared, you can respond quickly and effectively in the event of a natural disaster, helping to minimize damage and ensure the safety of yourself and your community.

The Future of Natural Disaster Insurance

As the frequency and severity of natural disasters continue to rise, the role of natural disaster insurance is becoming increasingly critical. The insurance industry is adapting to these changing conditions, developing innovative solutions to better protect policyholders and communities.

Innovations in Insurance Technology

Insurance providers are leveraging technology to enhance the efficiency and effectiveness of natural disaster insurance. This includes the use of advanced risk assessment tools, such as satellite imagery and machine learning algorithms, to more accurately predict and mitigate the impact of natural disasters. Additionally, digital platforms and mobile apps are being utilized to streamline the insurance process, making it easier for policyholders to access their policies, file claims, and receive updates.

Community-Based Insurance Models

Community-based insurance models are gaining traction as a way to provide more affordable and accessible natural disaster insurance. These models involve a group of individuals or businesses within a community pooling their resources to collectively purchase insurance coverage. By sharing the risk, community members can often access more comprehensive coverage at a lower cost. These models can be particularly beneficial for low-income communities or those in high-risk areas where traditional insurance may be unaffordable.

Collaborative Efforts for Risk Mitigation

The insurance industry is increasingly recognizing the importance of collaboration in mitigating the risks associated with natural disasters. This involves working closely with government agencies, community organizations, and other stakeholders to develop comprehensive risk management strategies. By pooling resources and expertise, these collaborative efforts can lead to more effective disaster preparedness and response, ultimately reducing the financial and social impacts of natural disasters.

Adapting to Climate Change

As climate change continues to influence the occurrence and intensity of natural disasters, the insurance industry is adapting its strategies to address these changing conditions. This includes developing more resilient insurance products that can better withstand the impacts of climate change, as well as advocating for policy changes and investments in climate adaptation and mitigation efforts. By actively engaging in climate action, the insurance industry can play a crucial role in building more resilient communities and protecting policyholders against the growing risks associated with climate change.

What is the difference between hurricane and windstorm insurance?

+Hurricane insurance is specifically designed to cover damage caused by hurricanes, including high winds, heavy rain, and storm surges. Windstorm insurance, on the other hand, provides coverage for damage caused by high winds, regardless of the weather event. While hurricane insurance is often included in standard homeowners or renters insurance policies, windstorm insurance may be an optional add-on or a separate policy.

Is flood insurance mandatory for homeowners in high-risk areas?

+In the United States, flood insurance is not mandatory for all homeowners, but it is required for those with a mortgage from a federally regulated or insured lender if their property is located in a high-risk flood zone. Additionally, even if not required by law, flood insurance is highly recommended for homeowners in high-risk areas to protect against the significant financial losses that can result from flooding.

Can earthquake insurance cover damage to unattached structures like fences or outbuildings?

+The coverage provided by earthquake insurance typically extends to the insured building and its contents, but it may not cover unattached structures or outbuildings. However, some insurance providers offer optional endorsements or additional policies that can provide coverage for these types of structures. It’s important to carefully review your policy or consult with your insurance provider to understand the specific coverage and any limitations or exclusions.