Best Health Insurance For Disabled Under 65

When it comes to navigating the complex world of health insurance, individuals with disabilities face unique challenges. The search for the best health insurance plan can be daunting, especially for those under the age of 65. In this comprehensive guide, we delve into the critical aspects to consider, providing you with the knowledge and tools to make an informed decision.

Understanding Your Health Insurance Needs

For individuals with disabilities, health insurance is not just a necessity but a vital component of their overall well-being and independence. The right coverage can ensure access to essential medical services, specialized care, and the support needed to manage their unique health requirements.

When exploring health insurance options, it's crucial to assess your specific needs. These may include coverage for prescription medications, access to specialized equipment, rehabilitation services, mental health support, and more. Understanding your health history and anticipated future needs is key to selecting a plan that provides comprehensive and affordable coverage.

Navigating the Health Insurance Market

The health insurance landscape for individuals with disabilities can be complex, with various options and considerations. Here’s a breakdown of the key aspects to navigate:

Marketplace or Private Insurance

The Health Insurance Marketplace, often referred to as the Health Insurance Exchange, offers a range of plans with essential health benefits. These plans are designed to provide comprehensive coverage and may offer cost-saving benefits for individuals with disabilities. However, private insurance plans can also be a viable option, especially for those with specific healthcare needs.

Private insurance plans can offer more flexibility and customization, allowing you to tailor your coverage to your unique requirements. These plans may provide access to specific providers, specialized services, or unique benefit packages that cater to your disability-related needs.

Understanding Coverage and Benefits

When evaluating health insurance plans, it’s crucial to understand the coverage and benefits they offer. Look for plans that provide comprehensive coverage for your specific disability-related needs. This may include coverage for:

- Prescription medications and specialized drugs.

- Durable medical equipment and assistive devices.

- Physical, occupational, and speech therapy.

- Mental health services and counseling.

- Home healthcare services.

- Specialized medical procedures and treatments.

Ensure that the plan's network of providers includes specialists and facilities that can cater to your specific disability. Check for any out-of-network coverage options and the associated costs.

Cost Considerations

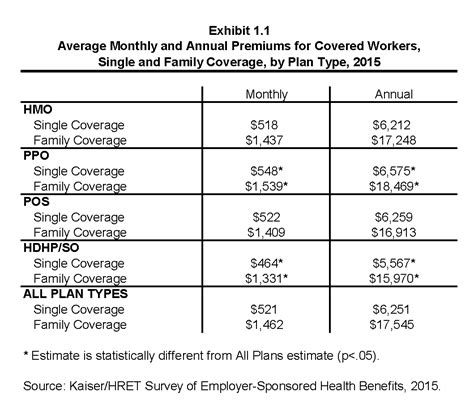

Health insurance plans can vary significantly in cost. When comparing plans, consider not just the premium but also the deductible, copayments, and coinsurance. Plans with lower premiums may have higher out-of-pocket costs, so it’s essential to balance coverage and affordability.

Look for plans that offer cost-saving measures such as discounted premiums, subsidies, or tax credits, especially if you have a low or moderate income. These can significantly reduce your overall healthcare costs.

Navigating Provider Networks

A crucial aspect of health insurance is the provider network. Ensure that the plan’s network includes providers and facilities that are accessible and convenient for you. Consider the proximity of these providers to your home or workplace, and whether they have experience treating individuals with your specific disability.

Some plans may offer out-of-network coverage, which can provide flexibility if you require specialized care from a provider outside the network. However, this coverage may come at a higher cost, so it's important to understand the terms and conditions.

Specialty Services and Support

Individuals with disabilities often require specialized services and support. When evaluating plans, consider whether they offer coverage for these unique needs. This may include:

- Specialized therapies (e.g., physical, occupational, or speech therapy)

- Assistive technology and devices

- Home modifications and accessibility adaptations

- Personal care services and support

- Respite care for caregivers

Some plans may offer additional benefits like telemedicine services, which can provide convenient access to healthcare professionals, especially for those with mobility challenges.

Comparing Plans and Providers

Comparing health insurance plans can be a complex task. Utilize online tools and resources, such as the Health Insurance Marketplace’s comparison tool, to evaluate and compare plans side by side. Consider factors like coverage, cost, provider network, and additional benefits.

Additionally, reach out to insurance providers and agents to discuss your specific needs. They can provide insights into plan features, benefits, and potential customization options. It's important to ask detailed questions and seek clarification to ensure you fully understand the coverage and terms.

Maximizing Your Health Insurance Benefits

Once you’ve selected a health insurance plan, it’s crucial to understand how to maximize your benefits. Here are some strategies to ensure you get the most out of your coverage:

Understanding Your Plan’s Coverage

Familiarize yourself with your plan’s benefits and coverage details. Review the Summary of Benefits and Coverage document provided by your insurance company. This document outlines what’s covered, any exclusions, and the cost-sharing responsibilities.

Understand your out-of-pocket maximum, which is the most you'll pay in a year for covered services. Knowing this amount can help you budget for healthcare expenses.

Managing Prescription Costs

Prescription medications can be a significant expense. Utilize your plan’s prescription drug coverage to manage these costs effectively. Many plans offer preferred drug lists (PDLs) or formularies, which categorize drugs based on cost and coverage. Choose generic drugs when possible, as they are often more affordable.

If you require a non-preferred or specialty drug, work with your doctor to explore alternatives or discuss options for reducing costs. Some insurance companies offer patient assistance programs or discounts for certain medications.

Utilizing Preventive Care Services

Many health insurance plans offer preventive care services at no additional cost. These services, such as vaccinations, screenings, and wellness checks, can help identify potential health issues early on and prevent more serious conditions. Take advantage of these services to maintain your overall health and well-being.

Managing Chronic Conditions

If you have a chronic condition related to your disability, work closely with your healthcare providers to manage it effectively. Many insurance plans offer disease management programs or care management services to support individuals with chronic conditions. These programs can provide personalized care plans, educational resources, and support to help you manage your condition.

Accessing Mental Health Services

Mental health is an essential aspect of overall well-being, especially for individuals with disabilities. Many health insurance plans offer mental health coverage, including counseling, therapy, and psychiatric services. Understand your plan’s coverage for mental health services and take advantage of these benefits to support your mental well-being.

Utilizing Telehealth Services

Telehealth services have become increasingly popular and can provide convenient access to healthcare professionals. Many insurance plans now cover telehealth visits, allowing you to consult with doctors, therapists, or specialists from the comfort of your home. This can be especially beneficial for individuals with mobility challenges or those who live in remote areas.

Exploring Additional Benefits

Some health insurance plans offer additional benefits that can enhance your overall healthcare experience. These may include wellness programs, fitness tracking incentives, or access to discounted health and wellness products. Explore these benefits to see how they can support your health and lifestyle.

Resources and Support for Individuals with Disabilities

Navigating the health insurance landscape can be challenging, but there are resources and support available to help. Here are some organizations and initiatives that can provide assistance:

- The Centers for Medicare & Medicaid Services (CMS) offers resources and guidance for individuals with disabilities, including information on health insurance options and coverage.

- The National Council on Disability provides advocacy and resources to support individuals with disabilities in various aspects of life, including healthcare and insurance.

- The American Association on Health and Disability (AAHD) offers resources and initiatives focused on promoting health, prevention, and wellness for people with disabilities.

- State-specific organizations and initiatives, such as disability councils or healthcare advocacy groups, can provide localized support and guidance.

Conclusion: Making an Informed Decision

Finding the best health insurance plan as an individual with a disability under the age of 65 requires careful consideration and research. By understanding your specific needs, navigating the insurance market effectively, and maximizing your benefits, you can ensure access to the quality healthcare you deserve.

Remember, the right health insurance plan can provide peace of mind and support your overall health and independence. Take the time to evaluate your options, seek guidance when needed, and make an informed decision that aligns with your unique circumstances.

How do I know if a health insurance plan covers my specific disability-related needs?

+

When reviewing health insurance plans, carefully examine the Summary of Benefits and Coverage document. This document outlines the specific services and treatments covered by the plan. Additionally, reach out to the insurance provider to discuss your specific needs and inquire about any potential exclusions or limitations.

Are there any government programs or subsidies available to help with health insurance costs for individuals with disabilities?

+

Yes, several government programs and initiatives are designed to provide financial assistance for health insurance costs. These include the Health Insurance Marketplace, which offers subsidies and tax credits based on income, and programs like Medicaid and Medicare, which provide coverage for specific populations, including individuals with disabilities.

How can I find a health insurance plan that covers my specific medication needs?

+

When researching health insurance plans, pay close attention to their prescription drug coverage. Look for plans that offer a preferred drug list (PDL) or formulary that includes your specific medications. Additionally, reach out to insurance providers to discuss your medication needs and inquire about any potential cost-saving options or patient assistance programs.