Multiple Car Insurance Quote

Obtaining multiple car insurance quotes is a crucial step in finding the best coverage and rates for your vehicle. With numerous insurance providers offering a wide range of policies, it's essential to compare options to ensure you're getting the most comprehensive coverage at the most competitive price. This article aims to guide you through the process of securing multiple car insurance quotes, exploring the key factors that influence rates, and providing valuable insights to help you make an informed decision.

The Importance of Multiple Quotes

Securing multiple car insurance quotes is a vital practice for several reasons. Firstly, it allows you to compare prices and coverage options, ensuring you’re not overspending on insurance. Different insurance providers may offer varying rates and benefits for the same level of coverage, and by obtaining multiple quotes, you can identify the most cost-effective option.

Additionally, multiple quotes provide an opportunity to assess the range of coverage available. Each insurance provider has unique policies, and by exploring different quotes, you can gain a better understanding of the various features and add-ons offered. This comprehensive analysis ensures you can tailor your insurance coverage to your specific needs and preferences.

Lastly, comparing multiple quotes helps you identify potential discounts and savings. Many insurance providers offer a range of discounts, such as safe driver discounts, multi-policy discounts, or loyalty rewards. By obtaining multiple quotes, you can identify these discounts and potentially reduce your insurance costs even further.

Factors Influencing Car Insurance Rates

Several factors play a significant role in determining your car insurance rates. Understanding these factors can help you make more informed decisions when comparing quotes.

Vehicle Type and Age

The type and age of your vehicle are crucial considerations for insurance providers. Newer vehicles, especially those with advanced safety features, often attract lower insurance premiums. Additionally, the make and model of your car can impact rates, as some vehicles are statistically more prone to accidents or theft.

For instance, sports cars or high-performance vehicles may have higher insurance rates due to their association with riskier driving behaviors. On the other hand, hybrid or electric vehicles, which are often viewed as more environmentally friendly and safer, may attract lower premiums.

Driving Record

Your driving history is a significant factor in determining insurance rates. Insurance providers thoroughly examine your driving record to assess your risk profile. A clean driving record with no accidents or traffic violations can lead to lower insurance premiums. Conversely, a history of accidents, especially those at fault, or multiple traffic violations can result in higher rates.

For example, if you have a record of multiple speeding tickets or at-fault accidents, insurance providers may classify you as a higher-risk driver, leading to increased premiums. It's essential to maintain a safe driving record to keep your insurance rates as low as possible.

Location and Usage

Your location and how you use your vehicle also impact insurance rates. Insurance providers consider factors such as the crime rate, traffic congestion, and accident rates in your area. Areas with higher crime rates or a history of frequent accidents may attract higher insurance premiums.

Furthermore, the purpose for which you use your vehicle can influence rates. Commuting to work daily or frequent long-distance travel may result in higher premiums compared to occasional recreational driving or limited local trips. Insurance providers assess the risk associated with your driving patterns and adjust rates accordingly.

Coverage and Deductibles

The level of coverage you choose and your deductible selection can significantly affect your insurance rates. Comprehensive and collision coverage, which protect against damage to your vehicle, typically come with higher premiums. On the other hand, liability-only coverage, which covers damage to other vehicles or property, may be more affordable but provides limited protection.

Additionally, your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can impact your rates. Opting for a higher deductible can lower your insurance premiums, as you're taking on more financial responsibility in the event of a claim. However, it's essential to choose a deductible that you're comfortable paying if the need arises.

Tips for Comparing Quotes

When comparing multiple car insurance quotes, consider the following tips to make the process more efficient and effective.

Be Detailed and Consistent

When requesting quotes, provide as much detail as possible about your vehicle, driving history, and coverage preferences. This ensures that you receive accurate quotes that reflect your specific circumstances. Additionally, ensure that you’re comparing quotes with similar coverage levels and deductibles to make an apples-to-apples comparison.

Understand the Fine Print

While comparing quotes, pay close attention to the fine print. Insurance policies can vary significantly in terms of coverage details, exclusions, and add-ons. Ensure that you understand the limitations and benefits of each policy to make an informed decision. Don’t hesitate to reach out to insurance providers to clarify any confusing terms or provisions.

Consider Bundle Options

If you’re also in the market for other types of insurance, such as home or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, potentially saving you a significant amount on your overall insurance costs.

Read Reviews and Ratings

Before finalizing your decision, take the time to research the reputation and financial stability of the insurance providers you’re considering. Read reviews and ratings from independent sources to gain insights into customer experiences and satisfaction levels. This can help you assess the reliability and responsiveness of the insurance company, ensuring you choose a provider that will be there for you when you need them.

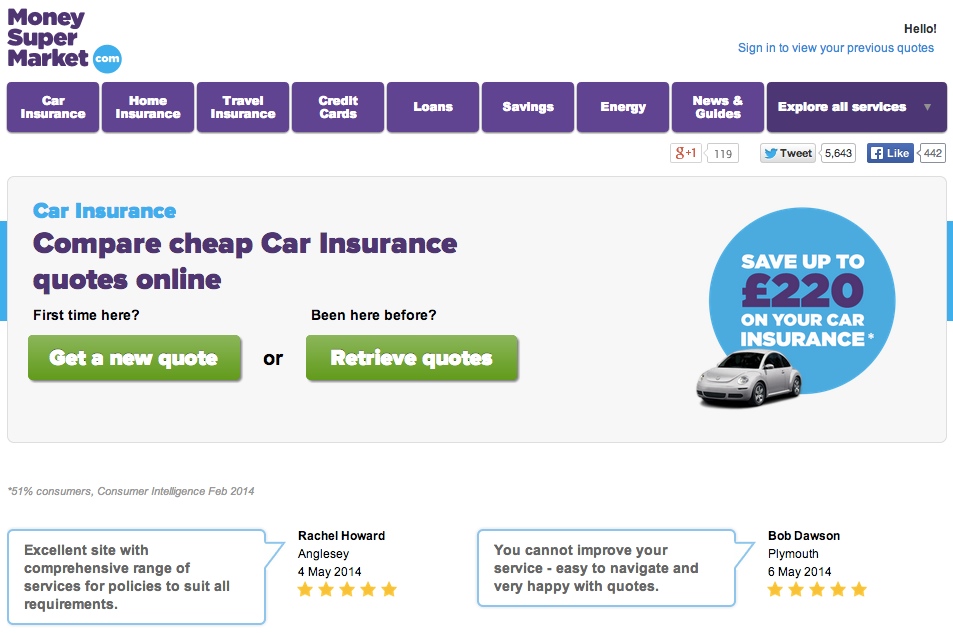

Utilizing Online Quote Tools

In today’s digital age, online quote tools have become a convenient way to compare car insurance rates. These tools allow you to input your vehicle and driver information and receive multiple quotes from various insurance providers in a matter of minutes. While these tools provide a quick and efficient way to compare rates, it’s essential to use them as a starting point and not the sole basis for your decision.

Online quote tools often provide estimates based on standard coverage levels and may not account for all the unique factors that influence your insurance rates. It's crucial to follow up with insurance providers directly to verify the accuracy of the quotes and explore any additional discounts or coverage options that may be available.

The Impact of Discounts and Savings

Discounts and savings can significantly reduce your car insurance costs. Insurance providers offer a variety of discounts, and by understanding and taking advantage of these, you can potentially save hundreds of dollars on your annual premiums.

Common Discounts

Some of the most common discounts include safe driver discounts, which reward drivers with clean driving records, and multi-policy discounts, which provide savings when you bundle your car insurance with other policies, such as home or renters insurance. Loyalty discounts are also common, rewarding long-term customers who have maintained their insurance coverage with the same provider.

Additionally, insurance providers may offer discounts for vehicle safety features, such as anti-lock brakes, air bags, or anti-theft devices. These features enhance the safety of your vehicle and can lead to reduced insurance premiums.

Understanding Discount Eligibility

While discounts are enticing, it’s essential to understand the eligibility criteria. Some discounts may be automatically applied when you meet certain conditions, while others may require you to take specific actions, such as completing a defensive driving course or installing a telematics device.

It's worthwhile to explore the various discount options available and assess which ones you may be eligible for. This can involve a conversation with your insurance provider to understand the specific requirements and benefits of each discount.

Making an Informed Decision

After gathering multiple quotes and exploring the range of coverage and discount options, it’s time to make an informed decision. Consider not only the cost of the insurance but also the level of coverage, the reputation of the insurance provider, and the ease of working with the company.

Evaluate the financial stability of the insurance provider, ensuring they have the resources to pay out claims promptly. Research customer reviews and ratings to understand the level of satisfaction and responsiveness of the company. Consider the convenience of their online platform or mobile app, as well as the availability and accessibility of customer support.

Ultimately, the decision should align with your specific needs and preferences. If you prioritize comprehensive coverage and have a history of accidents or traffic violations, you may be willing to pay a higher premium for robust protection. On the other hand, if you're a safe driver with a clean record, you may opt for a more basic coverage level to keep costs down.

Future Considerations and Trends

The car insurance landscape is constantly evolving, and staying informed about future trends can help you make more strategic decisions. One emerging trend is the use of telematics or usage-based insurance, where insurance providers track your driving behavior through a telematics device or smartphone app. This data is used to adjust your insurance rates based on your actual driving habits, potentially offering savings for safe drivers.

Additionally, the rise of electric vehicles (EVs) and autonomous vehicles is expected to impact insurance rates. EVs, with their advanced safety features and reduced maintenance costs, may attract lower insurance premiums in the future. Autonomous vehicles, while still in their early stages, have the potential to significantly reduce accident rates, leading to more affordable insurance coverage.

As technology advances and the insurance industry adapts, staying updated on these trends can help you make more informed decisions about your car insurance coverage and rates.

Conclusion

Obtaining multiple car insurance quotes is an essential step in securing the best coverage and rates for your vehicle. By understanding the factors that influence insurance rates and exploring the range of coverage and discount options, you can make an informed decision that aligns with your needs and budget. Stay vigilant about emerging trends and advancements in the insurance industry to ensure you’re always making the most strategic choices for your car insurance coverage.

How often should I review my car insurance quotes and coverage?

+It’s recommended to review your car insurance quotes and coverage annually, or whenever you experience a significant life change such as a move, marriage, or purchase of a new vehicle. Regular reviews ensure you’re always getting the best value and coverage for your needs.

Can I negotiate car insurance rates with providers?

+While insurance rates are largely standardized, you can certainly negotiate with providers, especially if you’re a loyal customer or have a unique situation. Highlight your clean driving record, safe driving habits, or any other factors that might qualify you for a lower rate. Don’t be afraid to ask for discounts or adjustments to your premium.

What are some common mistakes to avoid when comparing car insurance quotes?

+Common mistakes include failing to compare apples-to-apples, focusing solely on price without considering coverage, and neglecting to explore all available discounts. Ensure you’re comparing quotes with similar coverage levels and deductibles, and take the time to understand the fine print of each policy. Don’t forget to ask about potential discounts to further reduce your premiums.