State Farm Insurance Claims Phone Number

In the fast-paced world we live in, accidents and unforeseen events are an inevitable part of life. When such incidents occur, having a reliable insurance provider can make a significant difference in navigating the aftermath. State Farm Insurance is a prominent name in the industry, known for its comprehensive coverage and customer-centric approach. In this comprehensive guide, we will delve into the essential aspects of making an insurance claim with State Farm, with a specific focus on their claims phone number.

Understanding the Importance of Insurance Claims

Insurance claims play a crucial role in ensuring individuals and businesses receive the necessary support and compensation after an unfortunate event. Whether it’s a car accident, property damage, or a health-related issue, the claims process is designed to streamline the recovery journey. State Farm Insurance, with its extensive network and dedicated customer service, aims to provide a seamless and efficient claims experience.

State Farm Insurance: A Trusted Companion

State Farm Insurance has been a trusted partner for millions of policyholders across the United States for over a century. Their comprehensive range of insurance products, including auto, home, life, and health insurance, caters to a diverse set of needs. With a strong focus on customer satisfaction and a commitment to community involvement, State Farm has built a reputation as a reliable and caring insurer.

The Claims Process: A Step-by-Step Guide

Making an insurance claim with State Farm is a straightforward process designed to minimize stress and maximize efficiency. Here’s a detailed breakdown of the steps involved:

Step 1: Reporting the Incident

The first step in the claims process is to report the incident to State Farm. Policyholders can choose from various convenient reporting methods, including the State Farm mobile app, their online portal, or by calling the dedicated claims phone number. When reporting the incident, provide as much detail as possible, including the date, time, and location of the event, along with any relevant photographs or documentation.

Step 2: Assigning a Claims Representative

Once the incident is reported, State Farm will promptly assign a dedicated claims representative to your case. This representative will serve as your primary point of contact throughout the claims process, ensuring a personalized and efficient experience. They will guide you through the necessary steps, answer your queries, and provide regular updates on the progress of your claim.

Step 3: Assessing the Damage

The assigned claims representative will conduct a thorough assessment of the damage to determine the extent of the loss. This assessment may involve an on-site inspection, where the representative will carefully evaluate the impacted property or vehicle. For certain claims, State Farm may utilize advanced technologies, such as drone inspections, to accurately assess the damage remotely.

Step 4: Determining Coverage and Liability

After the damage assessment, the claims representative will review your insurance policy to determine the extent of coverage applicable to your claim. They will carefully examine the policy terms and conditions to ensure a fair and accurate evaluation. In cases involving liability, the representative will work with all parties involved to establish responsibility and facilitate a prompt resolution.

Step 5: Processing the Claim

Once the coverage and liability aspects are clarified, State Farm will initiate the claim processing stage. This involves a detailed review of the supporting documentation, including photographs, repair estimates, and any other relevant information. State Farm’s advanced claims processing systems ensure a swift and accurate evaluation, allowing for timely compensation.

Step 6: Receiving Compensation

Upon successful claim processing, State Farm will provide the approved compensation as outlined in your insurance policy. The method of payment may vary depending on the type of claim and your preferences. State Farm offers a range of payment options, including direct deposit, check, or even virtual payment methods, ensuring a convenient and secure transaction.

Step 7: Follow-up and Additional Support

State Farm’s commitment to customer satisfaction extends beyond the initial claim settlement. They provide ongoing support and assistance throughout the recovery process. Your claims representative will remain in contact, offering guidance and answering any queries you may have. Additionally, State Farm offers resources and tools to help policyholders understand their rights and navigate the claims process effectively.

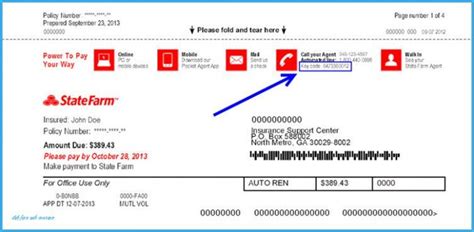

The State Farm Claims Phone Number: A Direct Line to Support

When it comes to insurance claims, having a dedicated and easily accessible support line is invaluable. State Farm recognizes the importance of prompt assistance, which is why they provide a dedicated claims phone number for policyholders.

State Farm Claims Phone Number: 800-782-8332

This toll-free number serves as a direct line to State Farm’s claims department, ensuring policyholders can reach out for assistance 24⁄7. Whether it’s to report a claim, seek guidance on the process, or obtain updates on an ongoing claim, the claims phone number provides a convenient and efficient channel of communication.

Key Benefits of the State Farm Claims Phone Number:

- Round-the-clock Availability: Policyholders can reach out anytime, ensuring prompt assistance regardless of the time or day.

- Dedicated Claims Specialists: Trained and experienced claims specialists answer calls, providing expert guidance and support.

- Personalized Assistance: Each call is treated individually, allowing for tailored advice and a customized claims experience.

- Quick Response Times: State Farm aims to provide prompt responses, ensuring policyholders receive timely updates and support.

Real-Life Success Stories: State Farm Claims in Action

To illustrate the effectiveness of State Farm’s claims process and the impact of their dedicated phone support, let’s explore a couple of real-life success stories:

Story 1: Auto Accident Assistance

Mr. Johnson, a loyal State Farm policyholder, was involved in a minor car accident. He promptly called the claims phone number and was connected with a knowledgeable claims representative. The representative guided Mr. Johnson through the necessary steps, helping him gather the required documentation and providing valuable advice on the repair process. With State Farm’s efficient claims handling, Mr. Johnson received a fair settlement, allowing him to get his vehicle repaired promptly.

Story 2: Homeowner’s Peace of Mind

Ms. Garcia, a recent homeowner, experienced a water leak in her basement. Worried about the potential damage, she called the State Farm claims phone number. The friendly representative assured her of State Farm’s coverage and guided her through the claims process. After a thorough inspection, State Farm covered the necessary repairs, providing Ms. Garcia with the peace of mind she deserved as a new homeowner.

The Future of Insurance Claims: State Farm’s Technological Innovations

State Farm is committed to staying at the forefront of technological advancements to enhance the claims experience. They continuously invest in innovative solutions to streamline the process and provide policyholders with a seamless and efficient journey.

State Farm’s Technological Initiatives:

- Mobile App Integration: State Farm’s mobile app offers a convenient platform for policyholders to manage their insurance needs, including reporting claims and tracking their progress.

- Digital Claims Management: State Farm utilizes advanced digital tools to manage claims efficiently, reducing paperwork and accelerating the processing time.

- Drones and Advanced Inspections: State Farm leverages drone technology for remote inspections, providing accurate assessments and reducing the need for on-site visits.

- AI-Powered Claims Analysis: Artificial Intelligence (AI) plays a crucial role in analyzing claims data, enabling faster and more accurate evaluations.

Conclusion: A Seamless Claims Experience with State Farm

State Farm Insurance’s commitment to customer satisfaction and innovative approach to claims handling sets them apart in the industry. With their dedicated claims phone number and a team of experienced professionals, policyholders can rest assured that they will receive the support and guidance they need during challenging times. The step-by-step claims process, coupled with State Farm’s technological advancements, ensures a seamless and efficient journey from reporting an incident to receiving compensation.

As we've explored in this comprehensive guide, State Farm Insurance's claims process is designed with the policyholder's best interests at heart. Whether it's auto, home, life, or health insurance, State Farm is dedicated to providing a smooth and supportive experience. Remember, in the event of an unfortunate incident, having a reliable insurance partner like State Farm can make all the difference in your recovery journey.

How do I report an insurance claim with State Farm?

+You can report an insurance claim with State Farm through various channels, including their mobile app, online portal, or by calling the dedicated claims phone number at 800-782-8332. When reporting, provide detailed information about the incident and any relevant documentation.

What happens after I report a claim to State Farm?

+After reporting a claim, State Farm will promptly assign a dedicated claims representative to your case. This representative will guide you through the claims process, assess the damage, determine coverage and liability, and facilitate the claim processing. They will keep you updated throughout the process.

Can I track the progress of my insurance claim with State Farm?

+Yes, State Farm provides various options to track the progress of your insurance claim. You can use their mobile app, online portal, or call the claims phone number to obtain updates. Your assigned claims representative will also keep you informed about the status of your claim and provide guidance as needed.