Homeowners Insurance Average Cost

When it comes to protecting your home and assets, understanding the average cost of homeowners insurance is essential. This comprehensive guide will delve into the factors influencing these costs, provide real-world examples, and offer insights to help you make informed decisions about your insurance coverage.

Understanding Homeowners Insurance: A Comprehensive Overview

Homeowners insurance is a vital financial safeguard, offering protection against a range of risks and liabilities. It provides coverage for your home’s structure, personal belongings, and even additional living expenses if your home becomes uninhabitable due to a covered event. However, the cost of this protection can vary significantly based on several key factors.

Factors Influencing Homeowners Insurance Costs

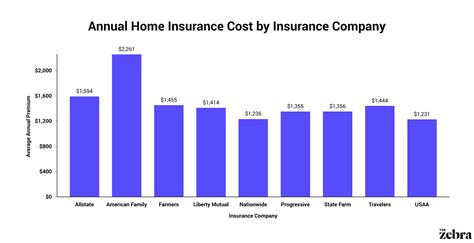

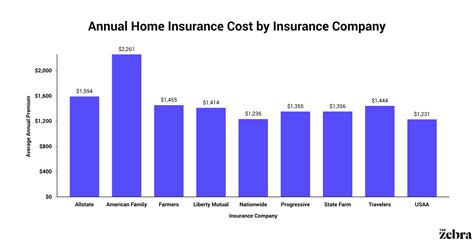

The average cost of homeowners insurance is not a fixed figure but rather a dynamic calculation influenced by numerous variables. These include the location of your home, its age and construction type, the coverage limits you choose, and any additional endorsements or riders you add to your policy.

| Factor | Impact on Cost |

|---|---|

| Location | Areas prone to natural disasters like hurricanes or earthquakes often see higher insurance premiums. Similarly, regions with higher crime rates or a history of severe weather events may also result in increased costs. |

| Home Value & Construction | The value of your home and its contents, along with the construction type (wood, brick, or concrete), can significantly affect insurance costs. More valuable homes or those with unique construction features may require specialized coverage, resulting in higher premiums. |

| Coverage Limits | The level of coverage you choose directly impacts your premium. Higher coverage limits for both the structure and personal belongings will increase your overall cost. |

| Endorsements & Riders | Additional coverage options, such as flood insurance or jewelry/artwork endorsements, can further increase your premium. These add-ons are tailored to your specific needs and assets, providing comprehensive protection. |

Real-World Examples: Average Costs in Different Scenarios

To provide a clearer picture of homeowners insurance costs, let’s explore some real-world examples based on varying home types and locations.

Example 1: Suburban Family Home

Consider a typical suburban family home located in a moderate-risk area. This home, valued at 300,000, has standard construction and is insured for the full value of the home with 500,000 in liability coverage. The average annual premium for this scenario could range from 1,200 to 1,800, depending on the insurer and any additional coverage options chosen.

Example 2: Coastal Property

Now, let’s examine a coastal property located in an area prone to hurricanes. This home, valued at 500,000, is insured for its full value with 1,000,000 in liability coverage. Due to the increased risk of natural disasters, the average annual premium for this scenario could range from 2,500 to 3,500, again depending on the insurer and any additional coverage.

Example 3: Urban Condominium

In an urban setting, a condominium valued at 250,000 might have a different set of considerations. This home is insured for its contents and personal liability, with the building's structure covered by a separate master policy. The average annual premium for this scenario could range from 800 to $1,200, primarily covering the contents and personal liability aspects.

Performance Analysis: How Homeowners Insurance Protects Your Assets

Homeowners insurance is more than just a financial obligation; it’s a critical layer of protection for your assets. Here’s a closer look at how this insurance safeguards your home and belongings.

Coverage for Your Home’s Structure

The primary purpose of homeowners insurance is to protect the structure of your home. This coverage ensures that, in the event of a covered loss such as fire, wind damage, or vandalism, you can repair or rebuild your home. The coverage limit you choose should align with the estimated cost to rebuild your home, ensuring you’re not underinsured.

Personal Property Protection

Homeowners insurance also covers your personal belongings, from furniture and electronics to clothing and collectibles. The coverage limit for personal property typically represents a percentage of the overall coverage limit for the structure. It’s important to understand this limit and ensure it adequately covers the value of your possessions.

Liability Protection

Liability coverage is another critical aspect of homeowners insurance. This protection safeguards you from financial losses if someone is injured on your property or if you, as a homeowner, cause property damage or bodily injury to others. The liability limit you choose should reflect the level of risk you’re comfortable assuming.

Evidence-Based Future Implications: Adapting to Changing Needs

As the world evolves, so do the risks and challenges facing homeowners. It’s essential to consider how these changes might impact homeowners insurance costs and coverage in the future.

Climate Change and Natural Disasters

With the increasing frequency and severity of natural disasters due to climate change, the cost of homeowners insurance is likely to rise in regions prone to these events. Insurers will need to adapt their risk assessments and coverage offerings to address these changing conditions.

Technological Advancements

Technological advancements, such as smart home devices and security systems, can impact homeowners insurance. These technologies may reduce the risk of certain incidents, leading to potential premium discounts. Conversely, the increased connectivity of these devices may introduce new cyber risks, requiring additional coverage options.

Changing Lifestyle Trends

Shifts in lifestyle trends, such as the growing popularity of home-based businesses or the increasing value of personal belongings like artwork and collectibles, may also impact insurance needs. Insurers will need to stay abreast of these trends to provide relevant coverage options.

Conclusion: Navigating the Complexities of Homeowners Insurance

Understanding the average cost of homeowners insurance is just the first step in protecting your home and assets. By considering the various factors that influence these costs and staying informed about industry trends, you can make more confident decisions about your insurance coverage.

Key Takeaways

- Homeowners insurance costs vary based on location, home value, coverage limits, and additional endorsements.

- Real-world examples illustrate how these factors impact premiums, from suburban homes to coastal properties and urban condominiums.

- Insurance protects your home’s structure, personal belongings, and liability, with coverage limits tailored to your specific needs.

- Future implications, such as climate change and technological advancements, will continue to shape the landscape of homeowners insurance.

Final Thoughts

Homeowners insurance is a vital tool for safeguarding your assets and providing peace of mind. By staying informed and consulting with insurance professionals, you can navigate the complexities of this coverage, ensuring you’re adequately protected without overpaying.

What is the average cost of homeowners insurance in my area?

+The average cost of homeowners insurance varies significantly by region and can be influenced by factors such as the prevalence of natural disasters, crime rates, and the cost of living. It’s best to consult with a local insurance agent to get an accurate estimate for your specific area.

How can I lower my homeowners insurance premium?

+There are several strategies to potentially reduce your homeowners insurance premium. These include increasing your deductible, bundling your home and auto insurance policies, maintaining a good credit score, and installing safety features like smoke detectors and security systems.

What additional coverage options should I consider?

+Depending on your specific needs and assets, you might consider adding endorsements for valuable items like jewelry, artwork, or electronics. If you live in an area prone to natural disasters like floods or earthquakes, you might also want to consider purchasing separate coverage for these events.