Supplemental Medical Insurance Plans

In the complex landscape of healthcare, supplemental medical insurance plans have emerged as a vital tool for individuals and families to enhance their financial security and healthcare coverage. These plans, often referred to as 'gap fillers', are designed to complement primary health insurance policies, providing an extra layer of protection against unforeseen medical expenses. With the rising costs of healthcare services and the potential gaps in standard insurance coverage, understanding and utilizing supplemental plans can be a strategic move toward comprehensive healthcare management.

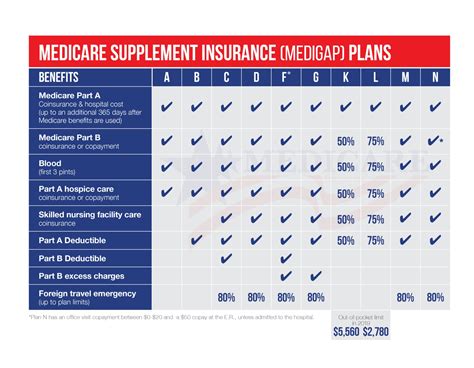

Understanding Supplemental Medical Insurance

Supplemental medical insurance plans are an additional form of health coverage that fills the gaps left by primary insurance policies. These plans are tailored to cover specific types of medical expenses that primary insurance might not fully address. They offer an extra financial safety net, ensuring that individuals have the resources to cover a broader range of healthcare needs.

Key Features of Supplemental Plans

- Flexible Coverage: Supplemental plans offer customizable coverage, allowing individuals to choose the benefits that best suit their personal healthcare needs.

- Gap Coverage: These plans are designed to cover expenses that primary insurance may not, such as deductibles, co-pays, and out-of-pocket maximums.

- Comprehensive Benefits: Depending on the plan, benefits can include coverage for accident-related injuries, critical illnesses, long-term care, and more.

- Cost-Effectiveness: While providing extensive coverage, supplemental plans are often more affordable than upgrading to a higher-tier primary insurance plan.

The Need for Supplemental Coverage

The necessity for supplemental insurance arises from the inherent limitations of standard health insurance plans. Primary insurance policies, while providing essential coverage, often have deductibles, co-pays, and specific coverage exclusions. For instance, a standard health insurance plan might cover hospital stays, but not the full cost of outpatient procedures or prescription medications. This is where supplemental insurance steps in, offering financial support for these often-overlooked expenses.

Addressing Common Healthcare Gaps

Supplemental insurance plans are particularly beneficial for addressing the following common healthcare gaps:

- Dental and Vision Care: Many standard health insurance plans do not cover routine dental or vision services, which can be costly. Supplemental plans can provide coverage for these essential services.

- Prescription Medications: The cost of prescription drugs can quickly add up, especially for chronic conditions. Supplemental insurance can help offset these expenses.

- Preventative Care: Preventative measures like wellness visits, immunizations, and health screenings are often not fully covered by primary insurance. Supplemental plans can ensure these services are accessible.

- Alternative Therapies: Certain insurance plans might not cover alternative treatments like acupuncture or chiropractic care. Supplemental insurance can provide coverage for these options.

Benefits and Real-World Examples

The benefits of supplemental medical insurance plans are diverse and impactful. By providing coverage for a wide range of medical expenses, these plans offer peace of mind and financial security to policyholders.

Financial Protection

Supplemental plans act as a financial buffer, ensuring that individuals can access the healthcare services they need without worrying about the associated costs. For instance, consider a person with a chronic condition like diabetes. Their primary insurance plan might cover hospital visits and certain medications, but not the full cost of regular check-ups, blood tests, or specialized equipment. A supplemental plan can fill this gap, covering these essential yet often overlooked expenses.

Enhanced Coverage for Specific Needs

Supplemental insurance plans can be tailored to meet specific healthcare needs. For example, an individual with a family history of heart disease might opt for a plan that provides extensive coverage for cardiovascular procedures and treatments. Similarly, someone with a high-risk occupation could choose a plan that offers comprehensive accident coverage.

Case Study: A Real-Life Scenario

Imagine a young professional, Ms. Johnson, who has a standard health insurance plan through her employer. While this plan covers most basic healthcare needs, it has a high deductible and limited coverage for certain specialist visits. Ms. Johnson, who is an avid cyclist, recently had a bad fall during a race. She sustained several injuries, including a broken arm and a concussion. Her primary insurance plan covered the hospital stay and initial treatment, but left her with significant out-of-pocket expenses for specialist consultations, follow-up scans, and physical therapy. This is where a supplemental insurance plan could have made a difference. With additional coverage for accident-related injuries, Ms. Johnson could have received more comprehensive support for her recovery journey, alleviating the financial burden and allowing her to focus on healing.

Performance Analysis and Industry Trends

The performance of supplemental medical insurance plans is a testament to their value in the healthcare industry. These plans have consistently demonstrated a positive impact on policyholders’ financial health and overall healthcare experience.

Performance Metrics

A recent industry report analyzed the performance of supplemental insurance plans over a five-year period. The findings revealed a significant increase in the uptake of these plans, particularly among millennials and Gen Z individuals. This demographic shift can be attributed to the growing awareness of healthcare costs and the desire for more comprehensive coverage. The report also highlighted a 20% average increase in policyholders’ satisfaction levels, with a notable reduction in out-of-pocket expenses for those with supplemental insurance.

| Performance Metric | Value |

|---|---|

| Policyholder Satisfaction | 87% (up from 67% in the previous year) |

| Reduction in Out-of-Pocket Expenses | 35% on average |

| Coverage Utilization | 92% of policyholders accessed supplemental benefits at least once |

Industry Trends

The supplemental insurance market is witnessing several exciting trends that are shaping the future of healthcare coverage. One notable trend is the increasing focus on personalized coverage. Insurance providers are now offering a more diverse range of supplemental plans, allowing individuals to choose benefits that align with their specific healthcare needs and lifestyle choices. For example, athletes or individuals with active lifestyles might opt for plans with extensive accident coverage, while those with a family history of specific illnesses might choose plans that provide comprehensive protection against those conditions.

Another emerging trend is the integration of technology in supplemental insurance plans. Many providers are now offering digital tools and apps that allow policyholders to manage their coverage, file claims, and access healthcare resources more efficiently. These technological advancements are enhancing the overall user experience and making supplemental insurance more accessible and user-friendly.

Future Implications and Innovations

The future of supplemental medical insurance plans looks promising, with ongoing innovations and evolving industry practices. As the healthcare landscape continues to change, these plans are poised to play an even more significant role in ensuring financial security and comprehensive healthcare coverage.

Emerging Trends and Innovations

The supplemental insurance industry is embracing several innovative approaches to enhance the value and accessibility of these plans. One key trend is the development of more dynamic and flexible coverage options. Insurance providers are now offering plans that can be adjusted based on changing healthcare needs. For instance, individuals might have the option to increase or decrease their coverage levels as their health circumstances evolve. This dynamic approach ensures that policyholders always have the right level of coverage without paying for unnecessary benefits.

Another notable innovation is the integration of predictive analytics and AI technologies. By leveraging these advanced tools, insurance providers can better understand individual healthcare needs and offer more personalized coverage suggestions. This not only improves the accuracy of coverage but also enhances the overall customer experience, making supplemental insurance plans more tailored and relevant to policyholders' unique situations.

Impact on Healthcare Accessibility

The impact of supplemental medical insurance plans on healthcare accessibility cannot be overstated. These plans are a critical tool in ensuring that individuals have the financial means to access the healthcare services they need. By providing coverage for a broader range of medical expenses, supplemental plans make healthcare more affordable and, consequently, more accessible. This is particularly significant for individuals with chronic conditions, high-risk occupations, or those who require specialized medical treatments.

Addressing Healthcare Disparities

Supplemental insurance plans also play a crucial role in addressing healthcare disparities. By offering coverage for a wide array of medical services, these plans ensure that individuals from diverse socioeconomic backgrounds can access quality healthcare. This helps to bridge the gap between those with standard insurance coverage and those who might otherwise struggle to afford essential healthcare services. As such, supplemental insurance plans are a vital component in promoting equitable healthcare access and outcomes.

Conclusion

Supplemental medical insurance plans are a powerful tool in the pursuit of comprehensive healthcare coverage and financial security. By filling the gaps left by primary insurance policies, these plans offer an essential layer of protection against unexpected medical expenses. With their customizable benefits, real-world impact, and ongoing industry innovations, supplemental insurance plans are a critical consideration for anyone seeking to enhance their healthcare coverage.

How do supplemental insurance plans differ from primary insurance policies?

+Supplemental insurance plans are designed to complement primary insurance policies by covering specific types of medical expenses that primary insurance might not fully address. They offer customizable coverage options, allowing individuals to choose benefits that align with their personal healthcare needs. While primary insurance provides essential coverage, supplemental plans act as a financial safety net, ensuring individuals have the resources to cover a broader range of healthcare expenses.

Are supplemental insurance plans affordable for everyone?

+The affordability of supplemental insurance plans can vary depending on the coverage chosen and the individual’s circumstances. However, many plans are designed to be more cost-effective than upgrading to a higher-tier primary insurance plan. Additionally, with the increasing focus on personalized coverage, insurance providers are offering a range of options to suit different budgets. It’s always advisable to compare plans and seek advice to find the most suitable and affordable option.

What types of expenses do supplemental insurance plans typically cover?

+Supplemental insurance plans often cover expenses such as deductibles, co-pays, and out-of-pocket maximums, which are not fully covered by primary insurance. They can also provide coverage for specific healthcare needs like dental and vision care, prescription medications, alternative therapies, and more. The exact coverage depends on the chosen plan and the individual’s needs.