State Farm Insurance Homeowners Insurance

In the vast landscape of insurance providers, State Farm stands out as one of the leading names, particularly renowned for its comprehensive and reliable homeowners insurance offerings. With a rich history spanning decades, State Farm has consistently demonstrated its commitment to providing top-notch protection and support to homeowners across the United States. This article delves into the intricacies of State Farm's homeowners insurance, exploring its coverage options, benefits, and the reasons why it has become a trusted choice for millions of policyholders.

Understanding State Farm’s Homeowners Insurance

State Farm’s homeowners insurance, often referred to as HO-3 or special form policy, is a comprehensive package designed to safeguard one of the most significant investments an individual can make - their home. It offers protection against a wide range of perils, from natural disasters to accidents and theft, providing financial security and peace of mind to homeowners.

Coverage Options

State Farm’s homeowners insurance policy offers a variety of coverage options tailored to meet the diverse needs of its customers. Here’s a breakdown of the key coverage types:

- Dwelling Coverage: This core coverage protects the physical structure of the home, including walls, roofs, and permanent fixtures. It ensures that in the event of damage or destruction, the home can be repaired or rebuilt to its original state.

- Personal Property Coverage: State Farm's policy covers the contents of the home, including furniture, electronics, and personal belongings. This coverage provides financial assistance to replace or repair damaged items, ensuring that policyholders are not left with a significant financial burden.

- Liability Coverage: A crucial aspect of homeowners insurance, liability coverage protects the policyholder in the event of lawsuits or claims arising from accidents or injuries that occur on their property. It provides coverage for legal defense costs and any awarded damages, offering a vital safety net.

- Additional Living Expenses: In the unfortunate event of a covered loss that renders the home uninhabitable, this coverage steps in to cover the additional expenses incurred while the policyholder and their family are temporarily displaced. It covers costs such as hotel stays, meals, and other necessary living expenses.

- Medical Payments Coverage: This coverage provides financial assistance for medical expenses incurred by guests who are injured on the insured property. It offers a quick and straightforward way to cover medical costs without the need for a liability claim, fostering a sense of security and responsibility.

Benefits and Unique Features

State Farm’s homeowners insurance is distinguished by several key benefits that set it apart from its competitors:

- Personalized Coverage Options: State Farm understands that every homeowner's needs are unique. Their policy allows for customization, enabling policyholders to choose the coverage limits and endorsements that best fit their specific circumstances. This flexibility ensures that homeowners receive the protection they require without paying for unnecessary coverage.

- Discounts and Savings: State Farm offers a range of discounts to help policyholders save on their insurance premiums. These include multi-policy discounts for bundling homeowners and auto insurance, loyalty discounts for long-term customers, and safety discounts for homes equipped with security systems or fire prevention measures.

- Excellent Customer Service: State Farm is renowned for its exceptional customer service. With a network of knowledgeable and friendly agents, policyholders can receive personalized support and guidance throughout the insurance process. The company's commitment to customer satisfaction is evident in its 24/7 claims support, ensuring prompt assistance during emergencies.

- Innovative Technology: State Farm embraces technology to enhance the insurance experience. Their mobile app allows policyholders to access their policy information, file claims, and receive real-time updates. Additionally, State Farm offers digital tools for home inventory management, helping homeowners create a comprehensive list of their belongings for easier claims processing.

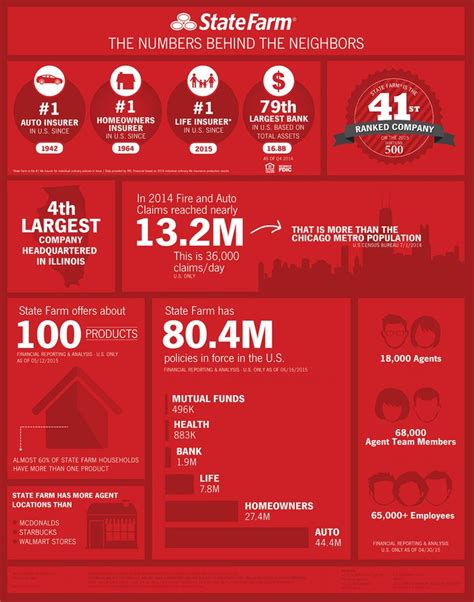

- Financial Strength and Stability: As one of the largest insurance providers in the United States, State Farm boasts an impressive financial stability rating. This assures policyholders that their insurance provider is well-equipped to handle claims, providing long-term security and peace of mind.

Performance and Claims Handling

State Farm’s reputation for efficient claims handling is a testament to its commitment to customer satisfaction. The company employs a team of dedicated claims professionals who work tirelessly to ensure that policyholders receive fair and prompt compensation for their losses. Their claims process is designed to be straightforward and transparent, with regular updates provided to policyholders throughout the claims journey.

In recent years, State Farm has implemented innovative technologies to further streamline the claims process. These technologies include drone assessments for property damage, virtual claims adjustments through video conferencing, and mobile apps that allow policyholders to submit claims and receive real-time status updates. These digital advancements have significantly improved the efficiency and accuracy of claims handling, enhancing the overall customer experience.

Real-Life Claims Scenarios

To illustrate State Farm’s claims handling capabilities, let’s consider a few real-life scenarios:

- Hurricane Damage: In the aftermath of a devastating hurricane, State Farm policyholders can rely on the company's extensive resources and expertise. State Farm deploys a team of adjusters and contractors to assess the damage and begin repairs promptly. With their catastrophe response plan, policyholders can rest assured that their homes will be restored as quickly as possible.

- Home Burglary: In the event of a home burglary, State Farm's liability coverage steps in to provide financial assistance for any stolen items. The company's claims team works closely with policyholders to ensure a fair and thorough assessment of the loss, helping them replace their belongings and restore a sense of security.

- Water Damage from Plumbing Issues: Plumbing failures can lead to significant water damage and costly repairs. State Farm's homeowners insurance covers such incidents, providing financial support for repairs and replacements. The company's claims professionals guide policyholders through the process, ensuring a smooth and stress-free experience.

Comparative Analysis

When comparing State Farm’s homeowners insurance to other leading providers, several key differences emerge. Here’s a concise overview:

| Category | State Farm | Competitor A | Competitor B |

|---|---|---|---|

| Coverage Options | Comprehensive, with personalized customization | Standard coverage with limited customization | Comprehensive, but with higher deductibles |

| Discounts | Multi-policy, loyalty, and safety discounts | Limited discounts, primarily for new customers | Similar discounts, but with higher premiums |

| Claims Handling | Efficient, with innovative technologies | Traditional claims process, slower response times | Efficient, but with higher claim denial rates |

| Customer Service | Exceptional, with 24/7 support | Average, with limited accessibility | Good, but with longer wait times |

| Financial Stability | Strong, with an excellent rating | Stable, but with lower ratings | Similar stability, but with higher premiums |

Future Implications and Industry Insights

As the insurance industry continues to evolve, State Farm remains at the forefront, leveraging technology and innovation to enhance its offerings. The company’s commitment to digital transformation is evident in its recent initiatives, such as the State Farm Innovate Hub, which fosters collaboration with startups to develop cutting-edge insurance solutions. This focus on innovation positions State Farm to meet the changing needs of homeowners and stay ahead in a competitive market.

Looking ahead, State Farm's data-driven approach to insurance is expected to play a pivotal role in shaping the industry. By leveraging advanced analytics and machine learning, the company can better understand risk profiles and tailor coverage options to individual needs. This data-centric strategy not only improves the accuracy of insurance rates but also enhances the overall customer experience, making it more personalized and efficient.

Furthermore, State Farm's partnerships with leading technology companies and its investments in insurtech startups demonstrate its commitment to staying at the forefront of industry advancements. These collaborations enable the company to integrate the latest technologies, such as artificial intelligence and blockchain, into its insurance processes, further streamlining operations and improving customer satisfaction.

In conclusion, State Farm's homeowners insurance stands as a testament to the company's unwavering commitment to providing top-notch protection and support to its policyholders. With its comprehensive coverage options, personalized approach, and exceptional customer service, State Farm has earned its reputation as a trusted and reliable insurance provider. As the industry continues to evolve, State Farm's focus on innovation and data-driven strategies positions it to meet the changing needs of homeowners, ensuring their peace of mind and financial security for years to come.

How can I get a State Farm homeowners insurance quote?

+To get a State Farm homeowners insurance quote, you can visit their official website or contact a local State Farm agent. Providing information about your home, its location, and your personal preferences will help generate an accurate quote. State Farm’s agents can guide you through the process and offer personalized advice.

What additional endorsements or coverage options are available with State Farm homeowners insurance?

+State Farm offers a range of endorsements and coverage options to enhance your homeowners insurance policy. These include coverage for high-value items like jewelry or artwork, identity restoration coverage, and additional liability protection. Discuss your specific needs with a State Farm agent to explore these options.

How does State Farm determine insurance rates for homeowners insurance?

+State Farm uses a variety of factors to determine insurance rates, including the location and value of your home, your claims history, and the coverage options you choose. The company also considers local crime rates, proximity to fire stations, and other risk factors. These factors help State Farm assess the level of risk associated with insuring your home and determine the appropriate premium.

What should I do in case of a claim with State Farm homeowners insurance?

+In the event of a claim, it’s important to contact State Farm promptly. You can report a claim online, over the phone, or through the State Farm mobile app. Provide as much detail as possible about the incident and any damages. State Farm’s claims team will guide you through the process, assess the damage, and work towards a fair resolution.